BTC, ETH, SOL and LUNA Take Hits in Digital Asset Sell-off: Markets Wrap

Digital assets stumble while traditional financial markets close strong, highlights of BTC, ETH, SOL, and LUNA price action.

Source: Shutterstock

- The broader cryptocurrency market experienced a sell-off early Tuesday morning

- “It is vital to remember that an 8% drawdown is considered a normal market move in the crypto markets.” Mikkel Morch, Executive Director & Risk Management at ARK36, wrote to Blockworks

The crypto markets have sold-off more than 13% since their prior peak a week ago.

BTC saw $274 million of liquidations, but the investment thesis remains intact.

ETH saw a drastic reduction in the percentage of supply held on centralized exchanges in the midst of the drawdown.

SOL experiences a minor pullback after its flagship conference, Breakpoint, concluded last week.

LUNA sees the largest correction despite burning 10% of the token supply to bootstrap liquidity for an insurance protocol.

Bored Ape Yacht Club and its’ Mutant derivative are on hot items.

Latest in Macro:

- S&P 500: 4,700, +.39%

- NASDAQ: 15,973, +.76%

- Gold: $1,850, -.67%

- WTI Crude Oil: $80.76, -.15%

- 10-Year Treasury: 1.635%, +.014%

Latest in Crypto:

- BTC: $60,510, -5.37%

- ETH: $4,266, -6.66%

- ETH/BTC: .0703, -1.97%

- BTC.D: 43.72%, +.81%

Broader market sell-off

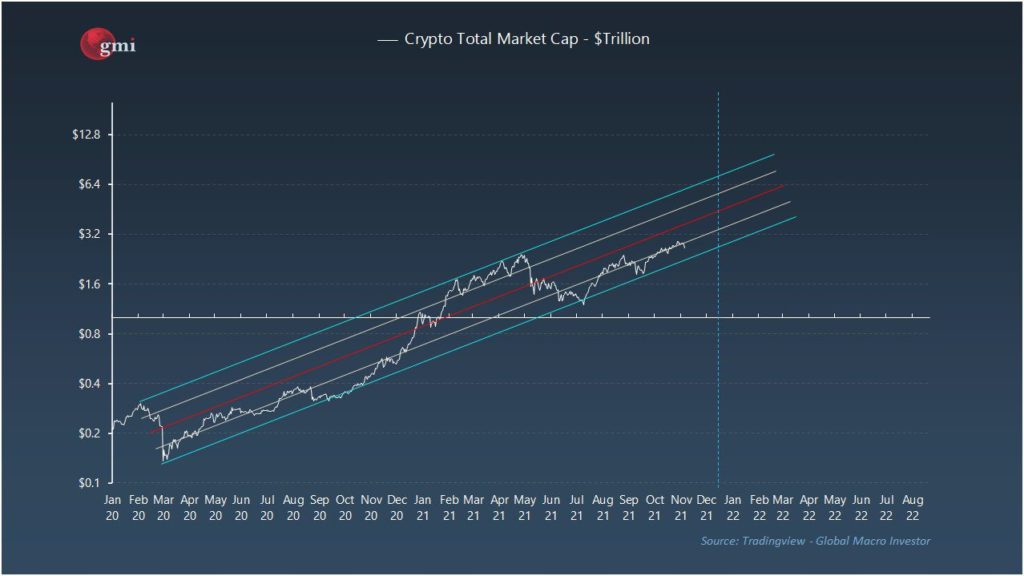

Despite the strength seen in traditional financial markets today, digital assets sold off across the board. The total crypto market capitalization dropped roughly 13.5% from the peak of $2.95 trillion seen on November 10 to a low of $2.55 trillion seen earlier this morning, according to data taken from Trading View.

The DXY, or the US dollar index relative to a basket of other foreign currencies, is at its highest level since July of 2020. The stronger USD is likely contributing to downward price pressure on all digital assets when returns are denominated in USD.

