YGG and MC and the NFT Gaming Craze: Markets Wrap

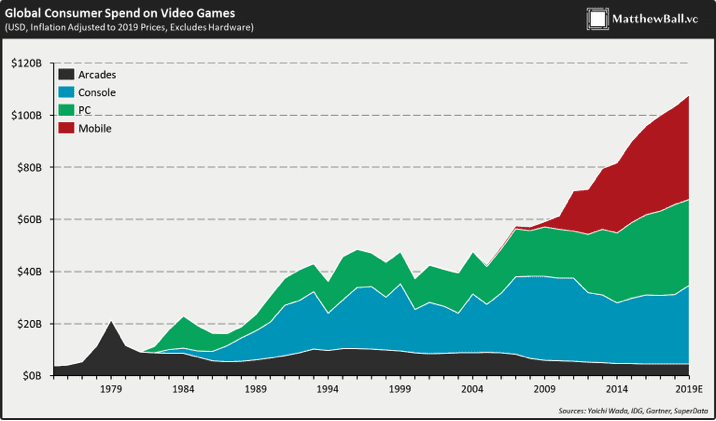

Yield Guild Games and Merit Circle lead the way in the NFT gaming craze. The video game industry has historically been early adopters of disruptive technology.

- The gaming industry has historically been an early adopter of disruptive technologies

- Yield Guild Games and Merit Circle are the guilds best positioned to capitalize on the NFT gaming craze

Non-fungible tokens (NFTs) have become a huge momentum driver for the adoption of digital assets as a whole, especially when it comes to gaming.

The gaming industry has historically been an early adopter of disruptive technologies.

Owning Yield Guild Games (YGG) and Merit Circle (MC) are ways to invest in the NFT gaming sector in order to gain wider exposure.

YGG is the largest gaming guild with a hefty balance sheet of assets and wide player base to prove it.

YGG backed Merit Circle is a new guild with a structure that differentiates itself from other gaming guilds.

The goal of both guilds is to further develop the play-to-earn (P2E) ecosystem together.

Latest in Macro:

- S&P 500: 4,697, +.37%

- NASDAQ: 15,971, +.20%

- Gold: $1,817, +1.38%

- WTI Crude Oil: $81.52, +3.44%

- 10-Year Treasury: 1.45%, -.074%

Latest in Crypto:

- BTC: $61,150, -.37%

- ETH: $4,476, -1.22%

- ETH/BTC: .0732, -.51%

- BTC.D: 42.86%, -.29%

Huge endorsements for NFT gaming

NFTs have become a huge momentum driver for the adoption of digital assets as a whole. NFT funding growth has been remarkable over the last 12 months, with a growth rate of 6,523% year-over-year. Funding for NFT-based projects is over $2 billion for 2021, while 90% of the deals have been early-stage ventures, according to a report from CB Insights.

It is common for the video game industry to be on the forefront of new technology trends which drives further adoption of said technology. This could be what is happening with blockchains and NFTs. “Every time there’s a new wave of technology, the video game industry has grown dramatically. They embrace it.” said Chris Dixon, a prominent internet entrepreneur and investor, on a podcast.

Source: joincolossus.com

Source: joincolossus.com“One thing I’m really excited about is you take a top-tier gaming studio, that’s making a great game and wants to have market mechanics in it and wants to have real user-ownership of the digital assets in it and wants to use blockchain technology, payment rails and NFTs to enable that,” FTX’s Sam Bankman-Fried said. “That’s where I would guess you’re going to see the biggest adoption early on.”

Capital has been flooding into the NFT gaming space over the past few weeks as firms try and capitalize on the movement. Some highlights include:

- Sfermion closed a $100M raise to make the metaverse mainstream.

- Facebook, one of the largest companies in the world, rebrands as ‘Meta’.

- Dapper Labs backer Animoca scored an investment of $65M to further invest in the metaverse.

- Galaxy Digital affiliate raises a $325M fund for NFTs and interactive gaming.

- FTX, Solana Ventures and Lightspeed create a $100M Web3 gaming investment.

With NFT gaming and the metaverse at the top of investors minds, many are wondering the best way to gain exposure to this rapidly emerging asset class. Enter the decentralized autonomous organizations (DAOs) Yield Guild Games (YGG) and Merit Circle (MC).

Yield Guild Games

Owning the YGG token is akin to owning an index in the stock market but for the NFT gaming sector. With 69,310 discord members and nearly 5,000 Axie scholars, or players who borrow NFTs in exchange for sharing in game earnings with the DAO and scholarship managers, YGG is the largest DAO in the NFT gaming space.

“Yield Guild Games is what we call a play-to-earn gaming guild. In a way I call it similar to a World of Warcraft Guild with a balance sheet. So we were a group of gamers who are set up as a DAO and we invest in assets in different blockchain games.” said YGG co-founder Gabby Dizon in a podcast.

The guilds main goals can be summed up by the following goals:

- Invest in the best yield producing NFTs in the Metaverse.

- Build a global economy of play-to-earn gamers.

- Produce revenue by operating and renting NFTs.

- Encourage community participation in the guild.

