SOL Down 40% from ATH; ETH/BTC Ratio Slides: Markets Wrap

ETH/BTC slides as investors seek safety in the largest digital asset

Blockworks exclusive art by Axel Rangel

- SOL is down 40% from all-time highs despite strong activity on-chain

- The ETH/BTC ratio slides as investors seek safety in the king of digital assets

SOL is trading near $160, down nearly 40% from its all-time high seen on Nov. 6, 2021.

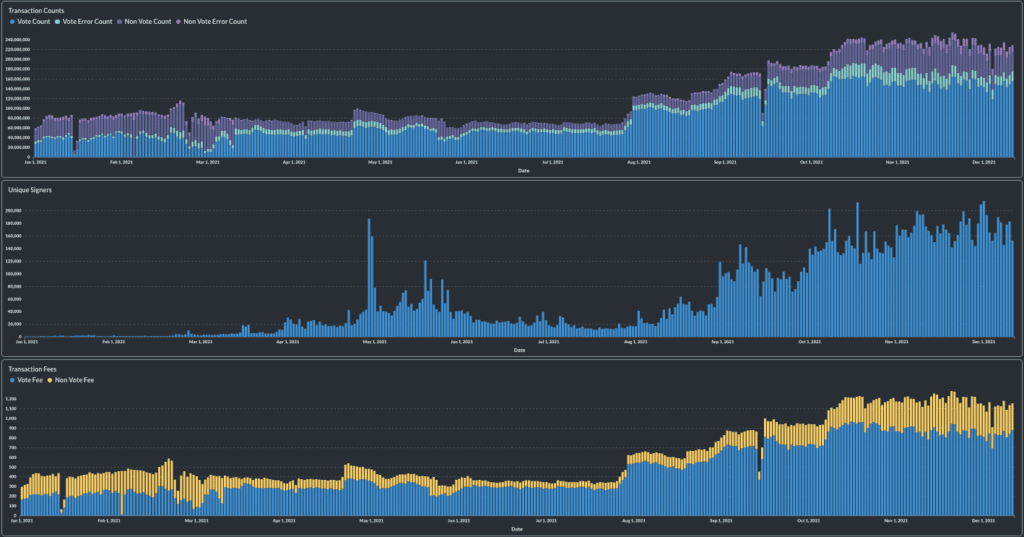

Data from Chaincrunch shows that on-chain activity on Solana remains strong.

80.78% of the SOL supply is held in only 173 wallets, according to data from Chaincrunch.

The ETH/BTC ratio has slid more than 7% this week as investors seek safety in BTC in a risk-off environment.

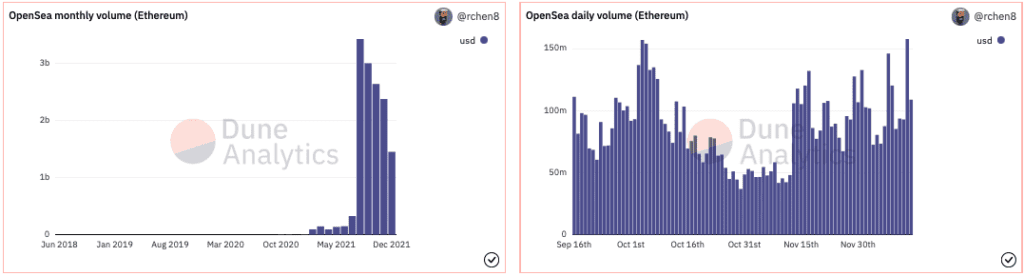

OpenSea volume has picked back up since the beginning of December after a down month in November.

Latest in Macro:

- S&P 500: 4,634, -0.75%

- NASDAQ: 15,237, -1.14%

- Gold: $1,773, -0.78%

- WTI Crude Oil: $70.65, -0.90%

- 10-Year Treasury: 1.443%, +0.019%

Latest in Crypto:

- BTC: $48,364, +1.50%

- ETH: $3,872, +0.80%

- ETH/BTC: 0.0797, -1.61%

- BTC.D: 41.95%, +0.14%

Solana user growth

Solana (SOL), the fifth-largest cryptocurrency in the digital asset space with a market cap of roughly $47 billion, is down approximately 40% from its all-time high of $258.93 seen on Nov. 6, 2021. It is currently trading at $154, according to data from CoinMarketCap.

Founded in 2017 by Anatoly Yakovenko, Solana aims to support all high-growth and high-frequency blockchain applications and to democratize the world’s antiquated financial systems. This means challenging some of the largest traditional financial institutions in the world.

While the SOL price has suffered over the past six weeks, activity on the layer-1 chain remains robust.

According to data compiled by Chaincrunch, the number of transactions, unique wallets, and transaction fees all hover near all-time highs despite the dip in SOL’s price. The fees to transact on Solana are less than a penny per transaction, which is likely the driving force behind the chains rapid adoption.

Source: Chaincrunch

Source: ChaincrunchCommon Solana critiques

Solana naysayers often point to the lack of decentralization and high concentration of wealth amongst top SOL holders.

Data from Solana Beach confirms the latter statement, stating that 80.78% of the supply is held in only 173 wallets. The distribution can be seen in the following pie chart breaking down the percentage of supply held by the top 10, top 50, top 100 and remaining wallets:

Source: solanabeach.io

Source: solanabeach.ioThe former critique which points to the concentration of validators, or registered participants, that can create new blocks to add to the chain.

