Cryptocurrency Luna Lurches as Terra USD Volatility Continues, Erasing Billions

Do Kwon claims he’s “close to announcing a recovery plan for $UST”

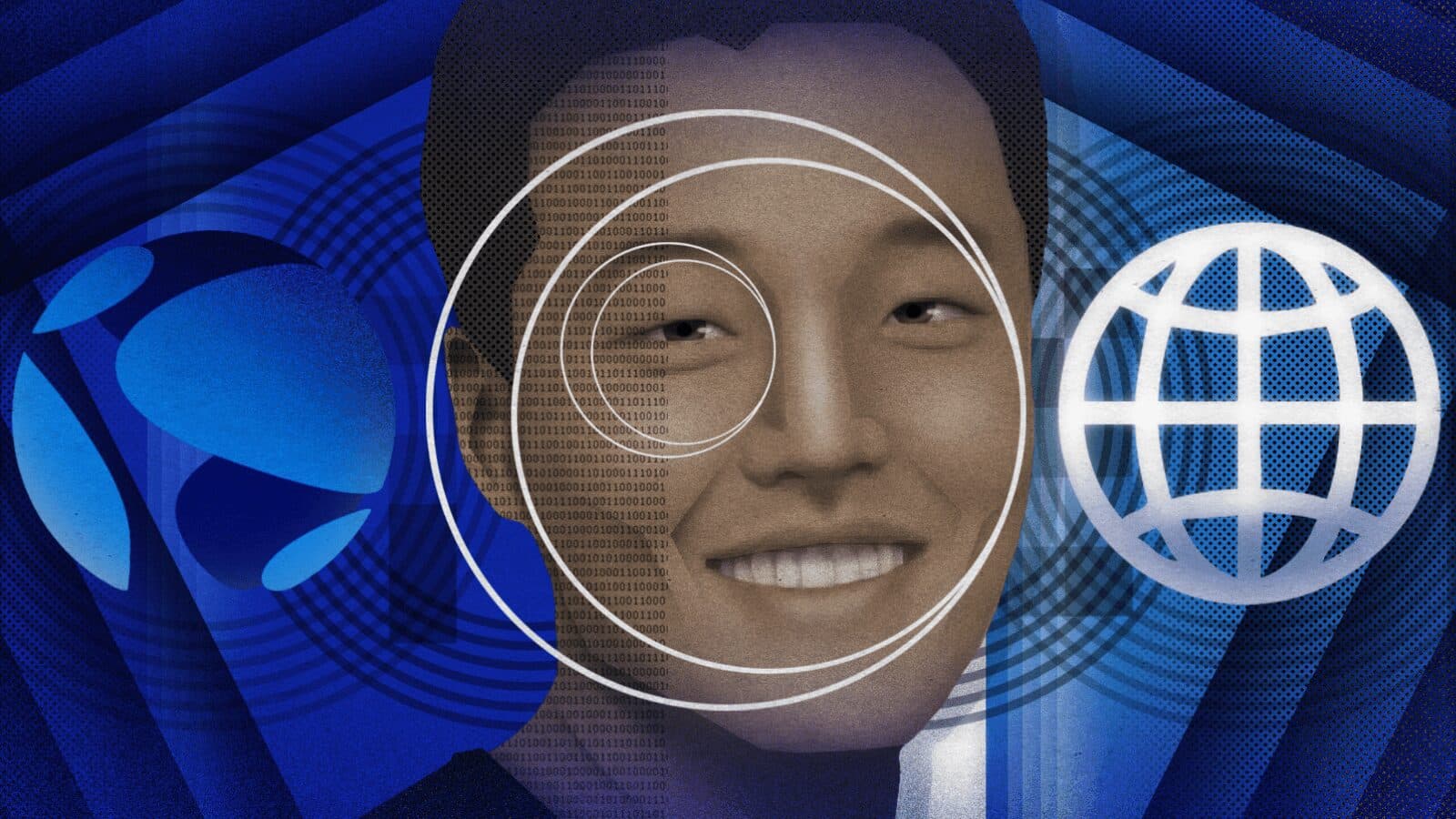

Do Kwon, CEO of TerraForm Labs | Blockworks Exclusive Art by Axel Rangel

- LFG has deployed its BTC reserves, but $1 billion in circulating supply contraction has so far failed to restore the dollar peg as UST trades around 90 cents

- Critics have long worried about the viability of an undercollateralized stablecoin

Retail users who have relied upon Terra’s Anchor Protocol as a safe, high-yield savings account are waking up to an unpleasant new reality.

Terra USD (UST) has been trading well below its dollar peg since Saturday, but the initial drop to 98 cents proved to be a prelude to a much greater fall. It has even attracted the attention of US Treasury Secretary Janet Yellen, who cited UST by name in Congressional testimony today.

As Do Kwon’s Terraform Labs and the Luna Foundation Guard work to restore regularly scheduled programming, the questions on everyone’s mind: Can the project be saved? And how?

The formerly-stable coin slid to just under 70 cents at one point in the past 24 hours, according to CoinGecko. This prolonged de-peg has led to mass withdrawals from the preeminent Terra blockchain dApp Anchor, which has seen its deposits plunge by some $7.8 billion.

The net UST supply contraction amounts to roughly $1 billion already. As each UST is redeemed for $1 worth of LUNA, the latter’s supply expands. Since the trouble began May 7, around 25 million LUNA have been minted by the protocol.

The increased supply has decimated the price of Terra’s native asset, which has fallen by 64% over the past week, according to data compiled by Blockworks.

On Tuesday, Terra mastermind Do Kwon again sought to quell concern via Twitter, postulating an imminent — though unspecified — recovery plan.

Monday madness

After dipping to 92 cents at 2:30 pm ET on Monday, UST appeared to stabilize over the next few hours, but conditions deteriorated rapidly beginning at around 6:15 pm, as UST began a relentless two-hour slide to a nadir of about 65 cents.

Unlike the weekend price action, which was centered on UST trading via centralized exchanges and the Ethereum dex Curve, the extreme volatility this time knocked UST off peg on the Terra chain itself. The speed of the descent overwhelmed the intended arbitrage-based stabilization mechanism built into the protocol design, which has a roughly $293 million per day soft cap for redemptions at $1.

Exceed the cap, and the spread — the amount of LUNA that one UST can be redeemed for — is designed to widen. The concept is supposed to prevent manipulation of the mechanism, but it also makes it a slow slog to recover from such a strong shock.

A proposal is currently up for a vote by LUNA holders to effectively increase the cap to $1.2 billion, to allow LUNA to absorb the supply of UST and eventually restore the peg.

Algorithmic stablecoins remain highly experimental and have failed spectacularly before. Most recently, the Waves-based stablecoin USDN collapsed to 77 cents in early April and has never fully recovered. It used a roughly similar burn and mint stabilization mechanism to UST’s, and the platform’s WAVES token has fallen by 80% since.

UST itself suffered a similar volatility-induced crash in May 2021, when it briefly hit 96 cents. But on a 1-year chart, that now appears as a minor bump in the road.

Many members of the Luna community, who call themselves “lunatics,” have expressed support for the protocol and its backers, even in difficult times. But for some, irrespective of whether the peg ultimately recovers, it has been a catastrophic loss.

The instability comes as no shock to crypto veterans, according to Mark Richardson, head of research at Bancor, a decentralized exchange and liquidity protocol.

“If you ask anyone from around the industry whether or not this is a surprise at all, everyone will tell you that they’re surprised this didn’t happen sooner,” Richardson told Blockworks.

This story was updated on May 11, 2022 at 6:20 am ET.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.