ETH Cracks $4,500; Bitcoin’s Supply Distribution: Markets Wrap

ETH cracks $4,500 on increased adoption and disinflationary supply issuance, Bitcoin’s supply isn’t as concentrated as many people claim.

Blockworks exclusive art by Axel Rangel

- ETH continues its hot streak as usage continues to explode

- Bitcoin’s supply distribution isn’t as concentrated as many people claim

ETH, the “triple point asset”, has surpassed $4,500 on further adoption and declining issuance.

BTC supply distribution is not what it seems at first glance.

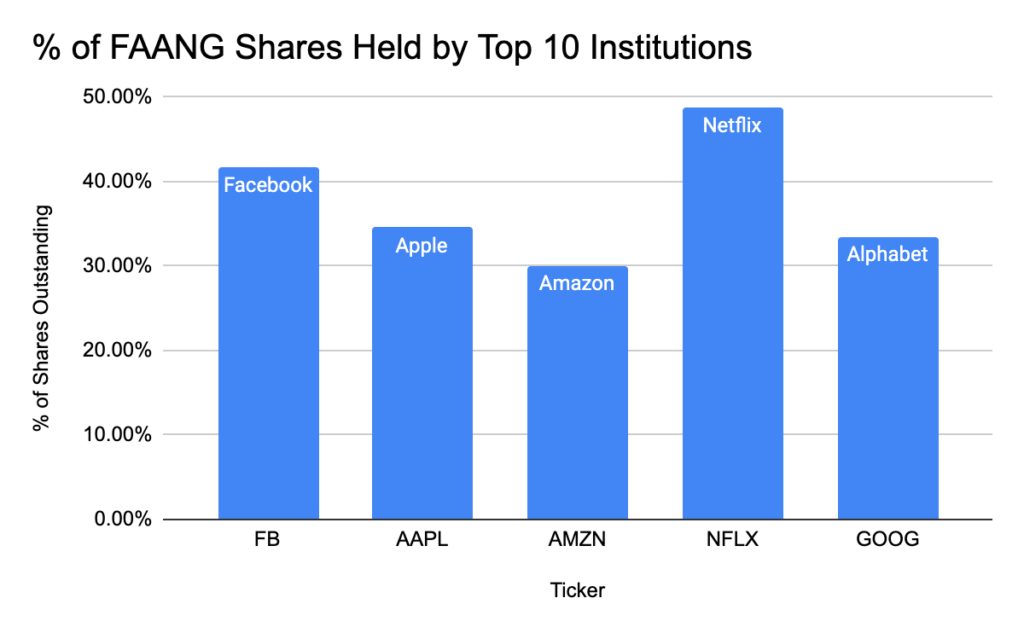

Shares of FAANG stocks appear to be in the control of just a few large institutions from a cursory view.

There are a few updates on various Bitcoin ETF filings.

Gary Vaynerchuk holds an estimated $83.265 million portfolio of NFTs. His wallet can be viewed on Zapper and Blockworks reported on it earlier today.

Latest in Macro:

- S&P 500: 4,630, +.37%

- NASDAQ: 15,649, +.34%

- Gold: $1,787, -.32%

- WTI Crude Oil: $83.51, -.64%

- 10-Year Treasury: 1.545%, -.028%

Latest in Crypto:

- BTC: $63,403, +3.40%

- ETH: $4,507, +3.83%

- ETH/BTC: .0714, +.70%

- BTC.D: 43.87%, +.53%

ETH bulls are in control

ETH can be viewed as a triple point asset, according to a newsletter released today from our friends over at Bankless.

- Store of Value

- “Due to its inherent nativity to Ethereum, ETH operates as a pristine collateral asset inside of DeFi. The settlement assurances that ETH provides as collateral gives it favorable economic treatment as a collateral asset. We can see this as virtually every DeFi protocol supports ETH as a collateral type.”

- Capital Asset

- “Ethereum secures itself by Proof of Stake where ETH is that ‘stake’. Validators stake their ETH on their promise to correctly validate the blockchain and, in return, are paid in ETH for their services.”

- Commodity

- “Ethereum blockspace is a commodity that powers all parts of the Ethereum economy. It is the energy that powers the smart contracts and operates the network. Using ETH, you pay for the computational resources that are required of the Ethereum network to process your transaction. It is the commodity money that exists inside of the Ethereum economy.”

