Bitcoin Soars Past $62,000; Price Discovery Nears: Markets Wrap

Bitcoin nears price discovery as options open interest rises alongside perpetual funding rates, bitcoin on Ethereum represents 1.5% of supply

Blockworks exclusive art by Axel Rangel

- Valkyrie filed an 8-A with the SEC in a key step for a bitcoin futures ETF approval

- Total market capitalization of all digital assets reaches all-time high

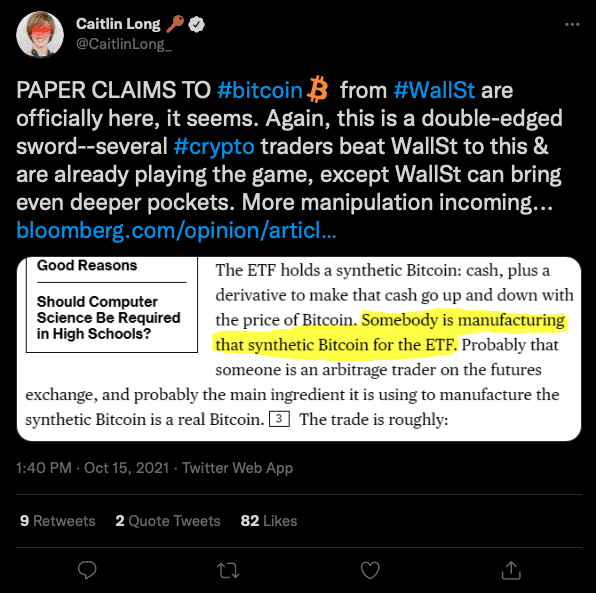

Valkyrie filed an 8-A with the US Securities and Exchange Commission in a key step for a bitcoin futures ETF approval. While an ETF is a net positive, a futures-backed ETF could invite Wall Street price manipulation games.

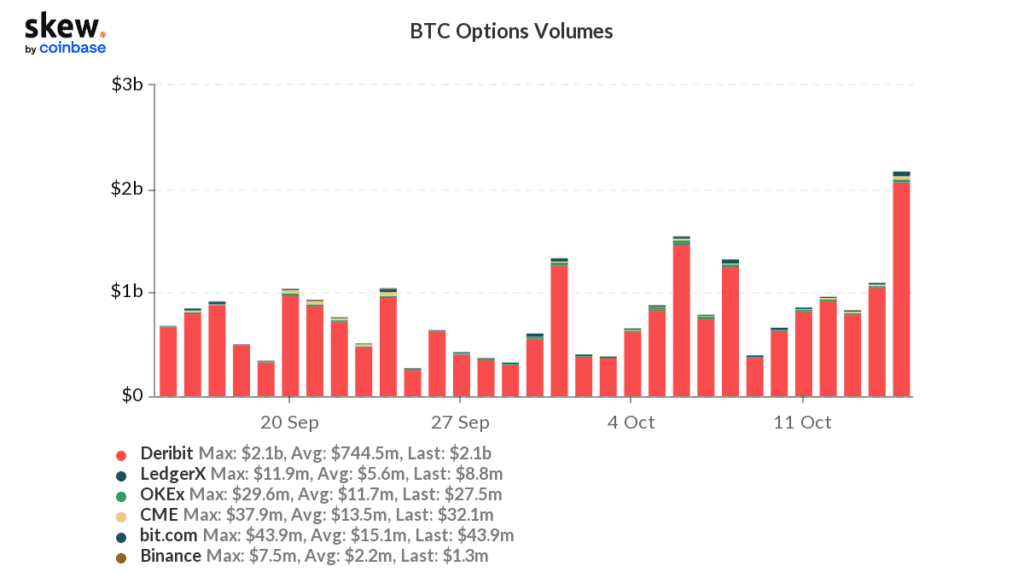

Bitcoin options volume spikes amidst bullish price action.

