BTC, ETH Momentum Stalls; Yellen Clarifies Crypto Regulation: Markets Wrap

BTC and ETH see their strong momentum stall on hawkish remarks from Jerome Powell, Janet Yellen provides clarity around ‘broker’ definition.

Janet Yellen, US Secretary of the Treasury; Blockworks Exclusive Art by Axel Rangel

- BTC and ETH momentum stalls on hawkish remarks from Fed Chair Jerome Powell

- Janet Yellen provides clarity over the definition of a ‘broker’ as it relates to digital asset regulation

US Secretary of the Treasury Janet Yellen clarified that the definition of a “broker” does not include hardware wallet manufacturers, software developers, miners or providers of un-hosted wallets that do not take custody of funds.

Grayscale sent the US Securities and Exchange Commission (SEC) a letter arguing that the rejection of a spot-based BTC ETF is in violation of the Administrative Procedure Act (APA).

US Federal Reserve Chairman Jerome Powell agrees to retire the word “transitory” as it relates to inflation, citing supply-chain bottlenecks as a key driver.

BTC and ETH saw their momentum stall after Powell’s remarks, as risk-off sentiment took hold on expectations of tighter monetary policy to combat inflation.

NFT volumes have fallen drastically over the past 24 hours, namely Bored Ape Yacht Club.

Latest in Macro:

- S&P 500: 4,567, -1.90%

- NASDAQ: 15,537, -1.55%

- Gold: $1,773, -.66%

- WTI Crude Oil: $66.70, -4.65%

- 10-Year Treasury: 1.439%, -.09%

Latest in Crypto:

