Market Recap: Inflation Keeps Rising, Stocks and Cryptos Slide

Uncertainty reentered the market as soaring inflation leads investors to believe that the Fed may turn more hawkish than expected

Source: Shutterstock

- New inflation reports shows inflation continuing to soar with the highest rate of increase in 40 years

- The increase seems to have brought fear back into the market as investors begin to expect more aggressive policy tightening from the Fed

Inflation continues to soar

In January, the consumer price index increased another 0.6%, pushing the year-over-year figure to 7.5%. The rate of increase in inflation is now the quickest it has been since 1982. In the last week, fear in the market seemed to have been clearing out, but the new inflation report brought it back.

Higher inflation will likely result in more aggressive interest rate hikes by the Fed, a move that has historically correlated with down markets and recessions.

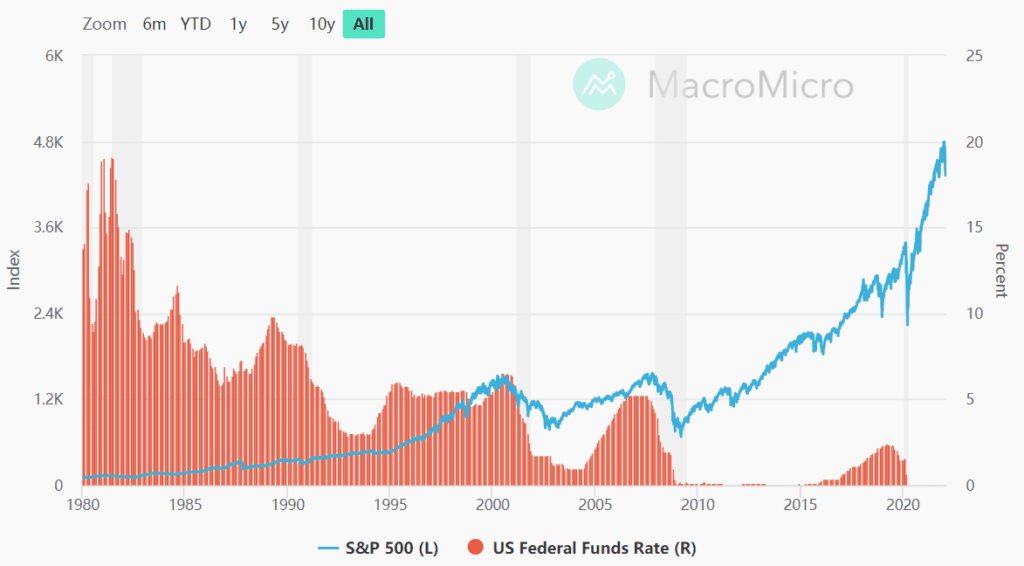

As shown in the chart below, slow increases in the federal funds rate, which directly controls the liquidity in the economy, have correlated with major drops in the S&P 500 in 2000, 2007 and, most recently, in 2019. In contrast, the lowering of the federal funds rate has correlated with intense bull markets.

S&P 500 and the Federal Funds Rate. Source: MacroMicro

S&P 500 and the Federal Funds Rate. Source: MacroMicro

Markets dropped on the news, with the S&P 500 falling as much as 2.18% on the day. The Nasdaq dropped as much as 2.72% and the Dow lost as much as 1.11% on the day, likely due to investors' fears of an aggressive stance from the Fed to combat inflation.

[stock_market_widget type="accordion" template="chart" color="#5B35D5" assets="^GSPC,^IXIC,^DJI" start_expanded="true" display_currency_symbol="false" api="yf" chart_range="1mo" chart_interval="1d"]

Crypto had volatile reactions to the inflation report, with bitcoin increasing 2% then losing 2.53% mid-day. Bitcoin then reversed again to go up over 3%. As the day went on, it began dropping, falling off by half a percent as the equity market wrapped up its day.

Ethereum moved similarly throughout the day, starting up 1.11%, then down almost 4.6% and then up again by over half a percent. By the end of the equity market's day, ether had dropped 3.9%.

[stock_market_widget type="accordion" template="chart" color="#5B35D5" assets="BTC-USD,ETH-USD" start_expanded="true" display_currency_symbol="true" api="yf" chart_range="1mo" chart_interval="1d"]

Crypto investors seemed unsure of how to react to the inflation figures. Some potentially saw inflation as a good sign for crypto, given bitcoin's touted use-case as a hedge for inflation. Many major bitcoin influencers tried to enforce the stance of bitcoin being investors' saving grace against inflation on social media.

Loading Tweet.. Loading Tweet..With bitcoin ending the day in the red, it seems that most investors are concerned that higher inflation only means a more aggressive approach from the Fed in combating the lowering purchase power of the dollar.

Top stories

Story: Sources: UBS Asset Management Vetting Crypto Hedge Fund Managers

- The hedge fund specialist had $43.8 billion of gross assets under management in November 2021, the most recent figure available.

- Crypto strategies present a fresh set of due-diligence challenges for investors.

Story: Analysts Weigh Likelihood of March Rate Hikes as CPI Disappoints Again

- US consumer prices are still on the rise, with January showing the largest year-on-year increase since 1982.

- Inflation woes have already been priced into the market, analysts say, but rate hike speculation continues.

Story: Decentraland, FTX ETPs Launch in Switzerland

- Firm expects further growth of Decentraland and the broader metaverse sector as it predicts that users will continue to distrust Facebook.

- 21Shares CEO Hany Rashwan previously said the firm looks to launch ETPs, supporting what it considers to be the top 50 cryptocurrencies by the end of 2022.

Story: YouTube Doubles Down on NFT Integration, Exec Says

- CEO Susan Wojcicki said last month that NFTs could be another form of revenue for creators.

- YouTube competitor Meta will reportedly integrate NFTs into its platforms.

Going forward

The increase in inflation seems to have spooked investors again, bringing back more fear and uncertainty in the marketplace. Volatility is likely to remain for as long as uncertainty does, which may only be alleviated by a Fed announcement on interest rates and asset purchases.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.