Binance Dominance Harks Back To Mt. Gox Heyday: Arcane

Scrapping spot bitcoin fees, rising dominance of its branded stablecoin and tasty BNB returns have solidified Binance as market leader

Binance CEO Changpeng Zhao | Stephen McCarthy/ for Web Summit/"Changpeng Zhao" (CC license) modified by Blockworks

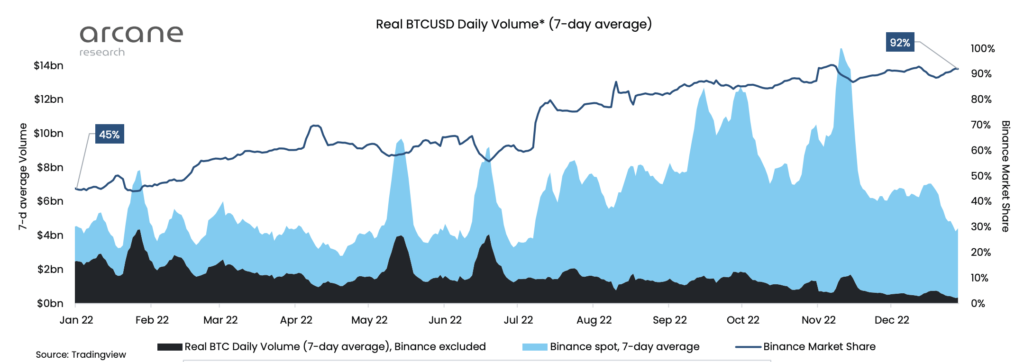

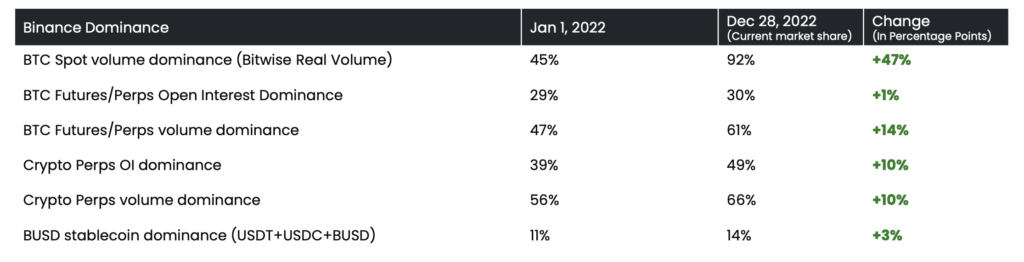

As the dust from a chaotic year settles, global exchange Binance is enjoying more dominance than ever, commanding as much as 92% of bitcoin spot volume.

That’s according to an end-of-year study by Arcane Research. The firm also found Binance made up 66% of crypto perp volume and 61% of BTC derivatives volume by the end of 2022.

“There are no other evident ‘winners’ of 2022 other than Binance when it comes to the crypto market structure and market dominance,” Arcane Research said.

Arcane said it would have to go back all the way to Mt. Gox’s heyday — one decade ago — to establish a period where a single exchange dominated BTC spot volumes like Binance.

Mt. Gox, one of the earliest bitcoin exchanges, reportedly handled as much as 70% of all bitcoin trading in 2013. The platform would dramatically implode the following year, leaving users out of pocket by 850,000 BTC ($500 million then, $14.3 billion today).

“However, the comparison to Mt. Gox stops there. While trading volumes are currently largely concentrated on Binance, BTC reserves are not,” Arcane said.

Binance’s bitcoin balance makes up only around 25% of all BTC held on exchanges, the firm found, translating to less systemic risks today than the Mt. Gox era.

Source: Arcane Research

Source: Arcane Research

Binance launched zero-fee trading for BTC spot pairs in July last year, a move attributed with solidifying its dominance — especially leading into FTX’s collapse in November.

Arcane predicted that Binance would revert and start charging BTC trading fees once more, which would normalize its market share.

Arcane addressed whether the reported spot volumes can be trusted. Crypto trading volumes can be notoriously difficult to truly measure considering the prevalence of wash trading.

“While the organic nature of some of this volume may be negotiable, it’s non-negotiable that this has consolidated Binance’s dominance over BTC spot markets,” Arcane said.

Other factors contributing to Binance’s success were its growing branded stablecoin BUSD, its native token BNB (which outperformed BTC and ETH) and its steady staff headcount compared to its peers.

Binance did however take risks with some big investments last year, including $500 million in Elon Musk’s Twitter deal, $200 million in Forbes and $1 billion for crypto lender Voyager’s assets.

Source: Arcane Research

Source: Arcane Research

Binance’s outsized market share only compounds the importance of its ability to process withdrawals. Jitters arose last month after Binance registered $1.9 billion of withdrawals in 24 hours, leading the exchange to temporarily cease withdrawals of stablecoin USDC.

That was the largest exchange daily outflow over a 24-hour period since June, according to Nansen. Binance CEO Changpeng Zhao deemed the withdrawals “business as usual.”

Arcane expects Binance’s dominance in the spot market will wane in 2023 while the dominance of BUSD will rise. It also reckons its share of crypto perp open interest will remain this year.

A Binance spokesperson reacted to Arcane’s report with another Zhao quote: “Binance is focused on the things that matter the most: building and staying user-focused.”

David Canellis contributed reporting.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.