Fed Speeds Tapering, Borrowing Activity on Aave, Compound, Maker, Anchor Slides: Markets Wrap

Stablecoin activity picks up in the midst of market volatility

Source: Blockworks

key takeaways

- Borrowing activity in DeFi can provide valuable insights

- Stablecoin activity has picked up as investors de-risk their portfolios

Total borrows on Aave, Compound and Anchor decreased.

Outstanding loans for MakerDAO are holding strong through market volatility.

Loan-to-value ratios continue to rise despite an uptick in users depositing.

Investors are fleeing to stablecoins as they ‘de-risk’ their portfolios.

A brief look at today’s action in NFTs.

Markets bounced after FOMC meeting minutes reveal accelerated taper of asset purchases.

Latest in Macro:

- S&P 500: 4,709, +1.63%

- NASDAQ: 15,565, +2.15%

- Gold: $1,779, +0.41%

- WTI Crude Oil: $71.60, +1.23%

- 10-Year Treasury: 1.463%, +0.024%

Latest in Crypto:

- BTC: $49,107, +4.49%

- ETH: $4,053, +7.21%

- ETH/BTC: 0.0825, +3.32%

- BTC.D: 41.23%, -1.61%

Hawkish Fed accelerates tapering

In one of the most hawkish moves in recent history, the US Federal Reserve announced Wednesday that it will double its current asset purchase tapering speed. Stocks and crypto turned positive on the news. Analysts say markets were concerned that the Fed was not adequately addressing rising inflation, but today’s decision was widely supported.

“Bitcoin and Ethereum rallied after the Fed showed they are turning more aggressive with rate hikes and significantly increased their inflation forecasts,” said Edward Moya, senior market analyst at Oanda Corp, in a note Wednesday. “The playbook for the next several months is that risk appetite could remain in place if the Fed only has to deliver only a few rate hikes next year, which would be great news for cryptos.”

Aave and Compound

Aave and Compound are two of the largest decentralized borrowing and lending platforms throughout the entire DeFi ecosystem with more than $22 billion of total value locked (TVL) between the two applications, according to data from DeFi Llama.

While Compound and Aave are both available on Ethereum, Aave launched on Polygon and Avalanche in recent months in an effort to expand its total addressable market.

Source: Defi Llama

Source: Defi LlamaBorrowing activity

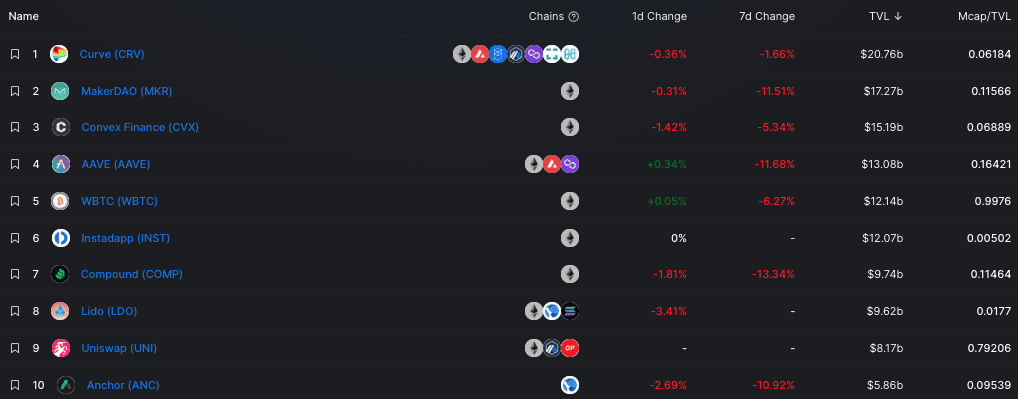

Ethereum boasts a 66% market share of TVL amongst layer-1s, so paying attention to borrowing activity on its largest dApps can provide some valuable insight.

