Bitcoin Dominance Rises; SEC Chief Confirms US Won’t Ban Crypto: Markets Wrap

Bitcoin dominance rises as price surges to $51,500, Gary Gensler echoes Jerome Powell’s comments confirming the US has no plans to ban crypto

Space Cat by Bitko Yinowsky was one of the many pieces featured in the Bitcoin 2021 Art Gallery in Miami

key takeaways

- Bitcoin dominance up sharply on today’s rally

- US Bank launches crypto custody service to satisfy demand

The NASDAQ and Dow Jones closed the day up 1.25% and 0.92% respectively.

US Bank will be launching a crypto custody solution powered by NYDIG. It will only offer bitcoin, with the intention to support additional coins over time.

Brazil is set to vote on a bill within the next few days to regulate Bitcoin in a way that encourages its use.

DeFi/NFTs/Gaming

- The game studio behind Axie infinity, Sky Mavis, received $152 million in a series B funding round led by Andreessen Horowitz. $AXS was last trading at $130, down 6% after its remarkable run the past week.

- ThorChain-based decentralized exchange, ThorSwap, raised $3.75 million in a private token sale. $RUNE was last trading around $8.90.

- Nexus Mutual ($NXM), an insurance protocol built on top of ethereum, passed proposal 157 to allocate nearly $50 million to earn ETH2.0 staking rewards through Lido Finance($LDO), a liquid staking solution.

TradFi

- China turns to abandoned coal mines in Australia to combat coal shortages.

- US ISM Sep services PMI data came in higher than expected at 61.9 vs. 61.7 in August. Yields on the 10-year treasury rose to 1.534% on the news.

- US gas prices locked in their highest close in 12 years due to supply concerns.

Insight

“This month all eyes are on the SEC’s potential approval of a bitcoin ETF, and this is all the more relevant given two recent developments 一 at a conference last week, Gary Gensler reiterated his preference for a bitcoin futures ETF rather than one based on spot prices, which is relevant given that the proposals up for consideration this month are largely futures-based. Also, on Friday, the CME revealed that it was doubling the limits on initial BTC futures positions. Notably, the day that this new rule will come into effect is October 18th, the same day a decision by the SEC on the ProShares Bitcoin Futures Strategy ETF is due. This could be a coincidence, or it could be the CME planning for a potential surge in futures volumes,” said Noelle Acheson, Head of Market Insights at Genesis

Bitcoin and Ethereum

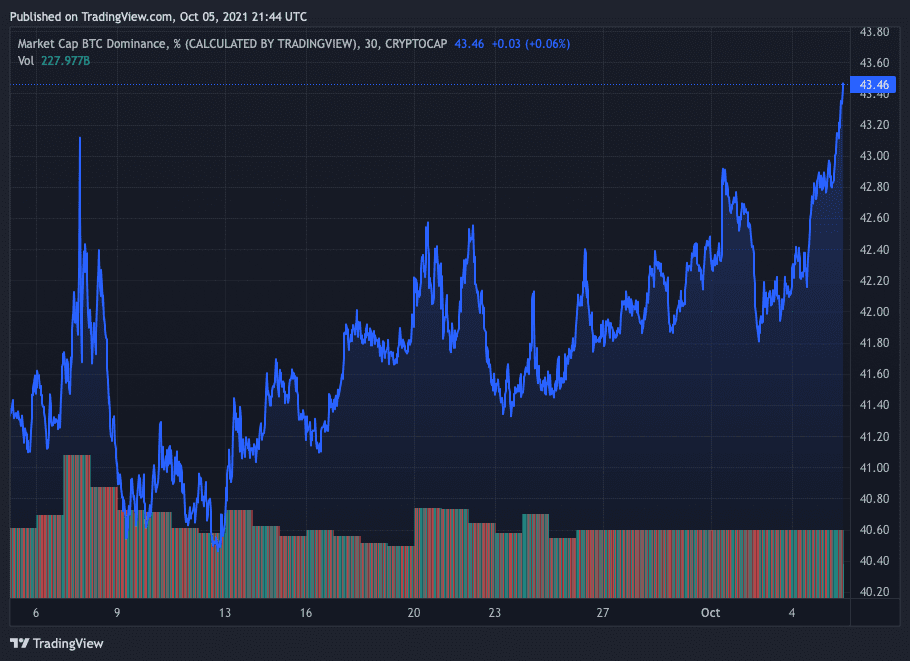

BTC dominance, or the percentage of the total crypto market capitalization BTC makes up, is up 5.16% over the last month. Historically speaking, rising BTC dominance sets the stage for alt coin rallies in the future.

Source: Trading View

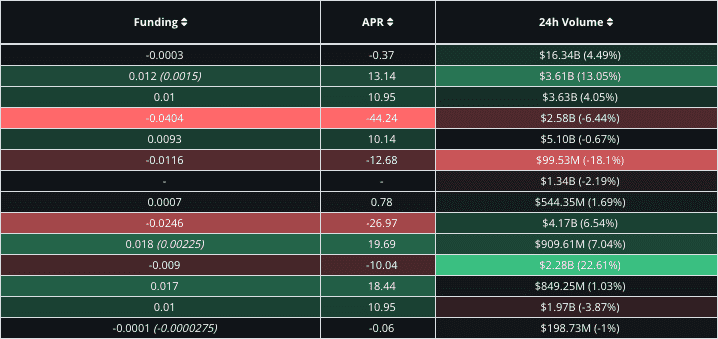

Source: Trading ViewPerpetual funding rates for BTC are mixed across different exchanges, implying that traders are divided on whether to take a short or long position.

Source: https://app.laevitas.ch/dashboard/btc/derivs

Source: https://app.laevitas.ch/dashboard/btc/derivs

Top 10 coins excluding stablecoins

Source: CoinMarketCap

Source: CoinMarketCap

- Despite all of the turbulence in traditional financial markets, bitcoin has shown a lot of strength over the past week, last up more than 23%. This is a narrative bitcoin investors would like to see continue. There will be a decision on a futures-backed ETF this month which could be another catalyst for an end of year rally.

- The poor performance of alternative layer-1’s tells us that money is rotating into the blue chips; BTC and ether.

Regulatory News

- Minnesota congressman, Tom Emmer, took to Twitter to call out Gary Gensler for attempting to classify some digital assets as securities. He believes that would hurt retail investors more than it would help them.

- Rep. Patrick McHenry (R-NC) introduced the Clarity for Digital Tokens Act today. This bill aims to keep innovation in the US and provide legal clarity to those involved with digital assets.

- SEC chairman, Gary Gensler, echoed Jerome Powell’s comments that the US has no intentions to ban crypto.

What else we are looking out for…

- ADP employment numbers on Wednesday

- Initial and continuing jobless claims on Thursday

- Nonfarm payrolls, unemployment rate and average hourly earnings on Friday

That is all for today. Let’s do this again same time tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.