Lightspeed Newsletter: Moonshot is vertical integration for memecoins

Blockworks plays around on Pump.fun competitor Moonshot, DEX Screener’s new memecoin launchpad

ddRender/Shutterstock modified by Blockworks

Today, enjoy the Lightspeed newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Lightspeed newsletter.

Howdy!

I know there have been allegations that I’m too sports bro-ey in these intros, but the haters and losers should know that I have range, baby.

Last night, I watched Pride and Prejudice for the first time. It was fun seeing Tom Wambsgans as a dour British guy, and Mr. Collins stole the show for me. His dinner party scene had me cackling.

Overall, I’d rate it an 8/10. Anyways:

DEX Screener’s ‘Moonshot’ vertically integrates memecoin trading

On Monday, I shelled out $2 in solana to become one of the first users to launch a token with Moonshot, which is DEX Screener’s new memecoin launchpad.

My token (which was VERY clever and funny, but I don’t want to shill my own coin, so you’ll just have to take my word for it) drew a $250 investment minutes after launch. I greedily snapped up a dollar’s-worth of my own token, wondering if I’d just created the next DogWifHat. Then the buyer dumped his allocation at a slight profit, leaving me holding the bag.

If you scroll through new Moonshot tokens, this is a very common event.

The platform is an unambiguous copy of the current king of memecoin creation, Pump.fun, with the same overarching theme: Cheaply launch a new Solana token and try to gather enough investment to migrate the token to the Solana-based DEX Raydium.

Shortly after the launch, Pump.fun’s pseudonymous co-founder Alon not-so-subtly posted the Soulja Boy “he copied my whole flow!” clip on X.

Moonshot does offer one innovation over the competition: the potential to vertically integrate memecoin trading. Pump.fun’s data offering is poor, and many traders currently rely on DEX Screener data for their metrics. DEX Screener also offers a mobile app and a sleeker interface than Pump.

The circumstances feel a bit reminiscent of Instagram’s rip-off of Snapchat stories, insofar as a team with a more established platform is copying an upstart’s feature in hopes of siphoning off users.

Blockworks Research analyst Ryan Connor explained that the market is recognizing memecoin trading as a legitimate retail business opportunity. He likened it to DraftKings sports betting or Robinhood’s 0DTE options trading, suggesting that Moonshot could become part of a larger trend.

“Everyone wants to be a platform, so we should expect attempts to bundle token launches, trading UIs and social [media] into a single application experience. Unlonely, Pump.fun, and now Dexscreener/Moonshot are all extensions of this trend,” Connor said.

Having a platform where users congregate opens up monetization opportunities, and running a Pump.fun derivative could potentially be lucrative. Pump makes money off of trading fees and the angel’s share of liquidity it nabs before tokens migrate to Raydium. I could not get in touch with DEX Screener for this story, but I’d imagine Moonshot’s business model works similarly.

Moonshot offers a better UX than Pump.fun, but it lacks a chat or livestream function, which are both things that make Pump enjoyable for users. Moonshot doesn’t make much of an effort to be a social platform as far as I can tell.

There are other warts to deal with too: Memecoin trading seems to be somewhat on the wane — the number of new Pump tokens created has declined for the past two weeks, according to a Dune dashboard. Plus, users’ odds on Moonshot are something of a long shot. Multiple tokens appear to be launching every minute on the platform, but only around 60 have garnered enough buy volume to reach Raydium. If every token feels like a pump and dump similar to what I experienced, it may be difficult to keep users around.

Plus, the field of competitors will likely grow more crowded.

Another memecoin launchpad soon to enter the arena is Meme Royale, which lets tokens “raid” each other for liquidity, a mechanism partly meant to cut down on dormant liquidity being held in abandoned memecoins. The platform is aiming to launch in roughly two weeks, a Meme Royale spokesperson told me.

“[J]ust like Reed Hastings says that Netflix’s main competitor is sleep, the main competitor to the 22k coins launched every day is all of the ones that go to 0,” the spokesperson said.

Beyond this, I wonder if memecoin platforms will think even bigger, moving beyond rudimentary “trending” feeds to letting users discover tokens via more complex algorithms — something a la TikTok’s ‘For You’ page for memecoins.

