Market Recap: Bitcoin Slides as Interest Rate Increase Looms

The increase in jobless claims and the Fed’s looming rate hikes have put pressure on both traditional and crypto markets

Blockworks exclusive art by Axel Rangel

- Jobless claims increased and the Fed’s looming rate hikes have put pressure on both traditional and crypto markets

- Bitcoin has increasingly become correlated with equities as of late, flipping its narrative as an asymmetrical asset class

The rate of unemployment has steadily gotten better but the most recent initial jobless claims report suggests the new wave of Covid-19 is hurting the economy.

Rate increases and the reduction in asset purchases by the Fed have added fuel to uncertainty among traders and investors.

Bitcoin has slowly become more correlated with equities making its narrative as an uncorrelated asset less appealing.

Latest in Macro:

- S&P 500: 4,659, -1.42%

- NASDAQ: 15,495, -2.57%

- Gold: $1,822.50, -0.20%

- WTI Crude Oil: $81.51, -1.49%

- 10-Year Treasury: -0.047, 1.699%

Latest in Crypto:

Yesterday

Markets rose sharply yesterday on news of the year-over-year inflation rate reaching 7.0%. The narrative surrounding bitcoin as a tool to combat inflation helped push it higher. Other metrics showed growth in positive sentiment within the crypto markets. Open interest on futures increased, more BTC flowed out of exchanges than in, signaling fewer sellers. The number of long positions vastly outweighed short-sellers among margin accounts at one of the largest crypto exchanges.

Even with this push, market participants still seem unconvinced in near-term crypto markets, largely due to the uncertainty around Covid-19’s recent spike and the Federal Reserve’s plans for a reduction in asset purchases and increased interest rates.

Today

Jobless Claims

While positive sentiment may have seen an uptick yesterday, crypto markets, and traditional markets in general, could not combat the steep increase in initial jobless claims reported by the Beauru of Labor Statistics (BLS). Continuing jobless claims, or people who were already unemployed, fell from 1.75 million to 1.6 million, but the more concerning figure is the initial jobless claims which saw a jump from 207,000 to 230,000.

The increase may seem small in light of the declining continuing jobless claims, but the rate of increase with initial claims is what has traders and investors concerned. This is the largest increase in initial jobless claims since mid-November and may signal a trend in wake of the drastically increased Covid-19 cases that could threaten the economy. The trend seems further worrisome when looking at the increase from 188,000 on Dec. 4, 2021, to 230,000 on Jan. 8, 2022.

Rising Rates and a Reduction of Asset Purchases

In testimony during today’s Senate Banking Committee hearing, Federal Reserve Governor, Lael Brainard, said that the central bank is close to starting a series of several rate hikes this year as soon as it slows its bond purchases sometime in mid-March.

“The [Fed’s policy-setting] committee has projected several hikes over the course of the year,” said Brainard. “Of course, we will be in a position to do that, I think, as soon as our purchases are terminated, and we’ll simply have to see what the data requires over the course of the year, and you know, we started to discuss shrinking our balance sheet.”

In order to stimulate the economy, the Federal Reserve mints new money to purchase assets like bonds, pushing new cash into the economy. The outcome of this strategy is the Fed’s ability to effectively manage how much liquidity there is among depository institutions, also known as banks. By controlling this liquidity, the Fed can then control the Federal Funds Rate or the interest rate at which institutions lend each other money. More liquidity results in lower interest rates which then creates cheaper loans.

These lower interest rates among banks eventually trickle down to retail consumers who can then take out loans of various types more easily due to the lower rate of interest owed to the banks. This increase in dollars in circulation generally raises the price of assets, goods and services over time, resulting in a lowered purchasing power per dollar.