Aave and Compound had roughly $6.6 billion and $7.2 billion of total borrows, respectively, on Dec. 2. However, today those numbers hover near $4.8 billion and $5.7 billion, according to data from Dune Analytics. The drop in total borrows can be attributed to multiple factors:

- The underlying assets being borrowed dropping in value alongside any collateral posted to take out a loan.

- Users paying back some of their loans to avoid being liquidated.

- A decreased appetite to borrow in a volatile market amongst DeFi participants.

Source: Dune Analytics

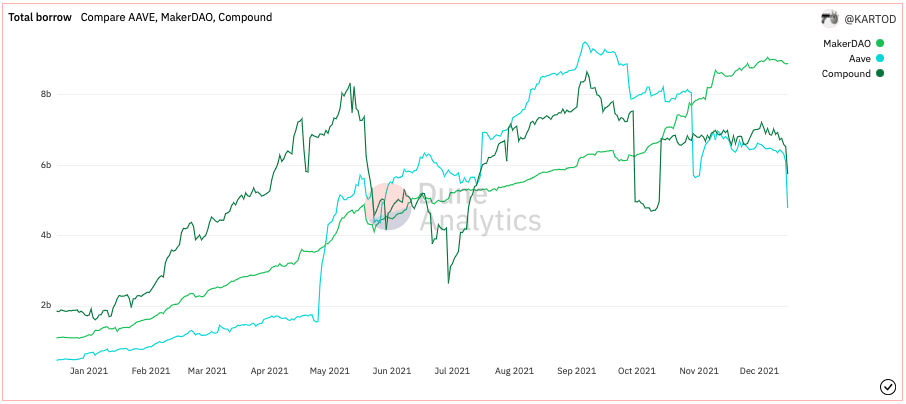

Source: Dune AnalyticsThe steady total borrow amount seen above for MakerDAO, a protocol that mints a decentralized stablecoin (Dai) through overcollateralized loans, is noteworthy. Dai is the third deepest asset on Aave with a market size of $1.86 billion, according to Aave’s website. It is also the second-largest market on Compound with a total supply of $4.37 billion, according to Compound’s website.

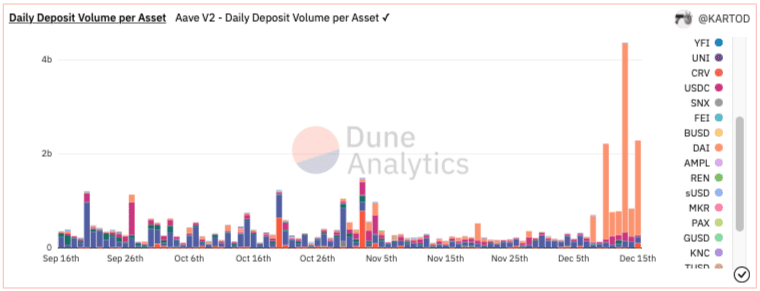

The only way to mint Dai is by opening up a Maker vault on Oasis and posting collateral. Data from Dune Analytics suggests that users of Aave and Compound are depositing Dai (orange bars below) to rebalance or close their outstanding loans, which likely explains MakerDAO’s total borrow resiliency.

Source: Dune Analytics

Source: Dune AnalyticsAnchor, another large borrowing platform that runs on the Terra blockchain, also shows a decreased appetite for leverage. Deposits have been steady whereas borrows have been on a downtrend, a historically uncommon divergence.

