Yearn Finance Launches YFI Buyback Program: Markets Wrap

Yearn Finance launches YFI buyback program to distribute earnings to token holders

- Yearn Finance initiates YFI buyback program to distribute earnings to token holders

- Bitwise launches the world’s first NFT Index

Yearn Finance is one of the leading yield aggregators in DeFi.

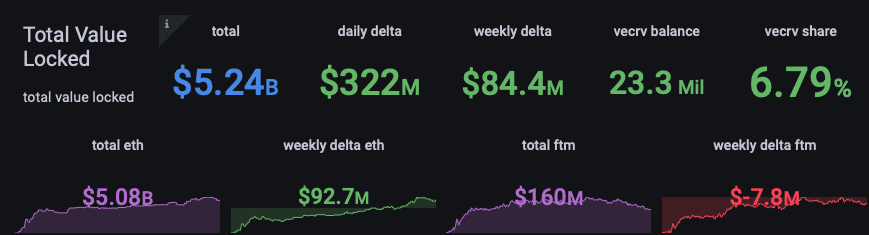

Yearn Finance boasts $5.24 billion in total value locked (TVL) and holds 6.79% of the Curve Finance governance token, veCRV.

0.77% of the YFI token supply has been repurchased by the DAO since the approval of the proposal on Nov. 12.

Shopify is launching its beta version of an NFT marketplace.

Bitwise launches the world’s first NFT Index.

Latest in Macro:

- S&P 500: 4,668, -0.87%

- NASDAQ: 15,180, -2.47%

- Gold: $1,799, +1.12%

- WTI Crude Oil: $71.98, +1.57%

- 10-Year Treasury: 1.424%, -0.038%

Latest in Crypto:

- BTC: $47,774, -1.76%

- ETH: $3,996, -0.39%

- ETH/BTC: 0.0837, +1.62%

- BTC.D: 40.83%, -0.89%

Yearn Finance overview

Yearn Finance (YFI) is a suite of products in Decentralized Finance (DeFi) that provides lending aggregation, yield generation and insurance on the Ethereum blockchain. The protocol is maintained by various independent developers and is governed by YFI holders, according to documents on the project’s website.

The protocol has three core product offerings as it stands today: Vaults, Labs and Iron Bank.

Yearn Finance is a decentralized application and is governed in a decentralized manner. “The Yearn ecosystem is controlled by YFI token holders who submit and vote on off-chain proposals that govern the ecosystem. Proposals that generate majority support (>50% of the vote) are implemented by a nine-member multi-signature wallet. Changes must be signed by six out of the nine wallet signers in order to be implemented,” noted the protocol’s documentation.

The project initiated one of the first community-fair-launched token distributions, giving out 30,000 YFI tokens to early protocol users by a surprise yield farming announcement on July 17, 2020, according to Coingecko. The total maximum supply of 36,666 YFI tokens are all in circulation. Coingecko also notes that there was no pre-mine involved.

Yearn statistics

Source: https://yearn.vision/?orgId=1&refresh=1m&kiosk

Source: https://yearn.vision/?orgId=1&refresh=1m&kioskAs seen in the photo above, Yearn Finance boasts $5.24 billion in total value locked (TVL) and holds 6.79% of the Curve Finance governance token, veCRV, according to data from yearn.vision.

Curve Finance (CRV) is a decentralized liquidity pool built on top of Ethereum, similar to Uniswap (UNI), but with a focus on the exchange of stablecoins.

The main goals of Curve Finance are to facilitate extremely efficient trading, with low slippage and to provide a relatively low-risk and supplemental fee income for liquidity providers (LPs) without the risk of so-called impermanent loss — the opportunity cost of being an LP in volatile digital assets, as I had reported at the end of October.

Curve is one of the largest decentralized apps (dApps) in the digital asset space when measured by TVL, with $13.91 billion of liquidity according to Defi Pulse. Due to the systemic importance of stablecoins in DeFi, Yearn Finance’s voting power in Curve governance is significant.

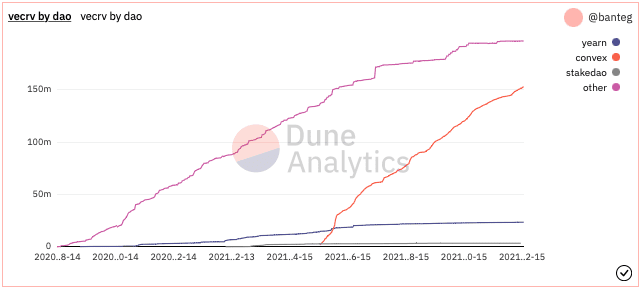

Yearn is currently the second-largest veCRV holder, according to data from Dune Analytics, amongst decentralized autonomous organizations (DAOs). This means they have a lot of pull in governance decisions when it comes to one of the largest automated market makers (AMMs) in Web3: Curve Finance.

