LUNA Closes in on ATH; MKR Trends Higher: Markets Wrap

MKR price soars as Dai adoption picks up steam, LUNA nears ATH on a countless number of near-to-medium term catalysts, SHIB retraces.

- MKR price soars as Dai adoption picks up steam.

- LUNA nears an all-time high on a number of near- to medium-term catalysts.

There are three primary types of stablecoins; fiat-backed, overcollateralized and algorithmic.

The adoption of decentralized stablecoins, namely Dai and UST, has been increasing.

MakerDAO’s governance token, MKR, is on a tear as Dai adoption picks up.

LUNA is inching toward an all-time high on a number of near- to medium-term catalysts.

SHIB retraces on news that a wallet holding $5.7 billion of SHIB moved a large portion of the funds into four different wallets, likely to be sold.

NFTs tread water as the assets they are priced in continue to race higher.

Latest in Macro:

- S&P 500: 4,660, +.65%

- NASDAQ: 15,811, +1.04%

- Gold: $1,770, -.42%

- WTI Crude Oil: $80.11, -4.53%

- 10-Year Treasury: 1.603%, +.067%

Latest in Crypto:

- BTC: $63,204, +.40%

- ETH: $4,615, +2.12%

- ETH/BTC: .0730, +.60%

- BTC.D: 43.32%, -.88%

DAI and UST adoption continues

Stablecoins are a form of digital asset that aim to peg their market value to an external reference such as the US dollar. Some of their main use cases include interacting with different applications in DeFi or for remittance payments.

The stablecoin market has grown to nearly $128 billion, representing an increase of roughly 500% over the last 12 months, according to a report released by the US Treasury earlier this week.

There are three main categories of stablecoins:

- Fiat-backed

- The two largest stablecoins, USDC and USDT, are fiat-backed stablecoins issued by the companies Circle and Tether respectively. Theoretically these companies hold $1 of reserves for every 1 USDC/USDT that is issued so that holders of the tokens have redemption rights.

- Some problems with fiat-backed stablecoins include: trusting that a centralized entity does in fact hold the reserves they claim and holders being subject to censorship by governments wherever they are domiciled.

- The two largest stablecoins, USDC and USDT, are fiat-backed stablecoins issued by the companies Circle and Tether respectively. Theoretically these companies hold $1 of reserves for every 1 USDC/USDT that is issued so that holders of the tokens have redemption rights.

- Overcollateralized

- For every stablecoin that is minted into the market, there is overcollateralization of various crypto assets to back it. The peg is maintained through arbitraging opportunities. Borrowers who mint overcollateralized stablecoins must maintain a minimum amount of collateral in USD terms in order to avoid being liquidated.

- Some problems with these types of stablecoins include: they can only be minted if the market has an appetite to borrow against their assets, which may not be able to match the parabolic demand stablecoins have seen to date. Also, the stablecoin is only as good as the collateral that backs it.

- For every stablecoin that is minted into the market, there is overcollateralization of various crypto assets to back it. The peg is maintained through arbitraging opportunities. Borrowers who mint overcollateralized stablecoins must maintain a minimum amount of collateral in USD terms in order to avoid being liquidated.

- Algorithmic

- With this type of stablecoin, on-chain incentives ensure the stablecoin maintains its price peg. There is no outside collateral backing these stablecoins and they are highly experimental.

- One of the main problems with algorithmic stablecoins is if the on-chain incentives fail, the stablecoin could be de-pegged and potentially go to zero.

- With this type of stablecoin, on-chain incentives ensure the stablecoin maintains its price peg. There is no outside collateral backing these stablecoins and they are highly experimental.

MKR and Dai

Dai is an overcollateralized stablecoin native to MakerDAO (MKR). It is the largest decentralized stablecoin and can be minted on Oasis by connecting a wallet and posting a digital asset as collateral.

