Bitcoin Outperforms; Solana NFT Floor Prices Boosted on FTX News: Markets Wrap

Bitcoin dominance climbs above 46% for the first time in 2 months, FTX launches their NFT marketplace, LUNA and other layer-1’s underperform

A segment of the painting "BTC1" by Nelly Baksht whose work was on display in the Art Gallery at Bitcoin 2021.

- Bitcoin dominance climbs above 46% for the first time in two months

- FTX’s secondary market for Solana NFTs is officially live

Markets Wrap Highlights

- Bitcoin is consolidating near $57,000 after a strong rally. Without excessive leverage in the system and rising open interest in the futures market, BTC looks poised for an end of year rally.

- Only 15% of the current bitcoin supply is held in the hands of short term holders.

- Over 505,000 ether have been burned since the implementation of EIP-1559.

- Traders who got caught up in the layer-1 liquidity mining wars have likely been outperformed.

- FTX launched its NFT marketplace for Solana NFTs and plans to follow with Ethereum.

Latest in Macro:

- S&P 500: 4,361, -.69%

- NASDAQ: 14,486, -.64%

- Gold: $1,754, Unchanged

- WTI Crude Oil: $80.48, +1.42%

- 10-Year Treasury: 1.61%, +.041%

Latest in Crypto:

- BTC: $57,266, +4.21%

- ETH: $3,512, +1.26%

- ETH/BTC: .0611, -1.80%

- BTC.D: 46.01%, +2.55%

Bitcoin

Bitcoin dominance surged past 46% for the first time since August 11th, indicating that money is rotating from altcoins back into bitcoin.

“With interest rates going up and global markets facing uncertainty, current economic conditions are epitomizing why bitcoin was created. Bitcoin is increasingly resistant to turmoil in the traditional markets and imminent regulatory scrutiny. In the wake of China’s crackdown on cryptocurrency, and as regulation of stablecoins and other cryptocurrencies in the U.S. looms on the horizon, bitcoin’s upward price movement remains strong and steady.” Matt Senter, co-founder and chief technology officer of popular bitcoin rewards app, Lolli, wrote in an email to Blockworks.

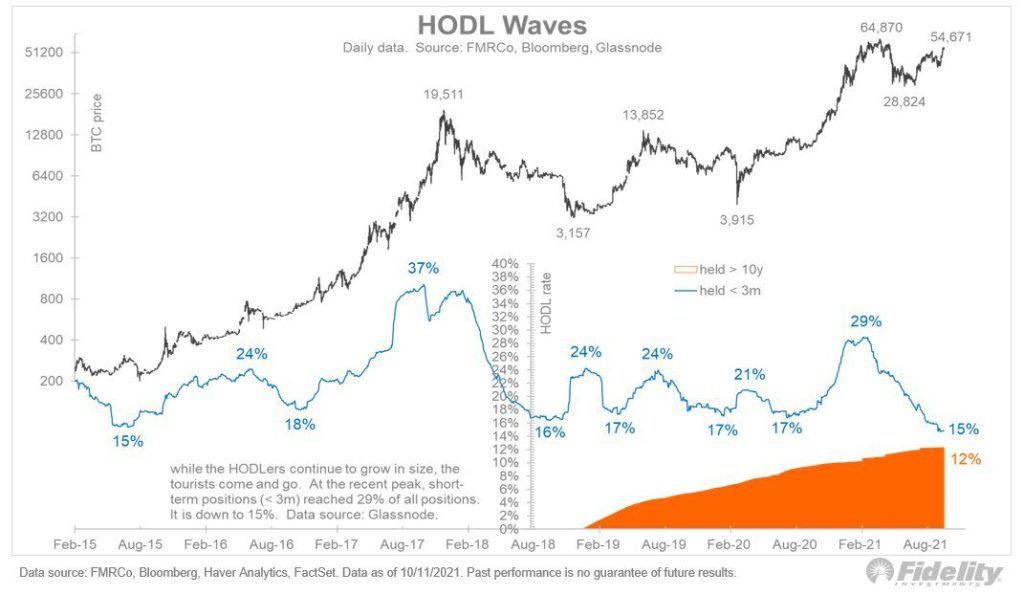

The blue line below shows the percentage of supply that has been held by investors for less than three months. When this number rises, it is a sign that long-term holders have been selling their BTC to short-term momentum traders.

With only 15% of the supply held by short-term holders, it appears this BTC rally has some more room to run.