— Jack Kubinec

Zero in

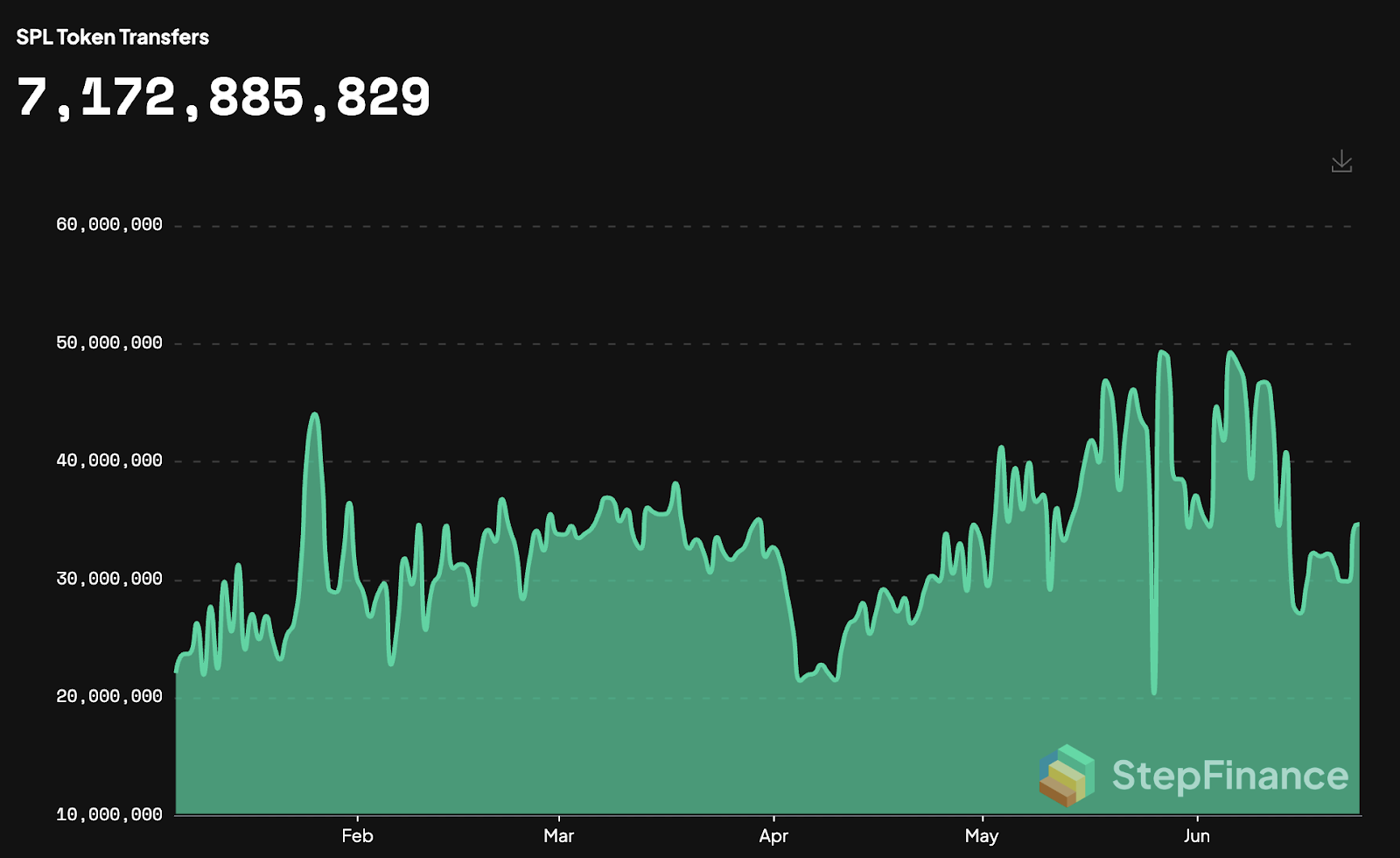

Solana tokens are moving around less than they were a month ago:

This chart from Step Finance shows transfers since roughly the start of 2024 for SPL tokens, which are created with the Solana network’s native token standard.

In late May and early June, daily Solana token transfers almost touched 50 million, and that figure has shrunk closer to 30 million over the past two weeks. Solana token transfers and SOL’s token price slumped in early April. However, the rally continued shortly after.

It’ll be interesting to see if SOL, memecoin trading, and token transfers all have the legs to climb out of the rut once again. Maybe these new blinks will help.

— Jack Kubinec

The Pulse

The launch of Solana blinks (or Blockchain Links) has stirred a lot of excitement and discussion on social media.

@AdityaShetts provided a comprehensive thread detailing his interactions with blinks that have gone live so far. He highlighted that users can now collect NFTs directly through Tensor blinks, trade memecoins directly through X via Meteora, vote on Helium governance proposals right from their Twitter feed, and much much more.

@N0ty0ur0pinion and others raised security concerns about protecting wallets from malicious blinks, while followers like @CryptoSteven88 and @solanasteve_ were amazed at the technology’s seamless integration.

Solana Labs advisor @jordaaash reflected on the transformative potential of Blinks, emphasizing innovative transaction integration into digital interactions. He applauded the collaborative efforts of development teams in pushing Web3 UX forward.

Well-known Solana figures such as @jnwng and @rajgokal encouraged developers to experiment with this technology, predicting it would revolutionize user engagement on social media platforms. Wong highlighted Dialect’s significant contributions, expressing optimism for Blinks’ future impact.

— Jeffrey Albus

One Good DM

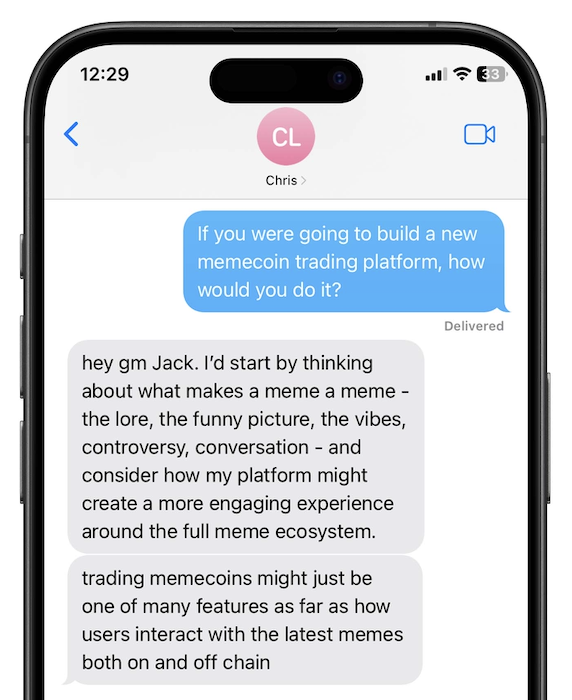

A message from Chris Liquin, CEO of Cupcake:

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.