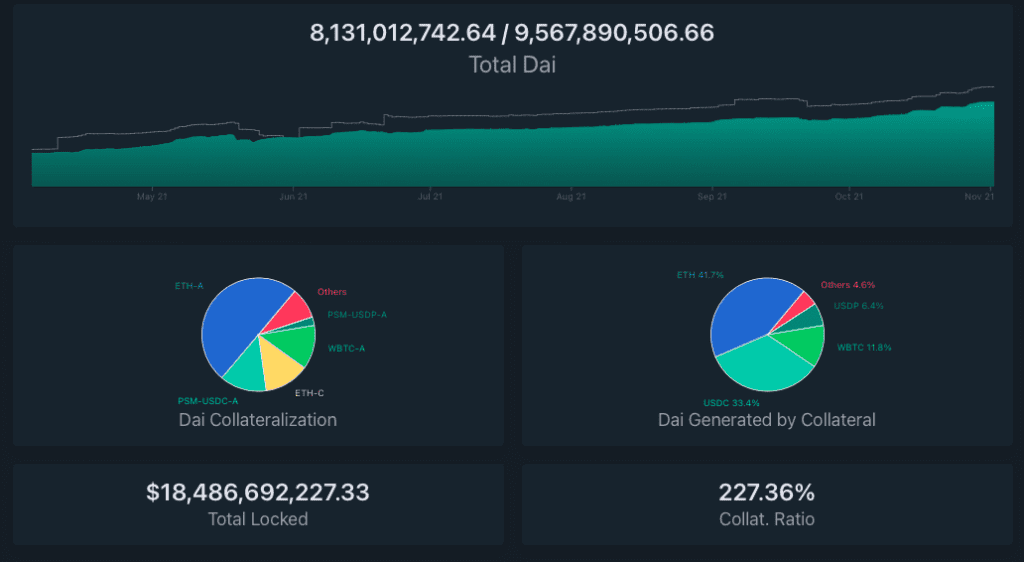

The total Dai supply sits at 8.13 billion, which marks an increase of 672% over the last 12 months.

Critics say that it is not sufficiently decentralized because a large portion of the collateral used to generate Dai is USDC, a fiat-backed stablecoin referenced earlier. However, USDC now only makes up 33.4% of Dai collateral, down from over 50% months earlier, according to writer Emily Tonelli.

Source: daistats.com

Source: daistats.com

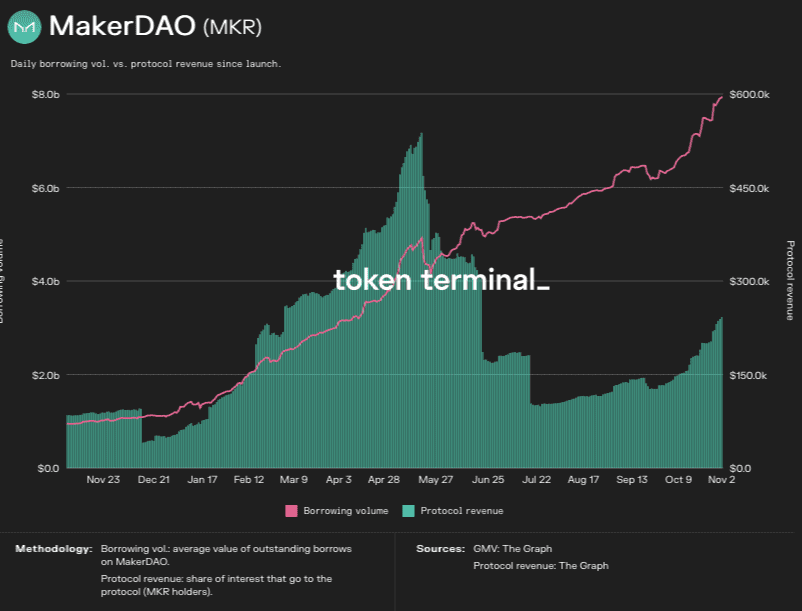

MRK revenues

MKR’s revenues are derived from three main sources, according to a Messari report:

- Interest revenues from overcollateralized loans

- Liquidation revenues from fees charged on liquidated vaults

- Stablecoin trading fees from the Price Stability Module (PSM)

