Is Solana the Next Crypto Investment For Institutions?

The emergence of a derivatives market suggests more institutional products focused on Solana will appear, a report by crypto investment firm Two Prime says

Blockworks exclusive art by Axel Rangel

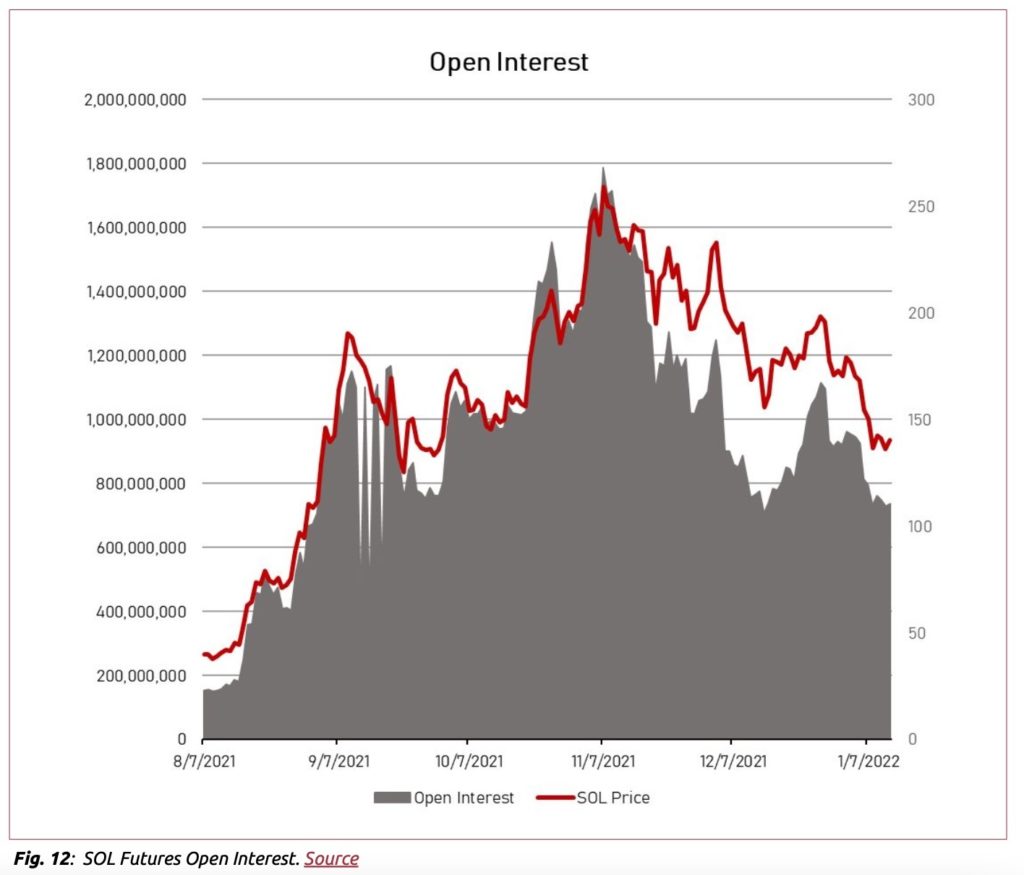

- Open interest for SOL futures contracts grew more than 400% in the past six months — from roughly $150 million in August to nearly $800 million this month

- Solana serves as a “natural hedge” to owning Ethereum, according to Two Prime Co-Founder Alexander Blum

