Bitcoin Mining Stocks Face Market Reckoning Amid Widespread Selloff

Traders and fund managers are selecting which bitcoin mining stocks they think will survive the bear market

Source: Shutterstock

- Markets are beginning to favor bitcoin mining stocks with the strongest balance sheets

- Valkyrie’s mining fund has cut its Core Scientific weight more than any other stock

Markets and fund managers are selecting which bitcoin mining stocks they believe will survive the bear market, with healthy balance sheets and low production costs proving the difference.

Bitcoin miners are still under pressure from expensive electricity alongside low cryptocurrency prices — and, in some cases, high-interest loans taken out at peak bull market last year.

Core Scientific (CORZ), which has historically commanded more hash rate than any other North American mining outfit, earlier this month disclosed it had sold $167 million in bitcoin in June, nearly three-quarters of its total stash.

Around the same time, rival mining unit Bitfarms (BITF) sold half of its BTC for $62 million to reduce debt. Riot Blockchain (RIOT), another major player, has also been steadily liquidating its mined bitcoin all year.

All these factors have weighed heavily on the share prices of bitcoin mining companies as markets fear further capitulation.

Excluding non-pure play mining companies, the 18 crypto native stocks that make up alternative asset management firm Valkyrie’s mining ETF, WGMI (crypto slang for “we’re gonna make it”), are down 51% on average over the past three months.

Shares in the ETF itself have tanked 42.5% — about the same as bitcoin.

Markets favor Stronghold, a vertically integrated bitcoin miner

Bit Digital, which has fully transitioned its mining operations from China to the US over the past 18 months, is leading the pack, having slid only 24% since April 25.

Jaran Mellerud, Arcane Research analyst, told Blockworks in an email that Bit Digital has been busy moving its miners between continents. This meant the firm couldn’t expand its operations as aggressively as most other public miners.

“In hindsight, massively expanding operations with new machine deliveries was not a good decision as the bitcoin price has plummeted,” Mellerud said.

“Bit Digital was ‘lucky’ that the bitcoin price plummeted in this period, while they were not able to expand as quickly.”

After Bit Digital, Stronghold and Marathon have proven the most resilient, shedding 29% and 36%, respectively, from their share prices.

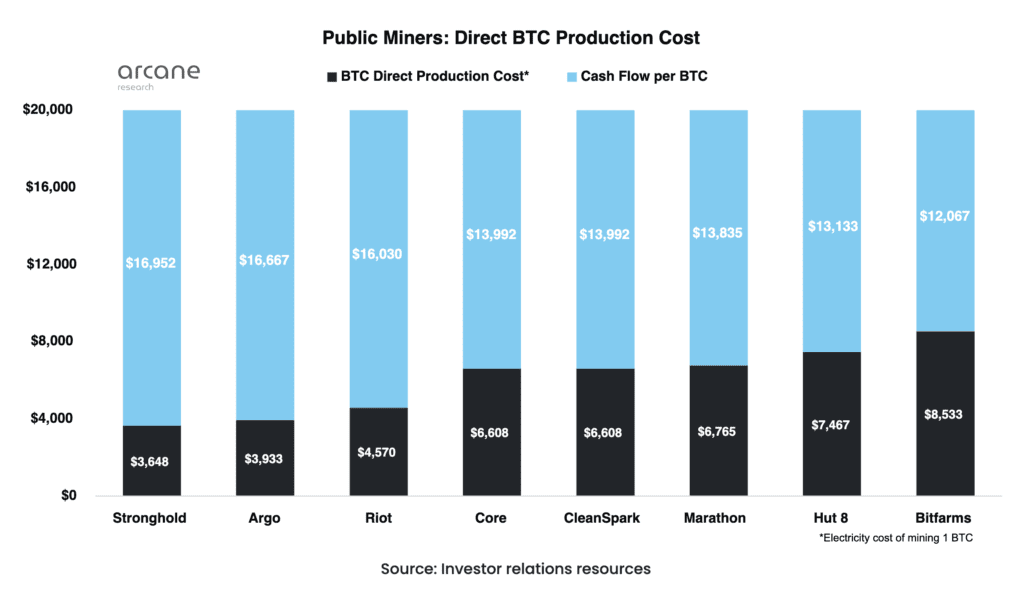

Image source: Arcane Research

Image source: Arcane Research

While Stronghold has one of the weaker balance sheets among its cohort, according to Mellerud, the company is vertically integrated, meaning it controls two of its own power plants.