The report continues by explaining how the income generated by the Maker protocol indirectly accrues to token holders. Currently, cash flows are used for three main purposes being:

- Covering the protocol’s development and operational costs

- Building a safety buffer to cover potential liquidation losses (a.k.a. surplus buffer)

- Buying and burning MKR tokens out of circulation

The MKR token is therefore a beneficiary of further Dai adoption. As the Dai supply expands, the revenues generated should also increase barring any changes to the protocol:

Source: Token Terminal

Source: Token TerminalSam MacPherson, a protocol engineer at MakerDAO, took to Twitter to announce the D3M initiative which will give one of the largest borrowing and lending protocols on Ethereum, Aave, privileged access to mint Dai once the test debt ceiling is raised. This has MakerDAO enthusiasts excited about Dai expansion and further price appreciation of its governance token: MKR.

The MKR token was last trading at $3,190, up 32.66% over the last five days.

LUNA and UST

Terra’s largest stablecoin, UST, is algorithmic. There is no collateral backing UST other than its reserve token, LUNA, which has a fixed supply. Whenever one UST is minted, one dollar worth of LUNA must be burnt.

“LUNA helps to maintain UST’s peg to the dollar by an arbitrage mechanism. Whenever UST trades above the peg, users can send 1 dollar worth of LUNA to the system and receive 1 UST,” according to a Messari report. “Conversely, when UST trades below the peg, users can send 1 UST to the system to receive 1 dollar worth of LUNA. In both cases, users are incentivized to arbitrage and help maintain UST’s peg to the dollar.”

Due to the fact that LUNA is burned in order to mint UST, LUNA holders relentlessly push for further adoption of UST.

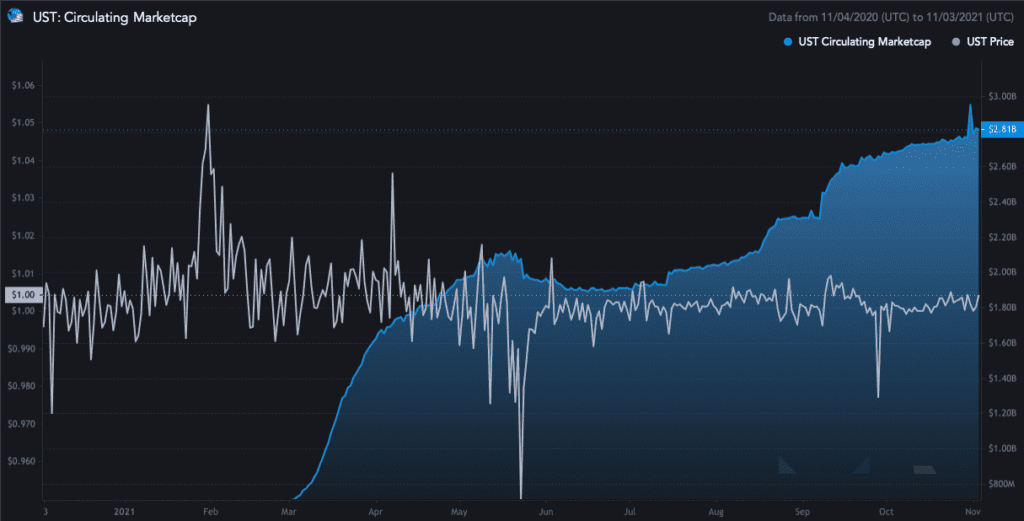

UST has experienced explosive growth, climbing to a circulating market cap of over $2.8 billion. But during spikes of volatility in crypto markets, the stablecoin has lost its peg as seen in the chart below:

Source: Messari

Source: Messari

In May of 2021 when digital assets crashed, UST holders were spooked and there was a roughly 25% contraction in the circulating supply which led the price of UST to drop below its $1 peg.

This type of bank run on algorithmic stablecoins is often referred to as a “death spiral,” where the entire economy crashes to zero. This has happened to numerous algorithmic stablecoins in the past.

