Crypto holders are eager to ‘bumper’ assets to defend against downside risk

A novel dual-purpose tool aims to provide sensible risk management in even the roughest market storms

Matthew Waring/Unsplash modified by Blockworks

In the mighty ocean that is the crypto industry, well-designed risk management solutions that keep participants’ portfolios above water are hard to come by — those that do exist have clear downsides. Take the commonly-wielded stop-loss, for example. While it does protect against downside price action, users can be blindsided by a swift market rebound and miss out on profits because the stop-loss involves immediately selling an asset at the specified strike price.

It’s no secret that participating in the crypto industry isn’t easy, regardless of a person’s level of activity. Passive holders are subject to high market volatility, a well-known hindrance to global crypto adoption that induces stress and makes it challenging to grow a portfolio of assets predictably. Many holders also face counterparty risk daily, which has been the source of extraordinary losses in scenarios like the FTX collapse during early November 2022.

For those more inclined to take on an active role in the crypto markets, sometimes-overwhelming complexities exist, especially when handling derivatives and options. Even for those more experienced in trading crypto assets, timing buys and sells to generate a profitable return is generally a complete mystery.

The burden of holding crypto assets is what Bumper, an upcoming crypto DeFi protocol launching in August, aims to solve. The project’s novel tools have crypto participants in the know fueled with anticipation to start ‘bumpering’ their assets to avoid losses and to start earning yield for contributing liquidity to the ecosystem.

Sensible risk management looms on the horizon

Promising to act as the ultimate safety net for crypto participants, Bumper is fueled by a mission to protect users from downside crypto market risk. The team behind the protocol calls it ‘DeFi’s most advanced price protection ecosystem’ and has built it to be entirely on-chain and decentralized, providing maximum transparency and security.

Bumper’s market design allows anyone to freely participate in hedging price risk in a way that is simple, provably fair, and eliminates counterparty risk. Bumper is a tool that enables people to protect the dollar value of their tokens and generate yield throughout DeFi passively.

The protocol’s utility token, BUMP, supports the entire ecosystem and the network effect of all of Bumper’s price protection market pairs. Every time a user takes a position on the protocol, whether to protect an asset’s value or provide liquidity to earn yield, it is required that they hold enough BUMP to ‘bond’ it to their position. This effectively means that BUMP is the ticket required to ride the Bumper ride — no BUMP, no fun for you. So long as there is a demand to use the Bumper protocol, there will be demand for BUMP as well. The token can also be staked to earn yield and provides voting power that enables holders to engage in the decision-making that determines the future of Bumper.

Bumper plays defense and offense

Bumper is incredibly easy to use for anyone, but don’t let that fool you. The protocol is a powerful dual-purpose tool that enables users to achieve two primary goals: protect assets and earn yield.

Protect

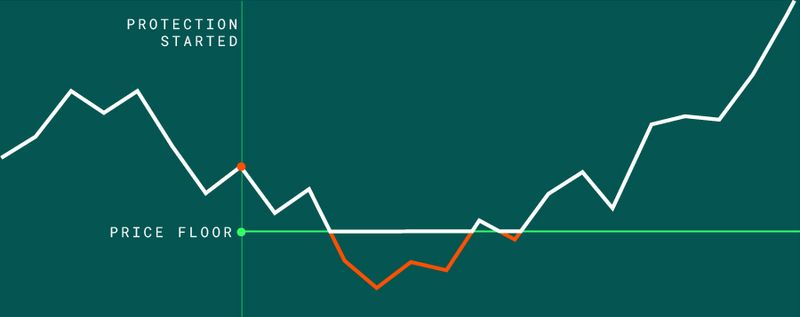

Bumper provides a novel solution that enables anyone in crypto to defend against negative price action by ensuring that selected assets do not fall below a certain USD value in the event of a significant downside price movement. On the protocol, this is all done in a way that is simple, provably fair, and eliminates counterparty risk while also leaving the door open to participate in the upside swings of the market as well.

Bumper price protection | Source: Bumper

Bumper price protection | Source: Bumper

To open a protective position, users only need to decide three things when using Bumper:

- The amount of ETH they wish to protect

- The ETH ‘floor’ price at which price their protection ‘kicks in’

- The length of time they want to have active protection

Let’s walk through an example of what happens when the position closes. Imagine you have 1 ETH that is valued at $4,000 at the time of position creation and set a floor price of $3,750. If upon closing the position, ETH is valued at $4,500, congratulations! You receive your original asset (1 ETH) back, minus the premium (the cost of protection) that Bumper requires you to pay. If, instead of ETH increasing in value, ETH has declined to $3,500 at the time of position closing, you will receive USDC and ETH to the value of the preset floor price, minus the premium.

Earn

Bumper users have the opportunity to earn yield by providing liquidity into the Bumper protocol with USDC. Given Bumper eliminates counterparty risk through decentralization, this is a safe alternative to using centralized exchanges, especially when considering that Bumper offers the flexibility for users to customize a position ‘tier’, which determines their exposure to risk and their profit potential.

Liquidity providers earn yield from premiums paid when price protection positions are closed, and also from yield farming which is automatically engaged via Bumper smart contracts (pooled USDC is employed in yield farming through external DeFi protocols). In regular market conditions, this provides the potential to generate greater profits than if a user were to instead engage in yield farming directly.

To open a position to earn yield, users only need to decide three things:

- Choose the amount of USDC to deposit

- Decide the tier they wish to join (risk tolerance)

- Choose a length of time to earn yield

Bumper’s plan to revolutionize DeFi

A core element of the vision for the future of the Bumper protocol is the novel concept of ‘bumpered assets.’ Bumpered assets will be incredibly useful and very well could open new doors to crypto holders that provide access to liquidity without the need to sell off assets or assume a risky, unprotected loan. Here’s how they work.

Any time someone takes a position on Bumper, they will receive a bumpered asset that represents the position once it has been locked in via bonding Bump token. Because of the established floor price that the Bumper protocol provides for assets that are active in a position, bumpered assets maintain a minimum guaranteed value and don’t suffer from the threat of forced liquidation in the event that the market continues to drop. Bumpered ETH (bETH), for example, is equivalent to ETH but with the downside volatility removed.

Bumpered assets will be freely exchangeable tokens that can be sold, transferred, locked into smart contracts, or even used as collateral for loans — a use case that could have tremendous implications for the future of DeFi by giving greater peace of mind to lenders who have, in many cases, traditionally been reluctant to lend due to fear of crypto asset volatility.

Preparing to bumper crypto assets

For passive holders and active crypto participants alike, the new era of asset risk management is on the horizon; one that enables users to bumper their assets to defend against volatility, better use tokens like ETH to access loans, and so much more. When Bumper launches in August later this year, the world of crypto will no longer remain bogged down by unideal solutions.

To stay up to all things Bumper and receive key announcements, register for updates on the Bumper website homepage, follow Bumper’s Twitter, and join the Bumper Discord.

This content is sponsored by Bumper.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.