BTC Turbulence Continues Heading into 2022: Markets Wrap

BTC investment vehicles are absorbing demand that would otherwise take place on-chain

Blockworks exclusive art by Axel Rangel

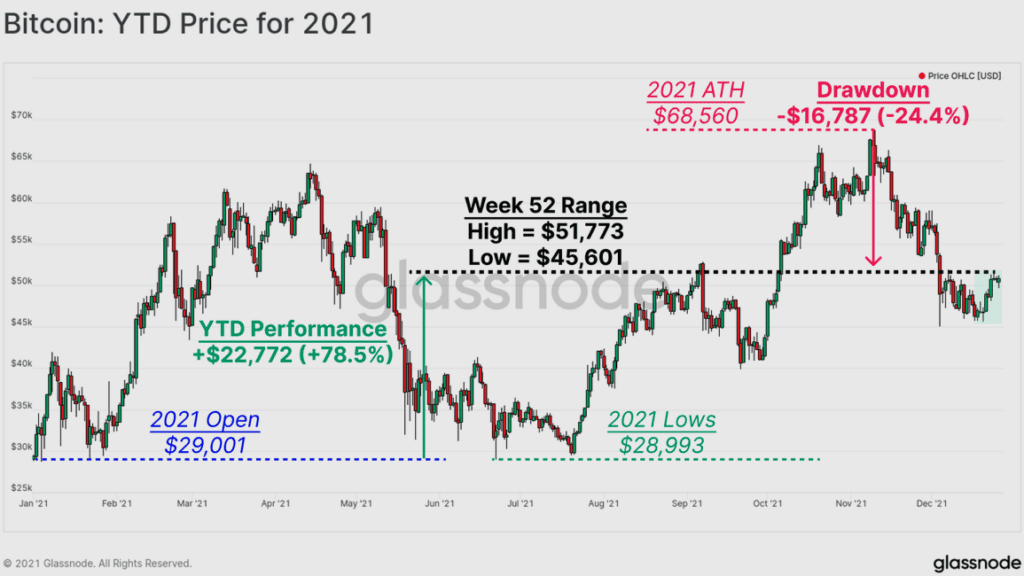

- BTC is up 78.5% from Jan. 1, 2021

- BTC investment vehicles could be absorbing demand that would otherwise take place on-chain

BTC is up 78.5% from Jan. 1, 2021, with a current drawdown of 24.4% from previous all-time highs.

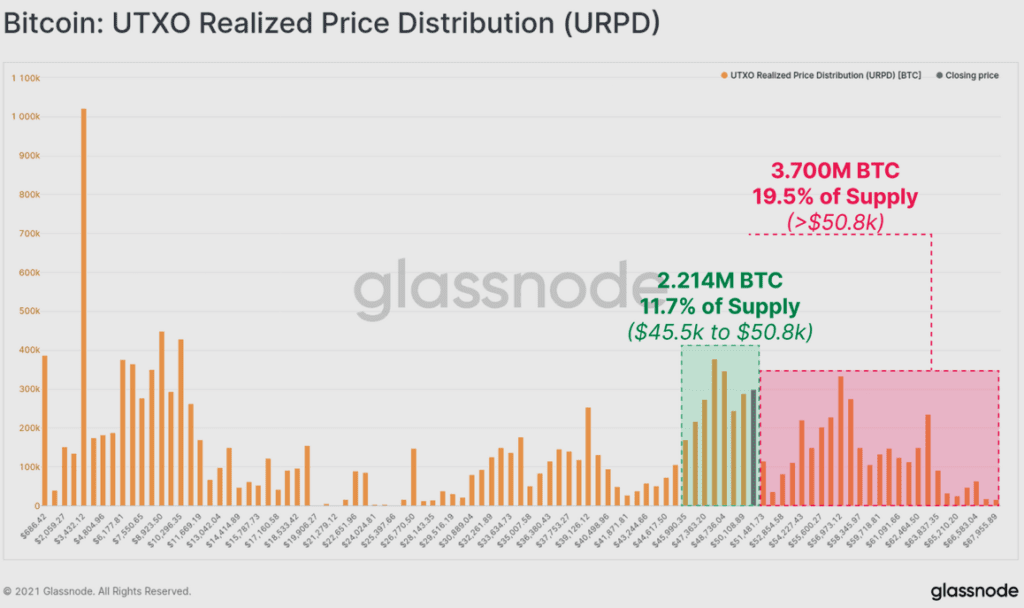

2.214 million BTC has traded hands between $45,500 and $50,800, according to data from Glassnode.