Stronghold also powers its mining operations by burning waste coal, so its energy is practically free. The firm even receives government subsidies for cleaning up the refuse, awarding them the lowest bitcoin production costs in the industry, Mellerud wrote last month.

Marathon, on the other hand, suffers from relatively high bitcoin production costs, but commands an “abnormally high quick ratio” (the value of its most liquid assets divided by its liabilities) compared to its major competitors.

Traders reject insider stock sales and poor balance sheets

Australian miner Mawson Infrastructure Group, a smaller stock valued at $68 million, has sunk nearly 77%.

Mawson posted a net loss of $11.3 million in the first quarter of this year, according to SEC filings, up from $38.6 million lost in 2021’s equivalent quarter. WGMI didn’t feature Mawson when it launched but it now makes up 2.71% of the fund’s portfolio.

Core Scientific, the industry’s largest public miner by hash rate, has done marginally better, down 72%. Arcane Research’s Mellerud found Core Scientific has a high debt-to-equity ratio — with the debt collateralized precariously by its ASIC machines.

As its mining rigs depreciate in value, the company must continuously post higher amounts of collateral to maintain its loans, further stressing its balance sheet — which is weaker than its competitors despite stronger cash flows.

But Core Scientific’s share price has faced downward pressure from its executives as well. SEC filings show company insiders have liquidated nearly $22 million in stock since the end of May, led by Darin Feinstein, co-founder and chief vision officer.

Feinstein netted $18.3 million by selling 6 million shares at an average price of $3.05 — 70% below its value when it went public via a SPAC deal in January. The company’s share price has fallen 40% since Feinstein’s sales, trading at $1.83 as of last Friday’s close.

Other insider sales were classified to the SEC as “Tax Withholding” transactions, relating to a type of executive compensation package known as “Restricted Stock Units,” or RSUs. Feinstein’s were not.

Core Scientific awarded more than 22.5 million RSUs over the past two months to its executives (81% to CEO Michael Levitt), currently worth $41.3 million, at which time they incurred tax obligations, leading to stock sales.

Core Scientific later disclosed in a press release that Feinstein had informed the company that his sales “were sold to provide capital to satisfy certain taxes related to the conversion of RSUs and other liabilities.”

Executives at Argo and Riot Blockchain have also been granted RSUs over the past three months, for which they also sold stock in “Tax Withholding” transactions, although Feinstein’s stand out due to their size.

Valkyrie goes back to basics

When the firm’s WGMI fund launched in February, Core Scientific was its sixth-biggest holding, weighted at 4.3% — ahead of Riot Blockchain and Marathon.

Core Scientific now makes up just 0.96% of WGMI’s $3.7 million portfolio, a whopping 78 percentage point weight reduction. The stock was cut more than any other holding, followed by renewable mining play TeraWulf, which saw its weight trimmed by nearly 70 percentage points; from 3.84% to 1.17%.

“As the year has gone on, especially over the last couple of months, it’s kind of a back to basics approach over here,” Bill Cannon, Valkyrie’s head of portfolio management told Blockworks. “We’re looking at adjusted balance sheets — just revenue, just net income.”

WGMI boosted its Stronghold, Marathon and Riot Blockchain stock over the past three weeks by 1.65%, 1.61% and 0.96% respectively. Those stocks make up between 4.24% and 5.87% of the fund’s total portfolio.

Argo Blockchain — which Arcane’s Mellerud believes is the only bitcoin miner with cash flows to fully pay off its remaining ASIC deliveries this year — is WGMI’s largest holding with 13.32% weight, up from 9.81% in February.

CleanSpark (CLSK), which has practically no debt on its balance sheet, comes second with 11.37%, although WGMI has recently scaled back its weighting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.