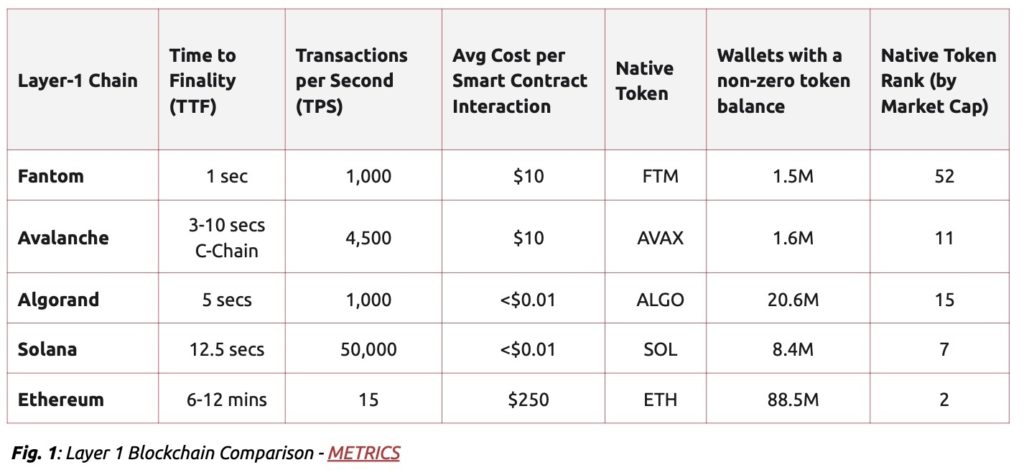

As Solana trading volume spikes, the cryptocurrency is poised to be the next institutional crypto investment, thanks to its fast transaction speeds and growing usage, according to a new report by digital asset investment firm Two Prime.

“We’ve been pretty restricted to just trading bitcoin and ether because that’s where there’s liquidity, especially in the derivatives market,” Two Prime Co-founder Alexander Blum told Blockworks. “What we’ve seen is a bunch of anecdotal and quantitative measures that suggest Solana’s becoming liquid enough where we could take a real position in it in our strategy with derivatives.”

Founded in 2017, Solana is a layer-1 blockchain network focused on high throughput and low transaction costs. It uses a proof-of-history consensus mechanism — a sequence of computations to verify the passage of time between two events cryptographically.

Solana’s native token, SOL, had a market capitalization of roughly $29 billion Thursday morning, CoinGecko data shows, the eighth-highest.

Open interest for SOL futures contracts grew more than 400% in the past six months — from roughly $150 million in August to nearly $800 million this month, according to Two Prime’s report, SOL Rising: Is Solana the Next Institutional Crypto Investment?

“As these trades become popular, it generally supports spot prices and reduces volatility, as institutions need to own the underlying asset to sell futures contracts against their positions, moving ownership from short-term speculative traders, to long-term holders,” it states.

While OTC desks and DeFi Option Vaults offer access to Solana derivatives,

Most crypto derivatives exchanges do not. But Deribit confirmed to Blockworks last week that it’s internally testing SOL options, with a launch slated within the first half of the year.

“With over 90% of options flow passing through Deribit’s exchange, this will bring increased access for non-US institutions,” the Two Prime report states. “If successful, it is likely that Solana futures and options products will follow BTC and ETH on the CME.”

More Solana products coming?

Osprey Funds launched a Solana Trust for accredited investors in September, and Grayscale Investments brought to market a similar product in November. The funds have roughly $15 million in combined assets under management.

The emergence of a strong derivatives market suggests the development of more Solana institutional products, according to the report.

Denver-based Two Prime offers a Digital Assets Fund, which uses a derivatives-overlay on a net-long bitcoin and ether portfolio to hedge out 50% of downside volatility, as well as a Liquid Yield Fund.

“Now that there is an emerging liquid derivatives market, the question is does [Solana] add anything that bitcoin and Ethereum don’t,” Blum said. “The answer is yes.”

Solana’s lack of gas fees and support for thousands of transactions per second make it attractive to portions of the NFT and decentralized finance (DeFi) market that Ethereum struggles to reach. The network serves as a sort of “natural hedge” to owning ether, he added.

The Solana network has processed more than 52 billion transactions, which is roughly 30 times more than bitcoin and Ethereum’s total transactions combined, according to the report. Solana has the fifth-largest DeFi ecosystem and has amassed the second-largest NFT transaction volume of any layer-1 blockchain.

“We think Solana holds unique potential for enterprise-grade financial applications, specifically the ability to handle an entire order book on-chain,” Matthew Sigel, head of digital assets research at VanEck, told Blockworks. “That means over the long run it may compete with other marketplace platforms like Nasdaq in a way which competing layer-1 chains won’t be able to do.”

While Ethereum remains the choice for “high-value” purposes like governance and staking, Solana has an edge when it comes to transactions, he said.

“Overall, smart contract platforms continue to take market share from traditional platforms such as banks and Web2,” Sigel said. “So, Solana and Ethereum can both co-exist together.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.