“It is vital to remember that an 8% drawdown is considered a normal market move in the crypto markets,” Mikkel Morch, executive director and risk management at ARK36, wrote to Blockworks. “A sudden price drop results in a leverage shakeout which contributes to a healthier market that is better set up for an uptrend continuation in the medium term. Bitcoin is also experiencing some downward pressure from macroeconomic conditions including the strengthening Dollar Index so investors may expect more volatility and a deeper correction in the short term.”

Source: @Remi_Tetot

Source: @Remi_Tetot

BTC

According to data from Coinglass, there have been $274 million of BTC liquidations over the past 24 hours. Nearly all of these liquidations have been those holding long positions, which forces price downwards as positions are closed resulting in increased sell-side pressure.

The digital asset industry boasts a lot of leverage and instant settlement, which explains the volatile nature of the underlying assets. While the heightened volatility is unnerving for investors, short-term price action and fundamentals do not always align.

The need for a censorship-resistant, highly secure, transportable, fungible, and reliable store of value in the current macroeconomic landscape remains unchanged.

“Real rates remain near historical lows and inflation is likely to accelerate as seen by the spike in short-term yields. In Q4, companies will pass more of their costs on to consumers in the context of strong demand. The hunt for yield will continue unabated and thus we see good support for BTC at 60k,” Martha Reyes, head of research at BEQUANT, wrote to Blockworks.

The hash ribbon indicator, introduced by Charles Edwards, has yet to flash a sell signal. The popular metric looks to be as healthy as it was at the beginning of the year when BTC was trading in the $30,000 range.

Source: @Luna_UST

Source: @Luna_USTETH

The price of ETH fell to a low of $4,108 on Coinbase at around 5:15 am ET. Despite the brief flash crash, similar to BTC, ETH’s short-term price action and fundamentals do not always align.

The total value locked on Ethereum continues to grow, non-zero wallet addresses are making new all-time highs, ETH is being burned as a result of the London Hard Fork, the Ethereum merge to its proof-of-stake chain is on the horizon, celebrities are paying hundreds of thousands of dollars for Ethereum NFTs, developers continue to bring innovative products to market, and activity on Ethereum remains in a long-term uptrend.

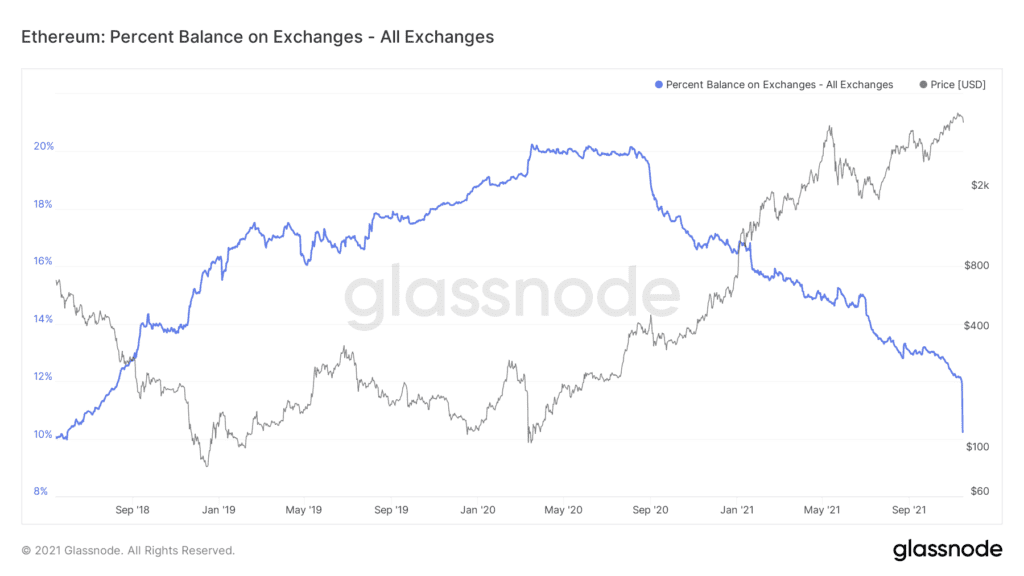

In the midst of the sell-off, there was a large drop in the percentage of ETH supply held on centralized exchanges (CEXs), according to data from Glassnode. While it’s inconclusive of whether this is CEXs moving around wallet funds or whales sending ETH into cold storage wallets for the long-term, it may be evidence of aggressive dip-buying.

