Microsoft’s Rhodes: Crypto, DeFi and NFTs Have Moved Beyond Early Adoption

“We’re watching the market carefully with all of the interest in crypto, DeFi and NFTs and I think that we’ve certainly reached that inflection point in the industry,” Yorke Rhodes, director of digital transformation, blockchain and cloud supply chain at Microsoft said.

Yorke Rhodes, director of digital transformation, blockchain and cloud supply chain at Microsoft

- The whole crypto ecosystem is just scratching the surface of what NFTs’ are, Rhodes noted

- Growth in crypto comes through understanding, especially for executives at traditional financial institutions, Nate McKervey, head of blockchain and DLT at Splunk said during the panel

The crypto industry has passed the stage of early adoption, according to Yorke Rhodes, director of digital transformation, blockchain and cloud supply chain at Microsoft.

“If we look at framing this as an innovative technology and a crossing the chasm moment similar to other innovation waves I think we can learn a lot from those just how long it takes to cross a chasm like this,” Rhodes said during the Bloomberg Financial Innovation Summit Thursday.

“You have the early adopters and once it reaches a tipping point it becomes de facto and when I say we’ve reached an inflection point in 2021 with NFTs, DeFi and crypto, I think we’re at that point where we’ve moved beyond the early adopters,” Rhodes added.

Rhodes said he began the Microsoft blockchain journey in 2015. Over the past six years, he has been working to enable “enterprises to cross the chasm from a tech perspective” at the company.

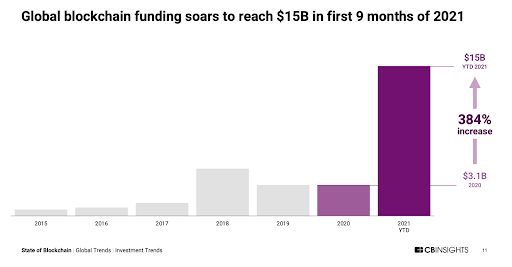

Globally, the blockchain ecosystem has seen a spike in attention, deals and funding during 2021. The total funding for decentralized finance (DeFi) deals year-to-date in 2021 is over six times the amount raised in 2020 for DeFi deals, according to a CB Insights’ blockchain report. Additionally, global blockchain funding hit over $15 billion within the first nine months of the year, up 383% from $3.1 billion in all of 2020, the data showed.

The recent growth in crypto can be attributed to a number of factors, but a lot of it comes down to understanding, especially for executives at traditional financial institutions, Nate McKervey, head of blockchain and DLT at Splunk said during the event.

“A lot of it comes down to the high variance of executive understanding. In some conversations we have to explain the technology, remove skepticism as much as possible but you can’t really remove skepticism until you understand the technology,” McKervey said.

“Those executives who have dug in and kind of have started to understand are recognizing this is potential and they’re starting to get ahead of vendors and peers. Really this is something I think everyone goes through, I went through the same thing. I was very skeptical of this technology for years,” McKervey added.

The move from the fear of the unknown happens through education and is a journey Rhodes expects executives to go through.

NFTs potential is “just scratching the surface”

“We’re watching the market carefully with all of the interest in crypto, DeFi and NFTs and I think that we’ve certainly reached that inflection point in the industry,” Rhodes said.

With that said, “NFT is a very interesting programmable digital asset that can represent many things” beyond ownership of digital images, Rhodes said. “It can also represent abstract things like entitlements – a ticket to a basketball game is an entitlement that gives you access to a specific event,” Rhodes added.

In general, non-fungible token (NFT) adoption has risen tremendously and continues to increase, some even predict that the space will grow 100 times over the next few years. The NFT funding space has exploded to over $2 billion in 2021, up 6,523% from 2020’s annual total, according to CB Insights.

“The ability to digitize physical assets and such even physical contracts and digitize so much more in the form of NFTs is going to make software devour the world. It’s going to make us be able to do the business so much faster,” McKervey said.

The whole crypto ecosystem is just scratching the surface of what NFTs’ are, Rhodes noted.