Options Traders Pay Hefty Premiums, Take Positions Ahead of ETF Decision: Markets Wrap

A futures-backed BTC ETF appears to be on the cusp of approval, implied volatility in the options market hints that a big move is near.

Source: Shutterstock

- The SEC posted an investors bulletin on bitcoin futures

- Coinbase launched its digital asset policy proposal on GitHub

Markets Wrap Highlights

A futures-backed bitcoin ETF appears to be on the cusp of US SEC approval.

Bitwise CIO makes the case for a spot bitcoin-backed ETF over a futures-backed ETF.

Implied volatility in the bitcoin options market signals a big move is afoot.

The regulatory environment continues to heat up, as Coinbase launches its digital asset policy proposal on GitHub.

Coinbase’s Ethereum NFT marketplace could bring in a shockingly large amount of capital.

Grayscale Bitcoin Trust (GBTC) continues to trade at a hefty discount to its net asset value (NAV).

Latest in Macro:

- S&P 500: 4,438, +1.71%

- NASDAQ: 14,823, +1.73%

- Gold: $1,797, +.21%

- WTI Crude Oil: $81.44, +1.23%

- 10-Year Treasury: 1.516%, -.033%

Latest in Crypto:

- BTC: $57,542, +.64%

- ETH: $3,775, +6.58%

- ETH/BTC: .0654, +4.05%

- BTC.D: 45.00%, -.37%

Bitcoin ETF

Bitwise filed its second request for a bitcoin ETF, Blockworks reported earlier. Bitwise CIO Matt Hougan, took to Twitter to break down three main reasons why the company thinks a spot bitcoin-backed ETF is better than its futures-backed ETF filing.

“A. Costs: It could cost over 5-10% per year to roll the futures (“contango”). Plus another 1-2% in fees.

B. Dilution: ETFs can’t hold 100% BTC futures due to rules. Most aim for 85%. So, 15% is other stuff, even bonds!

C. Tail risk: Remember USO (referring to when oil went negative) in 2020? Position limits, liquidity, etc — things can break.”

All of this comes hours before the SEC Investor Ed tweeted a link explaining to investors what risks and benefits are associated with bitcoin futures:

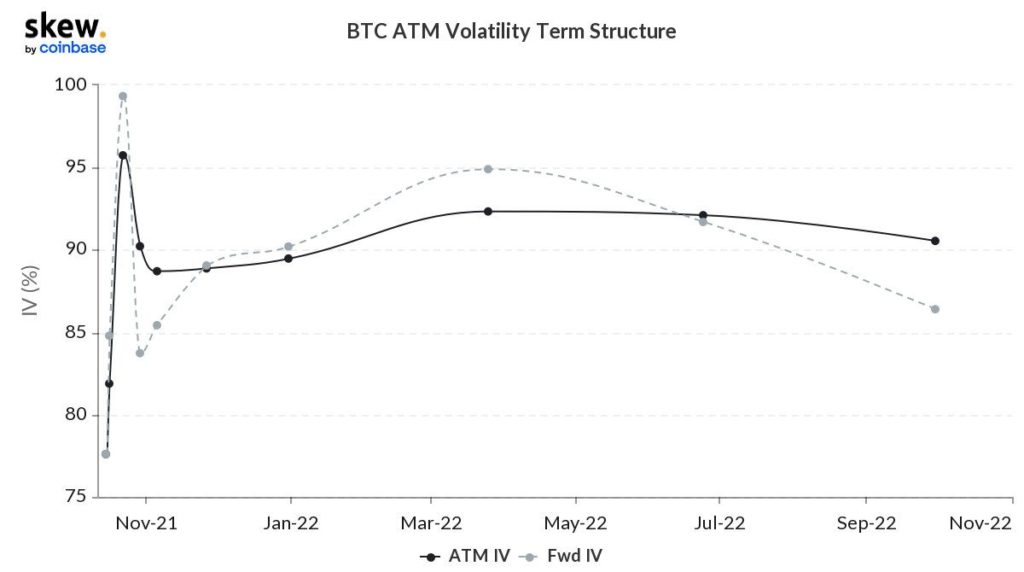

So what does this mean for price? The options market is pricing in a big move before the end of the month, implying that traders expect volatility ahead of the ETF announcement. The below chart shows BTC ATM (At-the-Money) volatility term structure. Options are priced in part by their time value — i.e. the duration until expiration and the underlying assets implied volatility (IV). We can see the IV of ATM calls/puts is abnormally high over the next week or two.

Anna Nikolayevsky, founder of Axel Capital and one of the leading women in hedge funds, has bet 23% of her portfolio in Grayscale Bitcoin Trust (GBTC) and Coinbase (COIN) as of September 30, 2021.

Many other big names endorsed crypto’s legitimacy today, such as Morgan Stanley’s CEO, James Gorman, Vladimir Putin and Billionaire Barry Sternlicht.

Regulatory News

Coinbase launched its digital asset policy proposal on GitHub, a library for open source code and proposals, in an attempt to open the conversation up to the rest of the community and educate policy makers, Blockworks previously reported. The separate proposed framework would be guided by three goals of enhancing transparency, disclosing requirements and protecting users against fraud and market manipulation

Sir Jon Cunliffe, the Bank of England Deputy Governor for financial stability, has called for cryptocurrencies to be regulated as a matter of urgency. In addition, he warned that a massive crypto market crash could be a realistic scenario.