ETH held on CEXs is officially at its lowest level since May of 2018, and that was before roughly 7% of the supply was locked up for staking.

Source: Glassnode

Source: Glassnode

SOL

SOL traded as low as $214.47 on Tuesday morning, just a week after the project’s Breakpoint event in Lisbon, Portugal.

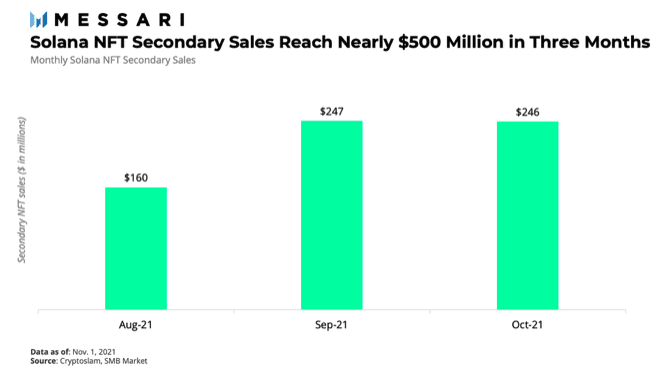

The event highlighted some of Solana’s major feats from the past year, some of which include the rising number of projects and developers contributing to the blockchain, increased adoption of the Phantom wallet, higher NFT sales, an abundance of capital pouting into the ecosystem, and more.

Source: Messari

Source: MessariCritics often point to the lack of decentralization and cost to run a validator on the Solana network, but there are now 1200 active validators with the number continuously increasing.

The number of active wallet addresses and transaction fees have experienced massive growth, indicating a growing network effect. Solana’s Market Cap/TVL ratio sits at 5.02, making it one of the most expensive layer-1s by that metric. However higher growth typically leads to higher price tags.

Source: Chaincrunch

Source: ChaincrunchLUNA

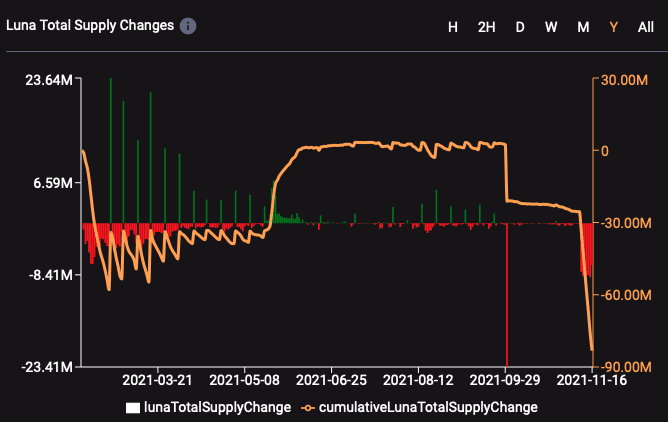

LUNA experienced the most drastic drawdown of the four assets discussed, declining by roughly 19% from its ATH seen on Nov. 10 to reach a low of $41.31 earlier on Tuesday.

The drawdown comes after the LUNA community approved a proposal to burn roughly 88 million LUNA tokens from the community treasury to mint billions of dollars of its largest stablecoin, UST, to bootstrap liquidity for an upcoming insurance protocol. The amount of LUNA being burned is sitting at unprecedented levels, as illustrated by the chart below.

