Bitcoin Takes a Breather; Fantom TVL Explodes: Markets Wrap

Bitcoin price retreats to $54,000 after a strong run while fundamentals remain strong, Fantom total value locked explodes; its price follows.

Logo of Fantom, on which Andre Cronje recently deployed projects; Source: Shutterstock

- Fantom ($FTM) climbs 35% in one day as its total value locked explodes higher

- Bitcoin retreats to $54,000 after a strong run

Markets Wrap Highlights

- Bitcoin is consolidating near $54,000 after a strong rally. On-chain fundamentals indicate further upside remains over the coming months.

- Dog coins back in the spotlight

- EIP-1559 adoption stalls

- Stablecoins remain a hot topic

- Voting for proposal 128 to enable inter-blockchain communication between Cosmos and Terra is live.

- Fantom takes off in a huge way

Latest in Macro:

- S&P 500: 4,399, +.83%

- NASDAQ: 14,654, +1.05%

- Gold: $1,755, -.49%

- WTI Crude Oil: $78.87, +1.85%

- 10-Year Treasury: 1.58%, +.056%

Latest in Crypto:

- BTC: $54,168, -1.84%

- ETH: $3,617, +.78%

- ETH/BTC: .0667, +3.29%

- BTC.D: 43.78%, -2.85%

Bitcoin

Bitcoin is consolidating, hovering around $54,000 after the impressive run-up the past week. The long-term narrative remains intact, with long-term holders (LTHs) holding strong. As seen in the graph below, when the LTH supply shock ratio touches the upper end of the range, the price goes up over the coming months. History does not always repeat, but it often rhymes. All there is to do is wait for the price to catch up to the fundamental on-chain data. LTHs set the price.

“As far as the markets in general go, we’re getting close to all-time highs in both bitcoin and ether. There’s energy in the air from VCs, Institutions, and the ETF-watching crowd,” Hans Hauge, Head of Quant Strategy at Ikigai told Blockworks. “At the same time, the S&P 500 seems to have stabilized and is recovering quickly. Notably, retail interest in crypto is quite low right now, with the exception of NFTs. What we’ve seen in the past is that once the ball gets really rolling it doesn’t top out until retail has FOMOd in. I think the next 3-6 months could be very exciting.”

Andrew Yang, former presidential candidate and founder of the Forward Party, took to twitter to express his views on cryptocurrencies. “Rule of thumb – when faced with a trillion-dollar industry that could define the future try not to screw it up”.

Source: Glassnode / @WClementelll

Source: Glassnode / @WClementelll

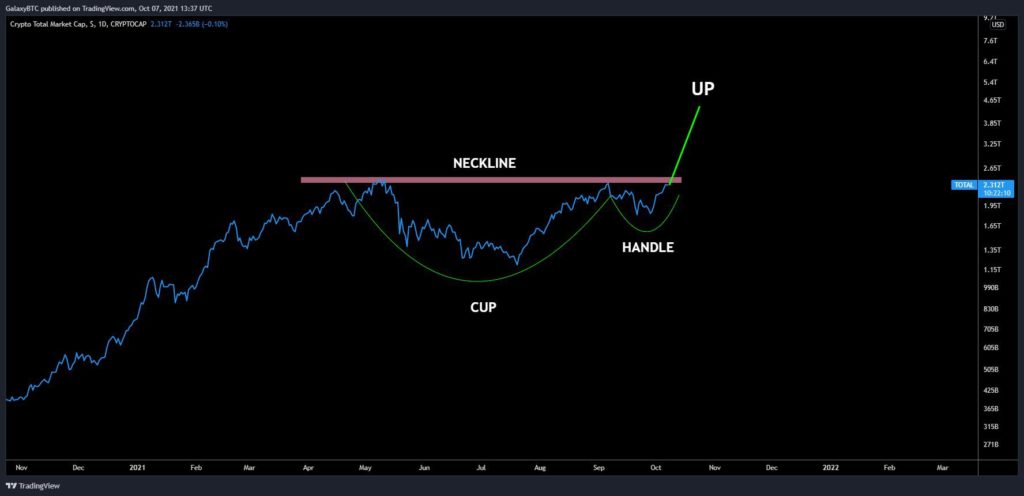

The entire crypto market looks ready to take another leg higher. There is a massive cup and handle pattern playing out as we try and break the neckline resistance, as seen on the chart below of the total crypto market capitalization.