“The reason why Terra has been resilient during market contractions is because there is a vibrant economy that is being built on the Terra blockchain and I think that’s the best defense that algorithmic stablecoins can have against death spirals,” said Do Kwon, co-founder of Terra, in a podcast.

LUNA nears ATH on bullish catalysts

- UST supply expansion which was previously discussed.

- MIM’s UST Degenbox is set to roll out soon, according to a medium article by Abracadabra.Money.

- Anchor protocol offering a 19.5% fixed APY on UST deposits.

- 283.05 million LUNA are staked out of the 399.88 million circulating supply, making 70.7% of the circulating supply illiquid.

- A pending proposal to burn roughly 10% of the LUNA supply from the community pool to bootstrap UST liquidity for an insurance protocol called Ozone. This would mark one of the largest burns of a major protocol to date.

- A recent interview with Do Kwon where he states there are plans to create a stability augmentation platform with $1 billion worth of BTC to back LUNA with the most pristine collateral in the digital asset realm.

There are also numerous protocols launching on Terra in the coming months which many expect will drive organic demand for UST, and thus lead to more LUNA being burned. There are too many projects to go into detail here, but the following Twitter thread provides a detailed overview:

As a result, LUNA is nearing an all-time high, last trading at $48.27. It is up 18.41% over the last seven days.

Shiba Inu retraces its steps

SHIB was last trading down 15.45% on news that a wallet holding $5.7 billion of SHIB moved a large portion of the funds in four different wallets, likely to be sold.

DOGE has reclaimed its spot as the top dog in the world of crypto. SHIB is the eleventh largest cryptocurrency with a market cap of $33.71 billion. DOGE is the ninth largest cryptocurrency with a market cap of $35.53 billion.

Non-Fungible Tokens (NFTs)

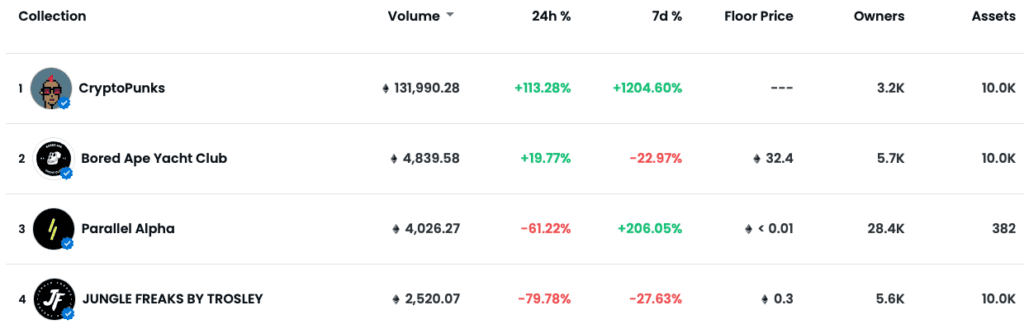

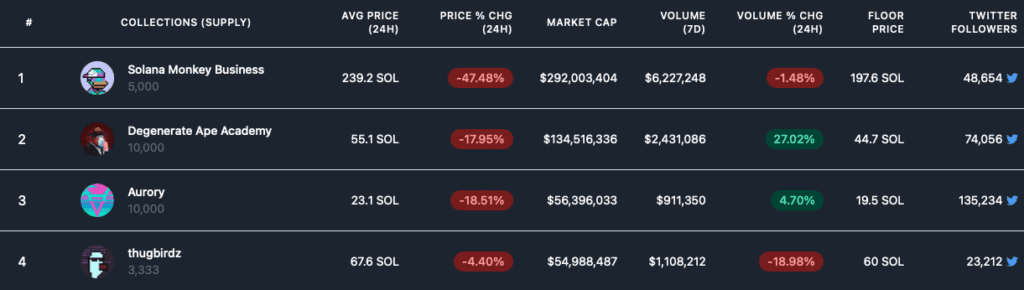

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.