Source: Terra.smartstake.io

Source: Terra.smartstake.ioThe Terra ecosystem has more than a hundred projects launching over the next couple of months, which could increase demand for UST and result in an increasing amount of LUNA being burned.

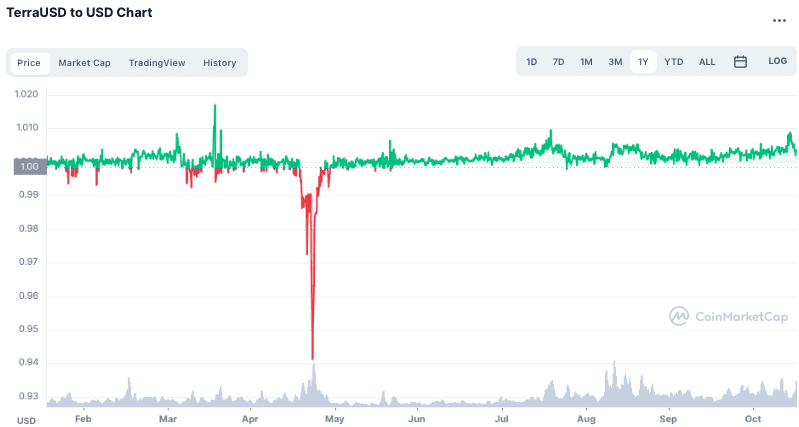

UST is an algorithmic stablecoin that is only backed by the LUNA/UST burn and mint mechanism. Although the drawdown has been brutal for LUNA investors, the UST stablecoin did not break its peg like it did during the crash back in May. This may be due to the amount of ‘demand’ coming out of the community treasury to mint UST.

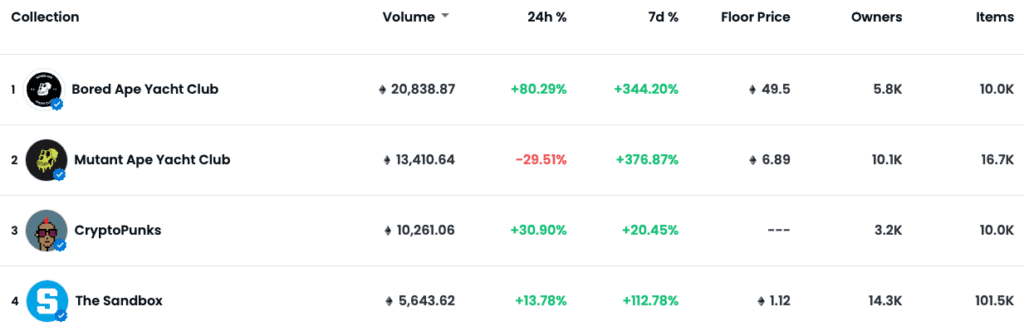

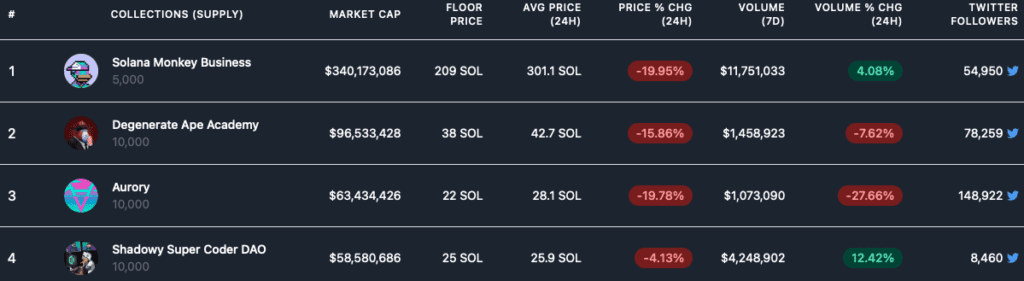

Non-Fungible Tokens (NFTs)

Bored Ape Yacht Club and its Mutant derivative are continuing its explosive run. Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.