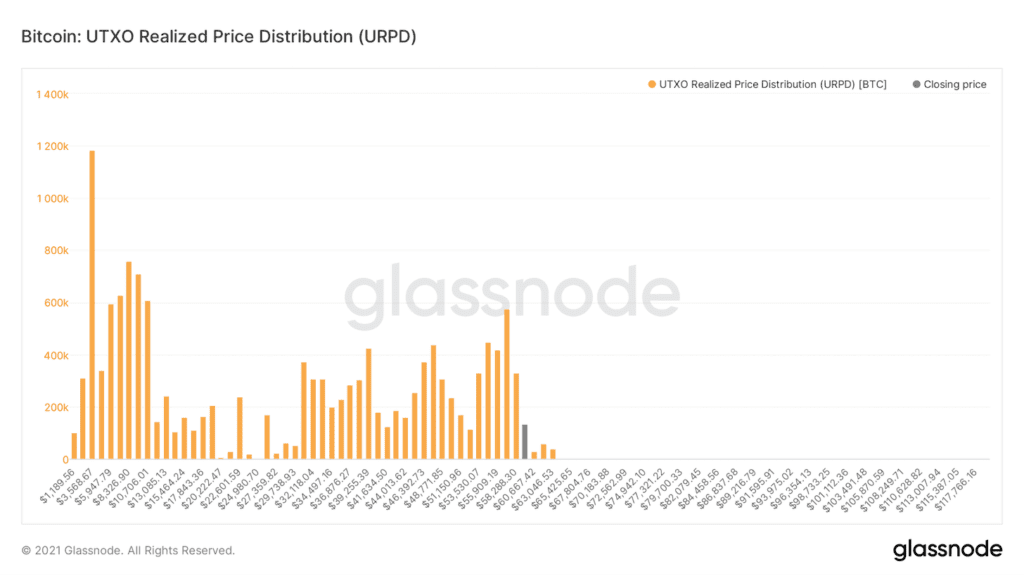

Very little of the BTC supply has traded hands above $60,000.

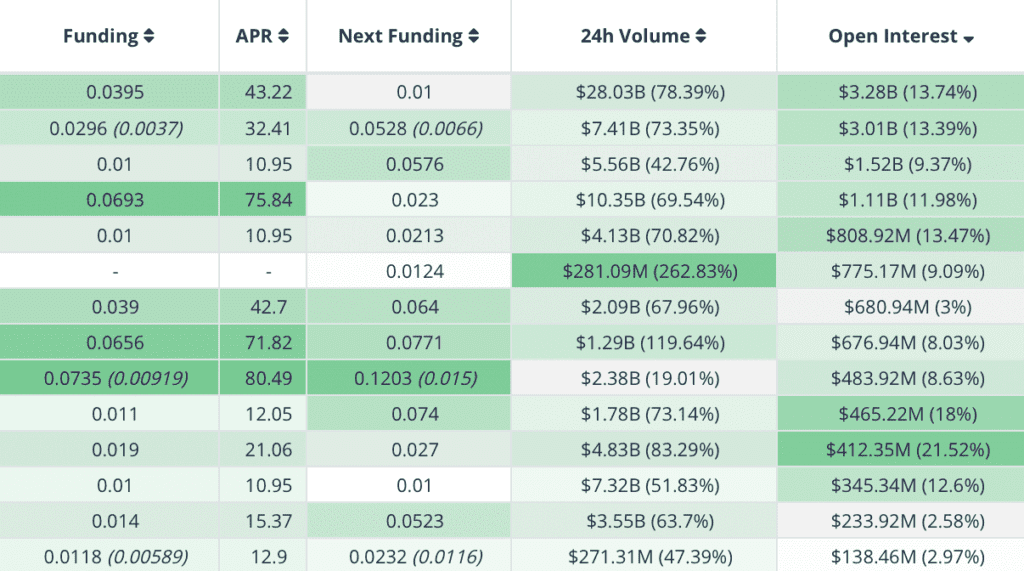

Perpetual funding rates are rising as traders enter long positions.

Approximately 1.5% of the circulating BTC supply is locked in Ethereum smart contracts.

Latest in Macro:

- S&P 500: 4,471, +.75%

- NASDAQ: 14,897, +.50%

- Gold: $1,768, -1.56%

- WTI Crude Oil: $82.24, +1.14%

- 10-Year Treasury: 1.572%, +.053%

Latest in Crypto:

- BTC: $62,150, +7.88%

- ETH: $3,856, +2.21%

- ETH/BTC: .0626, -5.45%

- BTC.D: 46.49%, +3.87%

Bitcoin ETF Update

“The U.S.’s dollar dominance, jobs, votes, plenty of revenue (tax) and, most importantly — it counters China — are top reasons we expect Uncle Sam will embrace cryptocurrencies with proper regulation and ETFs. Imagine the potential for a new digital world order if the price of Bitcoin keeps rising, and 1.4 billion citizens are banned from it by their government,” wrote Mike McGlone of Bloomberg Intelligence, in a report today.