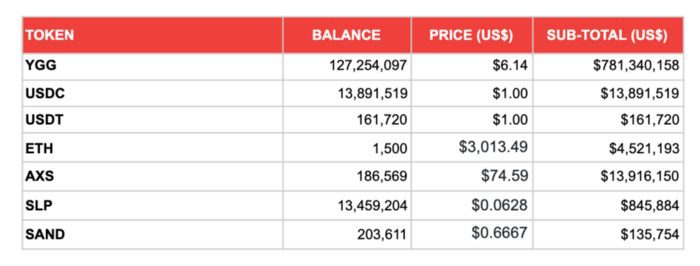

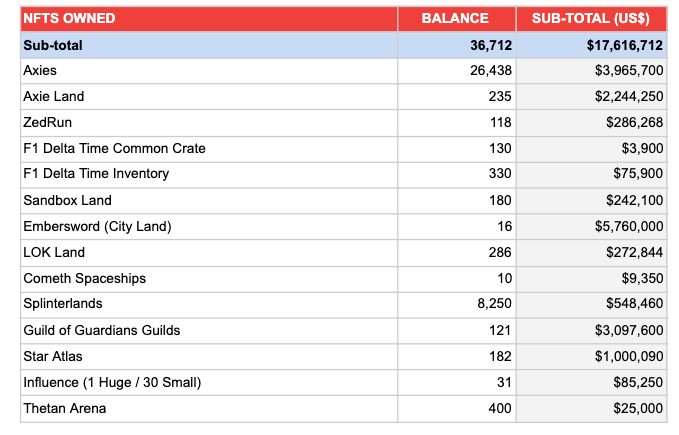

The a16z backed gaming guild boasts a portfolio of various tokens and NFT assets which are lent out to gamers to earn yield:

Source: https://medium.com/yield-guild-games/yield-guild-games-asset-treasury-report-september-2021-1de8b56fdd5e

Source: https://medium.com/yield-guild-games/yield-guild-games-asset-treasury-report-september-2021-1de8b56fdd5e“As YGG deals with more and more games, you start to see what works, and what doesn’t. And so they’re gonna want to tap in and integrate with you guys in every single way,” said Yan Liberman, co-founder of Delphi Digital. “There’s a massive user base to plug into, and they can learn from what you guys have seen in a game.”

Yield Guild Games has a competitive advantage because they can leverage their expertise and user base to invest in nascent projects to generate alpha. Some assets of smaller projects that YGG holds can be seen in the following table:

Source: https://medium.com/yield-guild-games/yield-guild-games-asset-treasury-report-september-2021-1de8b56fdd5e

Source: https://medium.com/yield-guild-games/yield-guild-games-asset-treasury-report-september-2021-1de8b56fdd5eYGG token

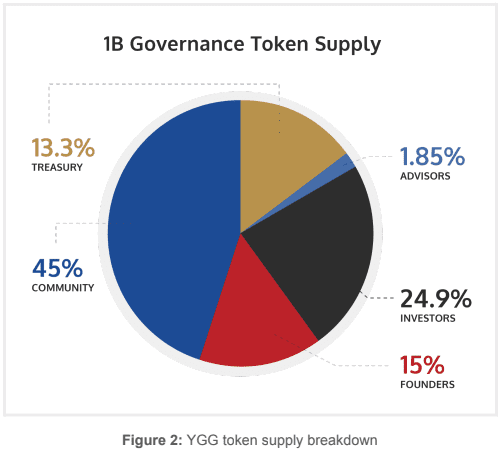

YGG was last trading at $6.77 with a market cap of $461 million. It is worth noting that the fully diluted market cap is $6.7 billion due to the fact that a majority of the coins have yet to enter circulation. 45% of the 1 billion YGG token supply is allocated for the community, which should be seen as a positive sign for YGG investors as it signals the DAO is focused on building a strong community.

Source: YGG whitepaper

Source: YGG whitepaperMerit Circle

Merit Circle (MC) is creating a DAO that develops opportunities to earn through play for people who want to help build the metaverse. This is done through the Merit Circle platform we are building, which hosts scholarship opportunities, educational opportunities and everything a person could need on their journey towards being an earning gamer in the metaverse, according to Merit Cicrle’s gitbook.

YGG does not view MC as a threat, but rather healthy competition that can help ecosystem further. YGG recently invested $175,000 in MC and will work together to help shape the play-to-earn ecosystem, according to a company released medium article.

“I’d like to point out it’s not a winner-takes-all market e.g. YGG is a partner of Merit Circle and a seed round investor.” Marco van den Heuvel, CEO and Co-Founder of Merit Circle, told Blockworks. “We believe we’re in the beginning of an industry that’s going to see major growth, and therefore collaborating is better than competing. Healthy competition is fun ofc. – but it is positive for both guilds when they play a game, as it grows the ecosystem.”

