Ethereum and Bitcoin Price Action, Fundamentals Diverge: Markets Wrap

Ethereum and bitcoin fundamentals paint a different picture than volatile price action, while NFTs continue to tread water

Source: Shutterstock

- Volatile price action in BTC and ETH do not align with fundamental market structures

- NFT projects continue to tread water as investors seek liquidity

Ethereum (ETH) addresses holding a non-zero balance hit an all-time high.

ETH issuance has been relatively flat since the London Hard Fork, while other metrics indicate that Ethereum adoption is growing organically.

The bitcoin network has mostly recovered from the hashrate migration out of China and remains as secure as ever before. Long-term BTC holders began to take profits, but other metrics indicate further upside.

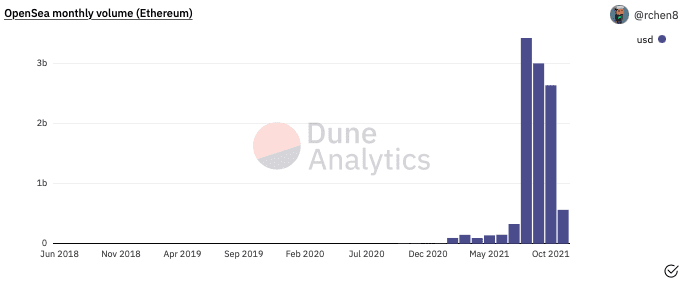

NFTs are experiencing large drawdowns as investors seek liquidity, and OpenSea volumes are lagging prior months.

Latest in Macro:

- S&P 500: 4,682, +.72%

- NASDAQ: 15,860, +1.00%

- Gold: $1,867, +.22%

- WTI Crude Oil: $80.79, -.98%

- 10-Year Treasury: 1.575%, +.017%

Latest in Crypto:

- BTC: $64,100, -1.09%

- ETH: $4,664, -1.44%

- ETH/BTC: .0727, -.09%

- BTC.D: 43.24%, -.11%

Ethereum Addresses

While the price action of ETH and BTC has been volatile over the past week, the data underneath the hood shows a strong market structure.

The number of wallet addresses holding non-zero balances of ETH continues to reach all-time highs, according to Glassnode, signaling increased adoption of the network.

When the ETH price hit its 2018 peak at $1,382, there were about 8.8 million wallet addresses with a non-zero balance, Glassnode data shows. Today there are 67.2 million addresses with a non-zero balance, and the ETH price is trading near $4,660. Despite the price being 3.3x higher, there are 7.6x more addresses that hold ETH.

ETH issuance

The emissions rate of ETH has also dropped drastically when compared to 2017. The London Hard Fork, which was implemented in August of this year, introduces a mechanism where a portion of transaction fees are removed from the circulating supply, commonly referred to as being “burned.”

“The ETH supply doesn’t increase anymore,” wrote Ki Young Ju, CEO of Crypto Quant. “Its rate of change became almost zero after the London Hard Fork. Just like Bitcoin, ETH is now a scarce asset with a limited supply.”

Source: Crypto Quant

Source: Crypto Quant

Organic growth on Ethereum

While alternative layer-1 chains have been a big narrative over the past few quarters, Ethereum still accounts for 66.9% of total value locked (TVL) across all chains, according to data from Defi Llama.

There is about $22 billion worth of assets locked in various Ethereum bridges, indicating a high demand to port assets to and from the world’s most dominant smart contract-enabled platform.

Trading of NFTs has been another factor driving further usage of Ethereum. It appears NFT volume is starting to taper off, as volumes for November are lagging the prior three months. It will be important to track what effects the launch of various NFT marketplaces on centralized exchanges such as FTX, Binance, and soon Coinbase will have on Ethereum usage metrics.

