Market Recap: Buying Opportunity Ahead?

The crypto markets have continued to slide amid volatility and other market pressures, but a buying opportunity could be on the way

shutterstock

- Volatility increased sharply as both equity and crypto markets slid

- Last known support line in bitcoin’s current range was in early August at a price of $37,640

Volatility has surged as investors shed equities in favor of cash to prepare for looming interest-rate hikes. Riskier assets, including tech stocks and cryptocurrencies, have experienced the harshest drops.

Bitcoin could have more room to crumble, with its next support line around the price of $37,640 formed back in early August.

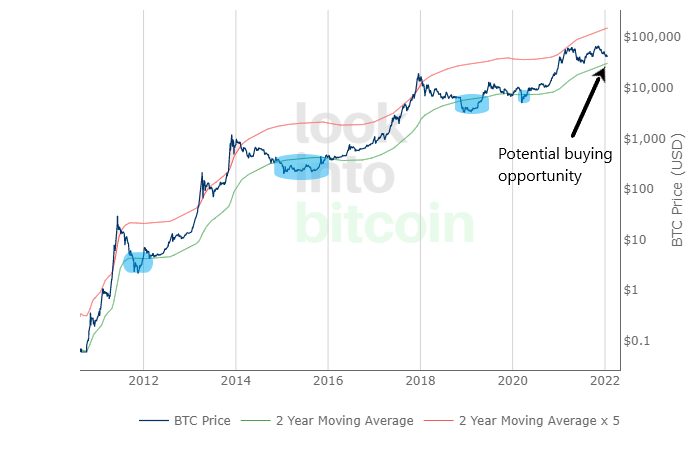

The cryptocurrency is inching closer to the low end of its two-year moving average multiplier, a consistent indicator of buying and selling points for bitcoin — which could become a buying opportunity.

Today

Volatility on the rise

The dramatic increase in volatility highlights increased uncertainty among market participants, many of whom will be reallocating holdings ahead of the Federal Reserve’s reduction in asset purchases and increase in interest rates. Investors are concerned about markets in the near-term as an increase in the Federal Funds Rate has historically resulted in down markets.

The VIX, a volatility index based on S&P 500 options, has increased over 71% in the last 90 days and over 31% in the last five.

VIX Volatility. Source: Tradingview

VIX Volatility. Source: TradingviewLast known support

Bitcoin has fallen past the support keeping it within the $44,500 and $40,000 range and slid as far as $37,862. The August support line of $37,640 suggested that bitcoin could have more room to drop. Should bitcoin fall further, it could endure a more sustained bear market until reaching the next heavy support line of roughly $30,000.

Bitcoin support. Source: Tradingview

Bitcoin support. Source: TradingviewBitcoin has taken the rest of crypto with it as it has cascaded downward. In the past 24 hours leading cryptocurrencies by market capitalization have dropped substantially. Ether (ETH) is down over 8% and Binance coin (BNB) is down almost 11%. Cardano (ADA) and solana (SOL) are down close to 15%. In the past day, the entire market cap of crypto has dropped from over $2 trillion to less than $1.8 trillion, scrapping off nearly $240 billion.

Total cryptocurrency market capitalization. Source: CoinMarketCap

Total cryptocurrency market capitalization. Source: CoinMarketCapTwo-year MA multiplier

The two-year moving average multiplier, a macro indicator tool used to give insight into the best areas to buy or sell bitcoin, is showing bitcoin slowly dipping closer to below the multiplier line — historically an ideal indicator of an investment opportunity. Every time since 2012 that it's dropped below this level, the currency has recovered sharply and in many cases surged to a new high.

730 Day MA (BTC/USD) and 730 Day x5 (BTC/USD). Source: Lookintobitcoin

730 Day MA (BTC/USD) and 730 Day x5 (BTC/USD). Source: LookintobitcoinWhile bitcoin's current price is around $8,000 higher than the green line on the chart above, a fall through the support of $37,640 could result in bitcoin falling as far as the green line, if not through it, presenting an enormous buying opportunity.

Tomorrow

Bitcoin has fallen nearly 12% in the past five days and has met support at $37,640. With current market pressures, namely the looming Federal Funds Rate increase, it may be tough for bulls to push back up again. Should bitcoin break through support, it could fall to as much as $30,000 and under the two-year moving average multiplier —presenting a significant buying opportunity.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.