German Crypto Exchange Nuri Shuts Down

Nuri — formerly Bitwala — filed for insolvency in August and has struggled to find investors since its latest Series B in June

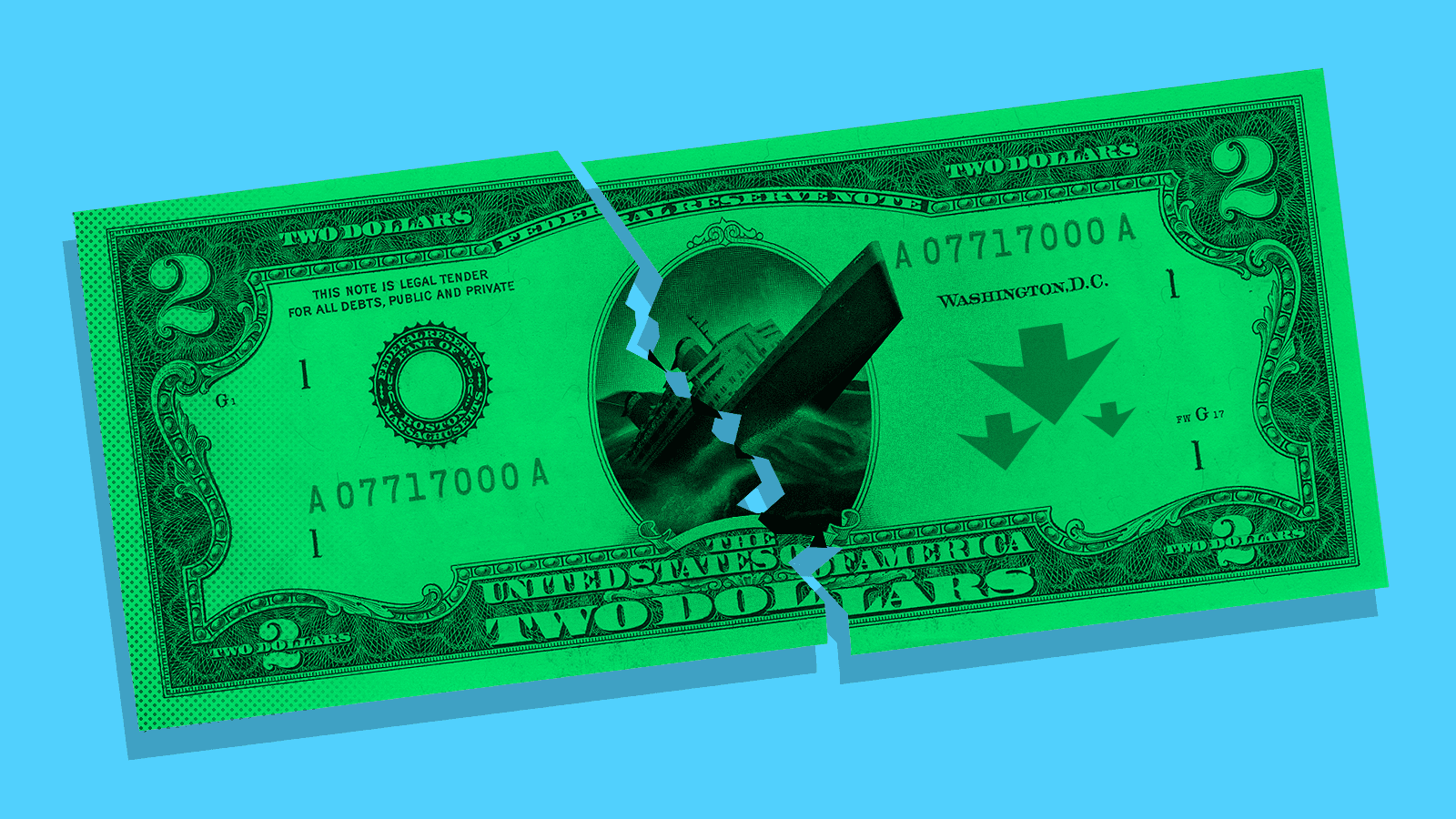

Blockworks exclusive art by axel rangel

- Trading will remain possible until Nov. 30

- Customers have until Dec. 18 to withdraw funds

German cryptocurrency exchange Nuri has closed its business after struggling to find investors.

The Berlin-based exchange with over 500,000 customers filed for insolvency in August after “challenging market developments and subsequent effects of financial markets,” the company said in an earlier statement.

Customers have been asked to withdraw funds by Dec. 18 and trading will still be possible before Nov. 30, Kristina Walcker-Mayer, CEO of Nuri, said in a blog post.

“We recommend you withdraw all funds in your Nuri account as soon as possible,” the company said. “After the closure of the Nuri app, you will not lose your funds. But you’ll need to contact the respective partners and go through a manual process to withdraw them.”

Nuri has partnered with European mobile crypto and banking app Vivid Money GmbH to enable its customers to continue to trade cryptocurrencies. All Nuri users will be given an exclusive offer and transfer of funds and assets, according to the company.

The cryptocurrency exchange was founded in 2015 under the name Bitwala. It has received a total of 42.3 million euros ($43.1 million) after eight funding rounds, but has struggled to find investors after its latest Series B in June, according to reports from German tech news website t3n.

“The challenges have become insuperable due to the tough economical and political environment of the past months, which kept us from raising new funds or finding an acquirer,” Walcker-Mayer said. “On top, the insolvency of one of our main business partners worsened the situation significantly and put us over the edge.”

Nuri is not the only cryptocurrency exchange that has been affected by the crypto bear market — many exchanges including Coinbase, Gemini, Robinhood, Crypto.com and BlockFi have all had to cut staffing after suffering significant losses.

Walcker-Mayer concluded her statement by thanking Nuri staff, customers and investors for their support.

“You went through very tough times with us since the beginning of the year and constantly rolled up your sleeves to face the next challenge together, constructively and positively. It was an honour to work with you. Every single day,” Walcker-Mayer said.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.