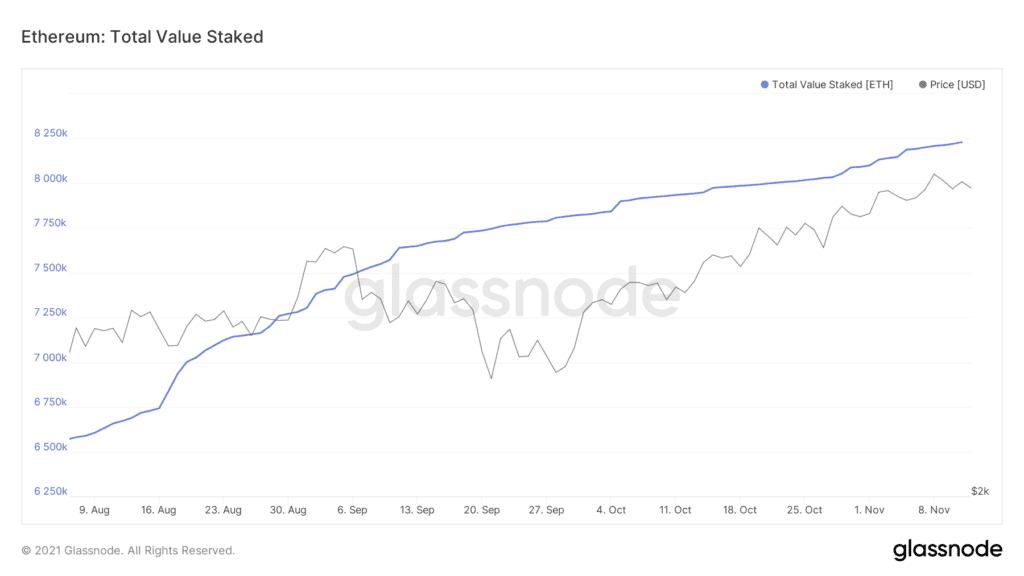

ETH staked

Token holders can delegate their holdings to different validators to help secure the network in exchange for a yield, which locks up supply and puts upward pressure on price. The number of ETH staked recently reached 8.2 million, or roughly 7% of the total supply, Glassnode data shows.

Bitcoin security

Similar to ETH, the BTC price action has not been indicative of the underlying fundamentals. Because bitcoin is more of a reserve asset and does not have much innovation occurring on top of its layer-1 chain, the metrics to keep an eye on for the health of the market structure differ.

Since the Chinese bitcoin mining ban took place and the market experienced a drastic reduction in hashrate, the amount of computing power dedicated to securing the bitcoin network has recovered. The current hashrate is 164 EH/s versus the peak of 176 EH/s prior to the ban.

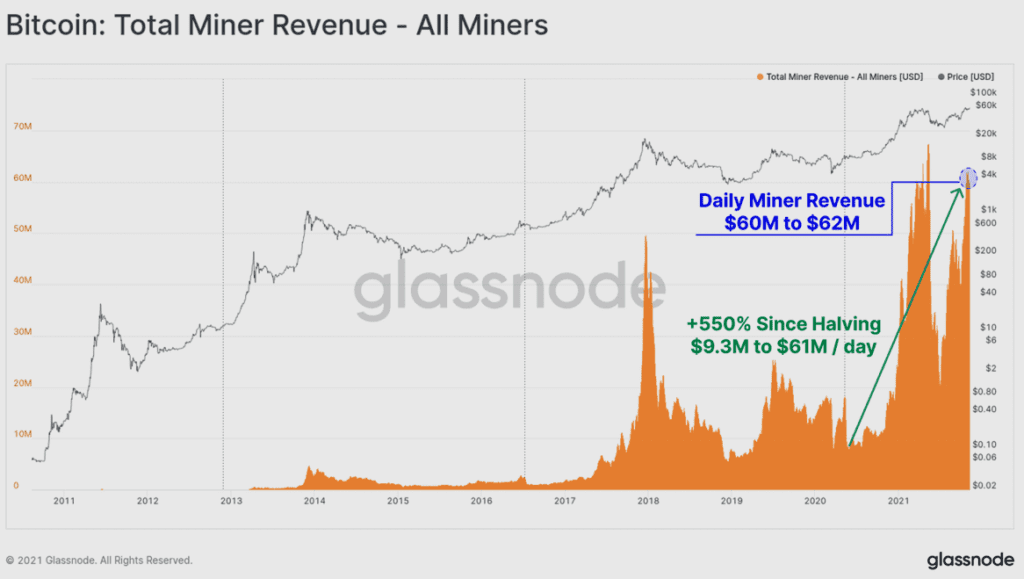

In May 2020, the bitcoin network underwent a halving — when the block subsidy paid out to miners gets slash by 50%. Despite the reduction in BTC denominated revenue for miners, daily revenue in terms of dollars is as robust as ever. There is roughly $60 million being earned by miners every day, which results in a $22 billion pie when revenues are annualized.