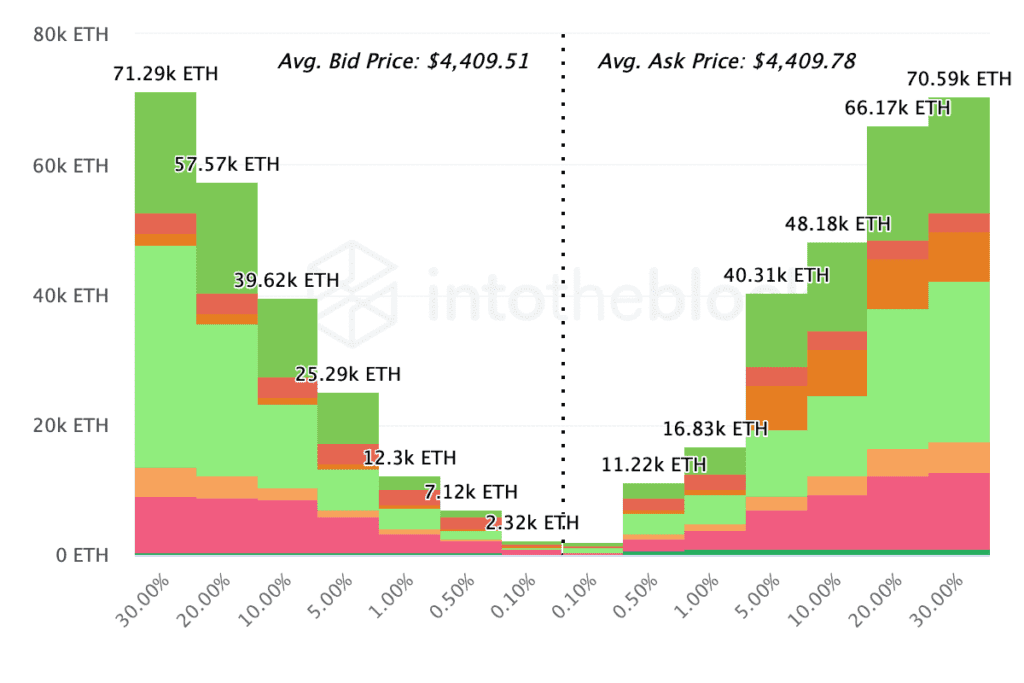

ETH has breached $4,500 and order books from major exchanges paint a bullish picture.

Source: intotheblock.com

Source: intotheblock.com

ETH issuance continues to decline thanks to the upgrade EIP-1559 that was implemented in August, causing the base fee when transacting on the Ethereum network to be burned. This makes ETH less inflationary.

Many investors anticipate the ETH issuance to become deflationary when the merge completes in the first half of next year, which will mark the end of proof-of-work for the Ethereum network as it completes its transition to proof-of-stake.

Source: intotheblock.com

Source: intotheblock.comETH holders are all in profit

Another catalyst for ETH going forward could be increased institutional adoption. Currently, a vast majority of open interest in the futures market and investment-grade products revolve around BTC. With ETH micro futures launching on the CME on December 6th and many analysts expecting the approval of a futures-backed Ethereum ETF over the coming months, a flood of capital waiting on the sidelines may pour in.

