Centralized Exchanges Make NFT Moves; Bitcoin Retreats: Markets Wrap

Centralized exchanges want a piece of the NFT craze, bitcoin underperforms the market, MetaMask posts impressive revenue numbers.

Blockworks exclusive art by Axel Rangel

- Coinbase plans to launch an NFT marketplace, challenging crypto native secondaries

- Bitcoin retreats with perpetual funding rates on the rise

Markets Wrap Highlights

- Bitcoin retreats below $55,000 while perpetual funding rates are on the rise.

- A bitcoin ETF may not translate into rising prices.

- Coinbase plans to launch an NFT marketplace, raising the question of what will happen to current market leaders such as Opensea, Solanart and Digital Eyes.

- MetaMask posted impressive revenue numbers.

- Binance creates $1 billion fund to further crypto adoption.

Latest in Macro:

- S&P 500: 4,350, -.24%

- NASDAQ: 14,465, -.14%

- Gold: $1,762, +.43%

- WTI Crude Oil: $80.49, -.05%

- 10-Year Treasury: 1.568%, -.037%

Latest in Crypto:

- BTC: $55,126, -3.67%

- ETH: $3,479, -1.53%

- ETH/BTC: .0625, +1.45%

- BTC.D: 45.46%, -1.02%

Bitcoin Retreats

Today, bitcoin retreats back below $55,000 after reaching a high of $57,833 on Monday. BTC has been notching higher-lows since breaching $30,000 back in July, so the general uptrend remains intact. With how volatile Bitcoin can be, it’s important to zoom out when looking at price momentum.

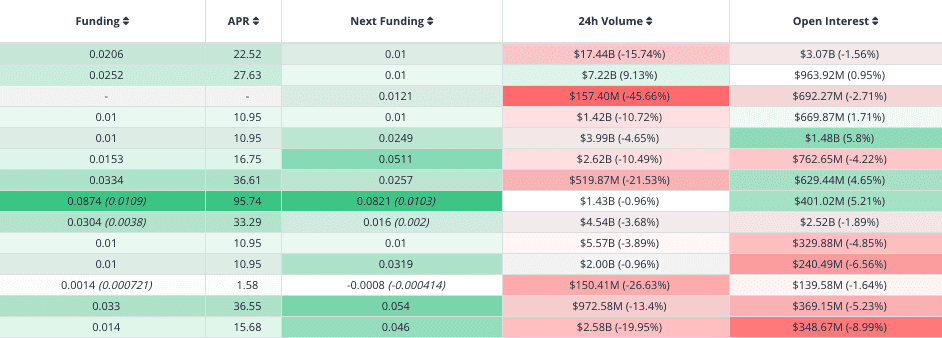

While the fundamentals discussed in yesterday’s wrap remain unchanged, perpetual funding rates have crept higher despite the drop in price. When funding rates are positive, longs are paying the shorts to keep positions open. This tells us that speculators are getting aggressive ‘longing the dip’, setting BTC up for a short-term correction to wipe out the leveraged players.

Source: https://app.laevitas.ch/dashboard/btc/derivs

Source: https://app.laevitas.ch/dashboard/btc/derivs

Bitcoin ETF Update

“To get a sense of what the market impact of a bitcoin futures ETF approval could be, we can look to Canada, where there are six listed bitcoin ETFs, two of which are based on futures. Going by AUM, these have significantly less interest from investors 一 indeed, they hardly appear on the map.” Noelle Acheson, head of market insights at Genesis told Blockworks. “This could indicate that US investors may also not have much interest in a bitcoin futures ETF even if approved this month, implying that its impact on the market could be less significant than many expect.”

“WHERE WE STAND: the SEC has a few days left to delay on bitcoin futures ETFs. If hear nothing, the first ETF filed (ProShares) will be free to launch on 10/18 as the 75 days req will have passed. That said, this is an unusual situation but no news is prob good news at this point,” said Eric Balchunas, Senior ETF analyst for Bloomberg, on Twitter.

Source: @EricBalchunas

Source: @EricBalchunasNon-Fungible Tokens (NFTs)

Coinbase plans to follow Binance and FTX in launching their own NFT marketplace, Blockworks reported. This would provide easy access for Coinbases’ 68 million verified users to join the NFT craze. To put that in perspective, there are currently only 538,000 traders on OpenSea, according to data compiled by @richardchen39 on Dune Analytics.

This leaves NFT collectors and artists with the question: “Where does this put the current leading secondary marketplaces such as OpenSea, Solanart and Digital Eyes?”

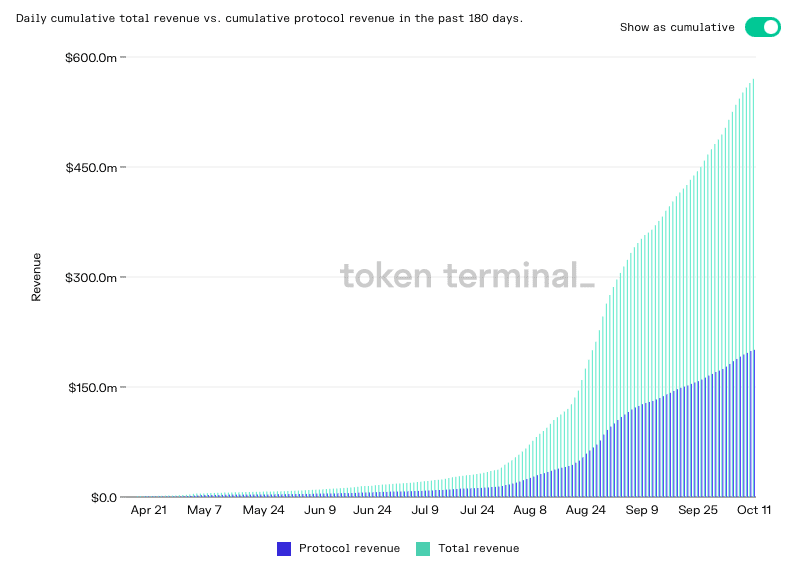

Only time will tell if users prefer more crypto native platforms over centralized institutions such as Coinbase, FTX and Binance. But it should come as no surprise that centralized parties took notice of the NFT craze and wanted to capitalize on the action. OpenSea has now generated close to $600 million in total revenue over the last 180 days, having just reached escape velocity in Q3 of 2021.