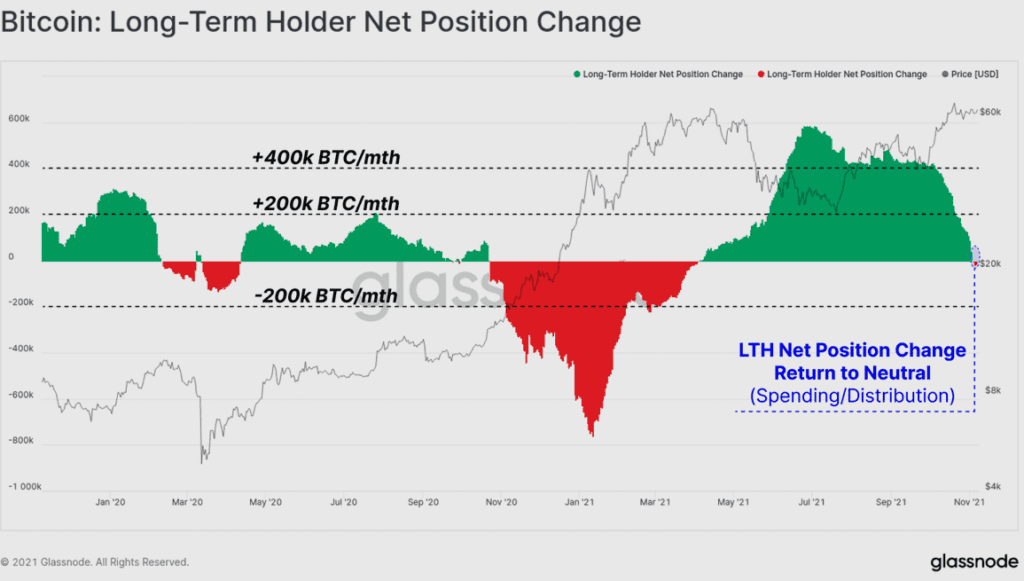

Long-term holders start cashing in

At the beginning of uptrends, it is normal for long-term BTC holders to begin taking some profits. Historically, the market has been able to absorb drastic sell pressure from long-term holders as momentum traders and retail investors get caught up in the hype.

The average cost basis of all BTC in circulation then rises, which theoretically raises the floor price of BTC. The realized price recently crossed $24,000 for the first time, according to on-chain analyst Dylan LeClair.

Glassnode pointed out earlier this week that long-term holders have indeed begun taking some profits. This trend is expected to continue as the price of BTC rises. Other notable Glassnode Insights include accelerated outflows from centralized exchanges, large increases in on-chain activity, and supply last moved less than three months ago is at all-time lows implying that long-term investors will set the price.

“There is a culmination of months of net outflows from exchanges and coming off the market, coupled with increasing demand,” Martha Reyes, head of research at BEQUANT, told Blockworks in an email. “This creates a supply shock, and we are far from levels where long-term holders, who make up a greater number of investors, start taking significant profits. $100k is likely on the horizon. Persistent negative yields due to central bank intervention and trillions of dollars of pandemic savings should assure that digital assets remain well supported.”

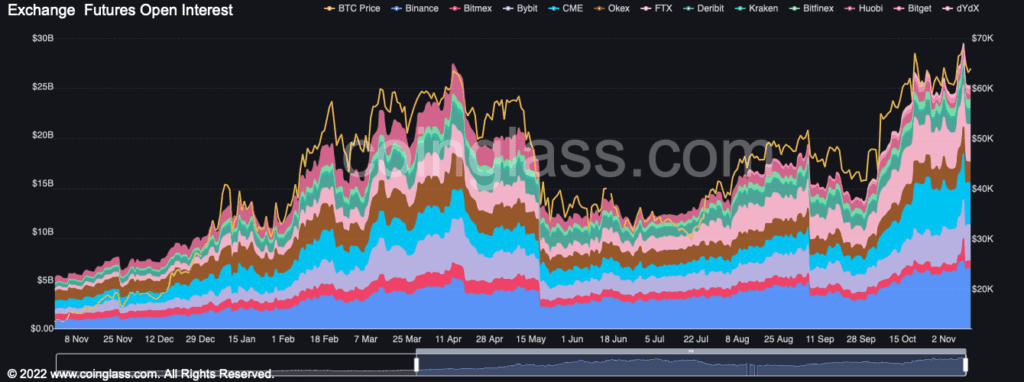

BTC Futures

The Chicago Mercentile Exchange (CME) has become the largest futures exchange by open interest. This indicates two things:

- Increased institutional activity in the US, as this is a way to gain BTC exposure.

