What the Strong Recovery of L1s Means — and How Active Addresses Will Be Key To Know Where They’re Going

Market valuations for L1 projects have rebounded from the harsh conditions created by the fallout of several centralized crypto companies

AlexanderTrou/Shutterstock modified by Blockworks

Layer-1 blockchains have recovered strongly from December market lows, underlining their prominence as a paramount sector of the cryptocurrency industry. The native assets for key players like Ethereum, BNB Chain, Solana, and Avalanche have posted massive gains across the board, with investors weighing up the possibility of a continued uptrend.

Tellingly, adoption metrics for the underlying networks have emerged as a crucial indicator for predicting the price action of layer-1 (L1) projects. On-chain data reveals that an L1 asset’s value tends to increase or decline based on user activity and demand for blockspace. Therefore, tracking the relationship between active addresses and the price of an L1 asset can enable investors to spot potential opportunities. These insights also deliver a gauge for measuring the competitive moat of a layer-1 network.

The Bloomberg Terminal provides actionable trading data from on-chain activity across leading L1 networks. Analyzing these data sets gives investors the competitive edge to make calculated investments into L1 ecosystems.

The year so far for L1s

Market valuations for L1 projects has rebounded from the harsh conditions created by the fallout of several centralized crypto companies, including FTX, Celsius, BlockFi, Genesis Capital, and several others. As of late December 2022, most L1 assets traded more than 90% below their all-time highs.

Nonetheless, the collapse of centralized entities emphasized the need for blockchain-based alternatives powered largely by L1 networks. This has, in turn, led to an increase in user demand for L1 assets to own a stake in these networks and access decentralized applications.

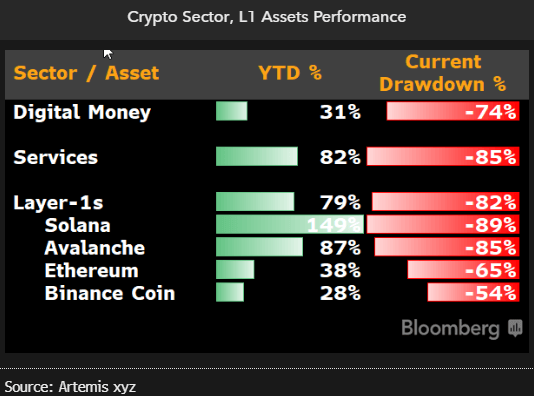

Unsurprisingly, the market value for a subset of L1 assets (ETH, BNB, SOL, AVAX) tracked by Bloomberg Intelligence has risen by an average of 79% year-to-date. Solana’s SOL token is the biggest gainer, with nearly 150% gains since the turn of the year. The most widely used networks, Ethereum and BNB Chain, have also recorded 38% and 28% gains, respectively.

Source: Bloomberg

Source: BloombergRegardless of the recovery of L1s, the year ahead is likely to be volatile. Unlike the recent increase linked to a broader market recovery from oversold levels, Bloomberg Intelligence Senior Market Structure Analyst Jamie Douglas Coutts predicts that “price momentum [for L1s] will need to be matched with strengthening fundamentals [while] pointers such as user adoption and protocol monetary policy” will be crucial, especially as the L1 wars resume in the coming months.

Competitive moats for L1 networks

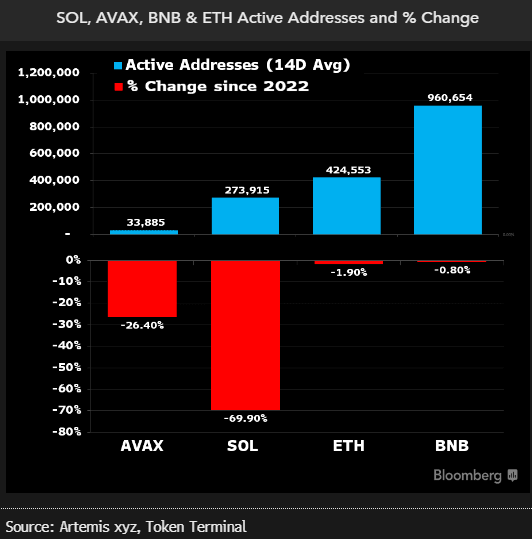

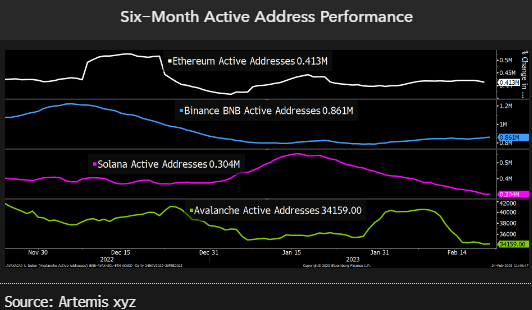

The 2022 bear market provided a stern test for L1 ecosystems, with user activity recording a steep decline throughout the year. At the same time, the downturn provided a yardstick for measuring the competitive moat of each L1 network.

For instance, Ethereum and BNB Chain showed greater resilience to the lower blockspace demand than competing L1s Solana and Avalanche. The number of active addresses on Solana and Avalanche dropped by 69.9% and 26.46%, respectively, while Ethereum and BNB saw less than a 2% decline under the same user metric.

