ATOM Splits From Market as BTC, ETH Bomb: Markets Wrap

Cosmos (ATOM) set to flourish in 2022 on increased developer interest, the upcoming Theta upgrade, and a flourishing DEX Osmosis

Blockworks exclusive art by Axel Rangel

- ATOM is up 36% over the past week despite the broader market sell-off

- The Cosmos network is set to thrive in 2022 with increased developer interest and the Theta upgrade

The Cosmos Network is home to nearly 50 protocols representing $151.8 billion of value.

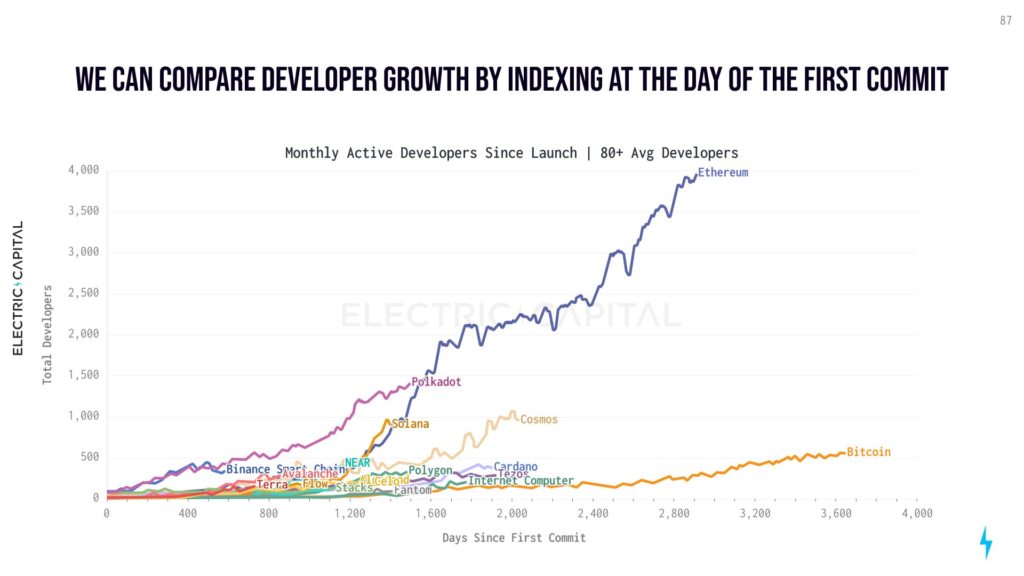

Electric Capital’s annual developer report revealed that monthly active developers on Cosmos grew approximately 70% throughout 2021.

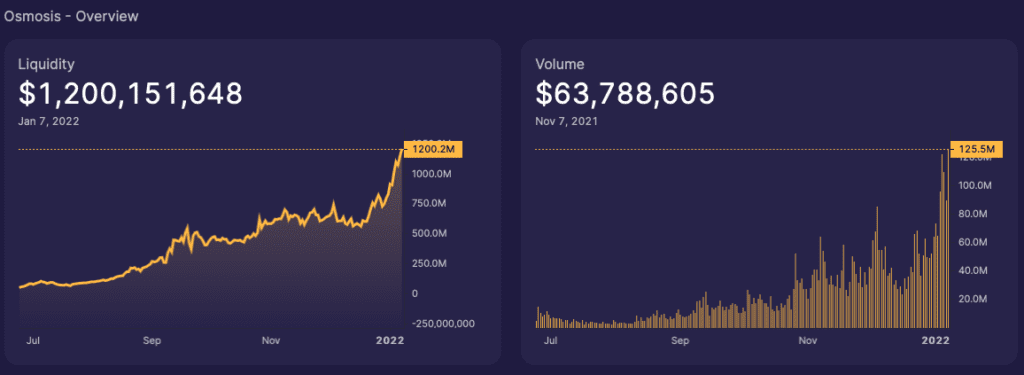

The rise of Osmosis, a DEX built on Cosmos, has driven significant traffic to the Cosmos ecosystem while attracting $1.2 billion of total value locked (TVL).

