Bitcoin Investment Products Endured $453M of Outflows Last Week

CoinShares reports record outflows, driven by redemptions from Purpose Investments offerings

Source: Shutterstock

- Assets in bitcoin-related offerings stand at $24.5 billion, the lowest since the beginning of 2021

- Purpose Investments accounted for $490 million of the bitcoin outflows last week

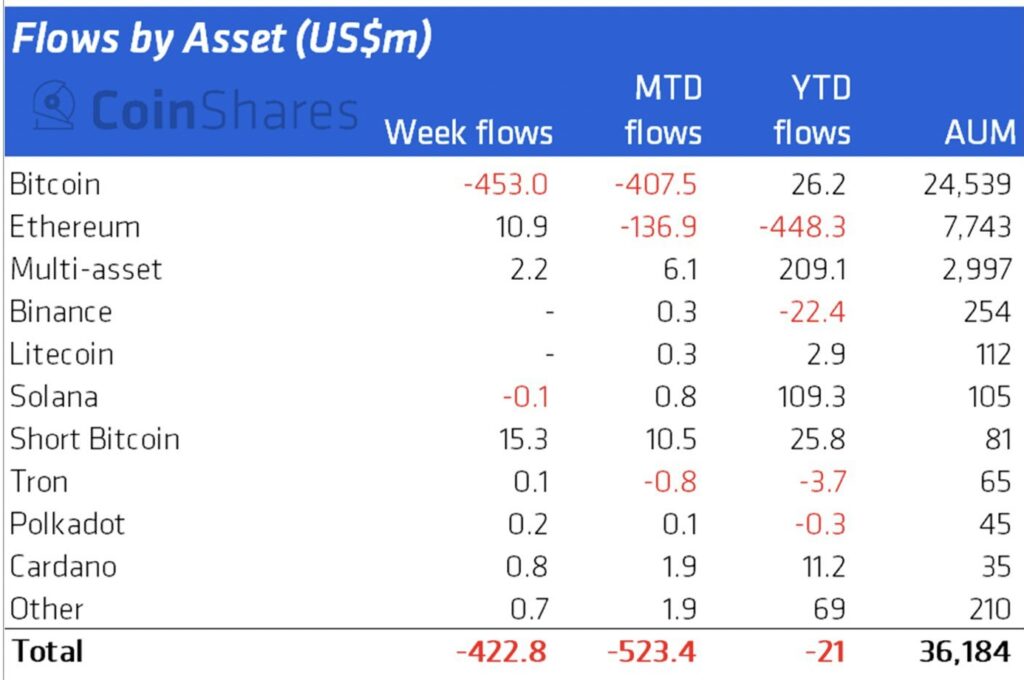

Net outflows from bitcoin investment products totaled $453 million amid the ongoing crypto market sell-off, CoinShares revealed in the firm’s weekly report, erasing almost all year-to-date inflows in the category.

Assets under management in these bitcoin-related offerings stand at $24.5 billion, the lowest point since the beginning of 2021.

Net flows by asset | Source: Bloomberg, CoinShares

Net flows by asset | Source: Bloomberg, CoinShares

The outflows come as the price of bitcoin was $20,800 on Monday at noon ET — down about 27% from a month ago and down 70% from bitcoin’s all-time high last November.

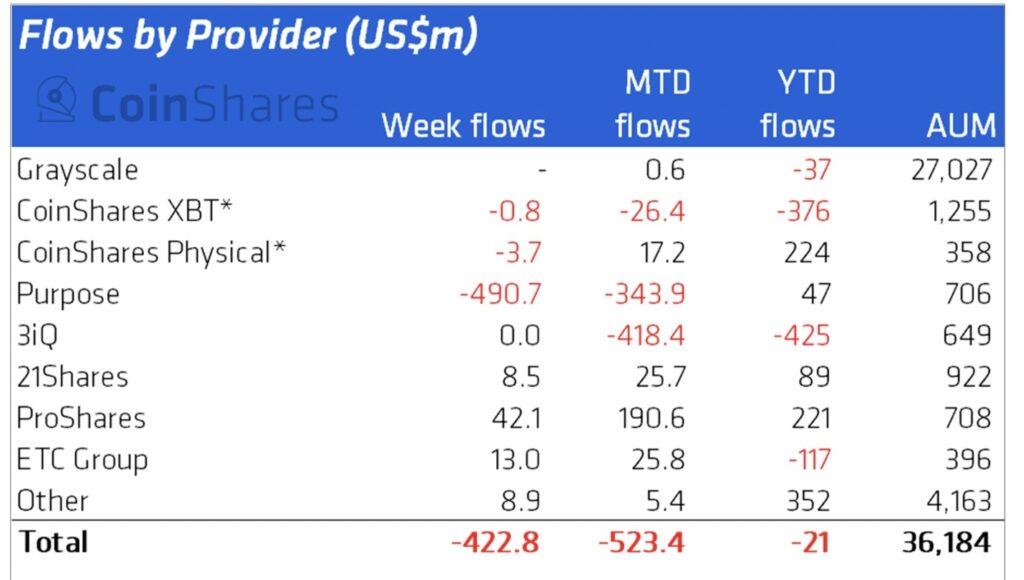

Canadian fund provider Purpose Investments accounted for $490 million of bleeding, CoinShares data shows.

Net flows by provider | Source: Bloomberg, CoinShares

Net flows by provider | Source: Bloomberg, CoinShares

Purpose Investments launched the world’s first ETF backed by physically settled bitcoin in February 2021 on the Toronto Stock Exchange. The fund, which gathered $1 billion in assets during its first month, now has roughly $640 million in assets.

“The outflows from last week were larger than previous weeks, however it’s normal course of operations,” Vlad Tasevski, Purpose Investments’ chief operating officer and head of product, told Blockworks in an email. “In fact, the key highlight is that the ETF was able to process that large size of outflows without any issue and without impacting the market.”

Other investors seek returns by betting against crypto: Products that short bitcoin notched net inflows of $15 million due to the launch of the first such product launching in the US last week. The ProShares Bitcoin Short Strategy ETF (BITI) — designed to deliver the inverse performance of the S&P CME Bitcoin Futures Index — traded more than 870,000 shares, or $35 million of value, on its second day of trading.

The bitcoin-related outflows drove the $423 million in net outflows across the broader crypto market, which was the largest figure on record by a wide margin, CoinShares Head of Research James Butterfill wrote in a blog post. The previous record had been $198 million of outflows, set in January.

The total outflows from crypto-related products last week was the third largest in terms of its total relative to assets under management — representing 1.2% of assets. The crypto bear market of February 2018 resulted in a week in which outflows accounted for 1.6% of assets.

“Historically, massive outflows such as this have marked turning points in sentiment, although as in 2018’s case, the inflows were slow to recover,” Butterfill told Blockworks. “Interestingly, we have recently begun to see outflows in short-bitcoin investment products, suggesting investors are becoming less bearish.”

Outside of bitcoin-related investment vehicles, ether products had $11 million of inflows last week, breaking a streak of 11 straight weeks of outflows.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.