Source: Dune Analytics

Source: Dune AnalyticsYFI Buyback program

Yearn Finance announced on Twitter that it launched an updated user interface and is continually working on the V3 product in its beta testing period. More details can be found in this Medium post written by DAO contributor @dudesahn.

On Oct. 6, @banteg, a community member of Yearn Finance, posted on the projects governance portal a call to action from the community asking for inputs on how the YFI tokenomics could be improved to help more value accrue to token holders.

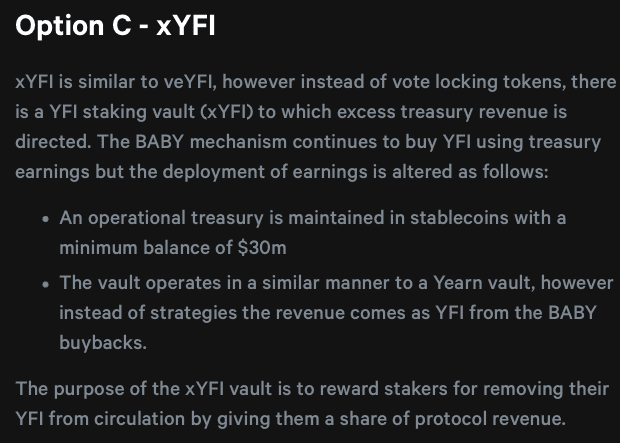

Many proposals were submitted from community members and a vote took place on which version to implement from Dec. 7 to Dec. 12, according to snapshot.org. An overview of the winning poll, xYFI, can be seen in the following photo:

Source: snapshot.org

Source: snapshot.orgAs a result of the communities approval, the project’s official Twitter account announced earlier today: “Yearn has purchased $7,526,343 worth of YFI from the open market. We got 282.4 YFI (0.77% of total supply) at an average price of $26,651. More YFI has been bought back in the past month than in the prior year. Now that the Treasury has more than $45 million saved up and with earnings stronger than ever, expect much more aggressive buybacks.”

Adam Cochran, partner at Cinneamhain Ventures, noted that Yearn is looking to do a fee distribution to holders, similar to the veCRV model and xSushi model. Cochran added, “I also think its 100% likely that when Yearn shifts to a veYearn model, DAO treasuries will start to accumulate YFI the same way they do CVX and CRV.”

What is the significance?

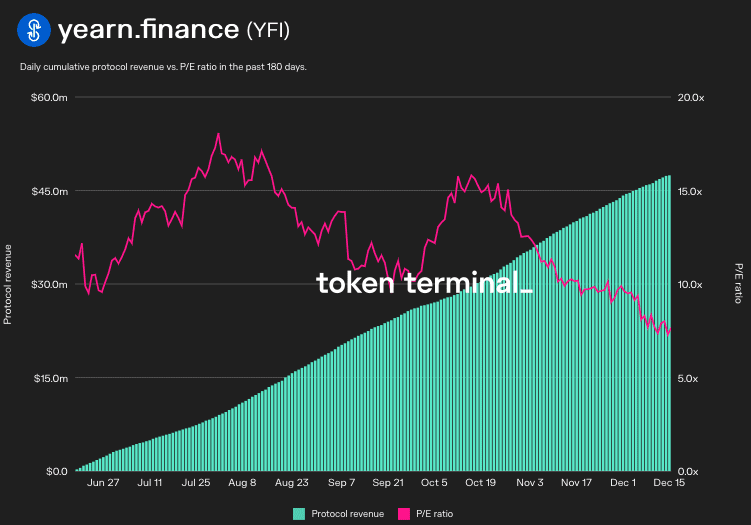

Now that Yearn has implemented a buyback program to distribute the protocol’s earnings to stakers, some traditional financial metrics can be applied, albeit not perfect, to assist investors in valuing the protocol.

As of Dec.15, Yearn has generated $47.4 million in revenue over the past 180 days and trades at a price-to-earnings ratio of 7.65x, according to data from Token Terminal.

