Many Exchanges in China Continue to Operate OTC Desks Despite ‘Ban’

RMB-USDT exchange rate has stabilized as the sector operates in an indefinite grey area.

Source: Shutterstock

- China’s recent ‘ban’ on crypto was simply a reaffirmation of the lack of legal avenues for consumer protection

- While some exchanges have signalled that they are halting new user signups and moving operations offshore, their OTC operations continue unabated

Despite reports of a ‘ban’ on cryptocurrency in China, the RMB-USDT currency pair continues to post significant volume while OTC desks remain active in the country.

China-focused exchanges OKEX and Huobi still offer the RMB-USDT, as do Binance, KuKoin, and Gate.io. According to pricing data reviewed by Blockworks, price slippage is stable only down approximately 1% from the official RMB-USD exchange rate.

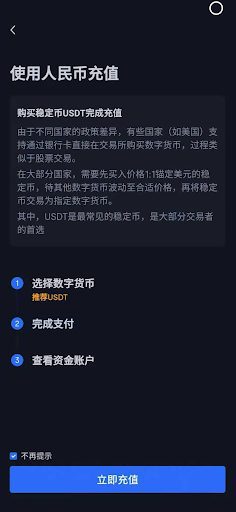

Source: OKEX being used to buy USDT from within China on Sept 28, 2021

Source: OKEX being used to buy USDT from within China on Sept 28, 2021The specific type of trade popular on these exchanges involves an OTC desk, which links together traders in a peer-to-peer fashion. The buyer would initiate a bank transfer to the seller’s designated account, and upon receipt of the transfer they would release the digital asset on the exchange.

“In China, there’s always a way to move around things and then get back,” Tony Ling, a Hangzhou-based partner at Bizantine Capital said to Blockworks via WeChat. “In the western world, illegal means illegal. It’s direct.”

To be sure, possession of crypto and peer-to-peer aren’t illegal in China. Rather, the government pointed out with its announcement last week, there’s simply no legal codification for crypto within China so in the event of a dispute it’s not possible to use the court system to resolve things. Securities laws, however, prohibit exchanges from offering RMB-denominated crypto pairs which is why OTC is popular

Ling also noted that around China’s national holidays everything becomes more rigorous and strict. Recently, The Block reported that some of the largest portals for digital assets data like CoinMarketCap and CoinGecko are now inaccessible from within China without a VPN.

However, other large data portals for digital asset prices like CryptoCompare and Crypto.com are not blocked in China according to GreatFire, a service to check if sites are blocked within China.

“But you never know if, tomorrow, exchanges like OKEX will shut down and leave China forever. But until now, things are still going on,” Ling said.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.