FTX Token Posts Gains, Terra Enables IBC: Markets Wrap

Bitcoin faces minor correction on the backs of greedy traders, FTT outpaces other exchange tokens, Terra enables IBC.

Source: Shutterstock

key takeaways

- Bitcoin retreats after surpassing all-time highs

- Terra enables inter-blockchain communication

Bitcoin retreated as traders levered up in an effort to capture further upside.

Interesting activity is occurring in the BTC options market as open interest notches fresh all-time highs.

The FTX token, FTT, is outperforming other exchange tokens on news of the company raising $420.69 million.

Terra integrates Inter-Blockchain Communication (IBC) to make its assets more composable with other Cosmos IBC-enabled chains.

The NFT fundraises remain abundant despite market turbulence.

Latest in Macro:

- S&P 500: 4,549, +.30%

- NASDAQ: 15,215, +.62%

- Gold: $1,783, +.05%

- WTI Crude Oil: $82.61, -.97%

- 10-Year Treasury: 1.705%, +.07%

Latest in Crypto:

- BTC: $62,700, -4.95%

- ETH: $4,091, -.06%

- ETH/BTC: .0652, +3.54%

- BTC.D: 46.09%, -1.64%

Bitcoin Retreats

After exploding through all-time highs yesterday, BTC has since retracted to under $63,000.

“While there is no cause for concern for long-term bitcoin HODLers, there are many signs of exuberance in the market among short-term speculators,” Blockworks reported in yesterday’s markets wrap. “Open interest weighted funding rates have shot up to levels not seen since the market top in April of 2021, hovering at .06%. The bybt crypto fear and greed index has climbed to 82 in a hurry after marking a reading of 20 just three weeks ago. The higher the number, the more greed that is seen in the market.”

As seen in the chart below, funding rates have begun to ease but still remain elevated around .05%.

Source: laevitas.ch

Source: laevitas.ch

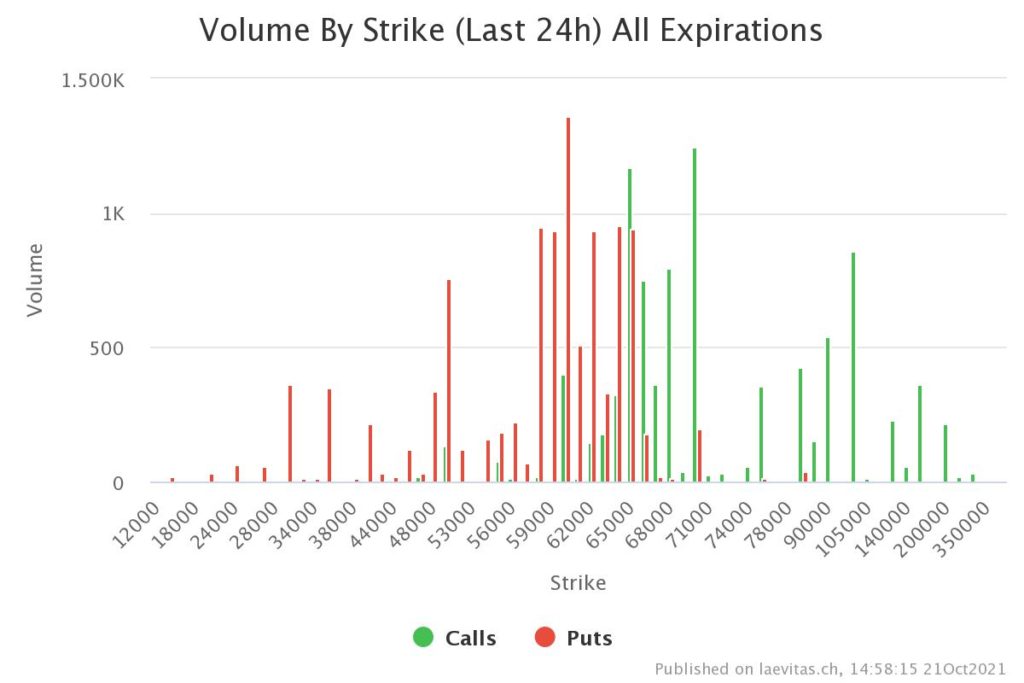

Interesting action has been taking place in the BTC options market. There has been $1.26 billion of volume traded over the last 24 hours and the put:call ratio is at 1.162, indicating that speculators are leaning toward further downside. The amount of open options interest hit all-time highs with over $15.5 billion, according to data from skew. A break down of volume by strike price over the last 24 hours can be seen below:

Source: laevitas.ch

Source: laevitas.chFTX Token Outperforms

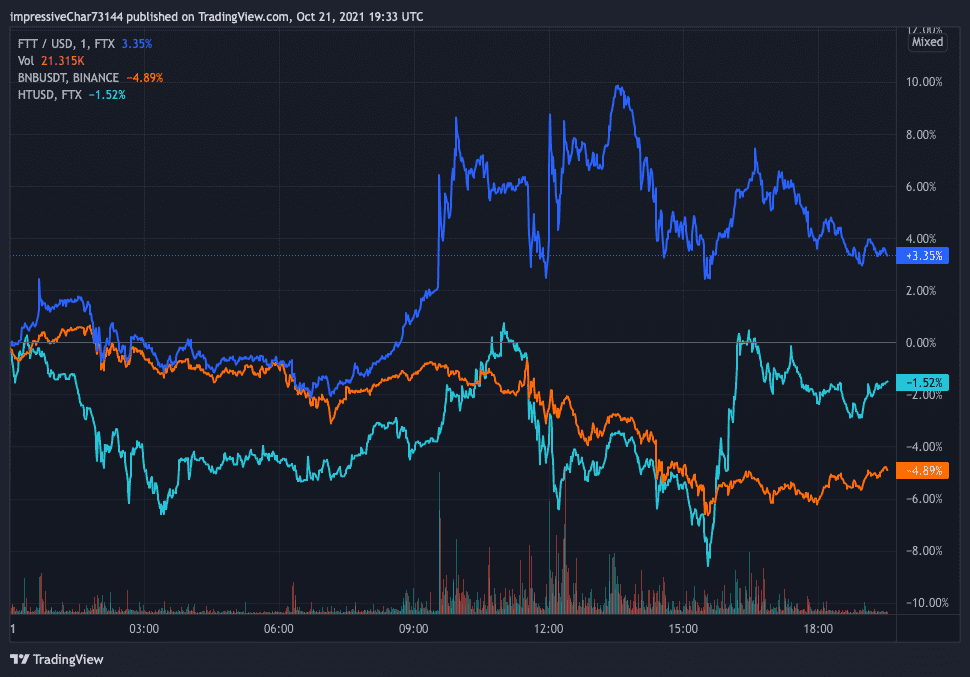

The native token to Sam Bankman-Fried’s exchange FTX, FTT (dark blue), has out performed other exchange tokens over the last 24 hours on news that the company raised $420.69 million.

Exchange tokens such as HT (light blue), BNB (orange), and FTT incorporate equity-like characteristics by linking the respective companies’ cash flows to their tokens via burning mechanisms. While token holders don’t actually have any legal rights to the companies underlying cashflows or equity in these firms, many investors use them as proxies to ‘bet’ on the success of certain exchanges. The tokens often times incentivize users to use the token via trading discounts and other perks.

Solana (SOL) has also performed well over the last 24 hours, trading up 7.65% at $186.23 as of reporting. FTX and Sam Bankman-Fried are notorious for their funding and public support of the Solana ecosystem.

Source: Trading View

Source: Trading View

Terra Enables Inter-Blockchain Communication (IBC)

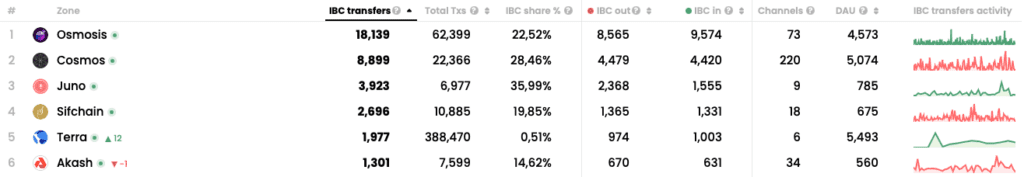

Terra (LUNA) has enabled IBC, making its ecosystem of assets more composable with other Cosmos IBC enabled chains. The largest stablecoin native to the terra ecosystem, TerraUSD (UST), will now be able to move seamlessly throughout numerous decentralized applications in the Cosmos ecosystem.

This is relevant for LUNA holders due to the rebalancing mechanism to maintain the UST peg — as demand for UST goes up, so does the amount of LUNA that is burned, thus increasing its price. Many bulls are hoping this will increase UST adoption around the world.

“UST is likely to be the reference price for all of Cosmos in the next month,” Zaki Manian, co-founder of Iqlusion told The Defiant. “Until now all the farming opportunities in Cosmos required holding volatile assets. The entire situation for bootstrapping DeFi in Cosmos changes today.”

Within the first 12 hours of launch, Terra is already one of the most active zones in the Cosmos ecosystem over the last 24 hour period.

Source: mapofzones.com

Source: mapofzones.com

Non-Fungible Tokens (NFTs)

- Hong Kong based blockchain game-maker Animoca hit $2.2 billion valuation, according to Forbes.

- Thailand’s regulators softened restrictions on NFTs as local banks invest in the ecosystem, Blockworks previously reported.

- Fanatics’ Candy Digital is valued at $1.5 billion as Manning and SoftBank Invest, according to a Sportico article.

- Sotheby’s takes part in a $20 million round backing NFT studio; Mojito, according to Forbes.

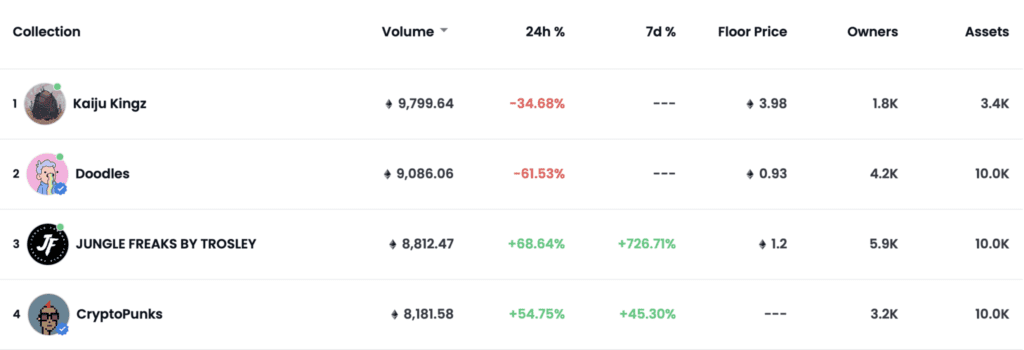

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects That is all for today, folks. Looking forward to catching tomorrow!

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.