- BTC: $57,721, -.91%

- ETH: $4,670, +5.32%

- ETH/BTC: 0.0808, +5.12%

- BTC.D: 41.72%, -1.51%

Yellen provides regulatory clarity

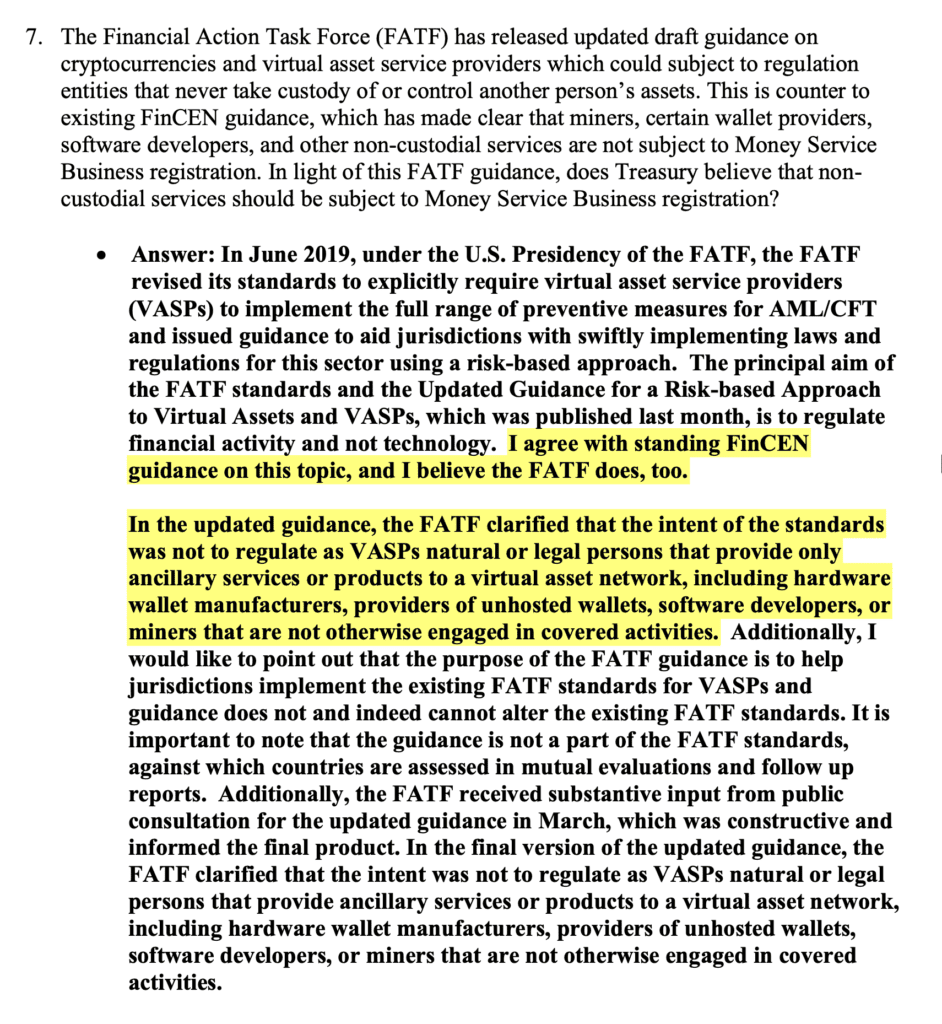

The $1 trillion bipartisan infrastructure bill that contained vague wording around cryptocurrency was signed into law on November 15, 2021. Although provisions will not go into effect until January of 2024, many experts in the digital asset industry have been worried it could lead to devastating repercussions for the emerging asset class.

The main cause for concern to this point has been the requirement for every broker to report their cryptocurrency gains in a type of 1099 form. Brokers would be expected to disclose the names and addresses of their customers.

The ambiguity around the definition of “broker” is significant because it could be interpreted to include hardware wallet manufacturers, software developers, miners or providers of un-hosted wallets. The reason that is such a problem is that the aforementioned parties do not have all of the information required to submit 1099’s, which would theoretically put them out of compliance with the law.

Today Yellen provided some much-needed clarity. She said that the guidance from the Financial Action Task Force (FATF) is consistent with the standing guidance from the Financial Crimes Enforcement Network (FinCEN) with regard to digital assets.

This means that the definition of “broker” does not include hardware wallet manufacturers, software developers, miners, or providers of un-hosted wallets who do not take custody of funds. Yellen went further to say that the guidance is not binding on jurisdictions and is in fact just guidance, according to a document laying out questions from Senator Pat Toomey (R-PA):

Source: @jerrybrito

Source: @jerrybritoGrayscale’s letter to the SEC

Craig Salm, a member of the legal team at Grayscale, took to Twitter to announce that the firm has sent the SEC a letter arguing that the rejection of a spot-based BTC ETF is in violation of the APA. Grayscale released a formal announcement on their website.

BTC and ETH stall on Powell’s remarks

Powell appeared alongside Yellen before the Senate Banking, Housing and Urban Affairs Committee about the Coronavirus Aid, Relief and Economic Security (CARES) Act Tuesday for the first of two days of testimony, Blockworks reported earlier today.