Source: https://app.anchorprotocol.com

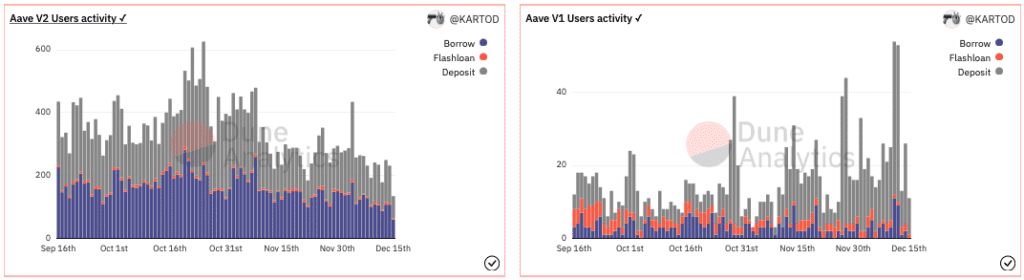

Source: https://app.anchorprotocol.comAave V1 and V2 user deposits have consistently outpaced borrows over the past few months, another signal of decreased appetite for leverage in the midst of bearish price action.

Source: Dune Analytics

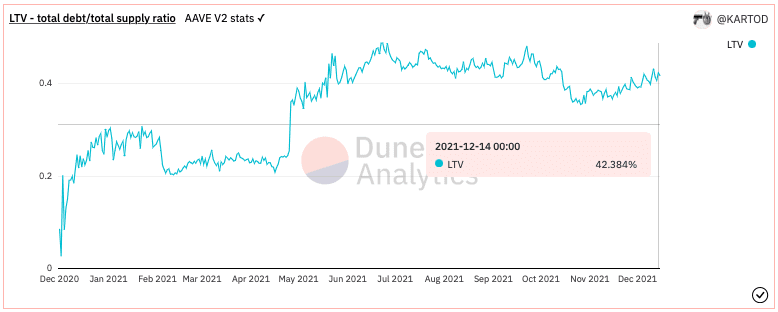

Source: Dune AnalyticsDespite the aforementioned increase in user deposits, loan-to-value (LTV) ratios have been rising on Aave and Compound. This means that borrowers are getting closer to their liquidation price as their collateral value drops. The total LTV on Aave has risen from 35.8% at the end of October to 42.3% as shown in the chart below:

Source: Dune Analytics

Source: Dune AnalyticsFlight to stablecoins

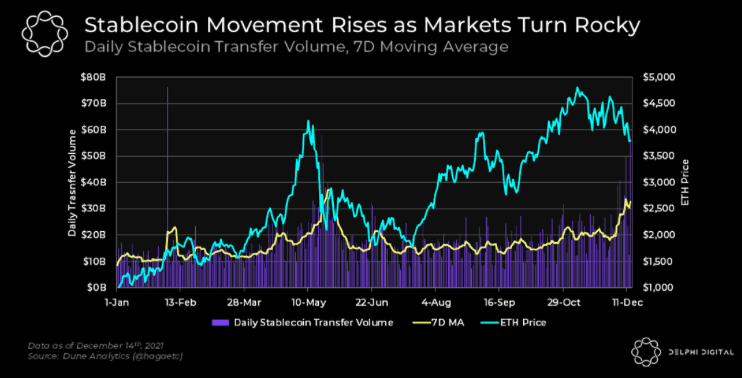

Digital asset investors have been loading up on dry powder in the face of market uncertainty.

“Interestingly, the market sell-off in May was characterized by a sharp increase in total stablecoin transfer volume, a trend we’re seeing play out yet again as we speak. For context, daily stablecoin transfer volume jumped to ~$57B yesterday, reaching levels only previously experienced in May after the bottom fell out from under assets like ETH (which dropped over 50% from peak to trough),” reads a Delphi Digital research report. “Daily stablecoin transfer volume tends to trend in the $10-20B range, with increases of more than $20B typically coinciding with price declines and heightened volatility.”