Source: @galaxyBTC

Source: @galaxyBTC

Ethereum

The price of ether is unchanged, hovering near $3,600. While there isn’t much action in ether price, perpetual funding rates are positive across the board. This indicates that many traders are anxious to take a long position. Another metric that says traders are bullish is the put:call ratio, which currently sits at .443.

Shiba Inu, an ERC-20 token equivalent of Dogecoin, is up a whopping 300% over the last 7-days, according to Bloomberg. Despite being a meme coin and having no utility, it has climbed to the 20th largest cryptocurrency by market capitalization with a value of $9.1 billion.

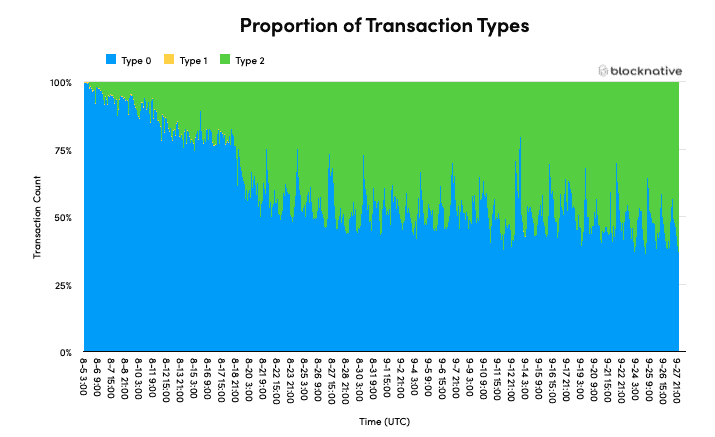

Type 2, or EIP-1559 enabled transactions, have stabilized at roughly 50% of total volume settled on the Ethereum protocol. Since the tail end of August, there has not been much increase in EIP-1559 adoption.

A German auto dealership aims to use Ethereum based smart contracts to reimagine the way people purchase or lease cars. The idea is to reduce the amount of documentation for themselves and their clients.

Source: Blocknative.com

Source: Blocknative.com

Non-Fungible Tokens (NFTs)

Gaming guilds Yield Guild Games and Merit Circle (no token available for trade) announced a partnership earlier today.

“YGG has made an investment of $175,000 in the guild and will be working together to help shape the play-to-earn ecosystem. Through this collaborative guild partnership, Merit Circle and YGG can host events, lend assets to each other, make investments, and pursue various projects to benefit both communities,” the article stated. “As of date, Merit Circle has impacted various communities through its scholarship program in the Philippines, Venezuela, Africa, and Nigeria.”

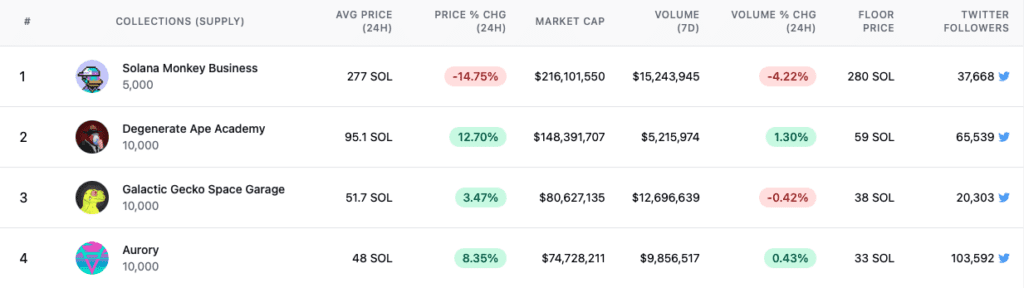

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the chart below:

Top Ethereum Projects

Top Ethereum Projects

Top Solana Projects

Top Solana Projects

DeFi and Stablecoins

- “If the value of Tether comes in essence from people’s confidence in the value of Bitcoin — could a strong wind blow the whole thing over?” Bloomberg opinion columnist Matt Levine said in an article about Tether.