Source: Token Terminal

Source: Token TerminalWith 0.77% of the YFI supply being bought back just a few days after the xYFI implementation, potential adoption of the veYearn model incentivizing DAOs to accumulate YFI, a maximum supply of 36,666 YFI, and a fully diluted value of $883 million according to CoinMarketCap, there are a lot of bullish tailwinds for YFI investors.

For comparison on the significance of the first YFI buyback, Ethereum has burned ~1.2 million ETH, representing 1.01% of its current supply, since the implementation of EIP-1559 in early August. It is worth noting that ETH does not have a supply cap like YFI, although it could be inflationary or deflationary depending upon market dynamics at any given time.

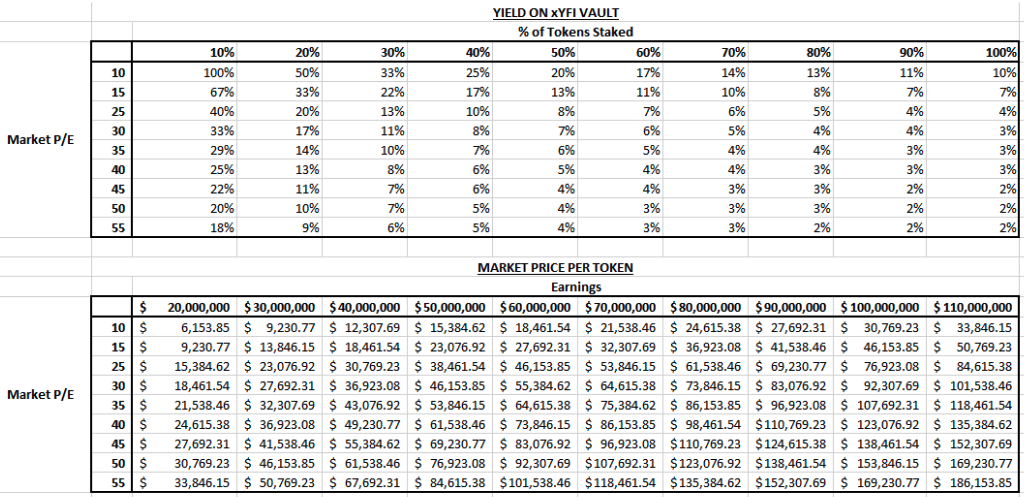

For investors wondering what xYFI staking yields or YFI token price could be in the future, the chart below from the xYFI proposal draft provides a rough framework for potential yields and valuations:

Source: xYFI proposal draft

Source: xYFI proposal draftThe draft states, “Above are two charts. The first shows the estimated yield of the xYFI vault based on market P/E and the percentage of total tokens staked. For example, if only 50% of all YFI was staked and the market was pricing YFI at a P/E of 35 then the xYFI vault would have a 6% yield. The second chart shows price per token based on market P/E and actual earnings.”

YFI was last trading near $24,750, up ~19% on the day according to CoinGecko. It is the 126th largest digital asset by market capitalization.

Non-Fungible Tokens (NFTs)

Tobias Lutke, the founder and CEO of Shopify, took to Twitter to announce that Shopify is launching its beta version of an NFT marketplace.

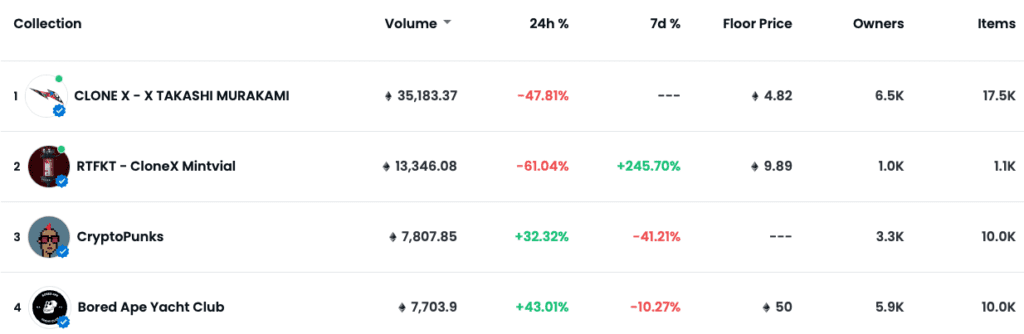

Matt Hougan, CIO of Bitwise, announced today the launch of the world’s first NFT Index. The heaviest weight projects are CryptoPunks and Bored Ape Yacht Club.

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.