Fidelity Digital Assets’ Sandler: The Regulatory Road Will Be Long

Regulators understand digital assets, they just are not completely sure what to do with them, Christine Sandler, head of sales and marketing at Fidelity Digital Assets said.

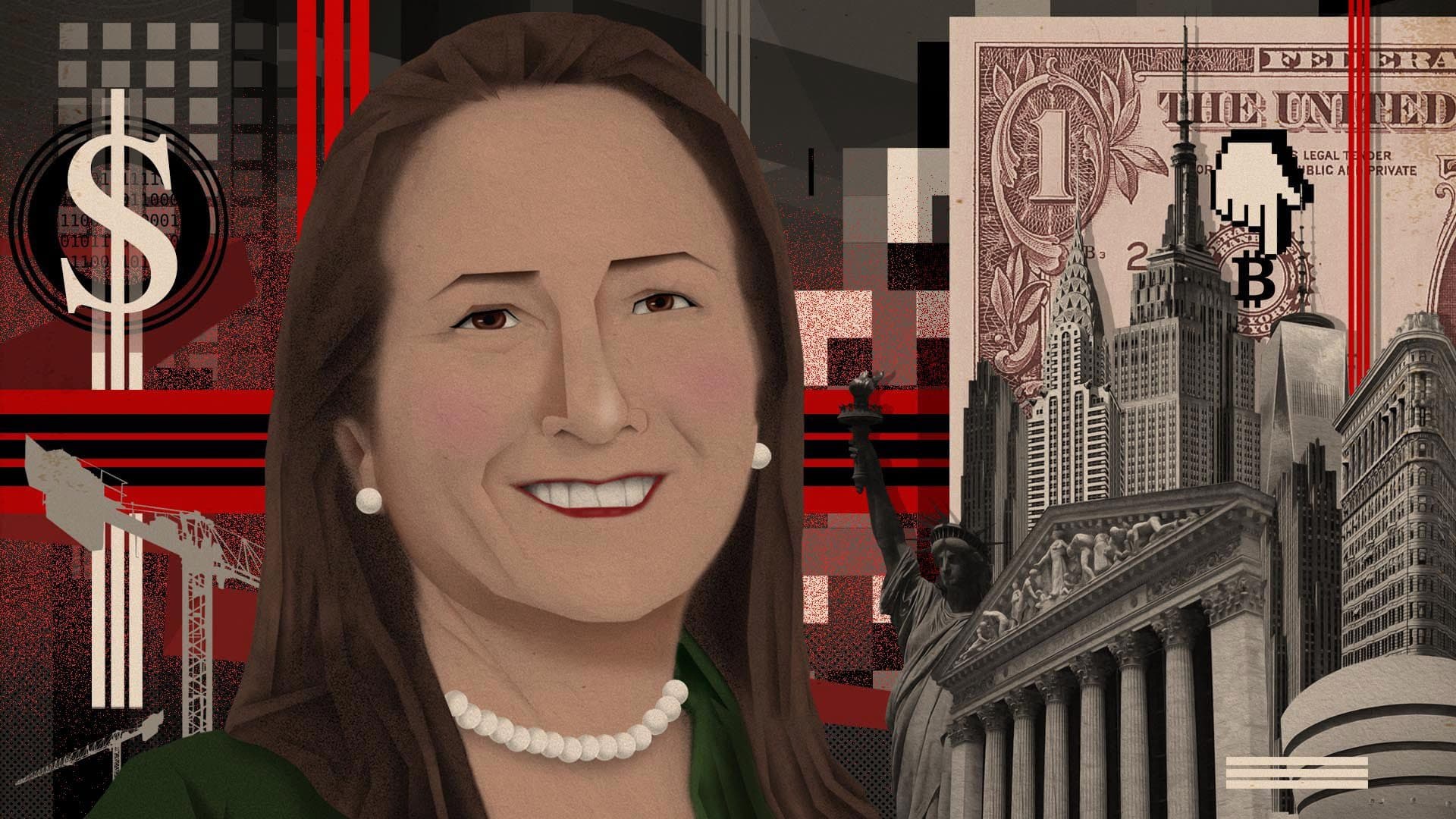

Christine Sandler, head of sales and marketing at Fidelity Digital Assets; blockworks exclusive art by Axel Rangel

- Sandler thinks that regulators mostly understand blockchain technology, but the path forward will be long

- There has been a significant increase in institutional investors looking to get involved in the space, a trend Sandler expects to continue

Earlier this month at Blockworks’ Digital Asset Summit in New York City, Fidelity Digital Assets’ Christine Sandler shared her thoughts on the current state of the regulatory landscape and what we can expect going forward.

Today’s regulatory environment is tumultuous, Sandler admitted, but the common notion that regulators lack understanding about blockchain technology is largely unfounded.

“Most regulators are really educated and really well informed,” she said. “I think they are seeking exposure from really balanced participants that are running commercial businesses in the space and are looking to partner with us and create solutions.”

We are in a period of mass expansion when it comes to digital asset adaptation, Sandler said, as evidenced by FDA’s recent institutional investor study, and regulation will follow.

Regulatory questions will not be easily answered and the road ahead is long, Sandler said, but she is optimistic about the future.

Watch the full interview below and watch all of the panel videos from DAS here.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.