Source: Fidelity / @TimmerFidelity

Source: Fidelity / @TimmerFidelity

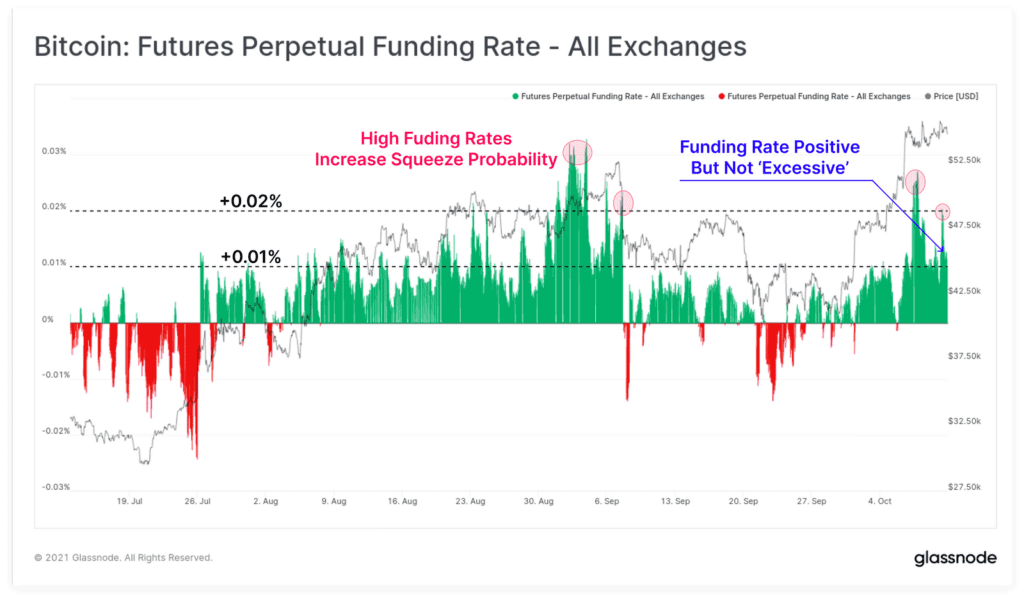

Perpetual funding rates are positive, but they aren’t nearly as elevated as they were during earlier parts of this bull run.

Source: Glassnode

Source: Glassnode

Ethereum

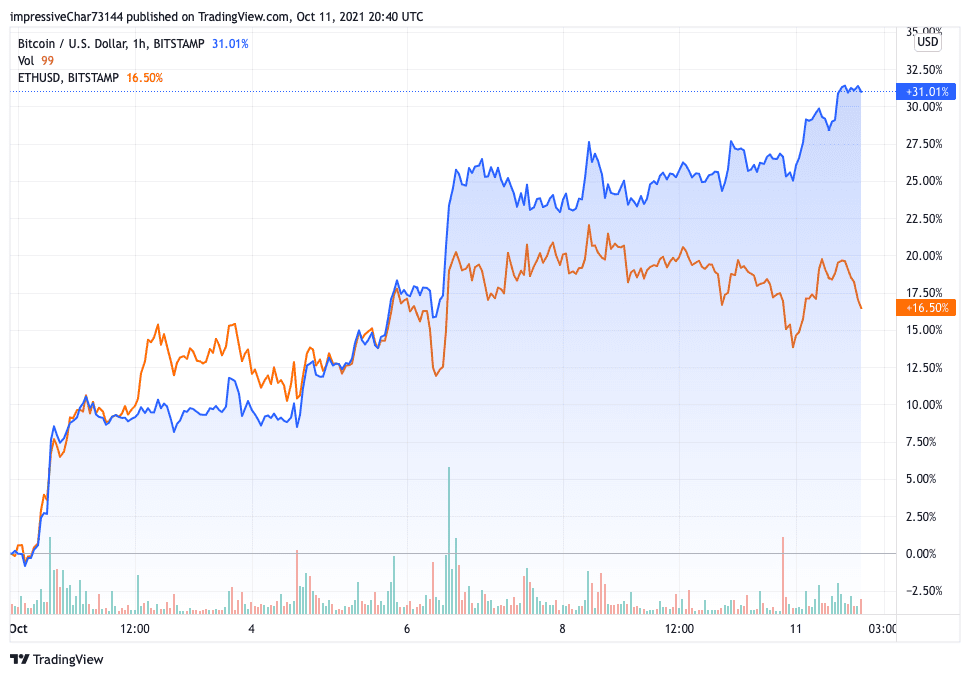

Similar to the rest of the digital asset market, ether continues to underperform BTC. The ETH:BTC ratio currently sits at .0611, down -14.65% over the last month.

