TVL Across All Chains Hits All-time High, SOL and LINK Outperform: Markets Wrap

Total value locked (TVL) across all chains hit an all time high, crypto investment products see record inflows, SOL and LINK outperform the market.

Blockworks exclusive art by Axel Rangel

- The total number of DeFi users sits north of 3.631 million users, which in the grand scheme of things is only scratching the surface of its total addressable market

- Digital asset investment products saw inflows of $1.47 billion last week, which represented the largest inflows on record by a long shot

Total value locked (TVL) across all chains hit an all-time high today when denominated in US dollars.

Uniswap surpasses $500 billion in lifetime trading volume.

Shares of Bakkt surge over 230% on news that it will partner with Mastercard in rolling out crypto credit and debit cards.

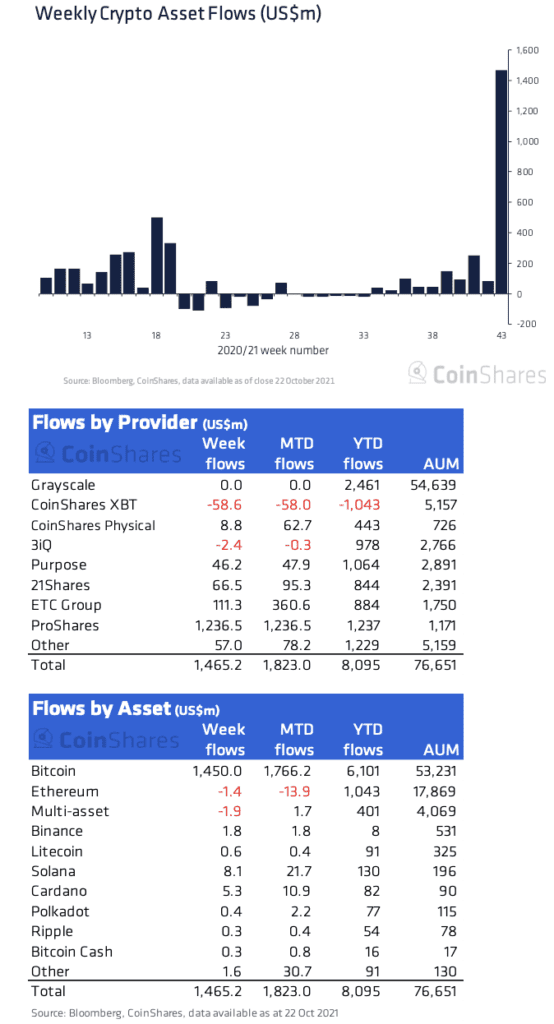

Digital asset investment products saw record inflows for the week ended on October 22 due to newly launched ETF’s.

Solana and Chainlink posted the strongest gains today among major altcoins.

Latest in Macro:

- S&P 500: 4,566, +.47%

- NASDAQ: 15,226, +.90%

- Gold: $1,807, +.87%

- WTI Crude Oil: $83.71, -.66%

- 10-Year Treasury: 1.633%, -.022%

Latest in Crypto:

- BTC: $62,985, +3.17%

- ETH: $4,191, +3.84%

- ETH/BTC: .0665, -.88%

- BTC.D: 45.18%, +.45%

TVL in Crypto Continues its Growth

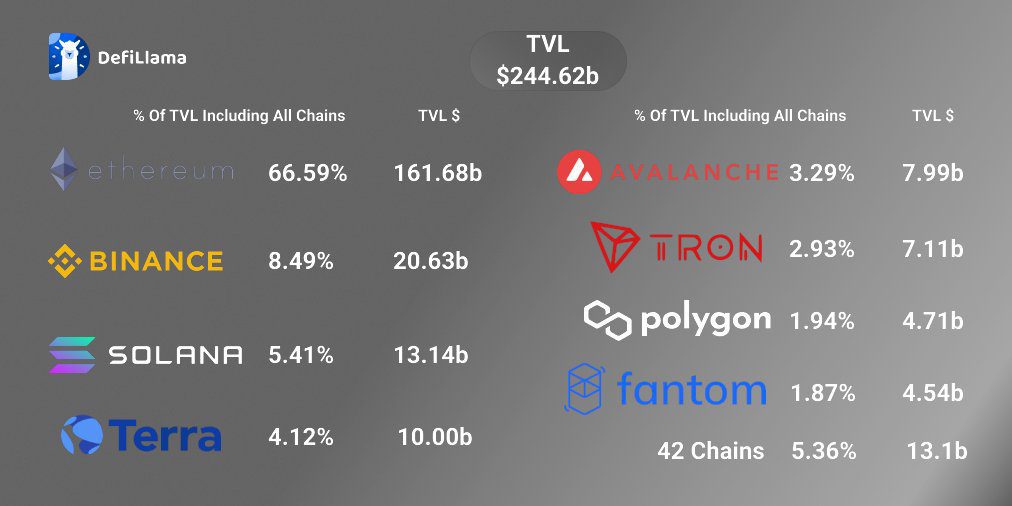

Total Value Locked (TVL) across all chains has reached all-time highs when denominated in US dollars. As of reporting, TVL sits at $247.09 billion, with Ethereum leading the way with a 66.51% market share. A breakdown of leading chains can be seen below, although the numbers were taken first thing this morning.