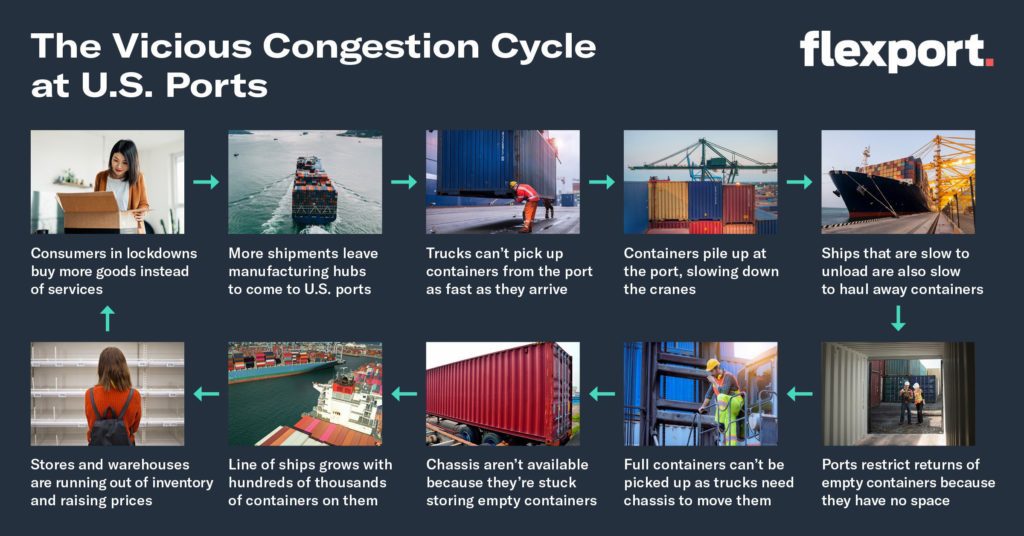

The Federal Reserve has a different definition of the term “transitory inflation” than most Americans, Powell said, suggesting that the word be retired. With CPI prints coming in at the highest rates in the past 30 years, it is safe to say inflation is no longer transitory due to ongoing supply-chain bottlenecks.

“We didn’t predict the supply side problems, and those are really [non-]linear and hard to predict,” Powell said. “That’s really what we missed, and that’s why professional forecasters had much lower expectations for inflation.”

Vice President, Kamala Harris, took to Twitter to say that President Joe Biden has taken action to get the largest US ports operating 24/7 to reduce port congestion which is contributing to the supply-chain problems and therefore higher inflation. (See image below.)

Source: Flexport

Source: FlexportIf inflation pressures persist, Powell said, it may be appropriate to hasten the pace of asset purchase tapering, which the Fed announced would begin this month.

Powell’s remarks sent both traditional financial markets and the digital asset market lower due to fears of tighter monetary policy. Prior to the testimony, ETH was within spitting distance of all-time highs while BTC topped $59,000 for a brief moment before they both corrected.

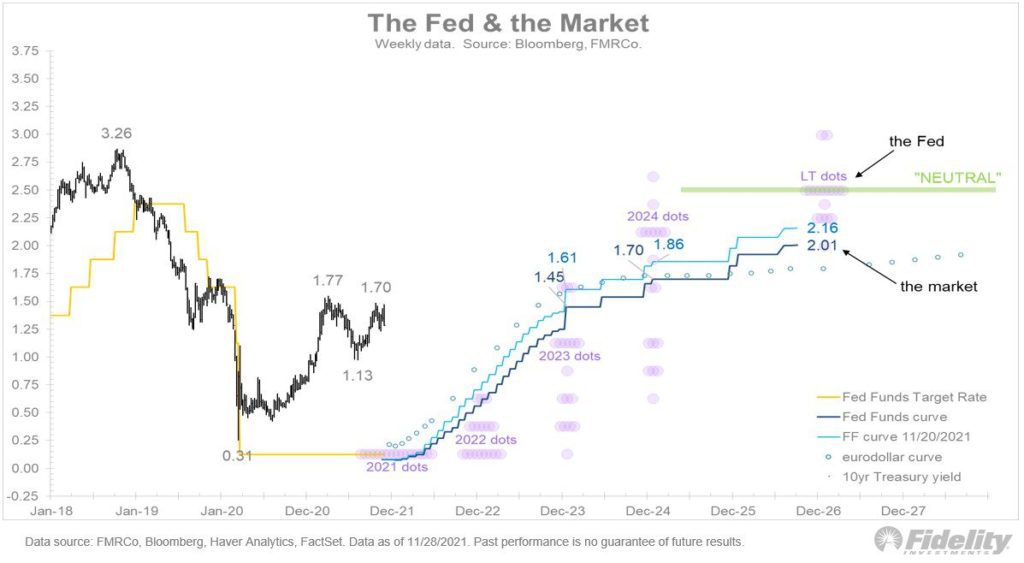

The Fed and the market

“The rates market quickly unpriced some of the Fed’s expected normalization path. This chart shows the Fed Funds curve as of Friday (dark blue) and a week before (light blue). In my view, Friday’s action wasn’t enough to slow down the Fed’s taper or projected rate hike path.” wrote Jurrien Timmer, director of global macro at Fidelity.

