Bitcoin Climbs Higher: Markets Wrap

Bitcoin rallies above $51,000 on the heels of neutral perpetual funding rates and bullish miner outlook

Blockworks exclusive art by Axel Rangel

key takeaways

- Bitcoin miners are accumulating BTC at record pace

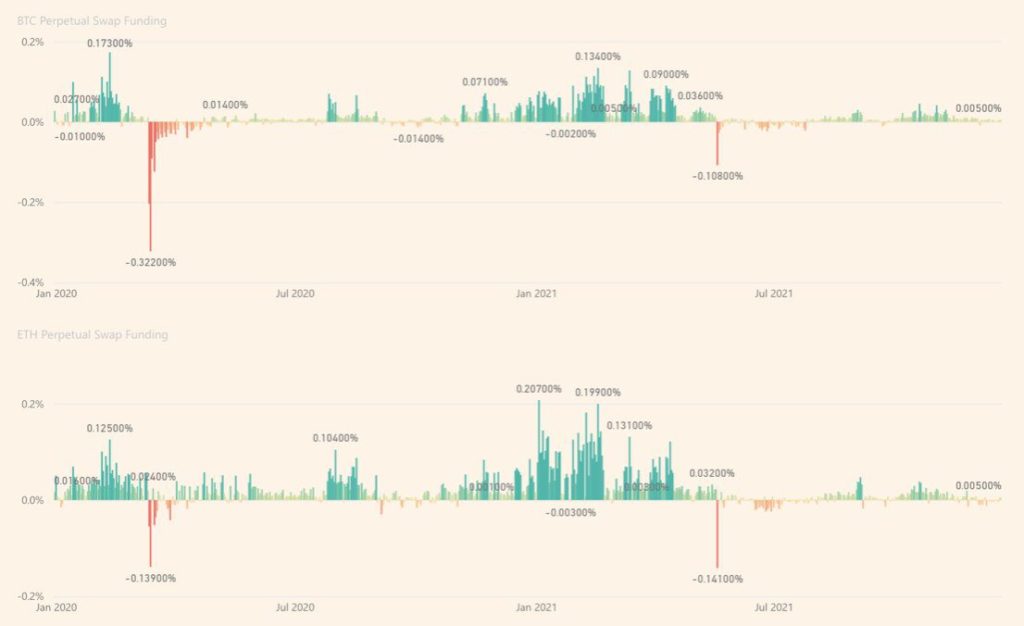

- Perpetual funding rates remain neutral despite increase in exchange leverage ratio

Bitcoin was last trading near $51,500, up over 10% over the last seven days according to data from Coingecko.

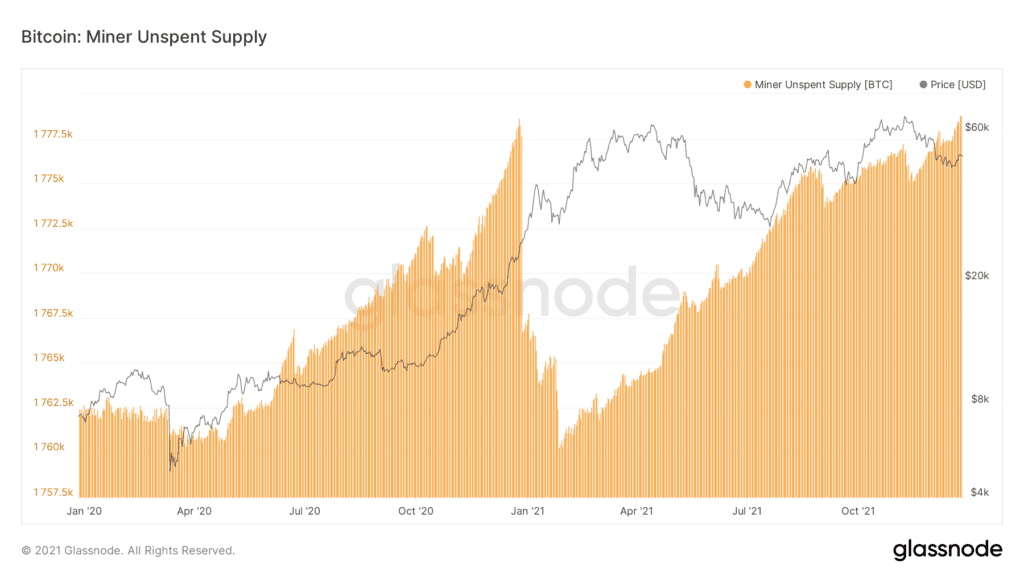

Bitcoin miners are accumulating BTC at a record pace.

Some BTC metrics signal that caution is warranted at current price levels.

Perpetual funding rates are neutral, implying no bias toward the upside or downside.

Latest in Macro:

- S&P 500: 4,791, +1.38%

- NASDAQ: 15,871, +1.39%

- Gold: $1,812, +0.15%

- WTI Crude Oil: $76.01, +3.01%

- 10-Year Treasury: 1.477%, -0.016%

Latest in Crypto:

- BTC: $51,134, -0.40%

- ETH: $4,070, -0.80%

- ETH/BTC: 0.0796, -0.66%

- BTC.D: 40.00%, -0.22%

Bitcoin miners are confident

Bitcoin was last trading near $51,500, up over 10% over the last seven days according to data from Coingecko.

“Miner Reserves, Mean Coin Age, and the Hashrate continued trending higher as BTC price fell. This is a very bullish signal indicating older coins and miners are not aggressively distributing during the sell off. The increasing Hashrate is a sign of Miner’s confidence in the network. Even with a 39% pullback over a month, Miners continued to add hash further securing the network,” wrote @DanBTC916, an Analyst at CryptoQuant.