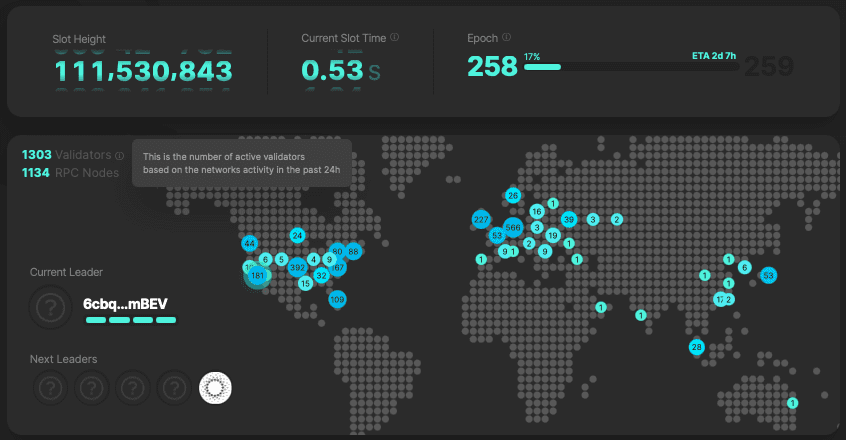

Last month, I reported that there are currently 1150 Solana validators, and the cost to set one up is north of $5,000. For comparison, there are well over 12,000 nodes on the bitcoin network who are visible and it costs less than $200 to set up a BTC node. It is worth noting that the actual node count for the Bitcoin network is likely much higher but is not traceable.

After checking back in today on the number of validators, this number has risen to over 1,300. That is 13% growth in validator count in six weeks time, according to data from Solana Beach.

Source: solanabeach.io

Source: solanabeach.ioETH/BTC note

The ETH/BTC ratio is a metric to watch for investors who are curious about the performance of the two largest digital assets in relation to each other. When the ratio is going up, it signals that ETH is outperforming BTC.

“The general view is that while ether is outperforming bitcoin, all is well in the crypto space, with the mood very much risk on given ether’s status as an innovation hub for web3.” reads a LMAX Digital report. “But as ether underperforms relative to bitcoin, it suggests the mood has shifted to one in which investors are more comfortable owning bitcoin over ether due to the safe haven, story of value draw of bitcoin.”

After a rally of 24% up to local highs of .0880, the ETH/BTC ratio has declined 7.19% over the past five days to .0802, according to data from TradingView.

Source: Trading View

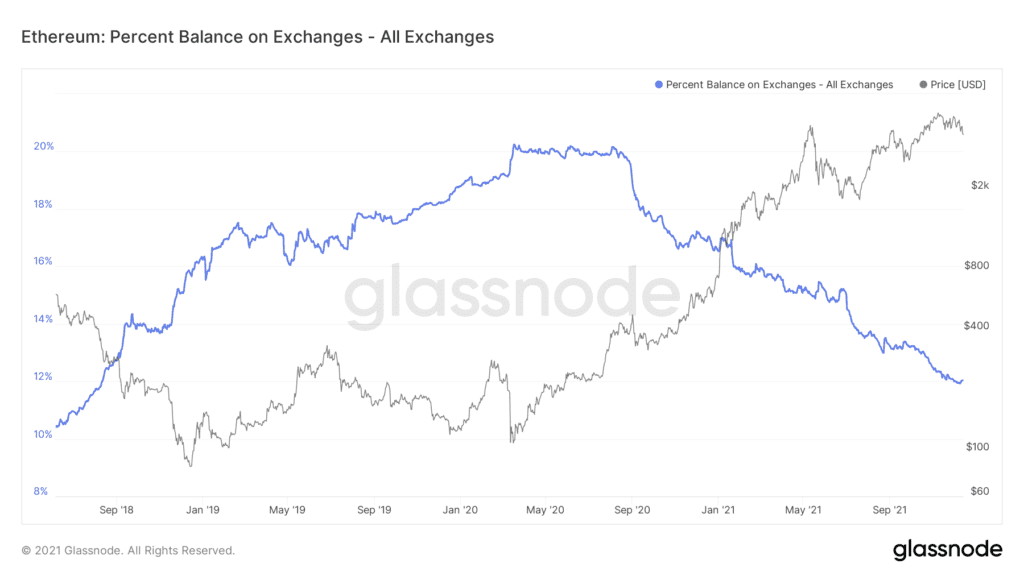

Source: Trading ViewETH balances on exchanges remain at levels not seen since 2018, implying that investors are looking to hold for the long term. There was a slight uptick over the past few days, according to data from Glassnode, as some investors have likely taken profits in the face of dicey price action.

Source: Glassnode

Source: Glassnode

Non-Fungible Tokens (NFTs)

Last month I noted that trading volume on OpenSea looks to be on track for its lowest monthly total since July. While that is, in fact, what occurred, OpenSea volume has since rebounded during the month of December, according to data from Dune Analytics.

Source: @rchen8

Source: @rchen8

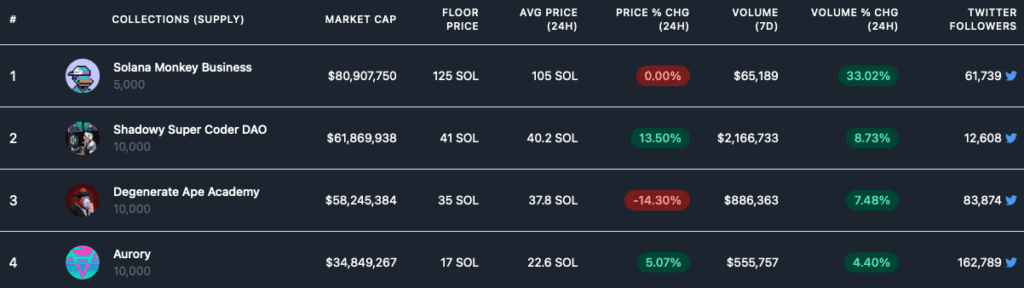

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.