Source: DefiLlama

Source: DefiLlama

The total number of DeFi users sits north of 3.631 million users, which in the grand scheme of things is only scratching the surface of its total addressable market. Goldman Sachs released a report on Friday highlighting that DeFi has many advantages over traditional finance, but it remains a work in progress.

“DeFi is easier to access for underbanked populations and provides faster settlements for users, but it’s still a work in progress with flaws like hacks, bugs and outright scams,” the report by Zach Pandl, co-head of foreign exchange strategy for Goldman Sachs Research, and Isabella Rosenberg, a foreign exchange analyst at Goldman Sachs, said.

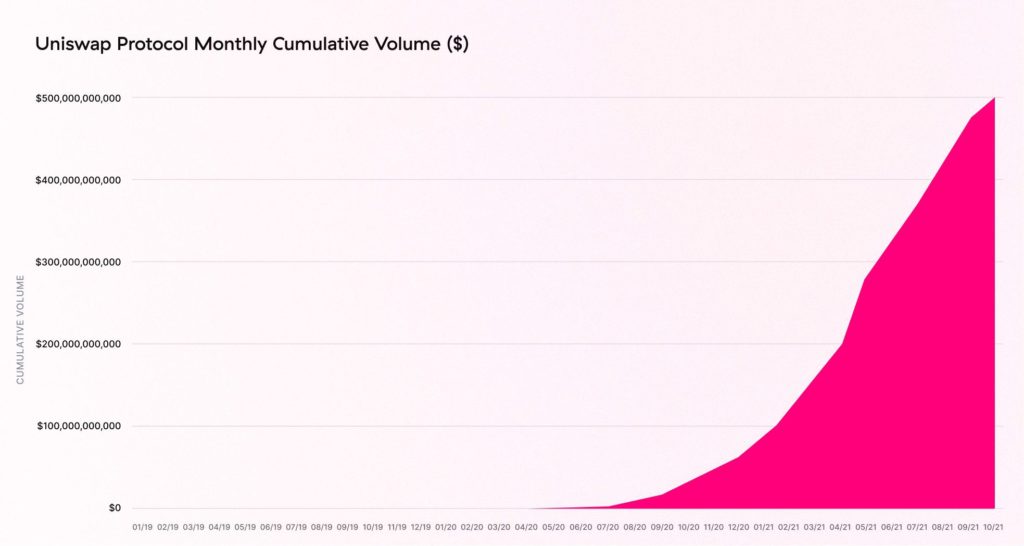

Over the weekend, Uniswap (UNI), the most popular decentralized exchange built on top of Ethereum, crossed $500 billion of total volume traded since its launch in November of 2018. UNI was trading at $26.63, up 3.51% over the last 24 hours.

Source: @Uniswap

Source: @Uniswap

Every day more large companies are trying to integrate various crypto networks to avoid getting left behind. Some highlights from today include:

- Citi CEO, Jane Fraser, says they are working on connecting clients to crypto wallets and enabling corporate clients to accept crypto for payments, Blockworks reported earlier.

- One River CEO, Eric Peters, calls digital assets the most interesting macro opportunity and most disruptive technology he has seen in his career.

- Mastercard announced plans to offer crypto credit and debit cards in a partnership with Bakkt, according to a company press release.

- Bankman-Fried, founder of FTX, says that financial institutions have a ‘mandate’ to invest in digital assets, Blockworks previously reported.

