Bargain-basement Opportunity for Crypto Volatility Traders

“Explosive” bull runs have proceeded those times when volatility has been low in the crypto markets, according to one analyst

Source: Shutterstock / Zakharchuk, modified by Blockworks

Volatility in crypto markets is hovering at long-term lows, signaling a potential profitable entrance for traders to begin piling into long volatility positions in both options and spot markets, analysts say.

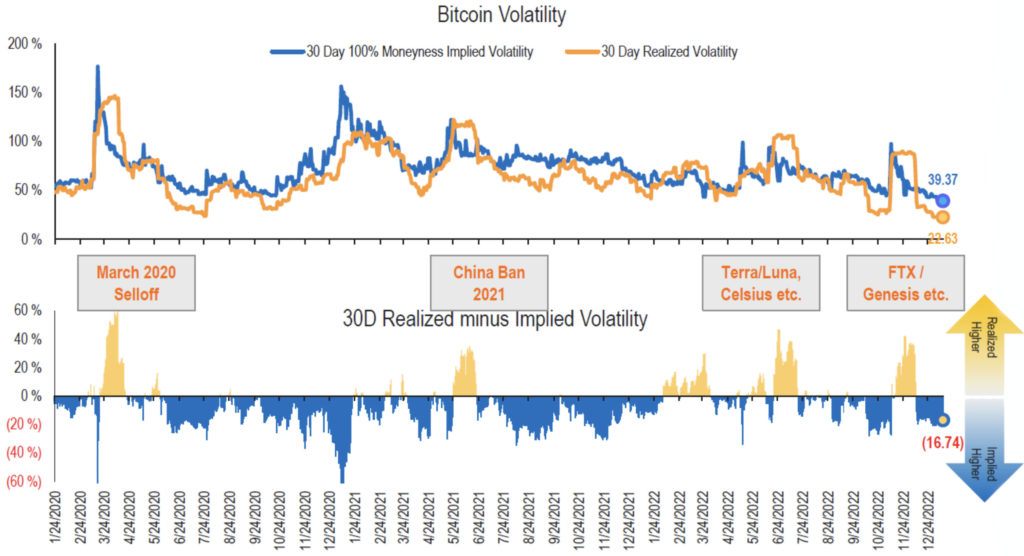

Bitcoin’s 30-day implied volatility has fallen to its lowest point in more than two years: to 16.7% above realized, according to data compiled by digital asset research firm BitOoda. Bitcoin’s realized volatility sits at 22%.

“We view these unusually low levels as a potential opportunity to go long volatility,” BitOoda said in its report. “Volatility seems very cheap right now, and we would expect it to increase in the coming days and/or weeks.”

Figure: Bitcoin annualized volatility based on 30-say trailing daily returns of BTCUSD (spot bitcoin) and 100% Moneyness Implied Volatility for BTC1 (CME bitcoin futures) since January 2020; Source: Bloomberg, BitOoda

Figure: Bitcoin annualized volatility based on 30-say trailing daily returns of BTCUSD (spot bitcoin) and 100% Moneyness Implied Volatility for BTC1 (CME bitcoin futures) since January 2020; Source: Bloomberg, BitOoda

Utilized within the derivatives markets, implied volatility refers to a metric designed to anticipate changes in an asset’s fluctuations. The setup, in turn, has rendered the purchase of bitcoin options remarkably cheap through a historical lens, per BitOonda’s report.

Typically, in bear markets, implied volatility tends to drift upwards where expectations of an asset’s price are believed to be heading down over time. In bull markets, implied volatility tends to drift down on expectations of a future price rise.

Here “typically” is important to keep in mind, since volatility expansion can come either to the upside or downside.

Implied differs from realized volatility, which is a measure of past performance and actual results.

With both realized and implied volatility both sitting at historic lows and volatility being cheap versus prior levels, structures such as bull call spreads may be attractive investment strategies, Toby Chapple, head of trading from Australian trading firm Zerocap told Blockworks.

Bull call spreads are an options trading strategy pairing a long call at a lower strike price with a short call higher at a strike price.

“If you look at the past performance of volatility, it has been down at these levels multiple times, so it is not out of the ordinary,” Chapple said. “It generally does not stay low for long, though.”

Chapple concluded volatility in the crypto markets has not been this low since July 2020 — more than two and a half years ago.

Over the same 30-day period, ether (ETH) options could also be “especially attractive” amid the highly anticipated Shanghai hard fork expected in March, which would likely be a catalyst for future volatility for the asset, BitOoda said. ETH realized volatility of 36% and implied volatility of 52% are also hovering at long-term lows.

“Interestingly in crypto, the times when volatility has been low have [preceded] explosive bull runs in the market, not crashes in prices,” Chapple said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.