SHIB Overtakes DOGE as Top Dog in Possible Sign of Froth, Bitcoin Retreats: Markets Wrap

SHIB and DOGE battle it out for ‘top dog’ status, BTC retreats as evidence of froth in the market emerges.

- Memecoins SHIB and DOGE battle it out for ‘top dog’ status

- Dog coin rallies typically indicate froth in the market and warrant caution

Memecoins take center stage as DOGE and SHIB battle it out for the top dog.

It is important to consider hash rate as a proxy for network security before investing serious amounts of money into memecoins.

SHIB is burning a considerable amount of ETH due to high activity taking place around the memecoin.

SHIB appears to have a more even token distribution when compared to DOGE.

Dog coin rallies have historically led to broader market selloffs, so caution is warranted.

While BTC may face a short term correction due to overall market froth, perpetual funding rates have eased and long term fundamentals look good.

Latest in Macro:

- S&P 500: 4,551, -.51%

- NASDAQ: 15,235, +.00%

- Gold: $1,796, -.01%

- WTI Crude Oil: $82.07, -3.05%

- 10-Year Treasury: 1.55%, -.062%

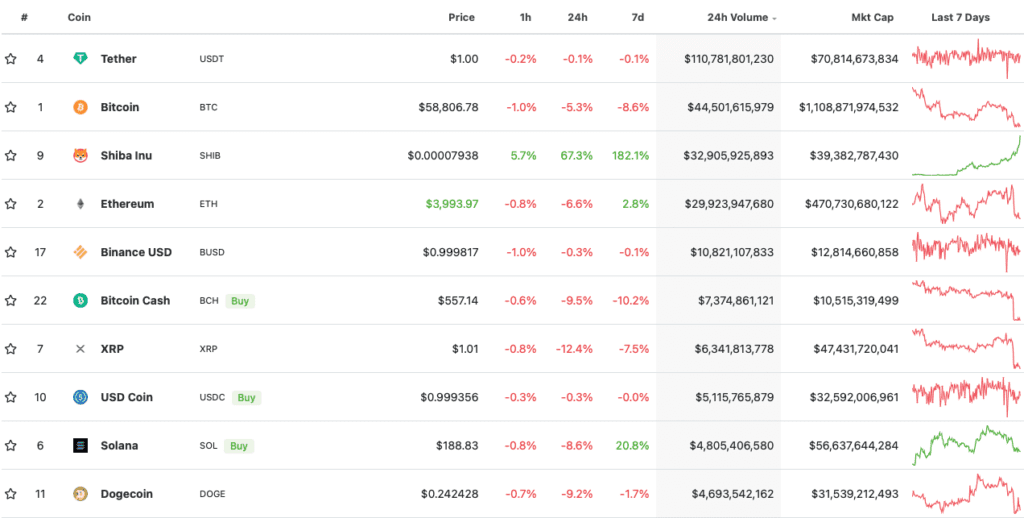

Latest in Crypto:

- BTC: $58,826, -2.25%

- ETH: $3,994, -4.32%

- ETH/BTC: .0678, -.88%

- BTC.D: 44.82%, +1.16%

DOGE Highlights

Dogecoin (DOGE) is a proof-of-work protocol that was born out of a fork from Litecoin (LTC) back in 2013, started by Billy Markus and Jackson Palmer. The project is based off of a Dog meme and was originally created as a silly joke.

“I threw it together, without any expectation or plan. It took about 3 hours to make.” wrote Billy Markus in a reddit post.

Today, DOGE has a market capitalization of more than $32 billion. It has also garnered the attention of billionaire celebrities Mark Cuban and Elon Musk. Mark Cuban owned NBA team, the Dallas Mavericks, also announced in March that they would begin accepting DOGE for payments.

DOGE does not currently have any smart contract capabilities or any type of ecosystem built up around it, so there remains very few use cases in its current state. Elon Musk has claimed in the past the he is working with DOGE developers to help change that, but there have been no updates since then.

DOGE made up 62% of crypto trading revenue of the $30 billion company Robinhood (HOOD) during Q2 of 2021, according to CNBC.