Source: Bloomberg

Source: BloombergThe number of active addresses on an L1 is a crucial metric as it represents the number of actual users on each chain. Hence, the sustained demand for Ethereum and BNB Chain blockspace underlines their position as the leading destination for Web3 users.

In contrast, the decline in active addresses on Avalanche and Solana amid the bear market suggests user interest in these L1s is connected to short-term plays within the respective ecosystems. Moreover, the active addresses metric delivers other actionable insights for investors to optimize their L1 portfolio.

The power of active addresses

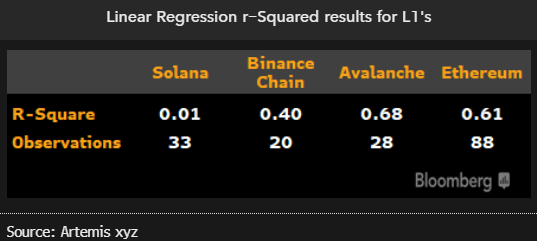

Bloomberg’s analysis demonstrates that the number of active addresses heavily impacts the price action of L1 assets. The study utilized the widely-trusted “R-squared” methodology to uncover that the correlation between price action and active addresses on the top three L1s (Ethereum, BNB Chain, and Avalanche) ranged from moderate to strong.

Understandably, Solana’s price action correlated less to the number of active addresses distorted by heavy venture capital interest in the network and the collapse of its biggest backer, Alameda Research. The price of SOL recorded a linear regression of 0.01 over 33 monthly samples.

Source: Bloomberg

Source: BloombergInvestors derive from the above metrics that price action for ETH and AVAX relies more heavily on an uptick in active addresses, while BNB is subject to other market forces. Accessing such invaluable on-chain data in real-time through the Bloomberg Terminal equips market participants to allocate trading capital efficiently and amplify returns on investments. Monitoring the trend on active addresses is especially crucial to investors as L1 activity begins picking up again in a post-bear market environment.

L1 activity trends in 2023

The rebound in the market value of L1 assets does not directly reflect a resurgence in user activity on the underlying chains. Instead, it is more closely linked to a less-hostile macro environment where investor appetite gradually returns after a devastating year for financial markets.

L1 activity trends remain relatively low, with BNB Chain the only network seeing an increase in active addresses in 2023. The Ethereum L1 failed to add new active users but has seen an uptick in new addresses onboarding layer-2 solutions such as Optimism, Arbitrum, and Polygon. The Ethereum-native ecosystem has grown by over 20%, with addresses jumping from 330,000 to more than 420,000 in the past year. Such growth demonstrates Ethereum’s competitive moat and increasing significance as more L2 solutions come onto the scene.

Source: Bloomberg

Source: BloombergAs the above Bloomberg Intelligence analysis further shows, Solana and Avalanche are the biggest underperformers, with unique active addresses relatively flat since the turn of the year. Both L1s inarguably require an uptick in the number of users and transaction activity to stage a comeback to 2022 highs.

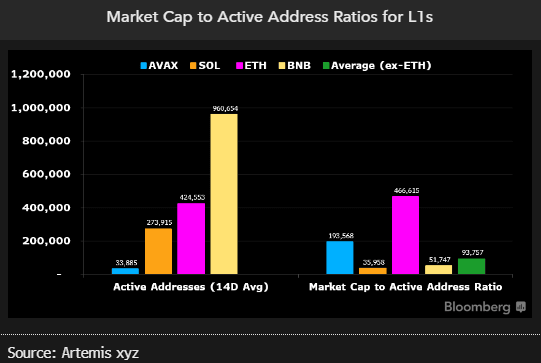

Using the active address ratio to spot potential mispricing opportunities

Data and analysis available on the Bloomberg Terminal also tap into the active address ratio to address one of the biggest challenges for digital asset investors – evaluating an L1 project. Efficiently comparing active addresses to an asset’s market cap allows investors to identify mispricing opportunities.

Ethereum leads the ranking for L1 assets by market cap to active addresses ratio, owing to its high level of decentralization and network properties. The switch to PoS would also help Ethereum scale its ecosystem faster through L2 solutions.

Source: Bloomberg

Source: BloombergHowever, Bloomberg’s findings reveal that Solana may be mispriced despite having a significantly higher number of active users than Avalanche. Avalanche’s market cap to active address ratio trades at a 500% premium vs. Solana. The EVM-based chain boasts only 12% of Solana’s active addresses. The metric also indicates that SOL may be undervalued and primed for an increase as bear market effects wear off.

Optimize L1 portfolios with data-driven insights from Bloomberg

Layer-1 chains play a crucial role within the digital asset industry and represent a sizable portion of many investment portfolios. Investors can optimize their exposure to the L1 ecosystem with data-driven insights from Bloomberg Intelligence, available exclusively for Bloomberg Terminal subscribers.

The Bloomberg Terminal grants users access to actionable on-chain data across different L1 networks, including Ethereum, BNB Chain, Solana, and Avalanche. For instance, analyzing high-value data on active addresses equips users to gauge an L1’s competitive moat and spot potential mispricing opportunities in real time. Investors can thus optimize short-term and long-term portfolios to maximize returns on the L1 bets.

This content is sponsored by Bloomberg.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.