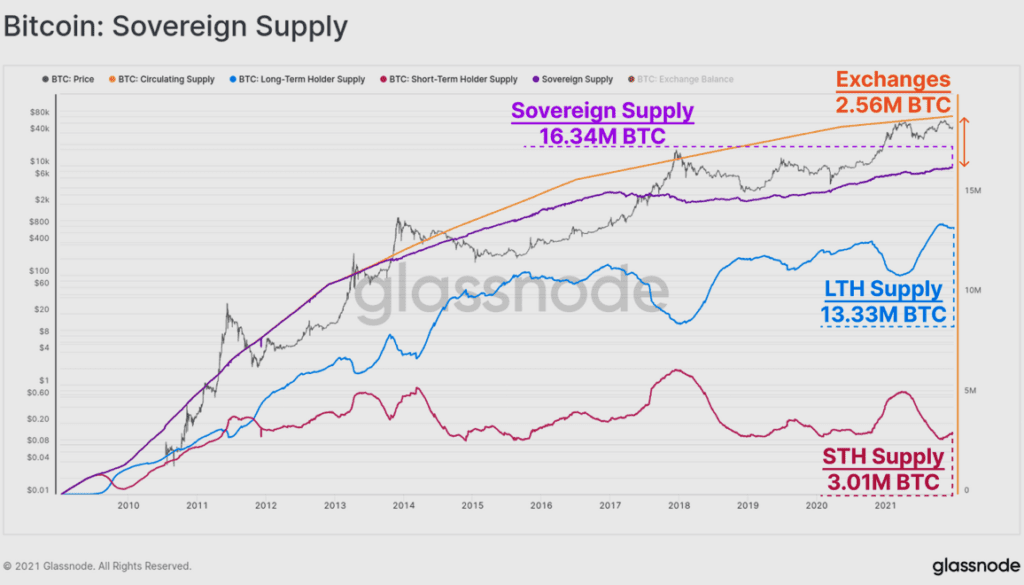

Long-term bitcoin holders have grown by ~16% over the course of this year.

Bitcoin investment vehicles, such as BITO, could be absorbing demand that would otherwise take place on-chain.

Latest in Macro:

- S&P 500: 4,793, +0.14%

- NASDAQ: 15,766, -0.10%

- Gold: $1,804, -0.13%

- WTI Crude Oil: $76.52, +0.71%

- 10-Year Treasury: 1.558%, +0.077%

Latest in Crypto:

- BTC: $47,357, -1.10%

- ETH: $3,732, -2.70%

- ETH/BTC: 0.0787, -1.32%

- BTC.D: 40.24%, +0.62%

2021 BTC price action

Bitcoin’s price is up 78.5% from Jan. 1, 2021, with a current drawdown of 24.4% from the all-time high seen on Nov. 10, 2021, according to data from Glassnode.

Source: Glassnode

Source: GlassnodeUnspent transaction output realized price distribution

“A reasonably large volume cluster has been established in this week’s price range, equivalent to 2.214M BTC (11.7% of supply). This indicates that a non-trivial degree of demand has been mobilsed during the consolidation, with a large proportion of coins changing hands between $45k and $50k,” reads a Glassnode report.

This has helped establish a relatively strong floor for bitcoin’s price in the mid $40k range, assuming investors don’t begin selling their underwater positions.

Source: Glassnode

Source: GlassnodeLong-term holders are stacking sats

Long-term holders have increased their holdings over the past year, taking advantage of any price dips to acquire more of the number one digital asset.

This week’s Glassnode report states:

- Long-Term Holders added 1.846 million BTC to their holdings, bringing their total stack to 13.33 million BTC. This reflects an increase of 16% over the year.

- Short-Term Holder supply has declined by 1.428 million BTC, with this cohort currently holding 3.01 million BTC. This reflects a decline of 32% on the year.

- Sovereign Supply, defined as all coins held outside exchange reserves, is currently at an all-time-high of 16.34 million BTC.

Source: Glassnode

Source: GlassnodeBTC on exchanges close to flat for 2021

The amount of bitcoin held on centralized exchanges is down 67,800 BTC on the year, representing a decline of 2.6%, according to Glassnode.

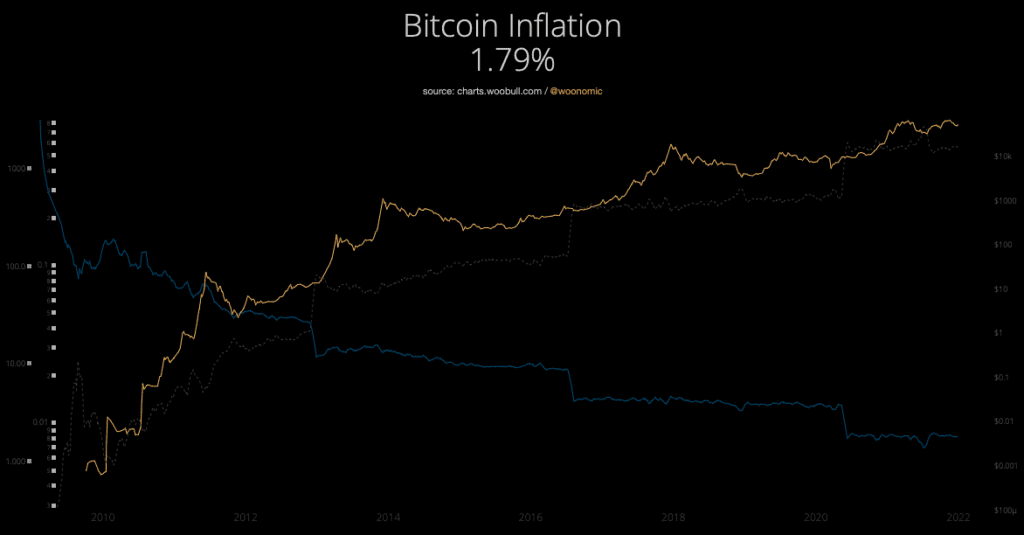

It is worth noting that the BTC inflation rate has been hovering around 1.75% since the halving took place in May of 2020, according to data from woobull.com. This implies long-term holders and miners are keeping freshly minted BTC off of exchanges.

