Crypto Exchanges Weigh Blocking Russian Accounts as Sanctions Intensify

Binance: “We will not unilaterally freeze millions of accounts”

Blockworks exclusive art by axel rangel

- Non-US based cryptocurrency exchanges face pressure from lawmakers around the world to ensure compliance with Russian sanctions

- Blocking all accounts would go against the founding principles of cryptocurrency, Binance said

As countries around the world continue to issue sanctions aimed at isolating Russia’s economy from the global financial system, cryptocurrency exchanges are facing pressure from governments and industry advocates to address sanction violation concerns.

Increasingly aggressive sanctions, including the Department of the Treasury blocking Russia’s central bank from transacting in US dollars and Switzerland freezing Russian financial assets, have lawmakers and industry members wondering if Russian businesses will turn toward cryptocurrency to work around the ruling.

“A US company using crypto to sidestep sanctions with Russia will be in violation of US laws. It is as simple as that,” Yankun Guo, partner at Ice Miller, said. “It is plausible that certain companies will try to circumvent sanctions by using crypto…only those companies willing to take the risk of violating sanctions are likely to do this.”

Mykhailo Fedorov, Ukraine’s vice prime minister and minister of digital transformation of Ukraine, pleaded with cryptocurrency exchanges to block the addresses of Russian users in a Tweet Sunday morning.

Cryptocurrency exchange Binance, which currently has no official headquarters, will be “taking the steps necessary to ensure we take action against those that have had sanctions levied against them,” a spokesperson told Blockworks Monday. However, it is not open to a blanket ban of all accounts.

“We are not going to unilaterally freeze millions of innocent users’ accounts,” the spokesperson said.

“Crypto is meant to provide greater financial freedom for people across the globe. To unilaterally decide to ban people’s access to their crypto would fly in the face of the reason why crypto exists.”

The exchange is monitoring current sanctions and will abide by any issued in the future, the spokesperson added. Binance also announced a $10 million minimum donation in cryptocurrencies to intergovernmental organizations and nonprofit organizations in Ukraine on Monday.

Bahamas-based exchange FTX is taking a similar approach and “plans to continue complying with the laws related to sanctioned countries,” a spokesperson told Blockworks.

“FTX does not service fiat with Russian banks,” Sam Bankman-Fried, CEO of FTX, told Blockworks. “If there were any sanctioned individuals on FTX, we would have taken action, but we cannot comment on who does/doesn’t have FTX accounts.”

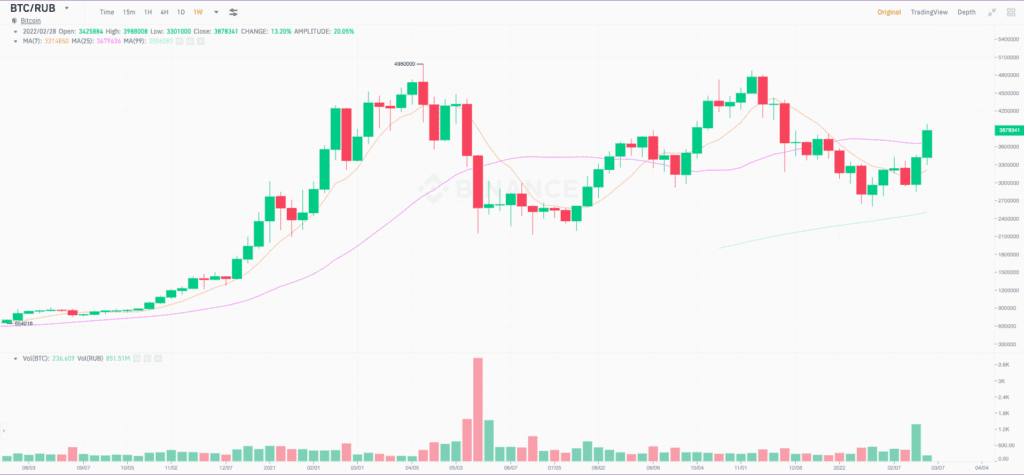

The sanctions increase comes as trading volumes between bitcoin and the Russian ruble hit a nine-month high, according to data from cryptocurrency research firm Kaiko, cited by Bloomberg. Volume on the most popular BTC/RUB trading pair, found on the Binance exchange, shows a surge over the past week not seen since mid-May 2021.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.