- Less leverage. The CME offers the lowest amount of leverage out of all other exchanges, so growing CME market share will hopefully lead to reduced volatility in the future.

The amount of futures open interest across all exchanges is hovering near $25 billion, according to Coinglass.

Source: coinglass.com

Source: coinglass.com

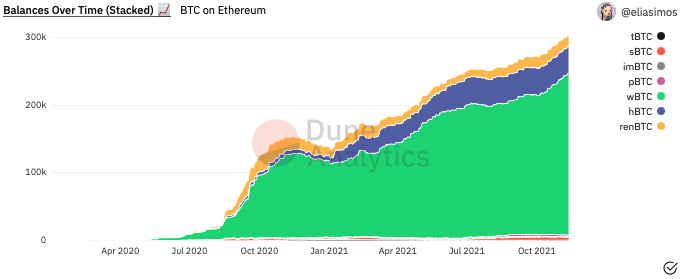

WBTC continues to grow

BTC holders are able to “wrap” their bitcoin to make it usable on the Ethereum network and utilize it as collateral in DeFi markets. Wrapped bitcoin (WBTC) is not actual BTC, but is easily redeemable on centralized exchanges.

There are currently 302,871 BTC wrapped on Ethereum, representing 1.6% of the total circulating bitcoin supply, Dune Analytics data shows.

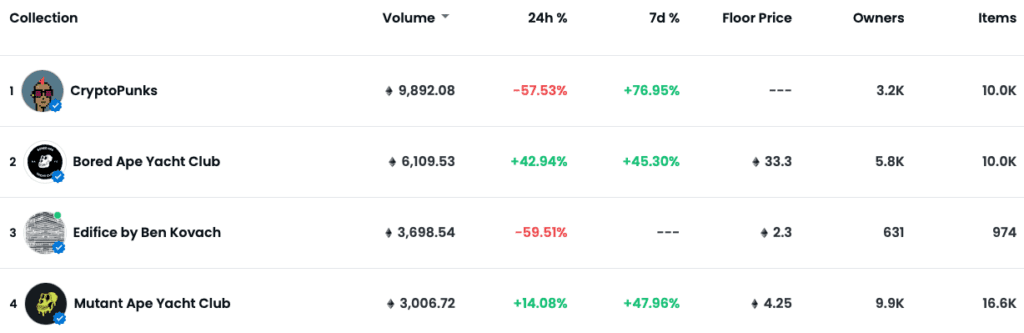

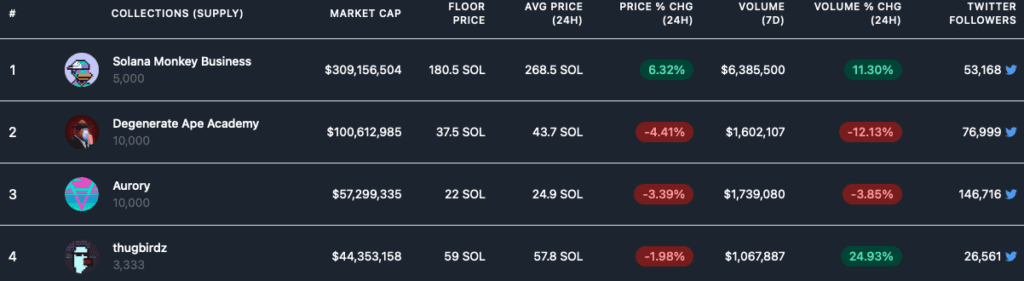

Non-Fungible Tokens (NFTs)

NFTs continue to tread water as investors seek liquidity in exchange for their art. Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up on Monday.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.