SHIB Highlights

Shiba Inu (SHIB) is a self-proclaimed “DOGECOIN KILLER” and was also started as a joke based on the Shiba Inu dog meme. It is an ERC-20 token, so it is currently secured as a proof-of-work protocol but will soon migrate over to proof-of-stake once Ethereum completes its merge. It was created in 2020 by a person(s) under the pseudonym “Ryoshi”.

The creators drew a lot of attention to SHIB by sending Ethereum co-founder, Vitalik Buterin, 410 trillion of the 1 quadrillion supply for free. Vitalik wound up sending 90% of the balance to a dead address, thus removing them from circulation forever, and sent the remainder to a charity, according to Yahoo. Today the 410 trillion of SHIB would be worth more than $30 billion.

Due to the fact that SHIB is built on top of Ethereum and has smart contract capabilities, it has a lot more use cases than DOGE. There is a website called Shibaswap which holds roughly $400 million of total value locked (TVL) where users can interact with NFTs, a decentralized exchange, liquidity mining, and more. So there is no doubt that SHIB has more use cases over DOGE at this point in time.

Elon Musk confirmed via Twitter on Sunday that he holds $0 of SHIB, despite being a big supporter of DOGE and memes in general.

SHIB has the 3rd most traded volume among digital assets over the last 24 hours and has officially overtaken DOGE as ‘the top dog’ and the 9th largest coin by market capitalization.

Source: Coingecko

Source: Coingecko

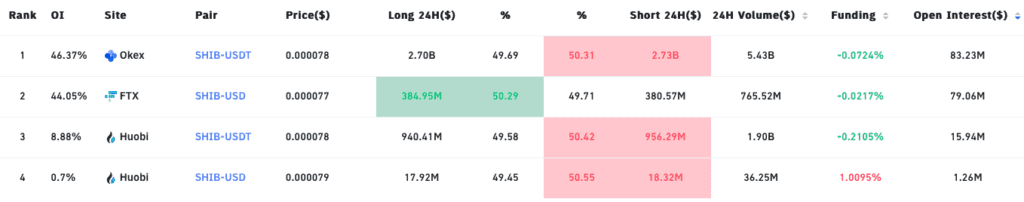

SHIB is also seeing extremely negative perpetual funding rates. This means that traders are paying astronomical rates to the longs in order to keep short positions open. Often times, this opens the door for monster short squeezes and may be indicative that a blow off top before an inevitable crash has yet to transpire.

Source: bybt.com

Source: bybt.com

Holder Base and Hash Rate Comparison

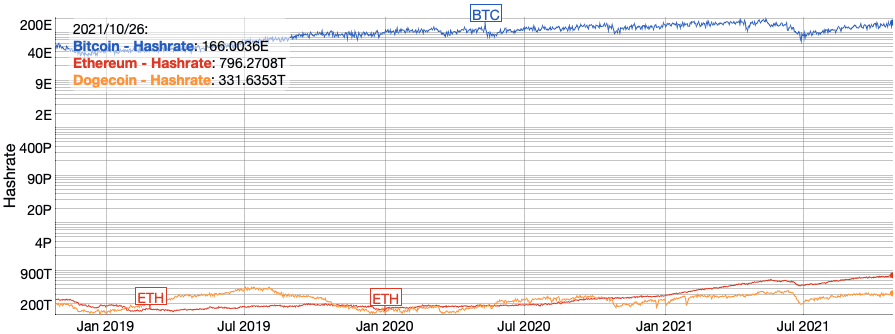

It is important to look at the hash rate for a general idea of how secure a network is when looking to invest money into digital assets. The hash rate is the amount of computing power dedicated to securing a network and processing transactions.

The following chart shows the hash rates of BTC, ETH, and DOGE on a logarithmic scale. It is worth noting that if a logarithmic scale was not used, the ETH and DOGE hash rates would not be visible because the hash rate on the BTC network is astronomically higher.