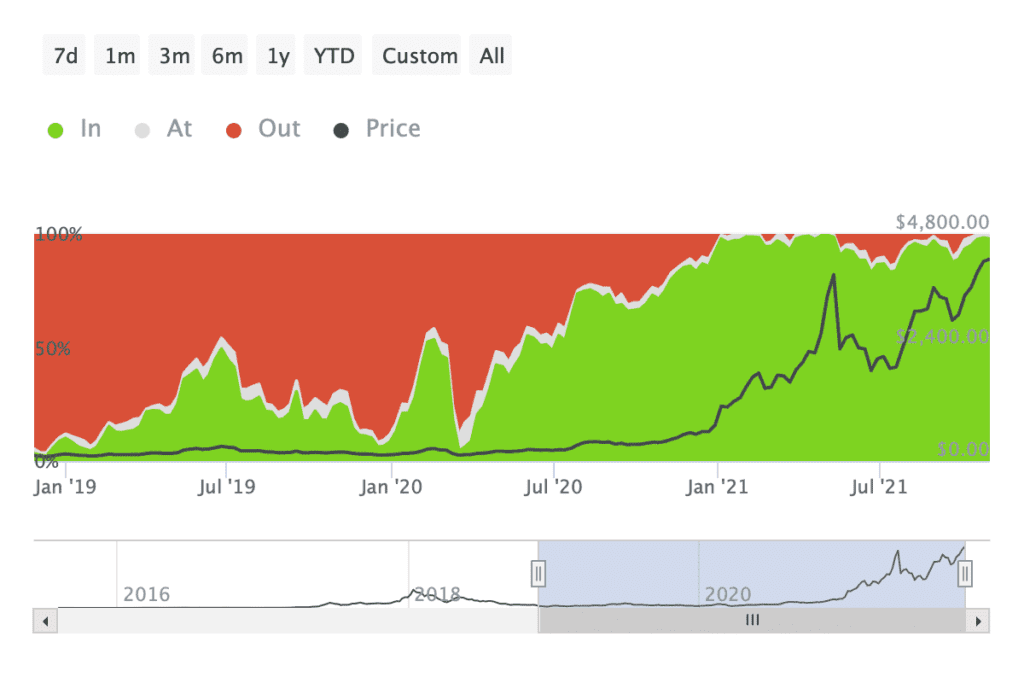

The percentage of ETH holders that are in a state of profit is hovering near all-time highs, practically at 100% as the triple point asset remains in price discovery. It turns out there has never been a bad day to buy ETH since its initial coin offering in 2014.

Source: intotheblock.com

Source: intotheblock.com

Bitcoin supply distribution

Critics often times like to use the data publicly available to claim that the BTC supply is concentrated and is therefore not adequately decentralized money.

At first glance of the on-chain data, this would appear correct. “18.7M of 18.9M total bitcoins are held by the top 10% of bitcoin addresses while 17.3M are held by the top 1% of addresses. But this is very misleading when taken at face value as many of the largest addresses are entities holding bitcoin on behalf of thousands, if not millions, of individuals,” a Coin Metrics report said.

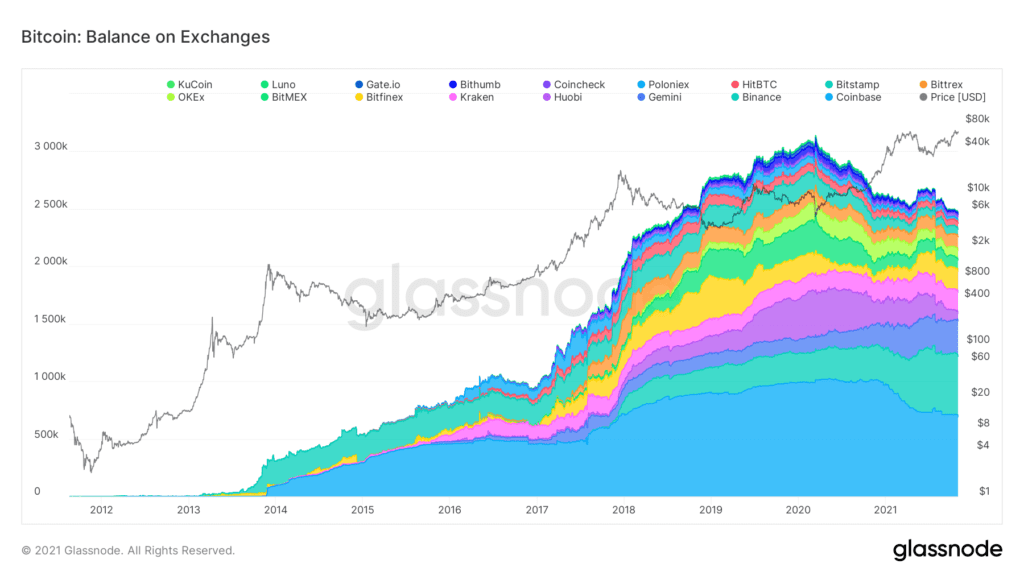

When looking at the balance of BTC on exchanges from Glassnode, there are roughly 2.475 million BTC, or approximately 13% of the circulating supply, held in their wallets. This would lead someone looking at the on-chain data to believe that the supply is being held by an individual, when in all reality that is not the case.

Source: Glassnode

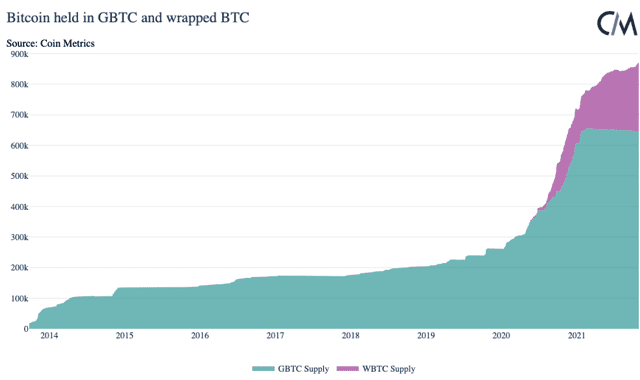

Source: GlassnodeThere is also a large number of BTC being held on behalf of Grayscale Bitcoin Trust (GBTC) investors, resulting in a large concentration of the supply being held in a small number of wallet addresses.