The Theta upgrade, scheduled tentatively for the first quarter of 2022, is another upcoming catalyst for ATOM and the Cosmos ecosystem as a whole.

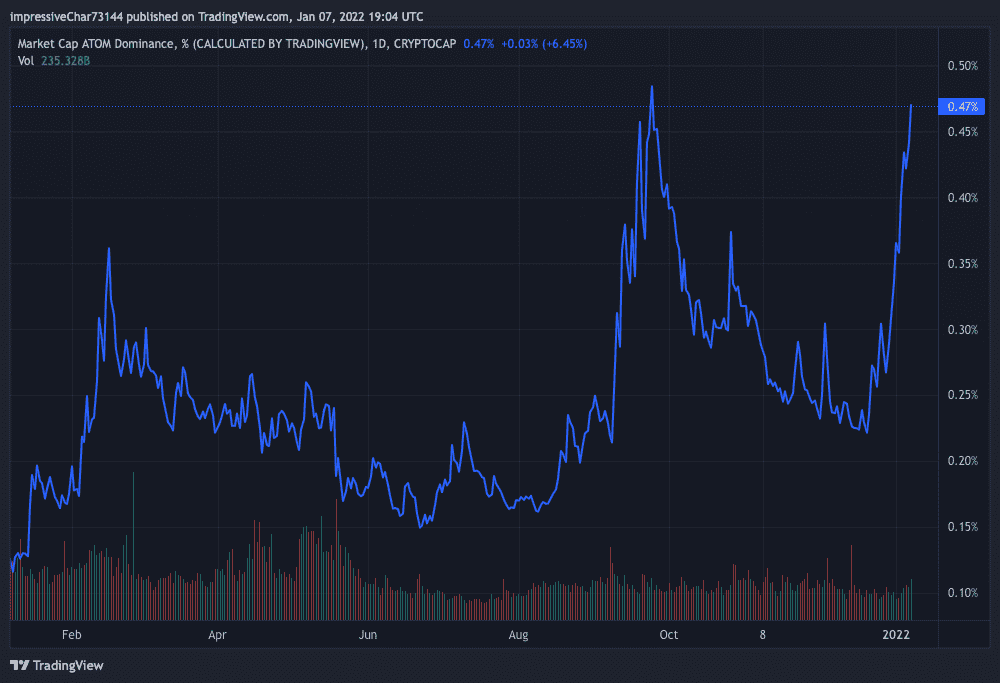

Cosmos’ token ATOM market dominance is approaching an all-time high, currently hovering near 0.47%.

Latest in Macro:

- S&P 500: 4,677, -0.41%

- NASDAQ: 14,935, -0.96%

- Gold: $1,796, +0.26%

- WTI Crude Oil: $78.97, -0.60%

- 10-Year Treasury: 1.773%, +0.04%

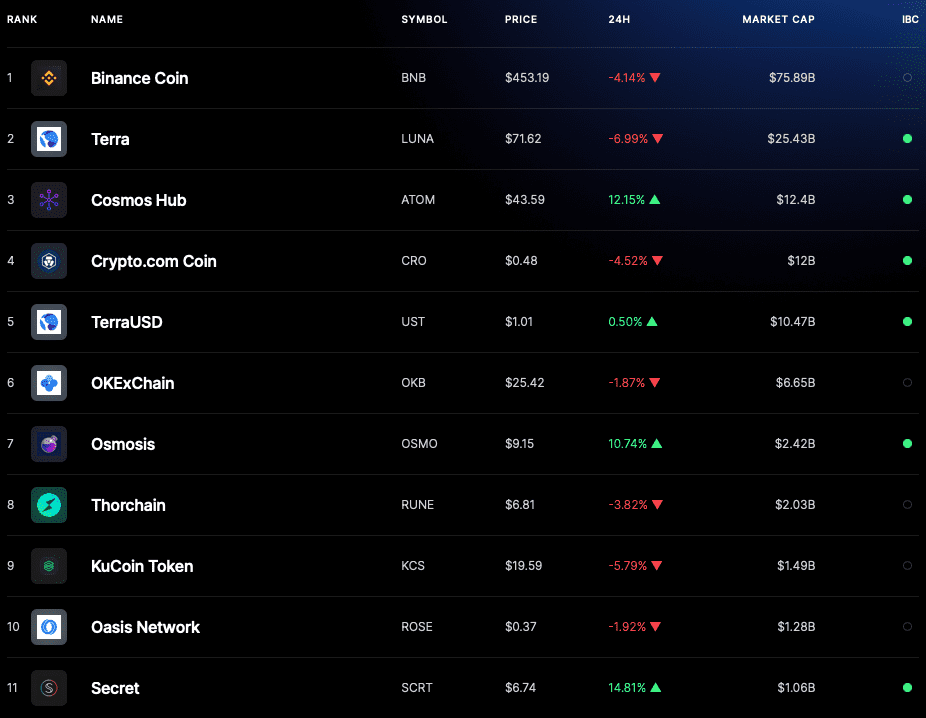

Latest in Crypto:

- BTC: $42,017, -3.00%

- ETH: $3,222, -5.90%

- ETH/BTC: 0.0767, -3.04%

- BTC.D: 40.03%, +0.95%

Cosmos overview

As previously covered by Blockworks, Cosmos (ATOM) is an ecosystem of blockchains that can scale and interoperate with each other. Historically, blockchains have been unable to interact with one another and had minimal transaction throughput with different programming languages, making it hard to attract developers to new chains.

The Tie released a research article on the Cosmos network in July of 2021 describing the ecosystem’s vision: “To make it easy for developers to build blockchains and break the barriers between blockchains by allowing them to transact with each other. This vision is achieved through a set of open source tools such as Tendermint, the Cosmos software development kit (SDK) and inter-blockchain communication (IBC), designed to let people build custom, secure, scalable and interoperable blockchain applications quickly.”

Cosmos is home to nearly 50 protocols representing $151.8 billion of value. Twenty-eight of these protocols are linked via IBC, a protocol designed for interoperability between arbitrary state machines, according to the project’s website.

Source: cosmos.network

Source: cosmos.network

Developer activity

Electric Capital’s annual developer report revealed that monthly active developers grew approximately 70% throughout 2021. The Cosmos network is home to over $151 billion of assets, and the third most active developers in all of crypto, behind only Ethereum and Polkadot.

Source: Electric Capital

Source: Electric CapitalOsmosis: The DEX of IBC

Osmosis (OSMO) is an advanced automated market maker (AMM) protocol that allows developers to build customized AMMs with sovereign liquidity pools. Built using the Cosmos SDK, Osmosis utilizes IBC to enable cross-chain transactions, according to the project’s website, and has driven significant traffic to the Cosmos ecosystem.

The protocol aims to extend the use of AMMs within the Cosmos ecosystem beyond traditional token swap-type use cases. “Through the customizability offered by Osmosis such custom-curve AMMs, dynamic adjustments of swap fees, multi-token liquidity pools, the AMM can offer decentralized formation of token fundraisers, interchain staking, options market, and more for the Cosmos ecosystem,” reads the project’s documentation.

The Osmosis DEX has logged 1.22 million IBC transfers over the last 30 days, more than double that of Cosmos itself and nearly 10 times more than Terra, according to data from Map of Zones.

