Ethereum Has Most Developers, But These Newer Chains Are Growing Fast

The year of the Merge saw the number of Ethereum developers jump to 5,000, a 400% rise compared to 2018

Source: Shutterstock / Maurice Norbert, modified by Blockworks

Crypto-focused early-stage VC firm Electric Capital has found that while Ethereum has the most developers in total, a majority of monthly active developers are working on other ecosystems.

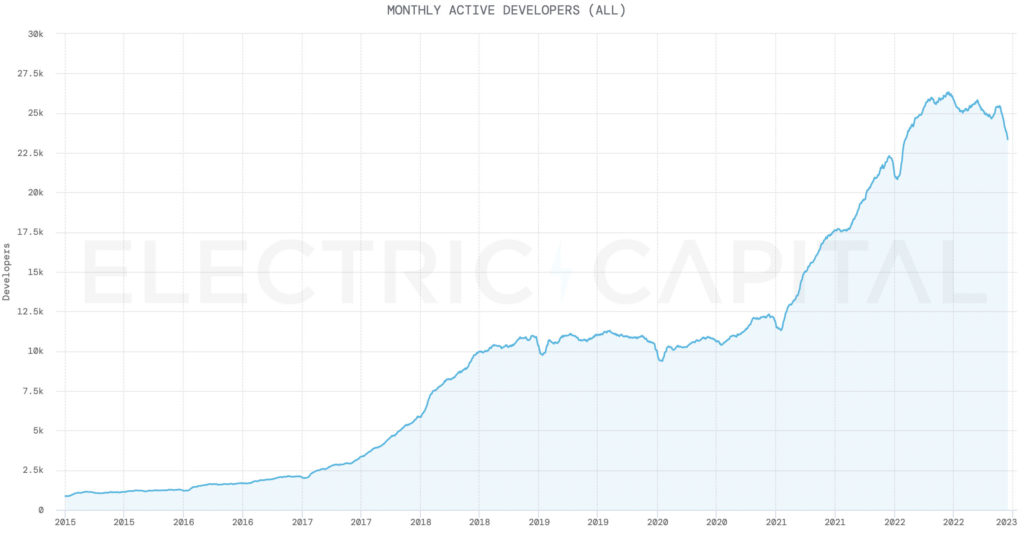

Despite a bear crypto market in 2022, developers continued to create and progress towards mass adoption of decentralized applications (dApps). The crypto industry added 5% more developers in 2022 year-on-year, despite a 70% plunge in cryptoasset prices, the report released on Tuesday showed.

The year was a rocky one for cryptoassets, given the tightening monetary policy and a string of bankruptcies, stirring fears of liquidity due to contagion. Yet, the industry captured over 61,000 first-time developers — an all-time high. Since the creation of Bitcoin in 2009, there are now more than 23,000 developers in the industry.

Total monthly active developers based on crypto ecosystems GitHub; Source: Electric Capital

Total monthly active developers based on crypto ecosystems GitHub; Source: Electric Capital

Core blockchain developers focus on designing the front-end and back-end of a proposed blockchain network, which will then be used as a foundation by others. Even after a blockchain is built, they continue to develop new features and technology to improvise or activate upgrades for better functionality.

Electric Capital found that developer activity in 2022 was far busier than the previous crypto winter of 2018, when bitcoin plunged 65%

Since 2018, the number of monthly active developers rose nearly 300% for Bitcoin. For Ethereum, developer count quintupled from 1,084 to 5,819 in that time period.

Some devs opt for emerging blockchains

The year of the Merge was significant for Ethereum, and its share of new developers for the stands at 16%.

But developers working on the Solana, NEAR and Polygon protocols rose 40% year-on-year, and added more than 500 total monthly active developers combined.

Sui, Aptos, Starknet, Mina, Osmosis, Hedera, Optimism and Arbitrum were other blockchains that absorbed developer activity.

Those working on software for non-fungible tokens saw a 300% jump since 2021.

Developer engagement is an “early and leading indicator of value creation,” according to the VC firm. “Developers build killer applications that deliver value to end users, which attracts more customers, which then draws more developers,” it added.

And what about Bitcoin, recently? Although developers working on the OG crypto tripled from 372 to 946 since 2018, year-over-year, the total has flat lined.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.