His comments came moments before Valkyrie filed an 8-A with the SEC in a key step for a bitcoin futures-backed ETF approval, indicating support of bitcoin from regulators.

In anticipation of approval, the basis on futures contracts is widening alongside rising open interest in BTC futures. This could open the door for institutions to put on a risk-free basis trade where they sell the futures contract and buy spot BTC in order to lock in a spread.

“While over a dozen organizations have applied to launch bitcoin ETFs, the diversity of the applicants attests to a climate of intensive interest in bitcoin among retail investors,” CTO and co-founder of Lolli, Matt Senter, wrote to Blockworks. “By offering clients indirect exposure to bitcoin, ETFs will be a powerful way to dissolve barriers to entry in bitcoin, building an onramp to adoption and greater knowledge about bitcoin as a new asset class.”

While providing more investors a new vehicle to gain exposure to BTC is a net positive, it is worth noting that a futures-backed ETF could lead the way to more price manipulation tactics from Wall Street firms.

Source: @CaitlinLong_

Source: @CaitlinLong_Bitcoin Fundamentals

Despite increased options premiums, volume has spiked on the bullish BTC price action as traders prepare for price discovery:

Source: Skew

Source: SkewThere isn’t much on-chain activity at these price levels, meaning that very little supply has changed hands above $60,000. That should come as no surprise considering the brief amount of time BTC maintained its price above $60K back in April. With little support or resistance in this trading range, expect higher volatility as BTC nears price discovery.

Source: Glassnode

Source: GlassnodePerpetual funding rates are creeping higher, which means the longs are paying the shorts in order to hold their positions. Bulls are getting aggressive in a hurry. It will be something to keep an eye on to gauge the amount of greed in the market over the weekend. The chart below shows the APR longs are paying to keep positions open, sorted from the highest open interest to the lowest.

Source: https://app.laevitas.ch/dashboard/btc/derivs

Source: https://app.laevitas.ch/dashboard/btc/derivs

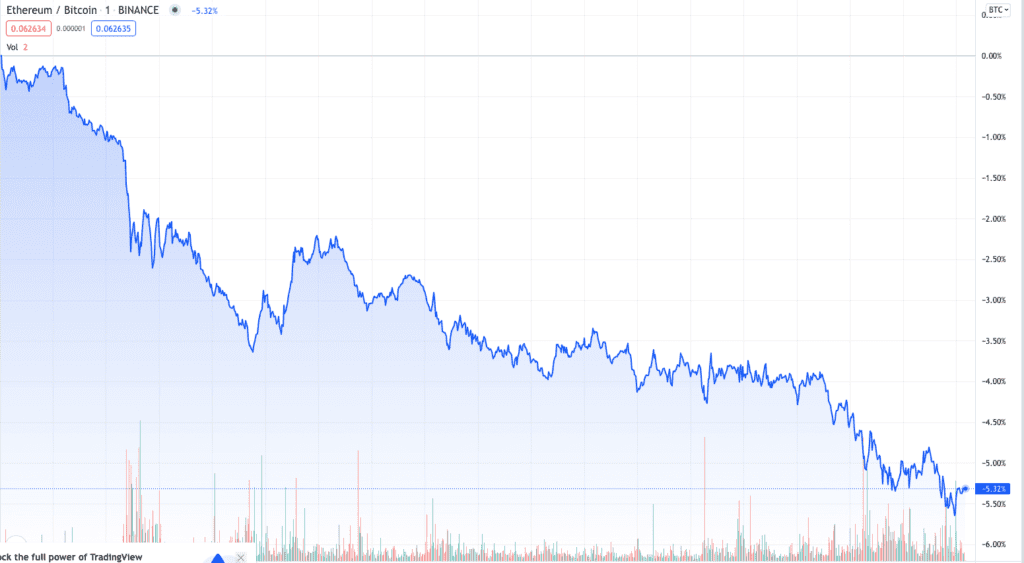

Bitcoin is outpacing all altcoins and ether, as seen in the ETH/BTC chart below. Anyone who is positioned heavily in alts is having a rough time.