DAO structure

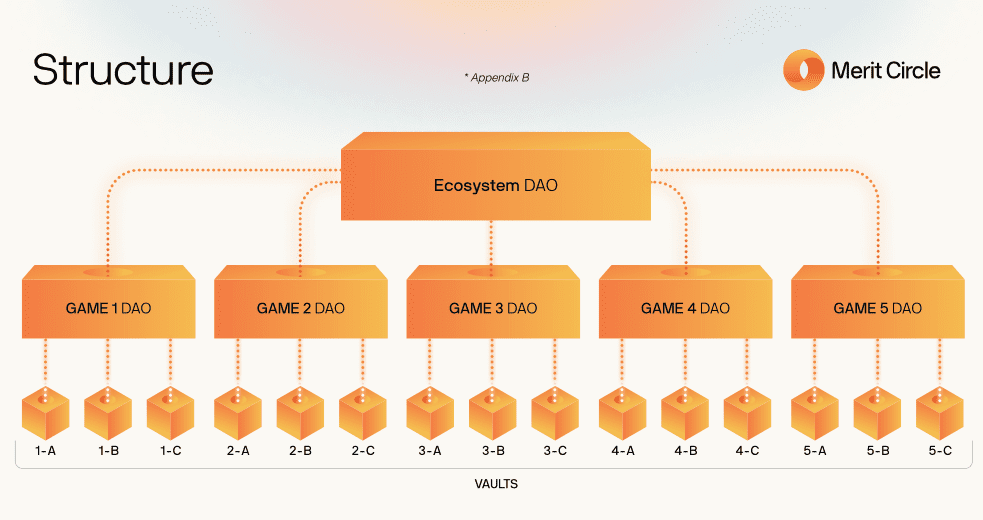

One of the main differences between YGG and MC is their DAO structure.

YGG takes a ‘guild of guilds’ approach, where guilds pay a take rate of 10% to leverage the YGG brand and potentially have a separate token. This means that YGG token holders may not own the assets held in subguilds and will only benefit from the take rate previously mentioned.

MC takes the superguild approach, where subguilds have their own governance structure but share the same token. This will ensure MC token holders benefit from NFT asset appreciation. Merit Circle also has 30% take rate versus YGG’s 10%, allowing more value to accrue to MC token holders due to better margins. The MC DAO structure can be best described by the following photo:

Source: https://meritcircle.gitbook.io/merit-circle/future-operations/structure

Source: https://meritcircle.gitbook.io/merit-circle/future-operations/structure

Marco continued by saying, “We believe that by having everything in-DAO we can create a more engaged and loyal MC community, with 70% going to the players and 30% going to the subDAOs. Education is going to be one of the major pilars (and already is) at MC. We provide educational content, and enable our top earners to earn more rewards by coaching other players in Discord live, so that they can become better at playing the game. As a result, the average SLP earnings per player is significantly higher compared to many other guilds that provide transparency reports.”

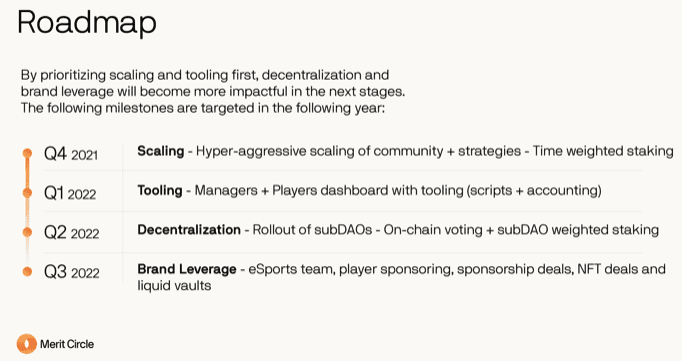

Staking and roadmap

Merit Circle plans on providing generous rewards to stakers modeled after the popular play-to-earn game that is still under development, Illuvium (ILV). Roughly 8% of the total supply is in circulation after their Balancer liquidity bootstrapping pool that was recently completed. However 10% of the 1 billion MC token supply will be distributed to stakers over the next year. This will enable token holders to roughly double their equity in exchange for locking up their MC holdings.

MC is a nascent token with only $111 million in 24 hour trading volume and 12.47 million in liquidity on Uniswap, so caution is warranted before investing. It is an ambitious project with the following road map:

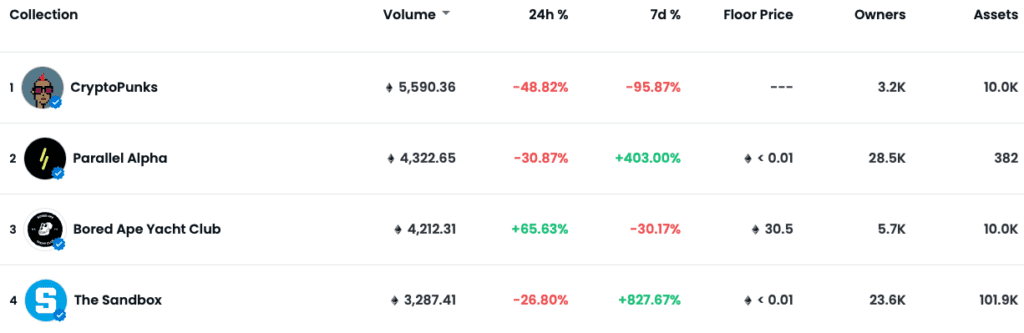

Non-Fungible Tokens (NFTs)

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.