Source: bitinfocharts.com

Source: bitinfocharts.com

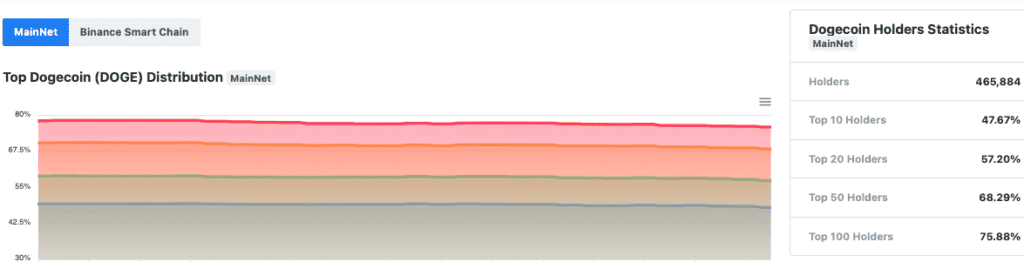

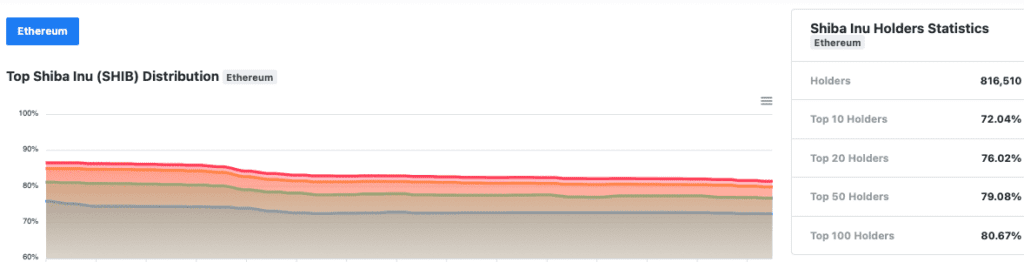

Another metric to keep in mind is the percentage of supply held by the largest wallets. The more distributed the supply, the less likely investors are to be ‘dumped’ on by whales.

In the case of DOGE, the top 100 holders own nearly 76% of the circulating supply.

Source: coincarp.com

Source: coincarp.com

In the case of SHIB, the top 100 holders own roughly 80% of the circulating supply. But remember, 41% of that is held in a wallet that Vitalik Buterin ‘burned’ and is thus inaccessible. So the supply concentration of the top 100 wallets is closer to 40%, much less concentrated than DOGE.

Source: coincarp.com

Source: coincarp.com

One last thing to note on SHIB, which will excite Ethereum enthusiasts, is the amount of ETH that is being burned due to activity relating to SHIB. It is 5th, only behind Ethereum’s largest DEX, organic activity, tether, and Opensea.

Source: ultrasound.money

Source: ultrasound.moneySigns of Froth

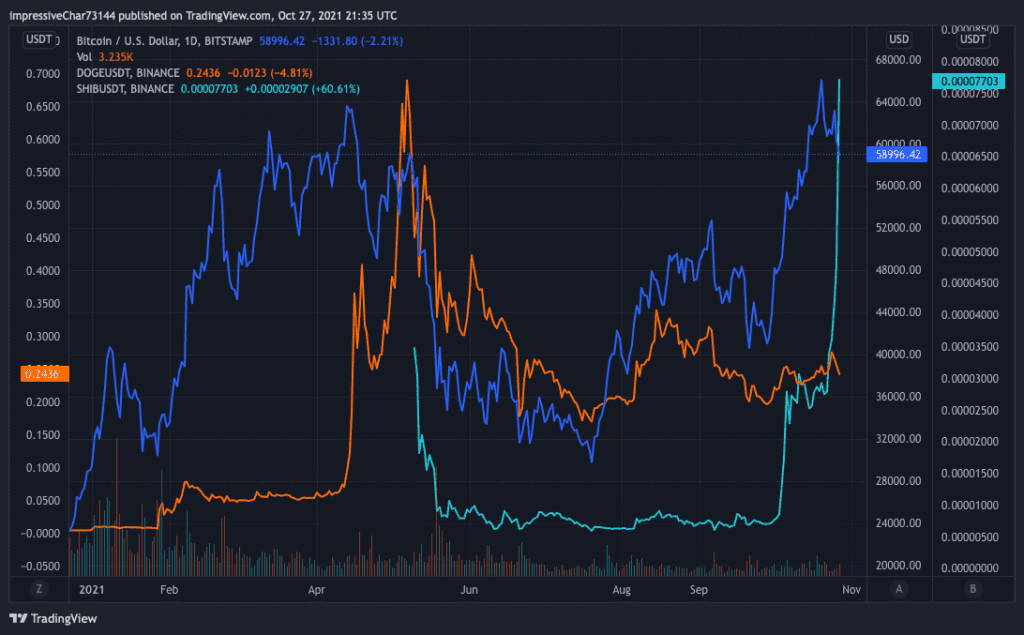

The rally of DOGE in May of 2021 coincided with a market wide collapse. It is never a good sign when dog coins are overtaking legitimate publicly traded companies in terms of market capitalization.