“The calls for more regulation in digital asset investments are, in principle, a much welcome sign of the broadening adoption of these assets. Careful and sensible regulation could indeed support the move of smart money into the space and reduce the volatility of crypto in general,” Mikkel Morch, executive director and risk management at ARK36 wrote to Blockworks. “On the other hand, rushed regulation is rarely good regulation. It is therefore of potential concern that Sir Jon Cunliffe calls regulating crypto a “matter of urgency”.

Former acting comptroller of the currency at USOCC, Brian Brooks, took to Twitter to say, “Regulation should be nondiscriminatory. Bank lending shouldn’t be favored over DeFi lending. Traditional securities shouldn’t be favored over decentralized tokens. Exchanges shouldn’t be favored over DEXs. Etc.”

Non-Fungible Tokens (NFTs)

As of 3:41 pm ET, Coinbase’s Ethereum NFT marketplace has more than 1.58 million users on the waitlist. That is nearly triple the number of users on OpenSea. In a hypothetical scenario where the average user spends $1,000 on NFTs, that would amount to $1.58 billion of fresh liquidity. For context, the market cap of all Solana NFTs is $825 million according to Solanalysis.

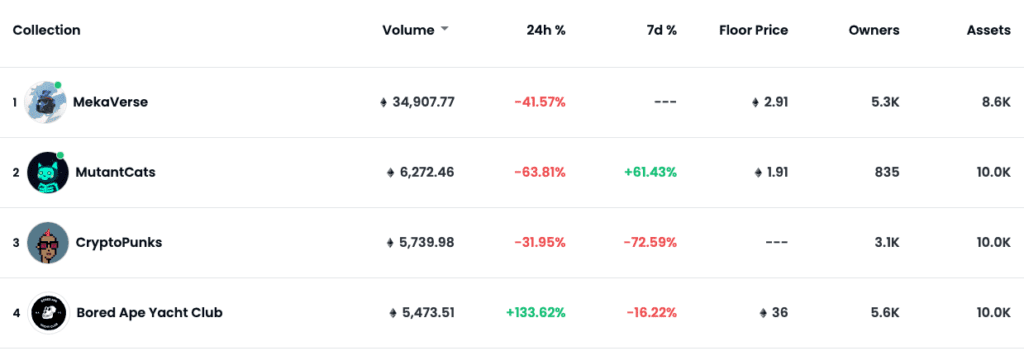

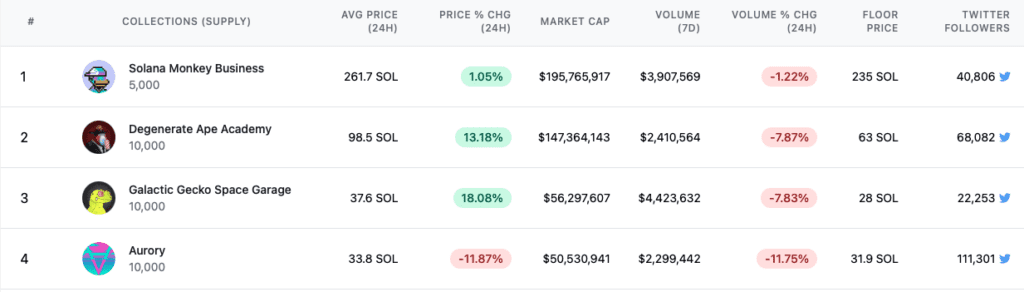

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects

Top Solana Projects

Top Solana Projects

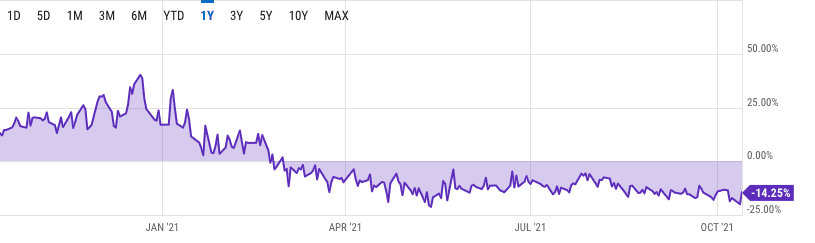

Grayscale Bitcoin Trust (GBTC)

- GBTC, a trust that holds BTC on behalf of investors and charges an annual fee, has been trading at a discount to their net asset value (NAV) for roughly seven months now.

- GBTC is different than an ETF because there are no authorized participants that reconcile the portfolio when underlying asset prices fluctuate.

- Because GBTC is a closed-end fund, investors can get ‘cheap’ exposure to bitcoin by buying it at a discount to NAV. However, it is worth noting that with an ETF approval looming, the discount could widen further for various reasons.

Source: https://ycharts.com/companies/GBTC/discount_or_premium_to_nav

Source: https://ycharts.com/companies/GBTC/discount_or_premium_to_navOther Notable News

- dYdX cumulative volume has surpassed $100 billion.

- Good resources on Ethereum scaling solutions can be found here.

- There is now over $7 billion DAI, the native stablecoin to Maker Protocol, in circulation.

- Jack Mallers announced ‘Pay Me In Bitcoin’.

That is all for today, folks. Let’s do this again at the same time tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.