BTC hits milestone as possible big month begins

Bitcoin saw price gains on each of January’s first five days — something that hasn’t happened since 2018

Andy Vinnikov/Shutterstock modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Just days into the new year, bitcoin’s price is back to six figures.

The asset’s price rose above $102,400 on Monday morning. It hovered around $101,750 at 2 pm ET — up nearly 9% from a week ago.

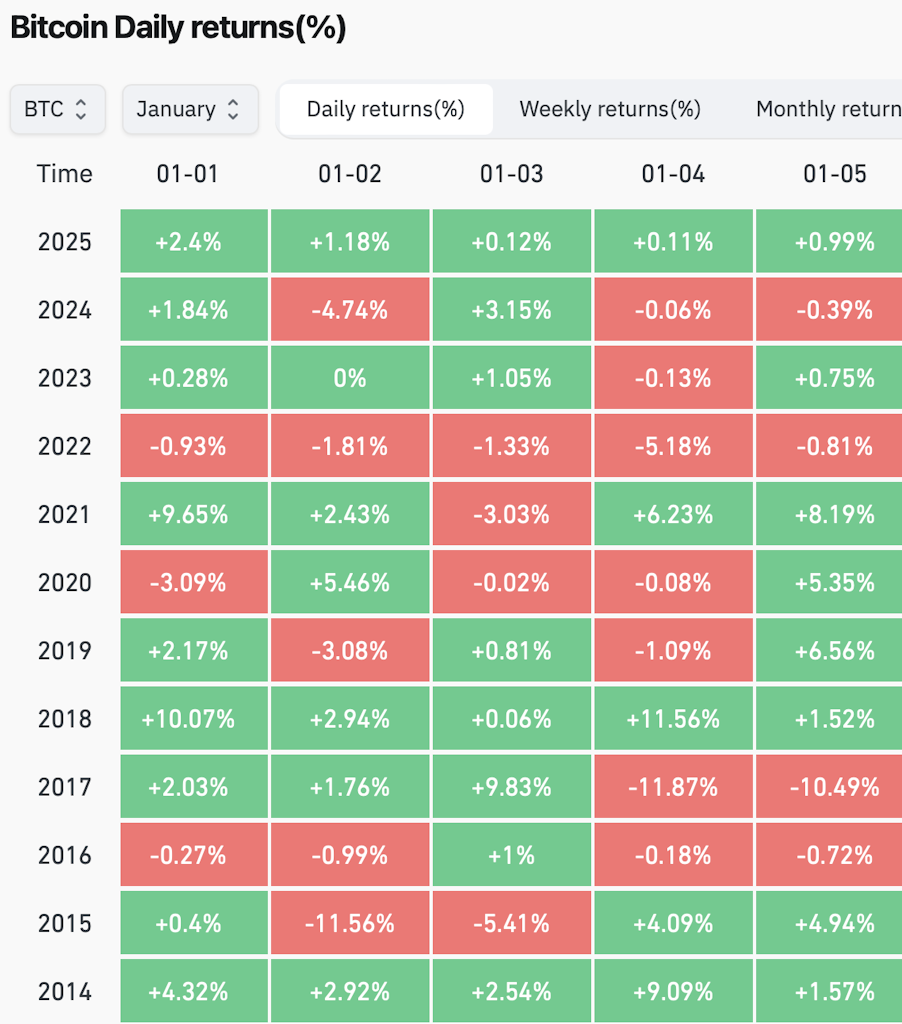

Crypto is so far seeing its own “January effect” — a term alluding to the potential rise of stock prices during the year’s first month. CoinGlass data shows bitcoin saw price gains — albeit slight ones — during each of the month’s first five days. That hasn’t happened since 2018.

You know by now about BTC’s historic rise to an all-time peak of $108,000 a little over a month after Trump’s election win. Then there was what some called a “healthy” correction fueled by hawkish Fed vibes and profit-taking, with BTC dropping below $92,000 on Dec. 30.

Grayscale product and research head Rayhaneh Sharif-Askary noted temporary drawdowns during bull markets are common, pointing out the FTSE/Grayscale Crypto Sectors Market Index’s 6% decline in December.

“However, strong demand from US-listed Bitcoin ETPs and treasuries like MicroStrategy’s may support bitcoin’s price,” she said when asked about the outlook for January.

The US bitcoin ETFs welcomed $908 million in net new assets on Friday — rebounding from a combined $940 million worth of outflows over the previous four trading days, Farside Investors data shows.

96% of financial advisers surveyed by Bitwise received a crypto-related question from clients in 2024. This finding jibes with the expected ongoing wealth manager-fueled capital influx into the crypto segment.

As for Sharif-Askary’s mentioning of treasuries, MicroStrategy’s latest bitcoin buy (on Dec. 30-31) was 1,070 BTC for roughly $100 million. Though smaller than its BTC buys in previous weeks, the company also just revealed targeting a $2 billion capital raise via perpetual preferred stock offerings to acquire more BTC.

On that note, Metaplanet CEO Simon Gerovich just noted his company plans to boost its BTC holdings (currently at 1,762 BTC) to 10,000 BTC in 2025. Then there’s KULR Technology Group, which said Monday it bought an additional $21 million worth of bitcoin.

Also set for January, of course, is Trump’s inauguration. And with members of the 119th Congress sworn in last week, hearings on the president-elect’s cabinet nominees are expected to kick off soon.

Confirmation hearing happenings, and subsequent signals on the pace and extent of future crypto regulatory clarity, could impact BTC price throughout the month, Sharif-Askary told me.

“Delays or restrictive policy announcements may dampen sentiment,” she said, before adding: “Macro factors — including Federal Reserve signals on interest rates and market responses to a stronger US dollar — could also play a role.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.