The DOGE explosion (orange, left axis) in May preceded a BTC crash. This time around, SHIB (light blue, far right axis) is exploding higher, implying that there is a lot of speculation in the market.

Source: tradingview.com

Source: tradingview.com

The good news is long term on-chain fundamentals for BTC still look good, which was previously covered by Blockworks.

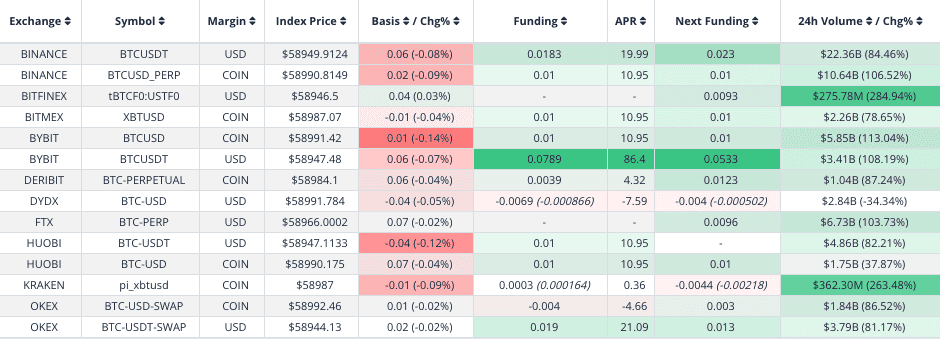

Perpetual funding rates on BTC have also reverted much closer to neutral, as seen in the following table:

Source: Laevitas.ch

Source: Laevitas.chNon-Fungible Tokens (NFTs)

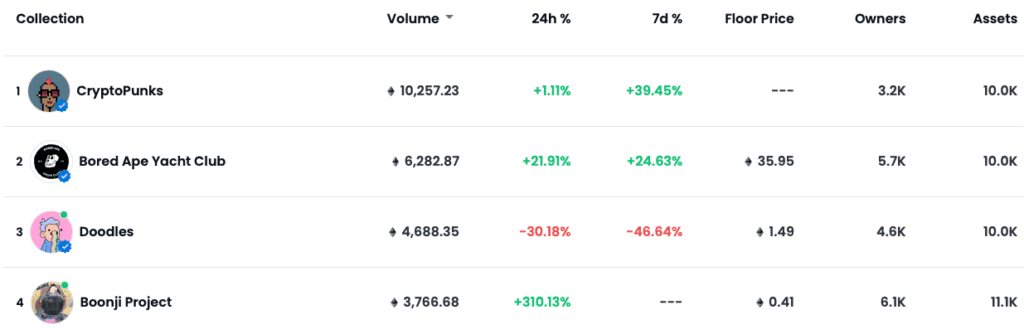

A notable sale took place earlier today, with CryptoPunk #1422 selling for 500 ETH.

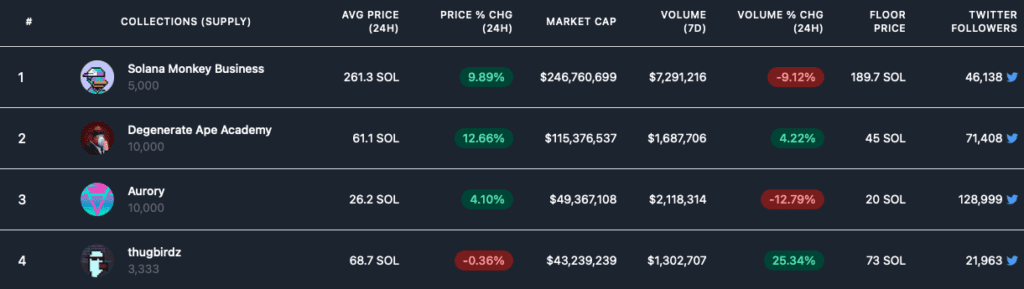

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! Looking forward to catching up tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.