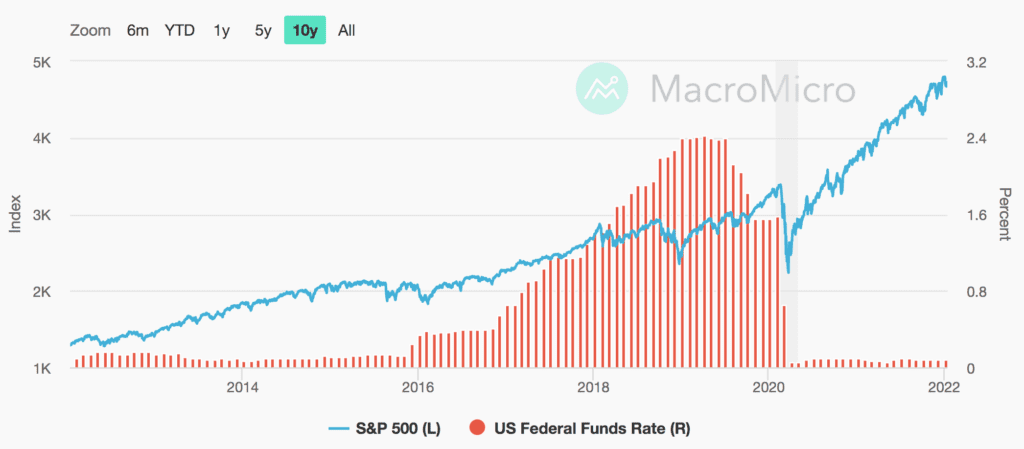

This type of economic stimulation has almost always caused increased values of investible assets like equities and real estate. One of the most prominent drivers of the recent decrease in both the traditional markets and the crypto markets is likely news of the Fed’s inevitable decrease of asset purchases and increase of interest rates expected to come sometime in March.

As depicted below, a lowered Federal Funds Rate is typically correlated with a boost to the economy while an increased Federal Funds Rate is correlated with a drop in equities.

https://en.macromicro.me/charts/91/interest-rate-sp500

https://en.macromicro.me/charts/91/interest-rate-sp500

What does this mean for BTC and crypto markets?

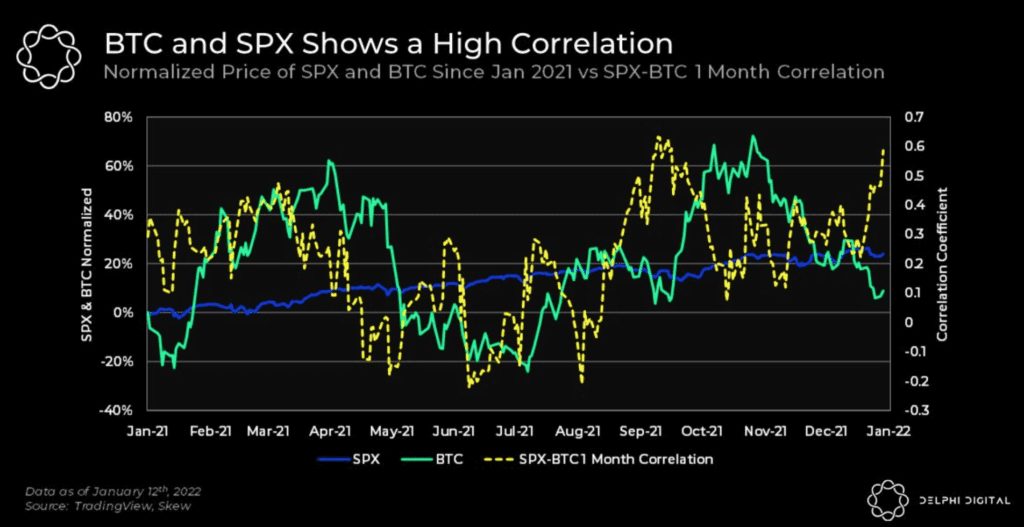

Current market psychology has created a correlation between traditional markets and the crypto markets when previously they were considered completely noncorrelated.

Bitcoin and cryptocurrency’s initial purpose and ethos were to be a tool to circumvent the traditional economic system of fiat currencies and the type of economic intervention that occurs with central banks as mentioned above. While some still see these digital assets in that light, their entrance into the mainstream financial media and into the more average individual’s portfolio has slowly caused it to ebb and flow with traditional markets.

Delphi Digital: https://twitter.com/Delphi_Digital/status/1481685443750019081

Delphi Digital: https://twitter.com/Delphi_Digital/status/1481685443750019081

It is likely that crypto assets will remain correlated to the traditional markets in some degree for the foreseeable future until a more significant adoption event or even more drastic levels of inflation than now occur.

Will Clemente, a popular crypto analyst and the lead insights analyst at the bitcoin mining company Blockwareteam, noted just how correlated bitcoin has become to traditional equities markets as of late.

“Correlation to equities so strong might as well just be watching them lol,” said Clemente on Twitter.

Just two days ago the Chief Economist of the International Monetary Fund, Gita Gopinath, shared a quote on Twitter from an International Monetary Fund blog post discussing the correlation.

“Bitcoin’s correlation with stocks has turned higher than that between stocks and assets such as gold, investment grade bonds, and major currencies, pointing to limited risk diversification benefits in contrast to what was initially perceived,” read the blog.

Tomorrow

Likely scenarios looking forward are that bitcoin and overall crypto markets remain in some level of sync with traditional equities and may experience an even deeper slide as investors flee to cash in preparation of increased interest rates. Bitcoin, in particular, is likely to trade sideways between $40,000 support and $46,000 resistance in the near term.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.