Crypto Venture Funding is at an All-Time High, This is Where the Money is Going

As of mid-June, an all-time high of $17 billion has been invested into crypto projects in 2021, and NFTs may be a front runner.

Blockworks exclusive Art by Axel Rangel

- Crypto projects are receiving a record amount of venture capital funding so far this year

- The NFT space is one of the fastest growing areas of the industry, and may be protected from regulatory crackdowns, one expert said

There is a record amount of venture capital money pouring into the digital asset space, and non-fungible tokens (NFTs) may come out on top. As of mid-June, an all-time high of $17 billion has been invested into crypto projects in 2021.

“We have many data points that show that institutional interest in this space is large and growing still, and venture funding is one really obvious one,” said Alex Thorn, head of firmwide research at Galaxy Digital. “We’ve seen enormous funds raised.”

This month alone, TRON, one of the world’s largest decentralized blockchain systems, announced the launch of a $300 million fund to invest in GameFi projects over the next three years. Andreessen Horowitz, Ribbit Capital, 10T Holdings, Alameda Research and Multicoin Capital invested $111 million into Helium Network, a peer-to-peer 5G wireless network provider.

“This is institutional money. They can maybe buy crypto directly, and many of them probably do so, but there’s huge interest to invest in the space and there’s an enormous number of unicorns now,” said Thorn.

One of the biggest areas of the industry gaining venture capital interest is the DeFi and the NFT space, Thorn said. Today’s precarious regulatory environment around bitcoin has pushed investors into NFTs, a sector seen as potentially more protected from regulatory crackdowns for now, Thorn explained.

“I also think it’s noteworthy that while DeFi in particular has a lot of regulatory overhang, I don’t think a lot of people are worried about NFTs having any kind of risk,” said Thorn. “Investors might think that bitcoin is great, but the Fed maybe doesn’t like it, so maybe that’s a risk, and same with DeFi, there are regulatory risks there, too.”

The gaming sector, which is seen as a key growth area for NFTs, has raised almost $5.9 billion in funding so far in 2021, more than the past two years. The record year for gaming venture funding was in 2018, with $6.1 billion allocated to the space, according to Crunchbase.

“I think we’re gonna see huge growth in NFTs for gaming,” said Thorn. “It’s such a massively large industry, gaming today generates more revenue than movies and music combined. We know blockchain technology could have a huge impact because it’s practically already being done in gaming; it’s like tokens without a blockchain, in many cases.”

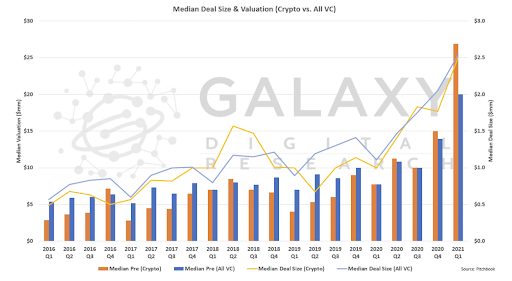

The environment for investors in the crypto space is also becoming more competitive, Thorn said, pointing to the difference between median valuations in digital asset projects versus the broader venture capital market.

Crypto vs. All VC funding; Source: Galaxy Digital

Crypto vs. All VC funding; Source: Galaxy Digital“There is a growing disparity between the median valuation in crypto and the broader VC space. It’s massive. It’s about 50% higher,” said Thorn. “It’s an enormous explosion and that’s a recent phenomenon. Just this year, basically.”

It’s an environment favorable to crypto founders, Thorn pointed out, but the trend will eventually fade.

“There’s obviously a lot of interest in allocating to this space relative to other spaces that we know,” said Thorn. “We’ve got a bonafide potential trend on our hands and we will see how long it lasts. Because we do think it’s still cyclical, interest is cyclical and the markets themselves are cyclical.”

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.