Wrapped Bitcoin (WBTC) is another black hole for BTC supply that could be deceiving at first glance.

The Coin Metrics report continued, “225K BTC is ‘wrapped’ as a token (WBTC) that can be used within the Ethereum ecosystem. WBTC tokens are backed 1:1 and redeemable for the underlying BTC. The BTC is effectively held in custody by a few addresses that appear like large holders when in reality 41K Ethereum addresses have a positive balance of WBTC.”

Source: Coin Metrics

Source: Coin MetricsFAANG outstanding shares supply concentration

It is also worth noting that many traditional financial instruments appear to have a high concentration of supply held by a select few entities, but a little bit of due diligence will quickly uncover that it is far from the truth.

The percentage of FAANG stocks held by top institutions would be alarming to those who don’t understand that millions of investors gain exposure to their holdings through various investment products such as ETFs.

Source: Coin Metrics

Source: Coin Metrics

Bitcoin ETF updates

The US Securities and Exchange Commission (SEC) moved back the deadline to make a decision on the proposed Valkyrie Bitcoin Fund by 60 days (from Nov. 8 to Jan. 7, 2022), according to a disclosure published on Monday.

The differentiating factor between Valkyrie’s proposed ETF would be that it holds spot BTC as opposed to currently listed, BITO, which is backed by futures contracts traded on the CME.

“We believe this a positive step because it means the agency is taking the time to deliberate and wholly consider the merits of such a product coming to the market,” Leah Wald, CEO of Valkyrie Funds, told Blockworks. “Given this expanded window, we are eager to use this as an opportunity to further collaborate with the regulator to help alleviate any concerns they may have and hopefully realize a positive outcome sometime next year.”

The postponement comes about two weeks before competing fund manager VanEck’s proposed physically backed bitcoin ETF reaches its last deadline — meaning the SEC cannot again delay its decision — on Nov. 14.

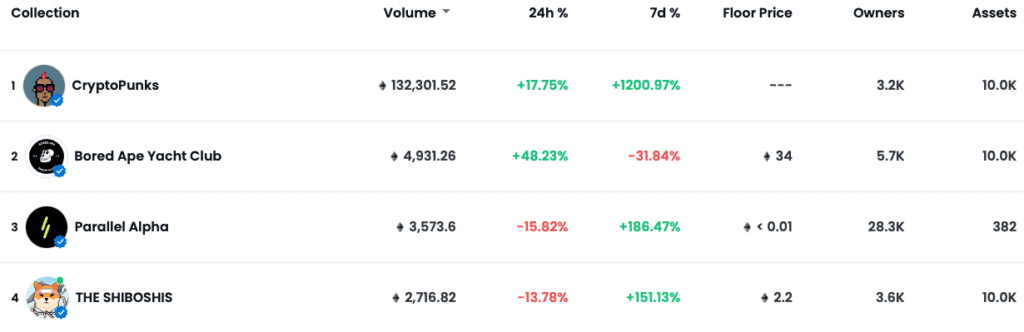

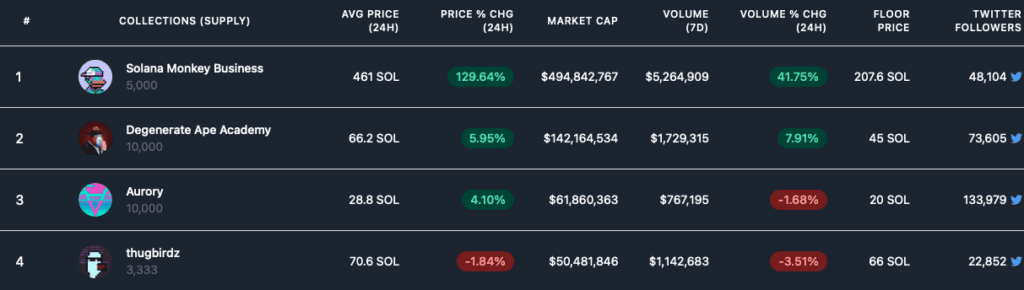

Non-Fungible Tokens (NFTs)

Gary Vaynerchuk holds an estimated $83.265 million portfolio of NFTs. His wallet can be viewed on Zapper and Blockworks reported on it earlier today.

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.