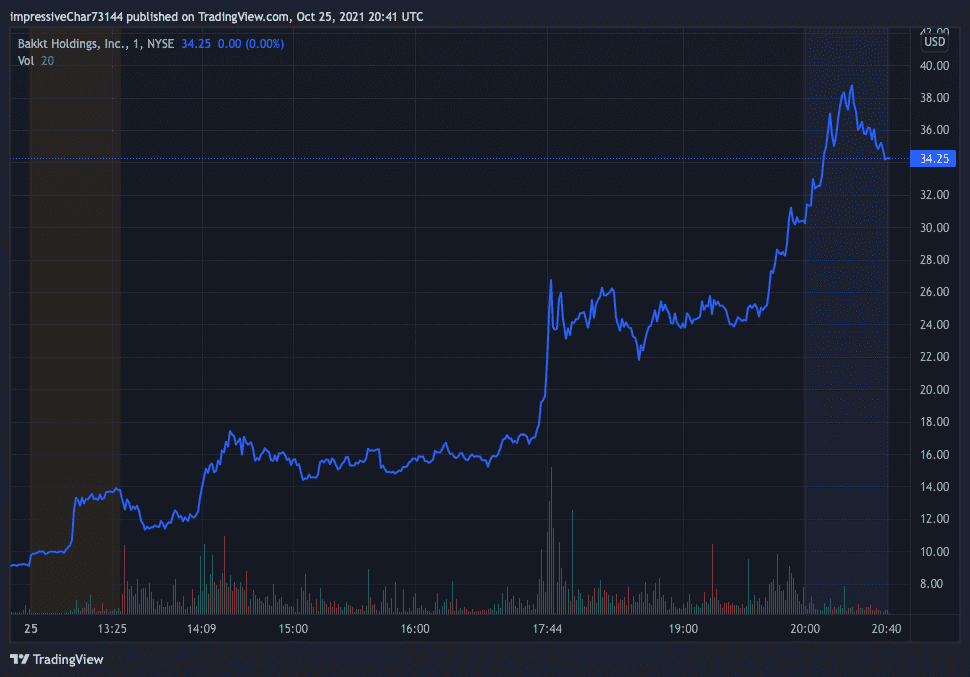

Bakkt Explodes

Shares of Bakkt, which trades on the NYSE under the ticker BKKT, surged over 230% during trading hours on the news. The yellow and blue shaded areas on the chart below represent pre-market and post-market trading activity.

Asset Flows Notch Record Inflows on ETF Approval Last Week

Digital asset investment products saw inflows of $1.47 billion last week, which represented the largest inflows on record by a long shot.

“The record inflows were a direct result of the US Securities & Exchange Commission allowing a Bitcoin ETF investing in futures and the consequent listing of two Bitcoin investment products with inflows totalling US$1.24bn.” according to a CoinShares report.

Source: CoinShares

Source: CoinSharesSolana and Chainlink Outperform the Market

Solana (SOL) and Chainlink (LINK) were the top movers among major altcoins today, last trading at $211.73 and $32.49 respectively.

- Investment products related to SOL saw $8.1 million of inflows last week, the most among altcoin products, according to a CoinShares report.

- Chainlink, a blockchain abstraction layer that enables universally connected smart contracts through its network of oracles, is now live on the Terra testnet. This could be contributing to LINK’s bullish price action.

- Solana hosted its Ignition hackathon, an event that incentivizes builders to join their ecosystem, and saw a record number of project submittals. This implies that more projects are coming to Solana and could be the catalyst behind SOL’s rally.

The top altcoin movers can be seen below:

Source: laevitas.ch

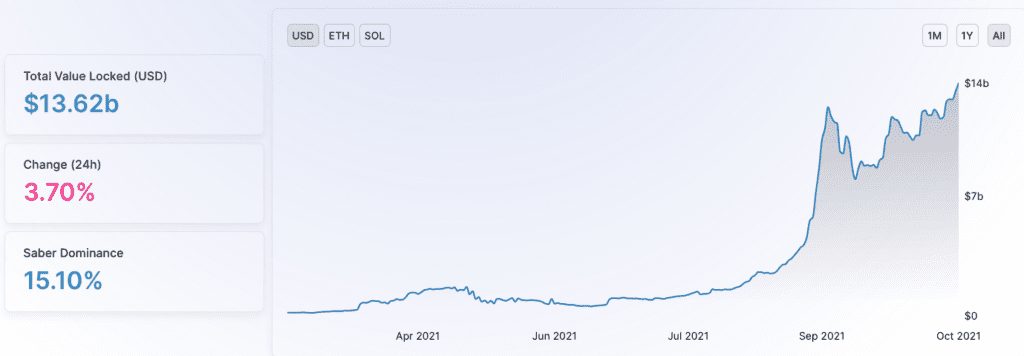

Source: laevitas.chSolana now ranks third in TVL among major chains, with over $13.6 billion locked in smart contracts.

Source: DefiLlama

Source: DefiLlama

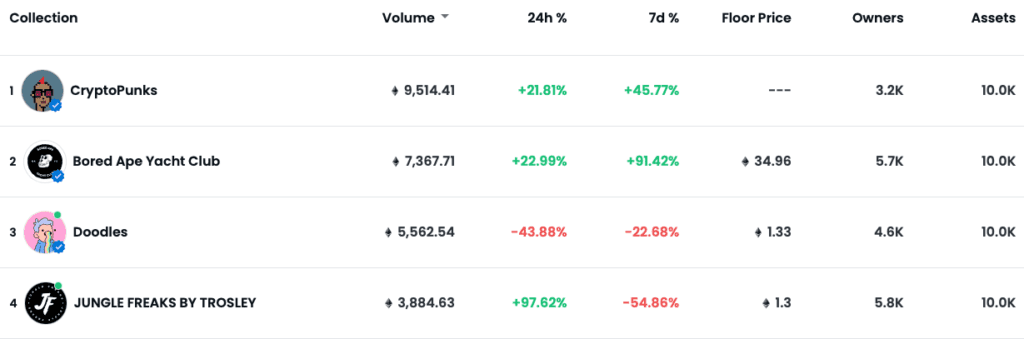

Non-Fungible Tokens (NFTs)

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects That is all for today, folks. Looking forward to catching tomorrow!

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.