Source: Trading View

Source: Trading View

Non-Fungible Tokens (NFTs)

Axie Infinity co-founder, Jeff Zirlin, took to Twitter to announce that the popular play-to-earn game has cracked the top 500 in global websites for engagement over the last 90 days.

Laguna Games raises $5 million from BitKraft Ventures and Delphi Digital to launch its blockchain-based game, Crypto Unicorns, next month.

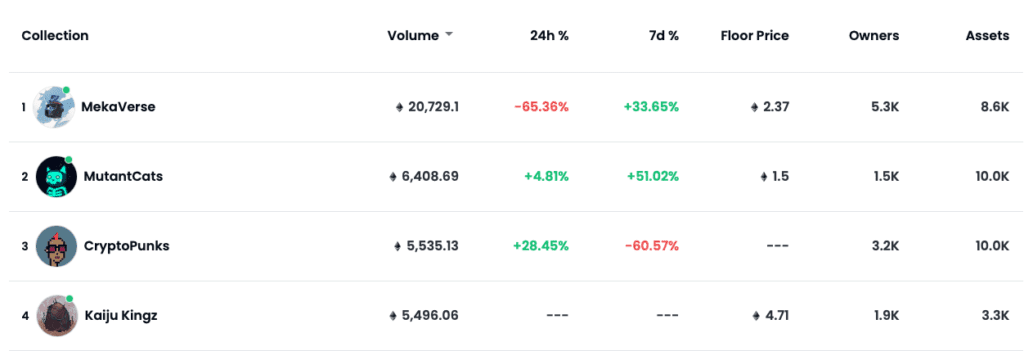

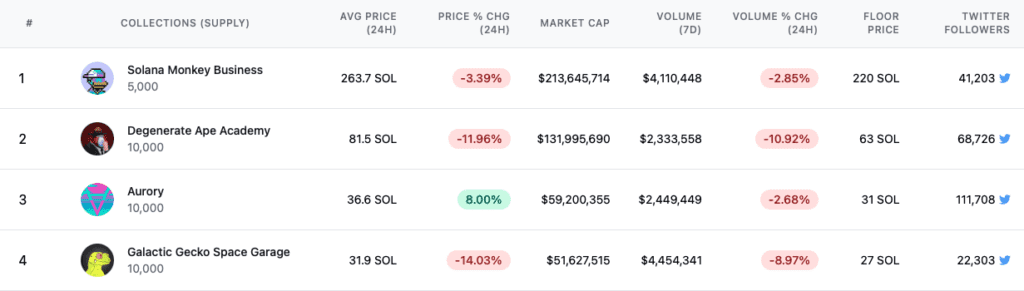

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects

Top Solana Projects

Top Solana Projects

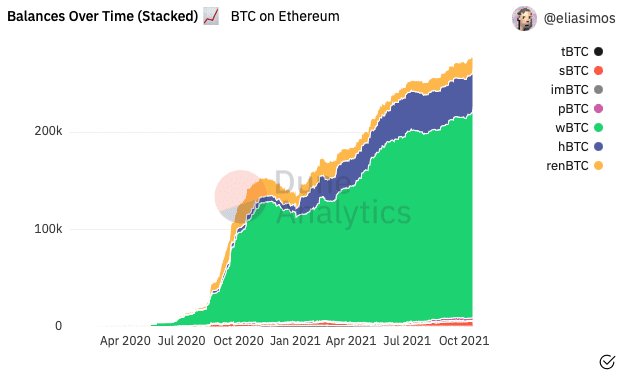

BTC on Ethereum

- There is now over 280,000 BTC locked in ethereum smart contracts. That equates to roughly 1.5% of the circulating BTC supply.

- The most popular form of BTC on Ethereum is wBTC, which holds a 76% marketshare.

Source: Dune Analytics

Source: Dune AnalyticsOther Notable News

- Tether settled with the CFTC for $42 million over false claims of being fully backed by dollars, Blockworks reported earlier.

- Nine out of 10 lightning nodes that were launched in the last year run on Umbrel, according to the company’s co-founder.

- The total crypto market capitalization has crossed $2.5 trillion for the first time today.

- US treasury five-year breakeven inflation rate hit 2.753% today for the first time since April 2005.

That is all for this week, folks. Looking forward to catching up on Monday!

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.