Since EIP-1559 went live a few months ago on August 4th, over 505,000 ether have been burned. This equates to $1,773,710,000 worth of ether that has been removed from circulation. That is a -55.71% reduction in issuance since EIP-1559 was implemented.

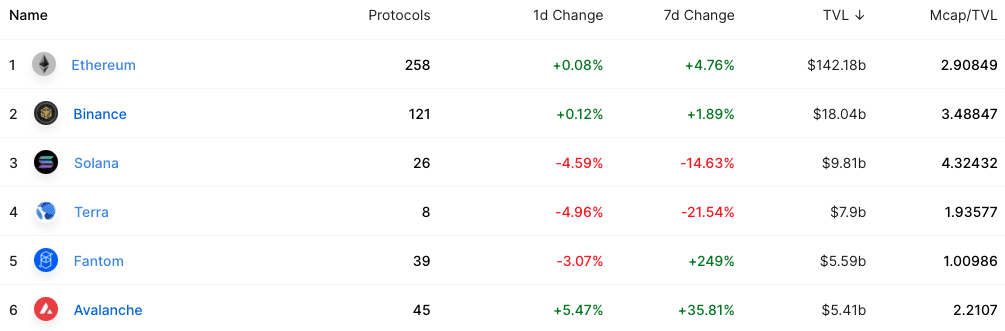

The total value locked (TVL) on Ethereum is $143.05 billion. As of today, this is a 69.41% marketshare of TVL across all chains. Since the start of October, ETH has gained 16.5% versus BTC’s 31.01%, per trading view.

Source: Trading View

Source: Trading View

Non-Fungible Tokens (NFTs)

FTX’s NFT marketplace officially went live today. The company is aiming to create a safer and more intuitive marketplace for collectors and artists. Only Solana NFTs will be supported initially, with plans to include Ethereum NFTs in the near future. The news has been favorable for Solana NFT floor prices.

“NFTs, it’s all anyone’s talking about. But for good reason, right? It is really just like tokenizing culture. And I think that in itself has no real ceiling. And that’s the most exciting part,” according to Anil Lulla, co-founder and chief operating officer of Delphi Digital, told Blockworks.

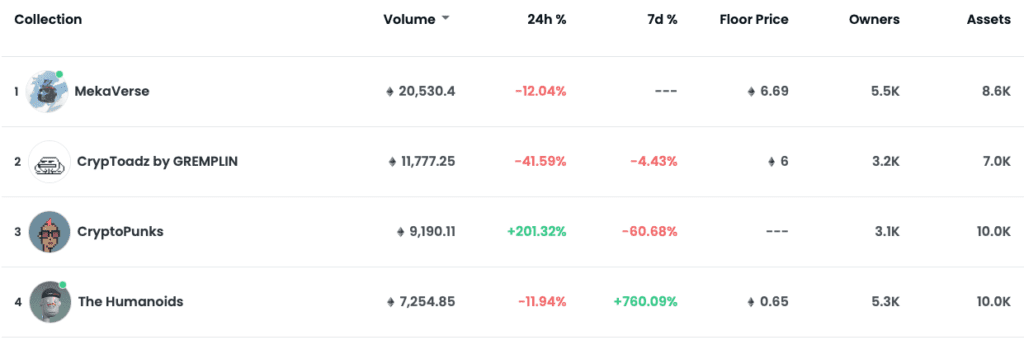

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the charts below:

Top Ethereum Projects

Top Ethereum Projects

Top Solana Projects

Top Solana Projects

LUNA Underperforming Post Columbus-5

- Terra (LUNA) has seen its TVL decrease over 21% in the last seven days, likely due to asset values within the ecosystem falling.

- Since the end of September when the highly anticipated Columbus-5 network upgrade went into effect, LUNA has underperformed the rest of the market.

- With bitcoin dominance on the rise, traders who got caught up in the layer-1 liquidity mining wars have likely been outperformed.

- LUNA was last trading at $38.08, down -18.70% over the last seven days.

Source: Defi Llama

Source: Defi Llama

That is all for today, folks. Let’s do this again at the same time tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.