Source: https://www.tokenterminal.com/terminal/projects/opensea

Source: https://www.tokenterminal.com/terminal/projects/opensea

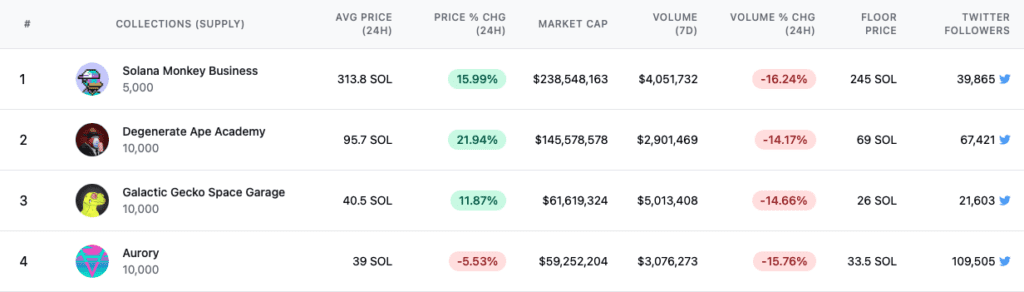

While NFT floor prices seem to be enjoying the news of opening up NFTs to a new set of users, volume traded has suffered. Solanalysis shows NFT volume for Solana-based projects down -13.63% over the last seven days.

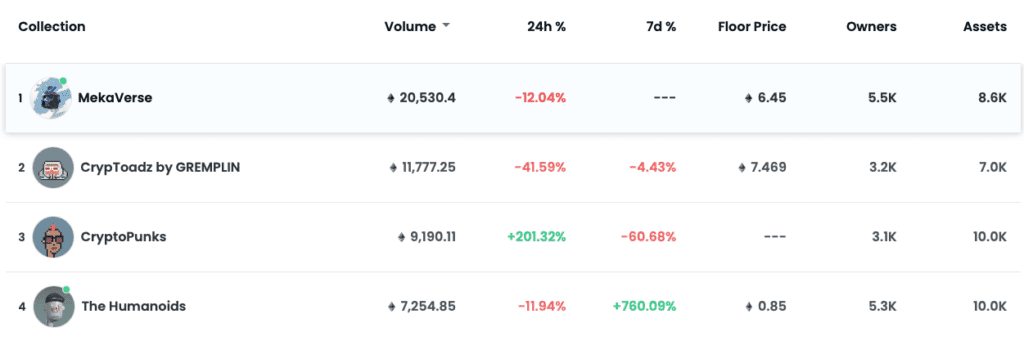

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects

Top Solana Projects

Top Solana Projects

MetaMask

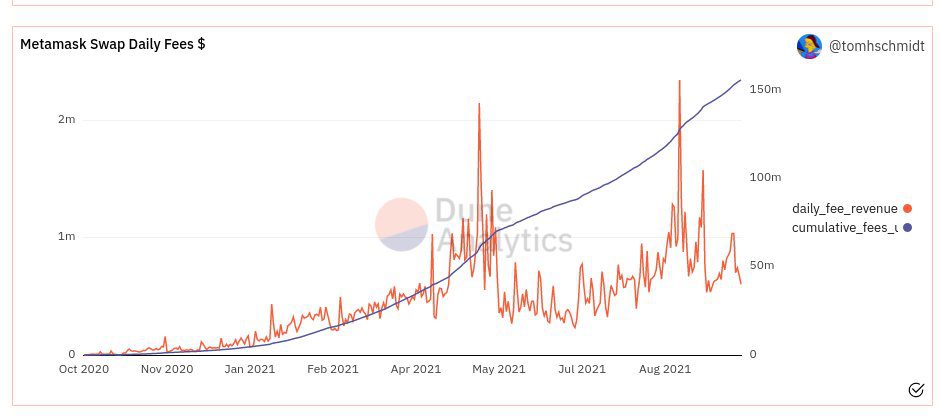

- More than $150 million in revenue has been generated via MetaMasks’ .0875% swap fee in the last 12 months.

- There are nearly 703,000 unique traders and over $18 billion in cumulative volume traded.

- With other layer-1s such as Solana rising in popularity due to extremely low fees (often less than $.01), unique traders on MetaMask has fallen from 146,000 on August 1 to 65,000 on October 1.

- Phantom, a popular wallet extension for Solana users, has been adding 100,000 new users per week.

Source: Dune.xyz

Source: Dune.xyz

Other Notable News

- XDEFI wallet is now live for the public to use. See the press release here.

- Pierre Rochard responded to JPMorgan CEO Jamie Dimon’s skepticism in regards to bitcoin’s 21 million supply cap, detailing out how to audit bitcoin’s supply.

- Celsius is valued at $3.25 billion after a $400 million-dollar raise, Blockworks reported.

- Binance created a $1 billion fund in an effort to support Binance Smart Chain (BSC) and increase crypto adoption globally, according to a Blockworks report.

That is all for today, folks. Let’s do this again at the same time tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.