Osmosis has grown to $1.2 billion of liquidity and over $100 million in daily trading volume, according to its stats page. Some of the main drivers for growth are:

- Incentivized pools paying out very attractive yields to liquidity providers; the ATOM/OSMO pair currently pays out 102.29% APR according to the application;

- High staking rewards on the OSMO token, currently yielding 95.1% rewards the popular Keplr wallet;

- Airdrops for LP’s and stakers of OSMO for up-and-coming projects in the Cosmos ecosystem;

- The upcoming integration of CosmWasm smart contracts and superfluid staking

Source: Info.osmosis.zone

Source: Info.osmosis.zone

Theta upgrade

The Theta upgrade, scheduled tentatively for the first quarter of 2022, is another upcoming catalyst for ATOM and the Cosmos ecosystem as a whole. Highlights of the upcoming upgrade, per the project’s documentation, include:

- Cosmos SDK v0.45

- Groups module: Enables higher-level multisig permissioned accounts, e.g., weight-based voting policies

- Meta-Transactions: Allows transactions to be submitted by separate accounts that receive tips

- Governance module improvements: Execution of arbitraty transactions instead of just governance proposals and will enables much more expressive governance module

- NFT module

- Enable simple management of NFT identifiers, their owners, and associated data, such as URIs, content, and provenance.

- An extensible base module for extensions including collectibles, custody, provenance, and marketplaces.

- Tendermint v0.35 — the Cosmos consensus engine

- Interchain accounts

- A requirement in order to manage accounts across multiple blockchains.

- Aims to provide locking/unlocking mechanisms across IBC-enabled blockchains.

- Allows custody providers to service any IBC connected blockchain through a common interface on the Hub.

- Liquid staking

- Frees secure and low-risk delegations for use in other parts of the Cosmos ecosystem

- Features include enabling transfer of rewards and voting rights

- Other potential upgrades still being discussed such as a Cosmos-to-Ethereum gravity bridge as well as budget and farming modules.

ATOM dominance

ATOM is nearing all-time highs in terms of market dominance over the total cryptocurrency market. It currently accounts for 0.47% of the entire crypto market capitalization, according to data from Trading View.

Source: Trading View

Source: Trading ViewATOM was last trading near $41.50, up 36.3% over the past seven days, with a market cap of $11.76 billion, according to data from CoinGecko.

For more information on what else is coming to Cosmos in 2022, refer to their recent blog post.

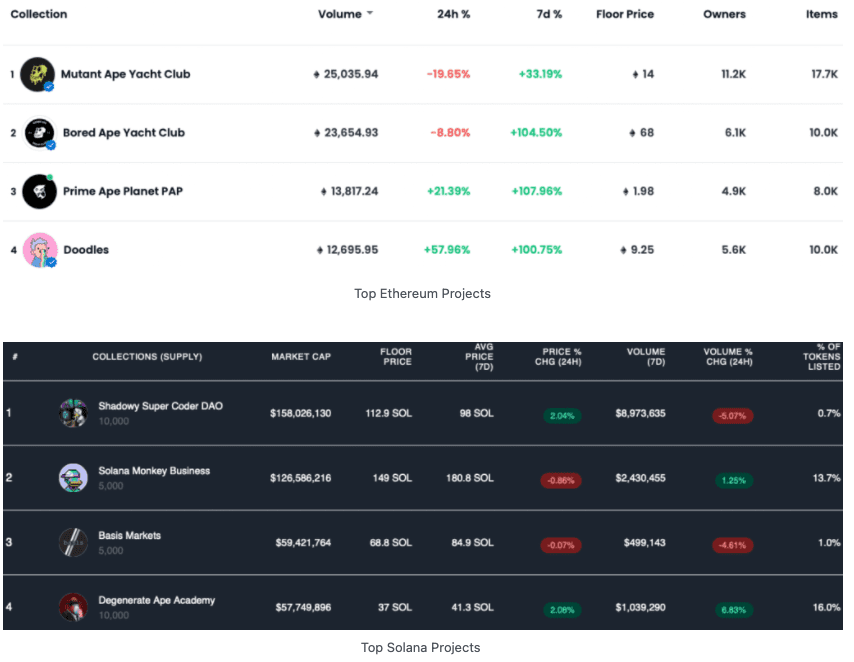

NFTs

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

If you made it this far, thanks for reading! I am looking forward to catching up on Monday.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.