Source: Delphi Digital

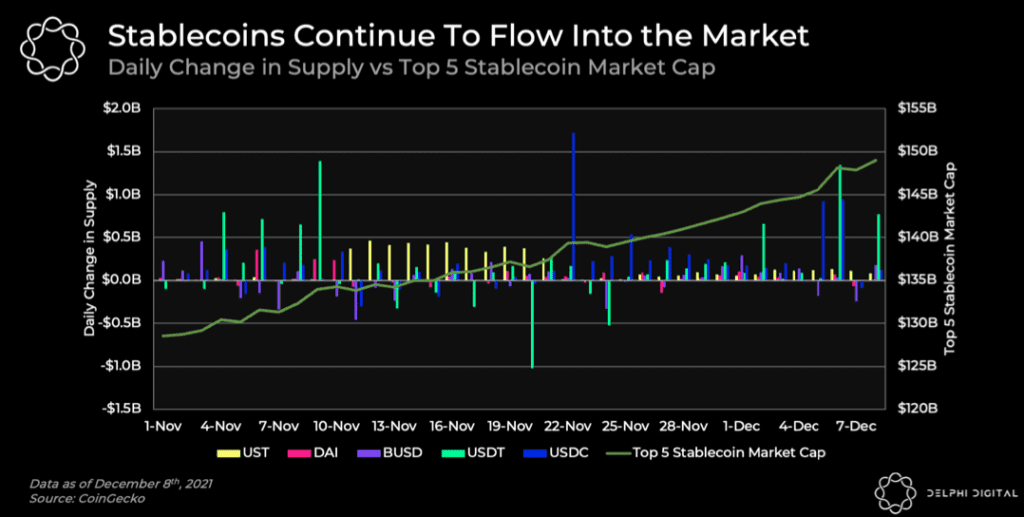

Source: Delphi Digital“Stablecoins grew substantially the past month, with the Top 5 Stablecoin Marketcap growing from $129B to just under $150B,” reads another Delphi Digital report. It is common for investors to rush into stablecoins in risk-off environments in order to reduce exposure and have a chance to buy any dips.

Source: Delphi Digital

Source: Delphi Digital

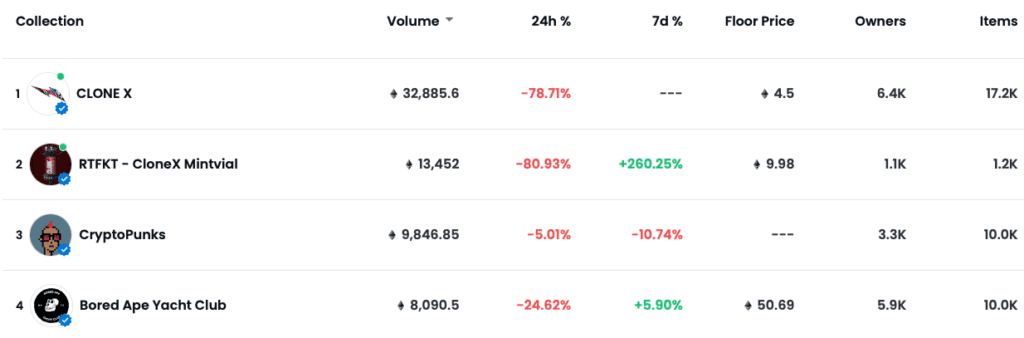

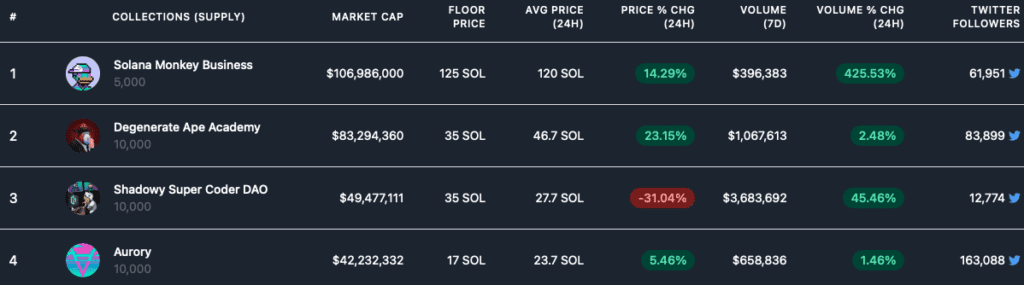

Non-Fungible Tokens (NFTs)

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.