- MoneyGram customers can soon convert cash to USDC, Blockworks reported.

- An anonymous wallet holder locked $54 million of $WBTC in a Maker vault in order to mint $20 million of dai. To see more details of the transaction, check out Oasis.

- Proposal 128 to enable cosmos inter-blockchain communication transfers on Terra is live for voting.

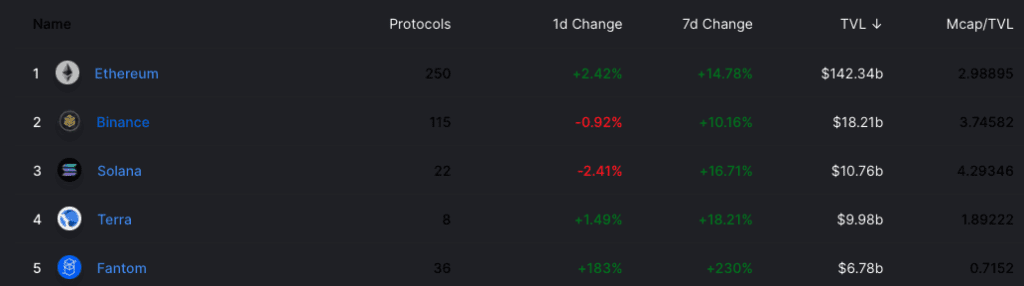

Fantom

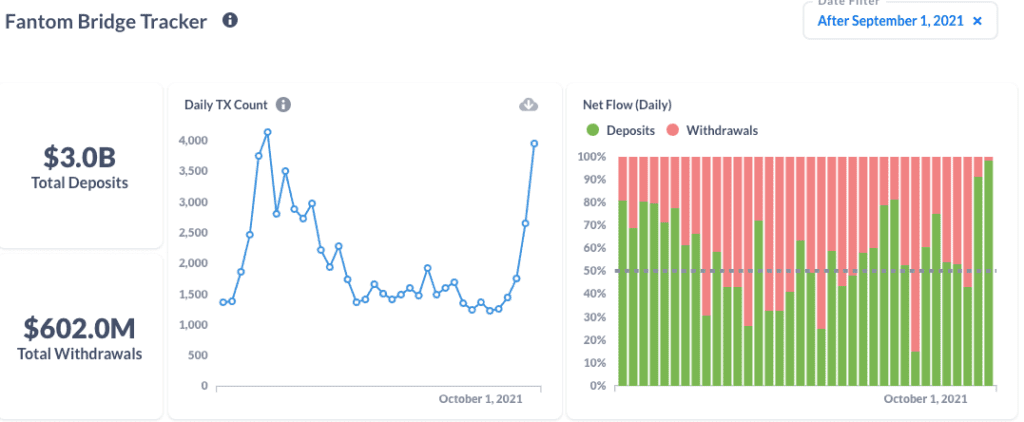

Total value locked (TVL) on Fantom surged over the last 24 hours to $6.67 billion, an increase of 183%. This put Fantom in the top-5 for TVL amongst Layer-1 chains. When looking at the Market Cap/TVL metric, Fantom has the lowest multiple of the top 5: sitting at just .71. This could mean that Fantom has some more room to run.

Geist Finance, a peer-to-peer borrowing and lending platform akin to compound or Aave, launched yesterday. 40% of its eponymous Geist token supply is allocated to lenders and borrowers through its liquidity mining program, hence the rapid growth in TVL. Michael Chen, the former CMO of the Fantom Foundation, committed Fantom incentives to Geist, allowing borrowers and lenders to earn Fantom in return for staking their Geist.

Source: Defi Llama

Source: Defi Llama

Billions of dollars have been bridged in the past 24 hours alone, according to Uniwhales. Fantom was most recently trading at $1.89.

Source: app.uniwhales.io

Source: app.uniwhales.io

That is all for today, folks. Let’s do this again at the same time tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.