BTC Stumbles on 6.8% CPI Print; Axie Infinity Teases Future Gameplay: Markets Wrap

BTC retraces after 6.8% year-over-year inflation print, Axie Infinity leaks game developments set to roll out in 2022

Blockworks exclusive art by Axel Rangel

- Bitcoin’s weekly outflows reached a five-month high with nearly $3 billion worth of BTC leaving centralized exchanges

- The inflation outlook for December remains unclear as shipping and energy costs begin to rollover.

BTC rallied to near $50,000 after the 6.8% CPI print before erasing the gains and trading below $47,500.

Real yields on the US 10-year are at their lowest level since the 1940s.

The inflation outlook for December remains unclear as shipping and energy costs begin to roll over.

Bitcoin’s weekly outflows reached a five-month high with nearly $3 billion worth of BTC leaving centralized exchanges.

Axie Infinity teases future aspects of gameplay and provides an overall update of the largest blockchain-based game.

Latest in Macro:

- S&P 500: 4,712, +0.95%

- NASDAQ: 15,5630, +0.73%

- Gold: $1,782, +0.36%

- WTI Crude Oil: $71.95, +1.42%

- 10-Year Treasury: 1.482%, -0.005%

Latest in Crypto:

6.8% CPI print

After a 6.2% Consumer Price Index (CPI) print for the month of October, November’s numbers showed a 6.8% year-over-year inflation rate. This is the highest inflation rate since June of 1982, according to Jack Farley.

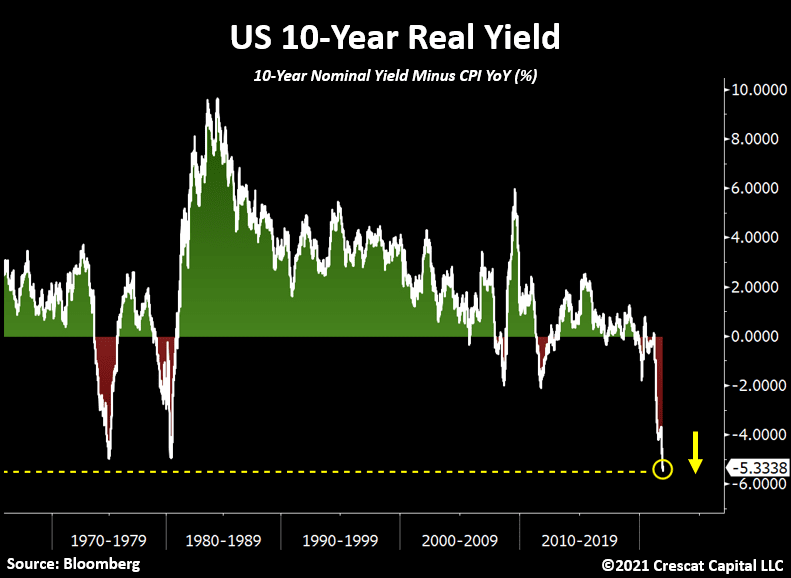

Moreover, the 10-year real yield is also officially at its lowest level since the 1940s, per Crescat Capital portfolio manager, Otavio Costa. Real yields are calculated by subtracting the prevailing inflation rate from the nominal Treasury yield, thus providing investors with the real rate of return of bond yields.

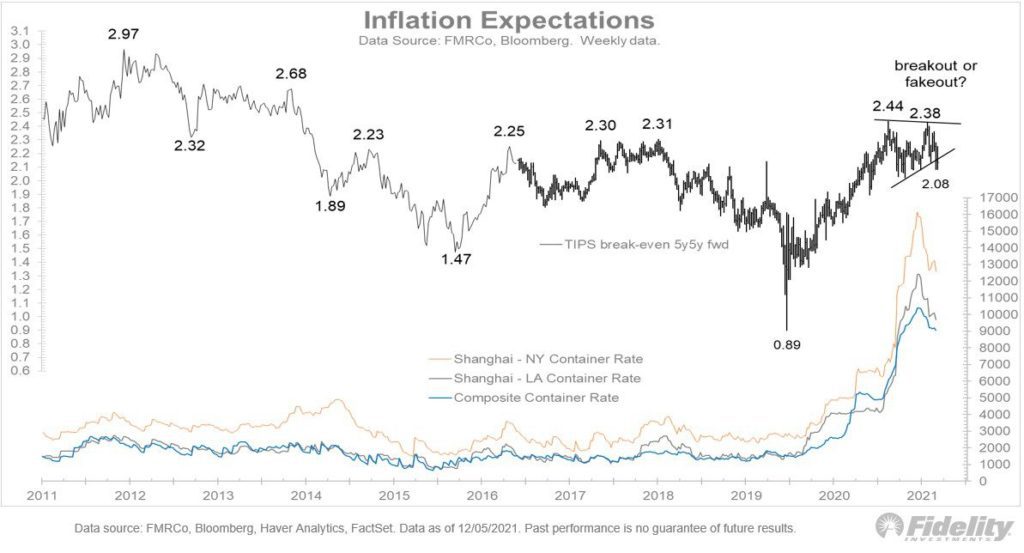

Container shipping rates have begun to roll over, which should help ease CPI prints going forward.