Source: @TimmerFidelity

Source: @TimmerFidelityToday’s remarks from Powell reaffirmed Jurrien’s expectations that the Fed plans to stick to the plan in terms of tapering and rate hikes in order to combat hot inflation.

“That means to get back to the kind of great labor market we had before the pandemic, we’re going to need a long expansion. To get that, we’re going to need price stability and the risk of persistent high inflation is also a major risk to getting back to such a labor market,” added Powell during the testimony.

The Fed’s acknowledgment of inflation and the dangers it brings to the economy makes it more likely that the Fed will lean towards tightening monetary policy over the near-to-medium term, hence the risk-off sentiment in markets after his remarks.

“The Fed chairman said the central bank will start discussing tapering faster than expected at its December meeting as the inflation pressures are higher than expected. Yellen also mentioned the uncertainty on the government funding situation after December 15, as well as Moderna’s CEO saying he expected the vaccines to be less effective against the new Omicron variant,” Kevin Kang, founding principal at BKCoin Capital, told Blockworks.

He continued by adding, “With the uncertainty in macro outlook, I don’t believe we’ll see the new all-time high in ETH in November. The dollar has rallied significantly this month, putting pressure on Bitcoin’s upside as well. However, we can certainly hope for the Santa Clause rally in December.”

Non-Fungible Tokens (NFTs)

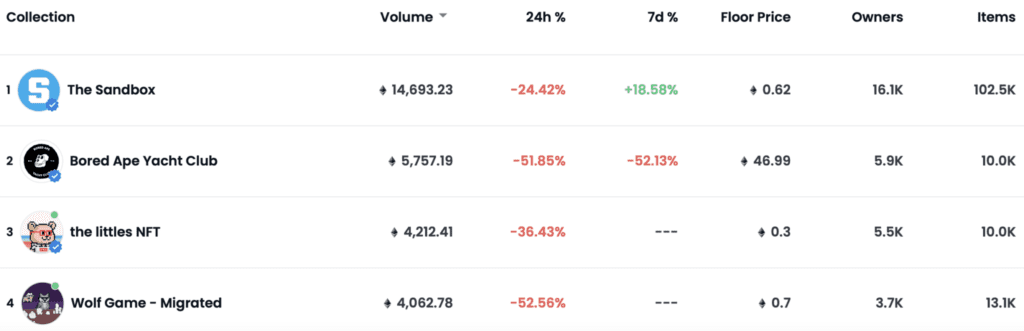

Trading volume for many NFT projects has dropped significantly over the past day. Bored Ape Yacht Club has cooled down considerably after a hot week last week.

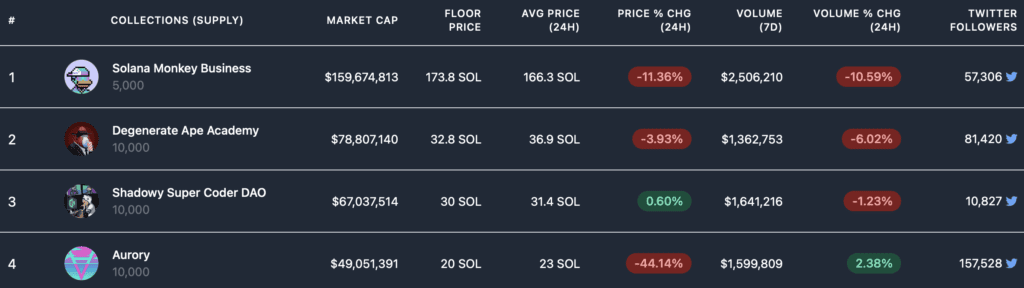

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.