Noelle Acheson, head of market insights at Genesis, took to Twitter noting similar observations: “We’ve seen a flurry of announcements recently about BTC miners’ plans to increase capacity *significantly* over the coming months. An often-overlooked detail is that this is being done with bank- or market-based financing.”

Noelle continued, “Miners turning to financing vehicles for expansion means that they don’t need to sell their BTC. Indeed, miner unspent supply (new BTC held rather than sold in the market) last week reached an all-time high.”

Source: Glassnode

Source: GlassnodeSigns that caution is warranted

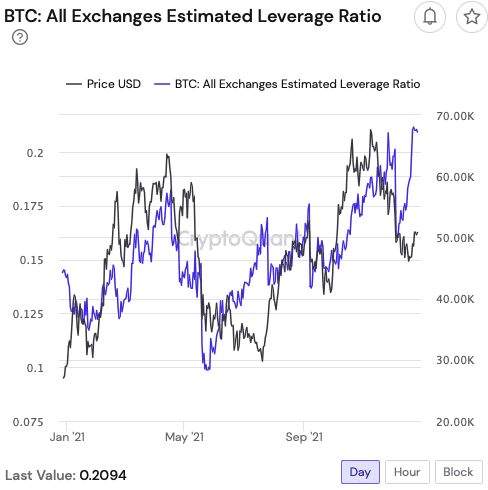

The BTC:all exchanges estimated leverage ratio, which is the amount of open interest across all exchanges divided by their BTC reserves, is hovering near annual highs. This suggests that there could be one last flush out of leveraged players before BTC can make another run.

According to CryptoQuant analyst, Marc Deloreankt, we have two bad signals near the corner:

- 1st: Big leverage ratio. The biggest one in two years. So soon, we probably will have a drop, or long liquidation to clear retail investors in next days.

- 2nd: No big bank outflows since last drop on May ’21. This is not normal and this is another bad sign.

Source: CryptoQuant

Source: CryptoQuantOn a positive note for the bulls, perpetual funding rates are essentially neutral which signals little bias towards the upside or downside on BTC.

Source: @eliasimos

Source: @eliasimos

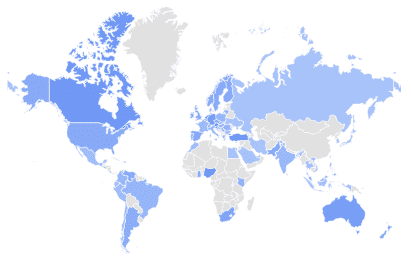

Google search interest for Bitcoin

Jameson Lopp, co-founder and CTO at Casa Hodl, wrote, “Countries with the highest relative search interest for Bitcoin have changed significantly from 2020 to 2021! While it’s no surprise to see El Salvador at #1, it’s notable that it wasn’t even on the list of 66 countries for which Google logged search interest in 2020. El Salvador surged from 150th to 1st place for relative Bitcoin search interest in 2021.”

Source: Google Trends

Source: Google TrendsNFTs

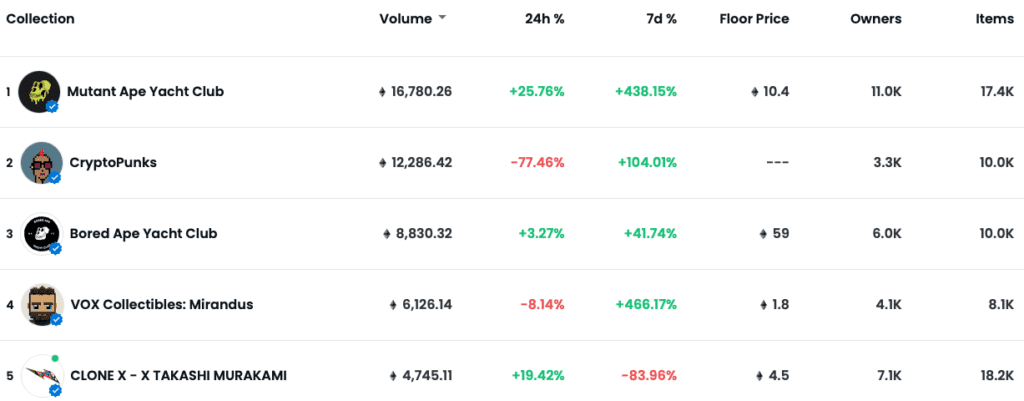

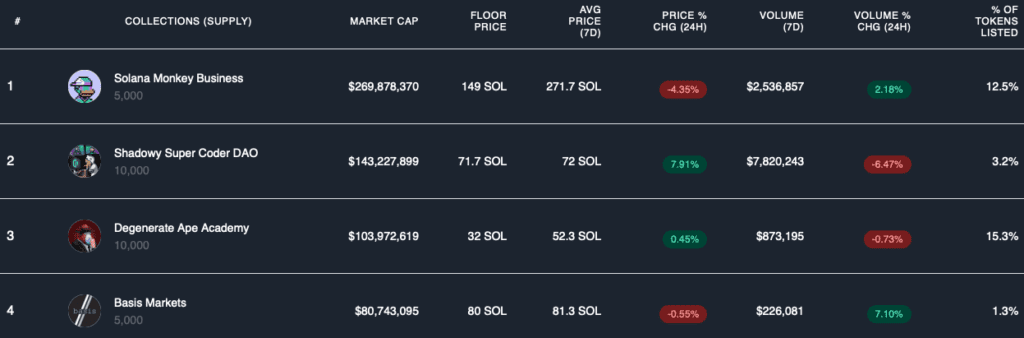

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.