5 Legal Threats Do Kwon Faces Since Terra’s Collapse

Do Kwon’s whereabouts are shrouded in secrecy as legal complications surrounding his failed stablecoin project pile up

Terraform Labs co-founder Do Kwon | Blockworks exclusive art by axel rangel

- Do Kwon is facing three lawsuits in the US and one in Singapore

- The 31-year-old entrepreneur is set to lose his home country’s passport

Do Kwon, Terraform Labs’ founder, shows up to select interviews calmly. He largely appears unfazed by the series of legal threats levied against him.

At the center of several accusations over his failed stablecoin TerraUSD, Kwon claims he isn’t aware of an international arrest warrant in his name and doesn’t believe Interpol is really after him.

TerraUSD (UST) lost its peg in May as wealthy investors dumped their deposits. A bank-like run followed, causing sister token luna to also crash, leading to a combined $60 billion wipeout as confidence in the projects vanished.

It took some time for players in the industry to absorb the impact on their businesses. For instance, Singapore-based crypto lender Hodlnaut froze withdrawals on its platform in early August. But the firm revealed only some 10 days later that it was TerraUSD’s crash that triggered high volumes of withdrawals.

Now, it’s reported to have lost nearly $190 million from the fallout.

South Korean prosecutors almost immediately opened investigations into Terraform Labs and blocked employees from leaving the country. Kwon, who claims to be cooperating with authorities, has remained silent about his whereabouts. While he’s believed to be living in Singapore, a recent report indicated he was in Dubai for a layover.

In an interview with crypto journalist Laura Shin, Kwon hinted at his plans for the future:

“I plan to be working on things that are exciting to me. Once again, I am but 31. I still want to contribute. Definitely, all of these are going to be highly experimental…just for my fun in building them.”

The potential for Kwon to fail upwards — or even sideways — and remain in the crypto industry is certainly real. Still, the entrepreneur will have to grapple with these legal challenges moving forward:

1. Lawsuits in US courts

US law firms Scott+Scott and Bragger Eagle & Squire filed similar class-action lawsuits, in June and July respectively, against Kwon and other affiliates on behalf of Terra investors.

The lawsuits claimed that the defendants participated in the sale of unregistered securities and that Terraform Labs deceived retail investors by inducing them to purchase tokens at artificially inflated prices.

A separate New York suit by plaintiff Matthew Albright on Aug. 25 argued the UST stablecoin amounted to a Ponzi scheme that was only supported by high yields of the Anchor protocol.

“Defendants engaged in a pattern of racketeering activity to support and profit off their scheme, namely by making fraudulent statements through interstate wire transmissions regarding Terra’s sustainability, and by laundering money out of Terraform Labs and into personal accounts,” Albright said in the lawsuit.

2. South Korea issues arrest warrant for Kwon

Four months after the Terra ecosystem’s collapse, South Korean prosecutors put out arrest warrants for Kwon and other employees including head of research Nicholas Platias and staff member Han Mo in mid-September.

They are wanted for charges relating to violations of capital market laws.

3. Interpol issues red notice for Do Kwon

In late September, Interpol issued a global request — called a red notice — to locate and arrest Kwon.

The Seoul Southern District Prosecutors’ Office confirmed the development after issuing arrest warrants for multiple Terraform insiders.

4. TerraUSD investors claim damages worth $57 million in Singapore lawsuit

According to a document shared by the Wall Street Journal this weekend, some 369 investors filed a lawsuit against Do Kwon in Singapore, claiming to have lost about $57 million from TerraUSD’s collapse.

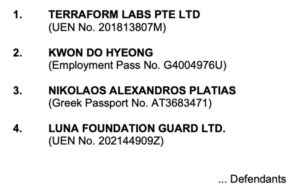

Source: Lawsuit filed in Singapore high court via the Wall Street Journal

Source: Lawsuit filed in Singapore high court via the Wall Street JournalThe lawsuit, filed Sept. 23, alleges Kwon made “fraudulent misrepresentations” about TerraUSD’s stability and was explicitly aware of the stablecoin’s “structural weakness.” It references Kwon’s Singapore Employment pass, a work visa issued by the local labor ministry permitting foreign professionals to live and work in the city-state.

Lead claimants are Australian resident Julian Moreno Beltran, who owned about $1.1 million worth of TerraUSD, and Singapore citizen Douglas Gan Yi Dong.

The claimants are looking to reclaim their money and seeking unspecified “aggravated damages.”

Aside from Kwon, other defendants in the suit are Terraform Labs, Platias and the Luna Foundation Guard.

5. Passport nullification

The South Korean Ministry of Foreign Affairs on Oct. 5 ordered Kwon to return his passport. If he chooses not to return the document, his passport will be invalidated, and traveling to South Korea would be difficult.

He has just a few days to return the document until it is automatically voided. It doesn’t seem like Kwon cares much about losing it, though. In his interview with Laura Shin, he said: “I’m not using it anyway. I can’t see how that makes a difference.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.