“If the Fed errs, the bond market and its deflationary signals will say, ‘Told you so!’ Long yields are very low considering low jobless rates and inflation, and inflation expectations are falling. Note the 5-yr-5-yr forward TIPS break-even spread and container shipping rates,” wrote Jurrien Timmer, Director of Global Macro at Fidelity.

US President Joe Biden also signaled ahead of today’s CPI number that, “the information being released tomorrow on energy in November does not reflect today’s reality, and it does not reflect the expected price decreases in the weeks and months ahead, such as in the auto market,” according to a Reuters report.

Source: Fidelity

Source: Fidelity

BTC fake-out

Similar to last month when BTC rallied to an ATH following the CPI print for the month of October only to quickly erase the gains shortly thereafter, the same thing happened today. BTC rallied close to $50,000 before dropping below $47,500 moments later, according to data from CoinMarketCap.

“Bitcoin is below the short-term holder cost basis, which currently sits at $53K. Until this is reclaimed, not bullish. Not saying I am a ‘giga bear’, just cautious until the market shows me otherwise. Happy to flip bullish if reclaimed. Bearish confirmation would be a failed underside retest of the band,” reads a Blockware Intelligence Newsletter.

Source: Blockware Intelligence

Source: Blockware IntelligenceSome other bitcoin highlights from an Intotheblock report include:

- Bitcoin recorded a modest increase in the fees generated by its blockchain as network activity picked up during the crash

- BTC’s weekly outflows reached a five-month high with nearly $3 billion worth of BTC leaving centralized exchanges

- Bitcoin’s underperformance comes at a time when both the dollar (DXY) and the volatility index (VIX) are at their highest in months

- Year-to-date, bitcoin has significantly outperformed traditional markets, potentially leading to profit-taking activity amid uncertain conditions

- Bitcoin perpetual swaps’ funding rate remain near zero, pointing to neutral expectations in the near-term

Axie Infinity December update

An Axie Infinity development update that was released last night shows that the popular play-to-earn game is approaching 3 million community members and significant progress in the battles, land and origins game development.

For comparison, there are roughly 4.1 million unique addresses in DeFi, according to data from Dune Analytics.

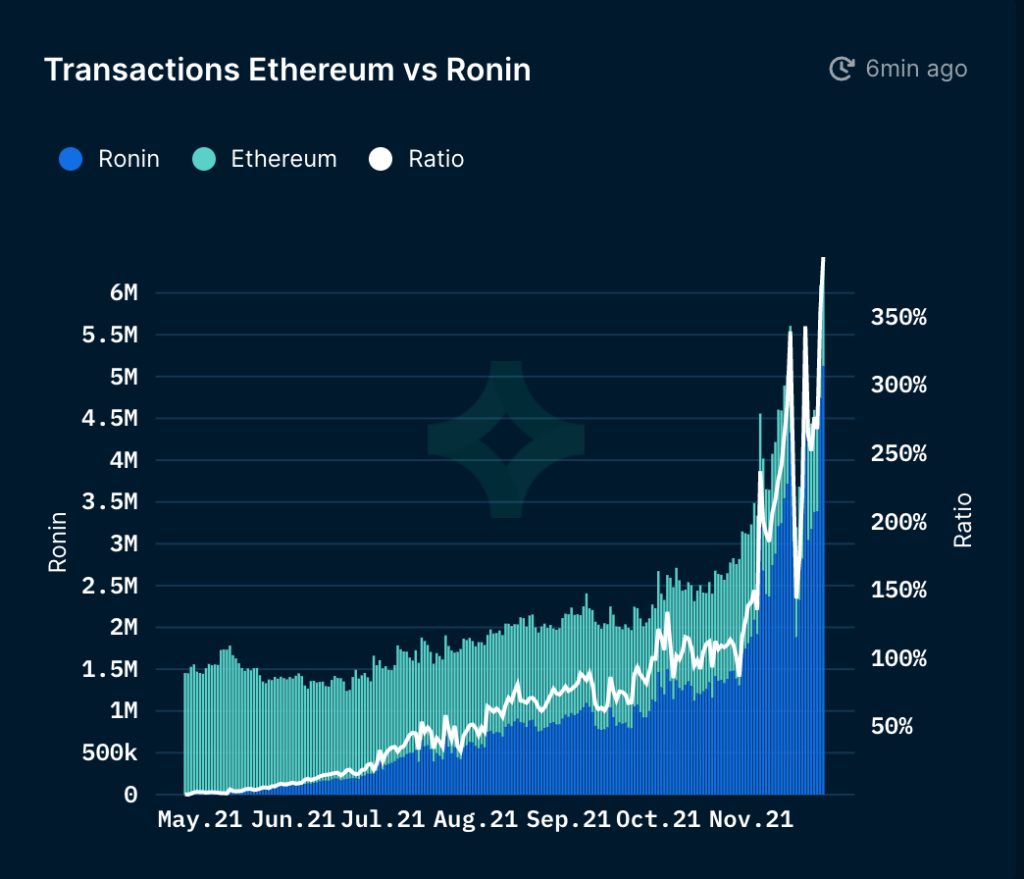

The report continues by comparing Ronin usage, the Ethereum sidechain that Axie Infinity is built upon, to activity on the Ethereum base layer. “Today, Ronin’s transaction volume has grown to roughly 4x the number of daily transactions of the Ethereum chain, and that growth has pushed us all to prepare for significant scale in 2022!” according to the report.