Source: charts.woobull.com

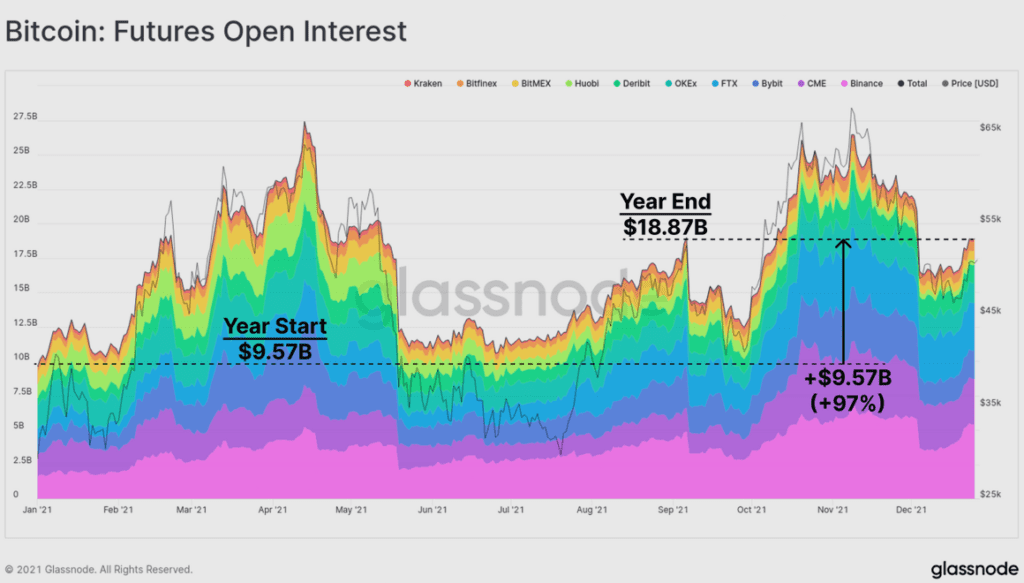

Source: charts.woobull.comFutures and BTC volatility

The Glassnode report continues: “Whilst futures open interest is still some way off all-time-highs, rapid increases in leverage can indicate a clustering of stop-losses and liquidation levels in close proximity to the current price. This adds higher probabilities to a potential short, or long squeeze in the more immediate term.”

Some industry experts, such as Caitlin Long, believe that the increase in derivatives surrounding BTC, such as a futures-backed ETF, has led to price suppression.

She took to Twitter over a year ago saying, “This question has been gnawing at me: how does all the price suppression that has hit Bitcoin in the past ~3yrs (as the bad kind of financialization started permeating the mkt) jive with Plan B’s stock-to-flow model? Answer: gold, silver, etc are massively rehypothecated too. An asset that has a fixed emission schedule & HASN’T been rehypothecated yet logically performs better than one that already has been, all else equal.”

Her point is that demand for bitcoin is being absorbed by investment vehicles, such as BITO and leveraged trading on various exchanges, that would otherwise flow into the Bitcoin network on-chain and be shown via price appreciation.

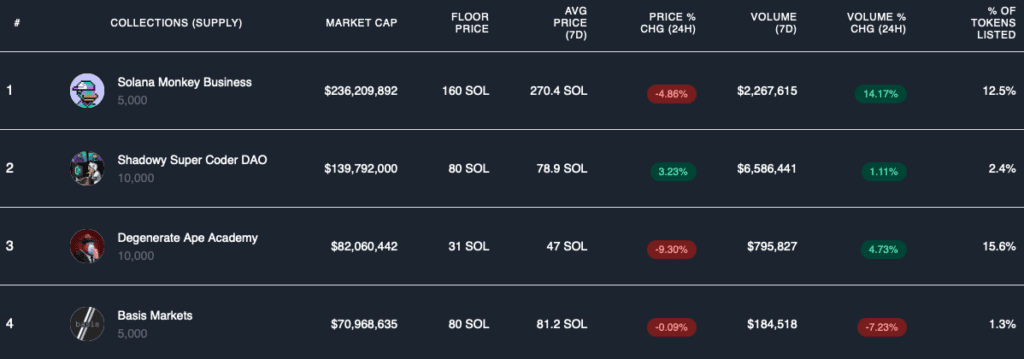

NFTs

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading and Happy New Year! I am looking forward to catching up in 2022.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.