Market Recap: Meta and Twitter Add NFT Support

Crypto markets jumped on news that Meta and Twitter are adding NFTs to their platforms only to nosedive later in the day

shutterstock

key takeaways

- Initial jobless claims have jumped to three-month highs in reaction to increased Covid-19 cases

- Bitcoin and broader crypto markets started the day up despite the negative jobs report and news that the Bank of Russia may look to ban cryptocurrency

Bitcoin jumped as much as 4.27% on the day even though the new jobless claims report showed three-month highs and Russia’s central bank called for a full ban on crypto.

The House Committee on Energy and Commerce had a hearing today about the energy use of blockchains that remained mostly positive.

Crypto markets bounced on news that Google is creating a new arm dedicated to blockchain while Meta and Twitter are adding NFT support to their platforms.

Today

More jobless claims following a spike in Covid-19 cases

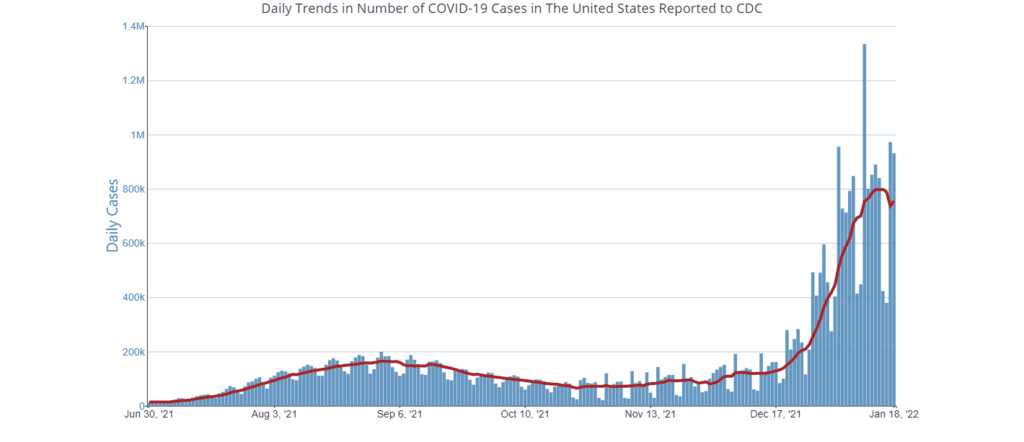

The new initial jobless claims report released today revealed a trend of job losses reflecting the drastic increase in Covid-19 cases. Initial jobless claims increased by 55,000, going from 231,000 to 286,000, while the forecast predicted a decrease down to 225,000 initial jobless claims.

The increase represents a three-month increase, though today's equity and crypto markets seemed to have had no reaction to what would seem like bad news to many. Jobless claims have been directly correlated to the rise in Covid-19 cases in the US, and have likely been a driving factor in the market's downward trend at the start of 2022.

US Covid-19 cases. Source: CDC

US Covid-19 cases. Source: CDC

Russia's central bank wants to ban crypto

Bitcoin and cryptocurrency markets seem to be behaving with less logic as of late. In the past, news that a large nation's central bank was seeking to ban cryptocurrency mining would surely make crypto markets nosedive.

Crypto markets had the opposite reaction today after a report was released from Russia's central bank stating that cryptocurrency is volatile, mostly used in illegal activities like fraud and that "potential financial stability risks associated with cryptocurrencies are much higher for emerging markets, including in Russia."

The report notes that Russia's existing ban must be further reinforced and that the issuance of crypto, over-the-counter trading desks, peer-to-peer platforms, institutional investment in crypto and even mining should all be banned:

"Introduce a ban on organizing the issuance and (or) issuance, organizing the circulation of cryptocurrencies (including by crypto exchanges, crypto exchangers, P2P platforms) on the territory of the Russian Federation and establish liability for violating this ban. Introduce a ban on investments by financial organizations in cryptocurrencies."

Bank of Russia report on cryptocurrency

"Cryptocurrency generates demand for infrastructure for conducting transactions with cryptocurrencies, which amplifies the negative effects of the spread of cryptocurrencies and creates incentives for circumvention of regulation. In this regard, according to the Bank of Russia, the best solution is to introduce a ban on cryptocurrency mining in Russia."

Bank of Russia report on cryptocurrency

The negative news from jobless claims, Covid-19 and Russia was reversed by positive news on the adoption of cryptocurrency among tech giants for most of the day.

Meta, Google and Twitter dive deeper into crypto

Yesterday and today have been filled with major crypto-related announcements from tech giants that are likely the catalyst that helped push markets up through the bad news.

Yesterday Google unveiled a new arm of the company dedicated to blockchain and promoted Alphabet engineering Vice President, Shivakumar Venkataraman, to be its head.

Today, Meta (formerly Facebook) made headlines by adding native support for NFTs and an NFT marketplace on both Facebook and Instagram. This allows users to not only buy, sell and use NFTs for profile pictures, but also lets them create new ones and share them.

Following the Meta news, Twitter announced that it was adding NFT support to its Twitter Blue premium subscription service. The new integration lets users connect various crypto wallets like MetaMask, Ledger and others to use NFTs as profile pictures. The news comes about four months after Twitter integrated bitcoin tips on its platform, showing a commitment to increasing crypto-related services.

In the past, just one of these announcements would have had enough weight to drastically affect the market, but volatility in crypto markets seems to have leveled out.

House hearing

The House Committee on Energy and Commerce hearing today on "Cleaning Up Cryptocurrency: The Energy Impacts of Blockchains," remained constructive and more on the positive side. A number of committee members questioned the necessity of bitcoin's and other blockchains' power usage and worried about how some nearly retired and inefficient fossil fuel plants have been brought back online to mine bitcoin.

“We cannot bring retired fossil fuel plants back online or delay the retirement of some of our oldest and least efficient plants in support of energy-intensive crypto mining,” said Democrat Rep. Frank Pallone who heads the Energy and Commerce Committee.

Witnesses at the hearing agreed the concerns were legitimate but noted that proof-of-work mining has the ability to speed up the process of making the grid renewable while innovating technologies outside of the mining space.

"One of the positive incentives about bitcoin mining, in general, is the incentive it creates to find more and more efficient energy of doing that activity, Which, by the way, has massive spillover effects to other sectors outside of crypto. I point to immersion cooling, for example, as something that reduces an enormous amount of energy cost first in bitcoin mining but now in high-performing data centers globally," said Brian Brooks, the CEO of the bitcoin mining company Bitfury.

"The energy improvement from 2013 to 2022 at Bitfury alone is, wait for it, 6,100% and the pioneering of those kinds quantum leap order of magnitude efficiency gains are shared across all of computing and not just bitcoin mining," added Brooks.

The hearing allowed committee members to get up to speed on the mining industry and the impact blockchains could have on the environment. Future hearings and discussions on the subject are likely to have more weight on markets.

Tomorrow

While bitcoin managed to rise as much as 4.27% today, it still remained stuck in a range between $44,200 and $40,500 and has been within this range for most of January. Prolonged consolidation ranges like we have seen this month usually result in intense volatility in either direction and investors should prepare for such an event.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.