Source: Nansen

Source: Nansen

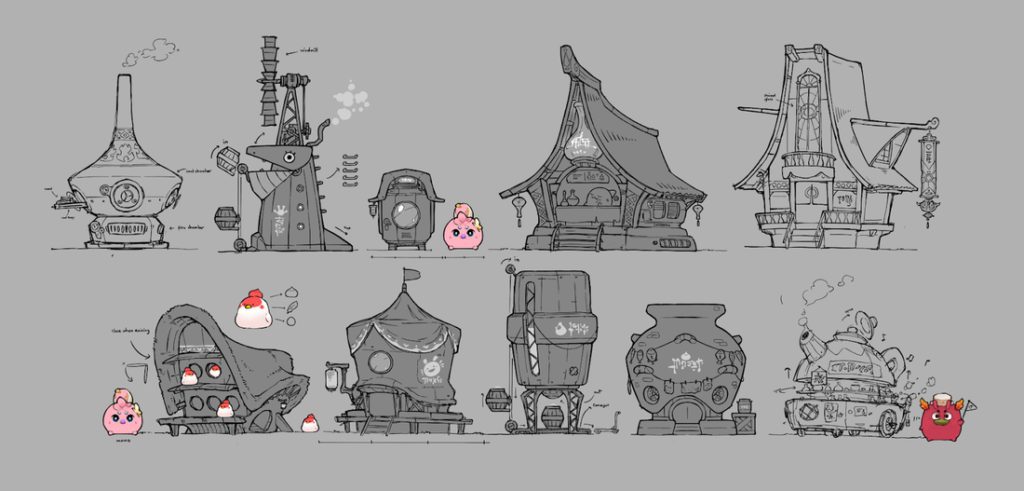

Land gameplay is still under development and set to roll out in the first half of 2022. The team continues to work on resource production, gathering, and crafting mechanics and even teased what some of the in-game art will look like:

Source: Axie Infinity Development Update

Source: Axie Infinity Development Update

The update continues by adding, “We also continue to make significant progress with our next generation battles experience, where we provide opportunities for players to experience a full, brand new storyline, non-blockchain “starter” Axies, the ability to attach power-ups to Axies, and much more.”

Sky Mavis, the developers behind Axie Infinity, are also working on graphical special effects for the game and leaked some of what they have been working on:

Non-Fungible Tokens (NFTs)

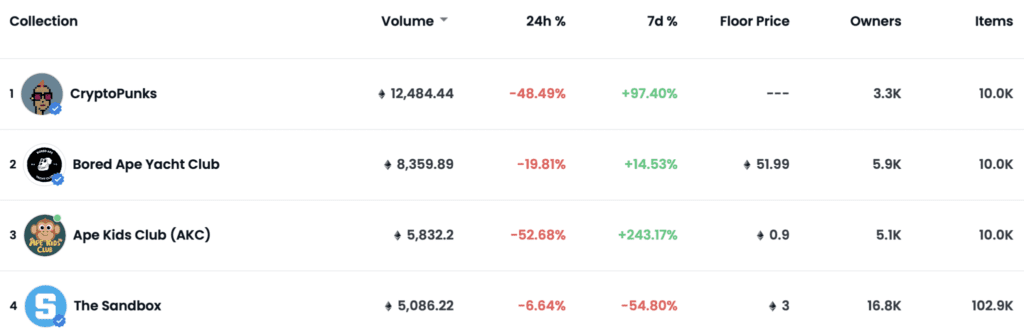

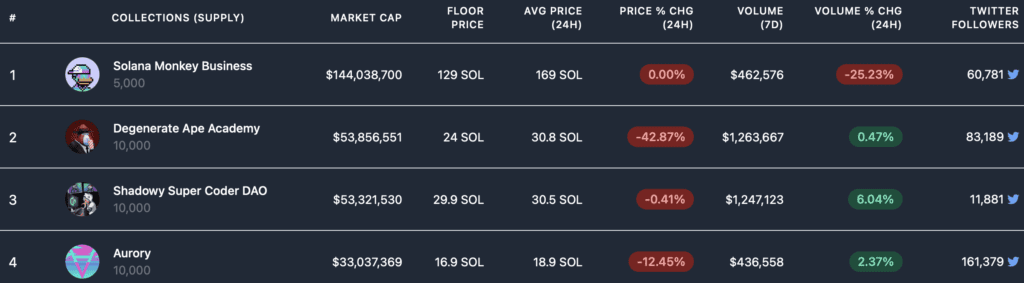

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up on Monday.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.